While I've previously been bearish on Australia, my position is now changing to neutral. There are two reasons for this change. First, the ETF has already fallen 20%, which is a bug move for an economy that is still printing decent GDP growth. Second, the LEIs have now printed a positive number for four straight months. This is from the latest Conference Board release:

The Conference Board LEI for Australia increased in April for a fourth

consecutive month, with money supply and stock prices making the largest

positive contributions. Between October 2012 and April 2013, the

leading economic index increased 0.7 percent (about a 1.5 percent annual

rate), up from a decline of 0.4 percent (about a -0.8 percent annual

rate) during the previous six months. Additionally, the strengths among

the leading indicators have remained more widespread than the weaknesses

in recent months.

Here is a copy of the components:

In general, we see a positive contribution from most components over the last 4-5 months with two exceptions: building approvals and the sales to inventory ratio. All other points are doing well. Let's now turn to the CEIs:

Like the LEIs, the CEIs are now printing mostly positive numbers.

Here's the assessment of the economy from the latest meeting minutes of the central bank:

Exports had grown further in the March quarter.

Resources exports, particularly of bulk commodities, had grown strongly

over the past year, while services exports had resumed growth more

recently.

Available information indicated that business investment

had declined in the March quarter. According to the latest ABS capital

expenditure survey, the decline had been in both the mining and

non-mining sectors. The fall in capital imports since the beginning of

the year was consistent with a decline in investment in the first

quarter, although recent data showed that capital imports had bounced

back somewhat in April.

According to the ABS survey of firms' capital

expenditure plans, non-mining investment was expected to show moderate

growth over the next year or so. While the survey also continued to

imply further growth in mining investment, in the past actual annual

capital expenditure by mining companies had often differed by a wide

margin from their forecasts as reflected in the ABS survey. Based on

public statements by mining companies and information from the Bank's

liaison, it seemed likely that mining investment was near its peak but

would probably remain at a high level for the next year or so. However,

members observed that there was considerable uncertainty about mining

investment beyond that period. In particular, changes in production and

exports of energy commodities in other countries were making it more

difficult to assess the potential for new projects in the gas sector in

Australia. Overall, conditions in the business sector remained

somewhat subdued, with survey measures for all industries at, or below,

average levels.

Household spending appeared to have picked up early in

2013, after having slowed late in 2012 and having been supported by

higher asset prices. In the March quarter, growth of retail sales

volumes was strong across most categories, amid a decline in retail

prices. Liaison suggested that the pace of retail spending might have

eased somewhat more recently, while measures of consumer confidence

fell back to around average levels in May.

Members observed that the effects of low interest rates

had been evident in a range of housing market indicators. Building

approvals for both higher-density and detached dwellings had increased

over recent months. The Bank's liaison contacts were generally becoming

more positive about the outlook for dwelling investment. Also, loan

approvals had grown more strongly in recent months, including for new

housing, and auction clearance rates were well above average in Sydney

and had picked up to be a bit above average in Melbourne. While

measures of dwelling prices had been relatively flat over recent

months, they were still higher than the previous year.

Labour market conditions remained somewhat subdued. The

monthly employment data continued to be volatile, with a large increase

in employment in April following a sizeable decrease in March. Looking

through this volatility, employment growth had not been as fast as

growth of the labour force, which had led to the unemployment rate

drifting higher over the past year, to 5½ per cent. Job advertisements

had stabilised earlier in the year, but had edged down in recent

months. Overall, leading indicators of employment pointed to continued

moderate employment growth.

The wage price index had increased by 0.7 per cent in

the March quarter, a little less than had been expected, and year-ended

wage growth was below the average of the past decade. The easing in

wage growth had been broad based across industries and states, with

notable declines in areas related to the mining sector. While the

decline in the pace of wage growth in recent quarters had been most

pronounced in the private sector, growth in public sector wages

continued to slow in the March quarter and remained relatively subdued,

consistent with ongoing fiscal restraint.

What we see in general is a business sector split between natural resource and non-natural resource sectors. The former is in flux as a result of the Chinese re-balancing, while the latter is OK. Consumers are still spending thanks to the wealth effect of higher asset prices. The Central Bank also has room to lower rates further if needed.

Let's turn to a few Australian ETFs, starting with the equity markets.

Prices have dropped almost 20%, from their high of 28.15 to yesterday's close of 22.60/ Prices are now below the 200 day EMA; they've brought the shorter EMAs with them. Also note the slight increase in volume and negative MACD and CMF. Prices are right at the 38.2% Fib reading from the June-May rally.

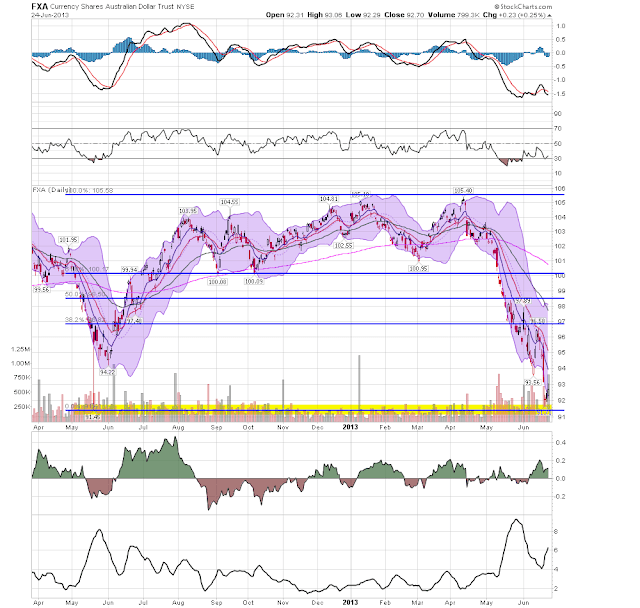

Like the equity markets, the Aussie dollar has also dropped sharply, falling about 12.66%. Like the equity market, the technicals are very negative. However, prices have made a 100% retracement from their May move last year, indicating this might be the end of the sell-off.