- by New Deal democrat

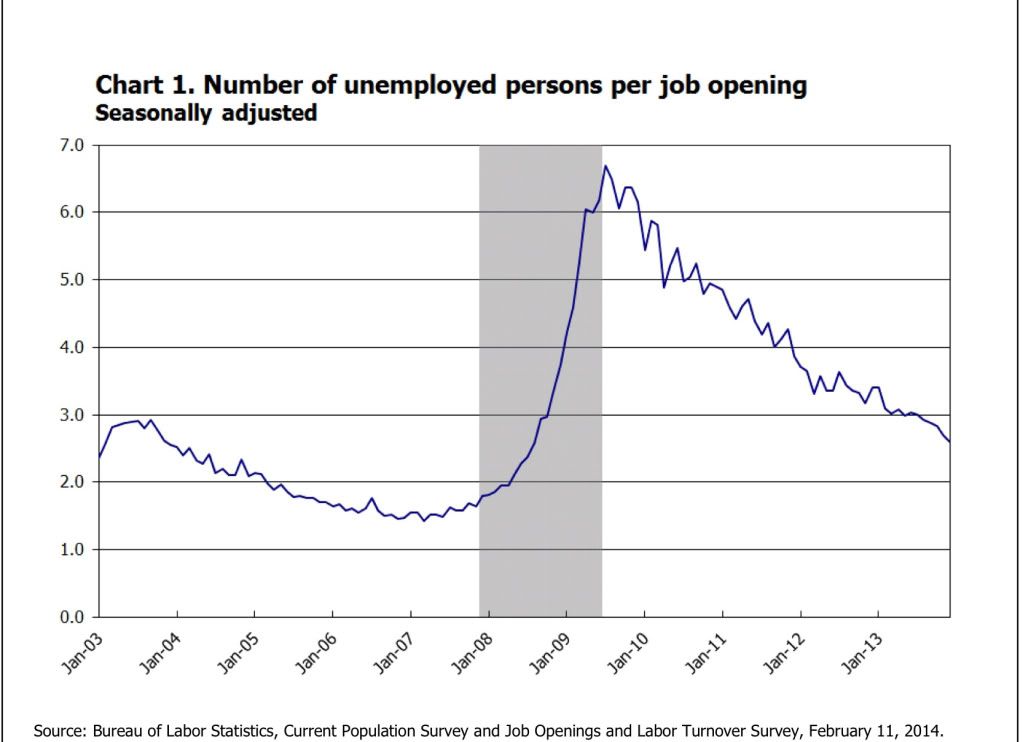

Before getting to the main subject of this post, let me say that I consider it an act of moral depravity to have cut off extended unemployment benefits when both unemployment and underemployment remain so high. Even if I were to accept the critique that such benefits create a "hammock" making certain people comfortable in their unemployment, the fact is that millions of the unemployed are *not* comfortable in their unemployment. There simply aren't enough jobs to absorb the millions of people who have looked for a job and cannot find one. That ought to be obvious from the fact that there are still nearly 3 unemployed people actively looking for work for every one job opening:

cutting off benefits to those people is an act of unconscionable cruelty, leading as it must to privation and maybe even homelessness for some.

But cutting off extended unemployment benefits at the beginning of this year wasn't just vile, it is actually harming the economy. It appears to be the primary additional factor beyond the unusually severe winter weather in the raft of relatively poor data we have seen so far this year.

To begin with, let's quantify the scope of the lost benefits:

Federal unemployment benefits that continue for 26 weeks after a person uses up the 26 weeks of state unemployment benefits ended Saturday, so now some 1.3 million people won’t be getting their $1,166 (on average) monthly check. By June, another 1.9 million will be cut off.

It is believed that another 600,000 or so lost benefits in February, which brings us to 2,000,000 people having lost unemployment benefits roughly equalling $1200 a month so far this year. Simple multiplication means a loss of $2.4 billion in spending ability per month, or $28.4 billion for the whole of 2014. It is ultimately estimated that about 4,000,000 people may be affected. That's a loss of $56.8 billion annually.

But it gets worse. Let's stick with just the 2,000,000 people affected so far. When a similar cutoff was being debated in 2011, the Department of Labor noted tha

- A study commissioned by the Labor Department under the Bush administration showed that for every dollar spent on unemployment benefits, two dollars are pumped back into the economy.

Applying the multiplier to the present situation gives $1200/mo * 2 million people * 12 months * 2 multiplier =$50-$60 billion loss in 2014.

With GDP running at $16 trillion in 2013, that translates into a -0.3% to -0.4% hit to GDP this year.

The Business Week article cited above indicates that a smaller, but similar multiplier of 1.55 was calculated by economist Mark Zandi of Moody's Analytics.

