- by New Deal democrat

House prices show a lot of seasonality, so the only good way to keep track of them is YoY, and YoY price increases are still running very strong.

So how can I be forecasting a decline in house sales if prices have continued to rise so strongly? Because sales will peak and turn down before prices.

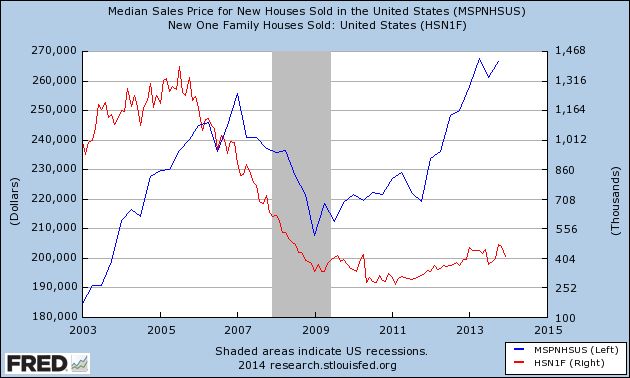

In case you needed a refresher, here's a graph of sales of single family homes (red, right scale) compared with median prices for new single family homes (blue, left scale) for the last 10 years:

Recall that sales peaked a full two years before nominal prices turned down.

While I don't believe we are in a new bubble (adjusted for income, prices haven't risen nearly so much off their bottom), there has been quite an outcry that traditional first time homebuyers are priced out of some markets.

In any event, I believe the transmission of higher interest rates through the housing market will unfold the same way. Sales will turn down before prices do.

But isn't inventory still tight? Yes, but remember that the months-of-supply metric can resolve either through more inventory coming on the market, or monthly sales declining, or both, which is what happened when the housing bubble burst. If in the next few months sales decline to 900,000 annualized, that will go a long way to a "normal" number of months of supply.