- by New Deal demorat

I have been generally unimpressed with the Job Openings and Labor Turnover Survey (JOLTS) for over a year, and like many others I have found the Labor Market Conditions Index a source of concern. Since both were updated ths week, let's take an updated look.

First of all, for the first time this year the LMCI rebounded into positivity (blue in the graph below)

This is a pretty good indication that a recession is some ways off. But before you cheer too much, note that the LMCI does a pretty good job forecasting the direction of the YoY change in employment (red). So even with this month's good LMCI reading, the overall direction is still towards the negative.

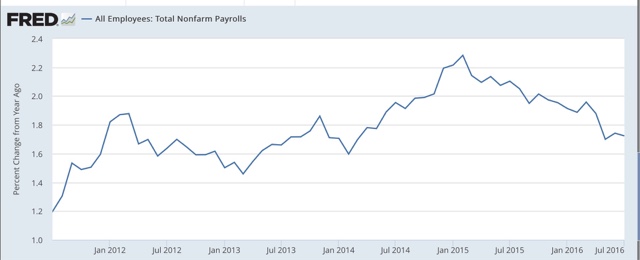

While I'm not forecasting any actual negative monthly job reports in the near future, even with the last two months' great numbers, the YoY payrolls graph still shows continued deceleration:

Today's JOLTs report, which covers June, also shows continued deceleration. For over a year I have noted that the pattern was similar to that in late in the last expansion, and the June report was more of the same.

First, here is a comparison of job openings (blue) and hires (red). Because there is only one compete past business cycle for comparison, lots of caution is required. But in that cycle, hires peaked first and then openings continued to rise before turning down in the months just prior to the onset of the Great Recession:

Through June, 2016 looks very much like 2006, or even early 2007.

After making a new post-reession record five months ago, quits have since fallen back at their late 2015 level. There had been a welcome positive increasing trend in quits earlier this year, but the pullback of the last few months calls that into question, and is consistent with the 2006 or early 2007 flatness in the last cycle. In the graph below, quits are inverted, and since they also appear very consistent with, and to slightly lead, the unemployment rate (red), that is also shown:

If the recent pullback is establishing a new flat (or worse!) trend, then the unemployment rate probably made its cycle low a few months ago.

In summary, both the LMCI and the JOLTS reports have been adding to the accumulating evidence that we are getting late in the expansion, but on the positive side, if we follow the 2001-07 template, and taking into account the recent improvement in the long leading indicators, there are stll another 12 - 24 months to go of jobs growth.