- by New Deal democrat

Bill McBride, a/k/a The Nicest Blogger on the Internet, and I have almost always seen eye-to-eye on the matter of housing. Both of us thought that housing was in a bubble in 2005. Both of us thought in 2011 that housing prices would bottom in early 2012.

But we have totally different opinions about the direction of housing in 2014.

In his forecast for 2014 residential investment, CR says, "I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013."

By contrast, several weeks ago, in a post at XE.com, I said that "If the typical past pattern is followed, we will shortly see permits running 100,000 less than one year previously."

This is quite a difference. Bill expects sales and starts to average about 1.150 million annualized this year. I expect that at some point permits and starts will sink under 900,000 annualized.

The difference is one in approach. Bill's post argues from the fundamentals:

demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That means starts will come close to increasing 60% over the next few years from the 2013 level.From there he deduces his forecast of 20% this year.

While I agree with CR over the long term that demographics and pent-up demand are a tailwind behind the housing market, my argument stems from strong past correlations of increases in interest rates and decreases in housing demand. The graphs I posted in the XE.com article show 15 occasions in the last 50 years that interest rates have backed up by at least 1% YoY. On 12 of those occasions, housing permits fell by at least 100,000 shortly thereafter. Those are pretty good odds.

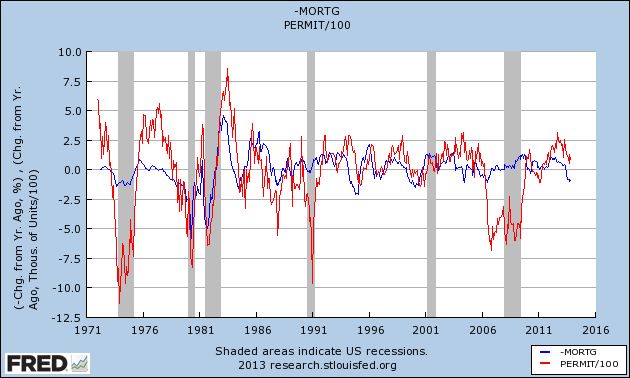

When one compares mortgage rates and housing permits, as in the below graph covering the last 40 years, the relationship is even stronger:

Of the 9 previous times in the last 40 years that mortgage rates have increased by 1% YoY, housing permits fell by at least 100,000 YoY on 8 of those occasions. The 9th time, briefly during the bubble year of 2004, was followed by a YoY decline of -65,000 permits in spring 2005.

My working principle is to look at the data in as dispassionate and detached manner as I can, and to default to the idea that "it's not different this time." Although permits have not even turned negative YoY at this point, their improvement has decelerated considerably since the low of interest rates in 2012.

So here are the terms of our bet: If starts or sales are up at least 20% YoY in any month in 2014, I will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.

Note that since our forecasts are not mirror images of one another, it is possible that both or us will win this bet. Or neither! And to be honest, since my forecast implies a weakening economy, probably with less hiring and wage growth, I hope I lose.

But I think this frames the biggest US economic issue of 2014 - will the rise in interest rates derail economic growth? - in a succinct manner.