More recently the Congressional Budget Office estimated that:

the proposal would increase outlays relative to those under current law by nearly $26 billion—by about $19 billion in fiscal year 2014 and by $6.5 billion in fiscal year 2015. The net increase in deficits over the 2014–2023 period would amount to about $25 billion because the proposal would also boost revenues by $0.5 billion over that period.CBO estimates that extending emergency unemployment benefits would raise gross domestic product (GDP) and employment in 2014 relative to what would occur under current law. Recipients of the additional benefits would increase their spending on consumer goods and services. That increase in aggregate demand would encourage businesses to boost production and hire more workers than they otherwise would, particularly given the expected slack in the capital and labor markets.

However, those positive effects on output and employment in 2014 would be partially offset by ... [the belief that] in response to the extension of benefits, some unemployed workers who would be eligible for those benefits would reduce the intensity of their job search and remain unemployed longer—which would tend to decrease output and employment. CBO estimates that those negative effects would be modest, though, in 2014 because most of the jobs that would not be taken by some of the people receiving the additional benefits would instead be taken by some of the many people searching for work who would not be eligible for those benefits.

Combining the ... effects ..., CBO estimates that extending the current EUC program and other related expiring provisions until the end of 2014 would increase inflation-adjusted GDP by 0.2 percent and increase full-time-equivalent employment by 0.2 million in the fourth quarter of 2014. Those figures represent CBO’s central estimates .... The full ranges that CBO uses for those parameters suggest that, in the fourth quarter of calendar year 2014, GDP could be increased very slightly or by as much as 0.3 percent, and employment could be increased very slightly or by as much as 0.3 million.

It appears that the CBO did not address the spending multiplier issue, since its $26 billion estimate is close to the raw $28 billion estimate we obtained by simply multiplying the number of people affected by the average amount in monthly benefits received.

Even at a multiplier lower than 2, for example the 1.5 multiplier proposed by Mark Zandi, gives us a likely negative affect of GDP of about -0.3%.

Since almost 1/3 of all of the people who would be affected in all of 2014 were cut off in January, it is in the January and February consumer spending numbers that we would expect to see the biggest hit. And so far, that is indeed what we have seen.

For example, here is the 4 week moving average of same store sales going back to the end of the recession (h/t Bearnobull):

Note that the YoY% increase in spending since the turn of the year is the lowest during the entire period. For the last two weeks, including the week reported just yesterday, the ICSC same store sales index recorded YoY gains of only +1.4% and +1.5%, respectively, so the effect is continuing right up until the present.

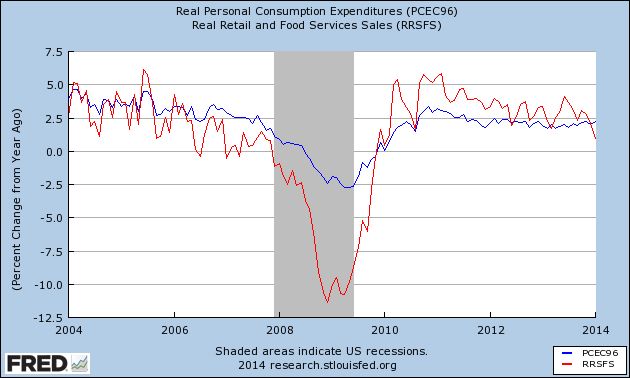

Now here is a graph comparing real personal consumption expenditures (blue) and real retail sales (red). Since PCE's are the broader measure, and encompass "wants and needs" vs. the narrower measure of retail sales, which are more focused on "wants," this comparison tells us how confident or pinched consumers feel:

As I have previously shown, in every business cycle since World War 2, YoY retail sales have declined further than YoY PCE's prior to the onset of a recession. January 2014 marks the first month since the beginning of the 2009 economic expansion that YoY retail sales are significantly below YoY PCE's.

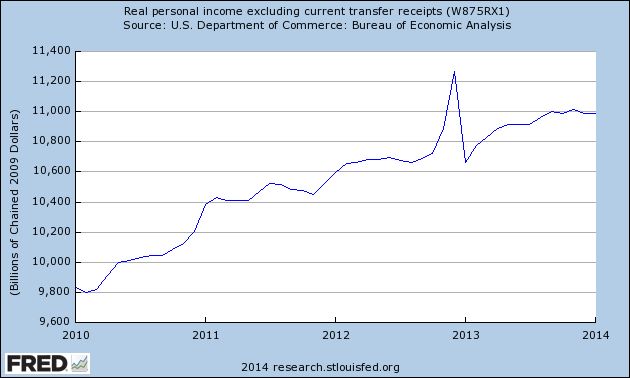

Real personal income minus transfer payments (such as food stamps and unemployment insurance) has also turned flat for the last several months:

There has been much commentary that the relatively poor winter weather only explained part of the slump in much of the economic data these last several months. The sudden elimination of $1200 a month spending power to 2 million people since January first is an excellent candidate for explaining that slump.

So the cutoff in extended unemployment benefits isn't just vile, it is counterproductive as well.