- by New Deal democrat

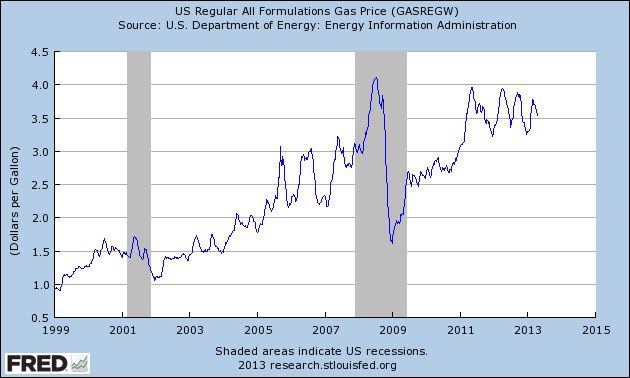

One of the themes I've been exploring is whether and how much the Oil choke collar has been responsible for the slow growth in the US economy since the turn of the Millenium. The increase in the price of a gallon of gas from $0.91 at its low in February 1999 to $4.11 in July 2008 was certainly spectacular, as shown in the graph below:

So significant is that rise that at one point Professor James Hamilton estimated that the Oil shock of 2008 was responsible for nearly half of the entire decline in GDP during the great recession.

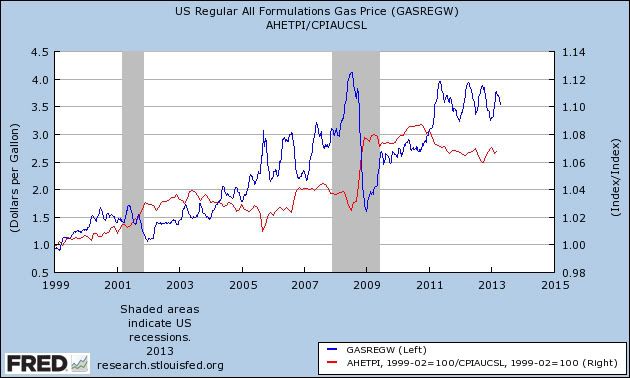

During that same time since 1999, the average Amercian's wages in real, inflation-adjusted terms have only risen very slowly, and have been very much constrained by the increasing price they must pay at the pump, as shown in the next graph which compares the increase in the price of gas (blue, left scale) with the increase in real wages (red, right scale):

Real wages have only grown about 7% over the last 14 years, almost all of that growth during three stairstep increasies coinciding with gas price declines during two recessions and during the very weak economy of 2006.

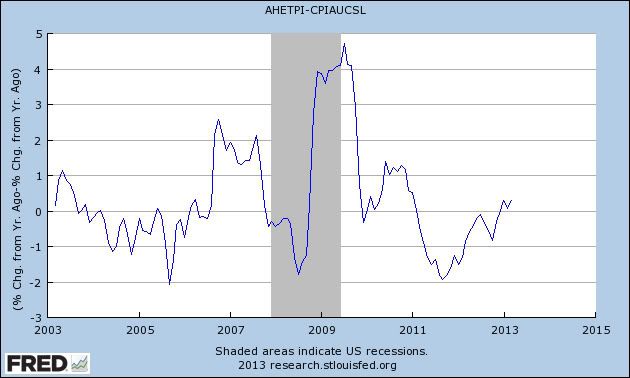

Focusing on the last several years, earlier this week I ran a graph of real hourly wages showing that deflation in March meant that real wages had turned back up albeit slightly:

I noted the other day that the loosening of the Oil choke collar this spring is giving Joe Sixpack a little respite. The improvement really shows up when we switch to a measure of the YoY% change in real wages. March, along with January marked the best comparison in two years:

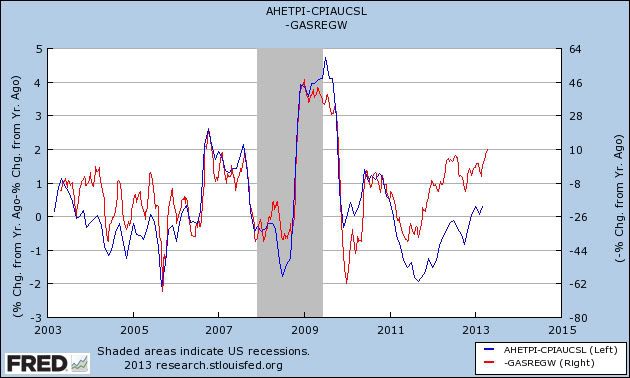

Just how close the correlation between gas prices and real wage growth has been since gas prices began to rise in 1999 is shown on the next graph, in which gas prices are inverted so that lower prices are higher on the graph, and higher prices lower:

The renewed surge in gas prices past $3 all the way back to $4 in 2011 caused an actual decline in real wages, that persisted until the end of last year. As you can see in the graph above, the loosening of the oil choke collar this year has led to the first YoY increase in real wages in 2 years.

Dependiing on what happens with gas prices in the next two weeks, we could get the biggest one month decline in consumer prices since the depths of the great recession this month. Whether the decline in gas prices is momentary or signifies a real secular event makes all the difference as to whether or not this is just a brief respite or starts a real improvement in the outlook for the average Amercian family.