To reiterate my view on the markets

My primary concern for the US markets has been the international markets. Simply put, with other markets and economies slowing down, I've wondered how the US can continue rallying (see here, here, here and here). Last week's action in the US markets indicates the US is coming under more pressure both from international markets and internal weakness.

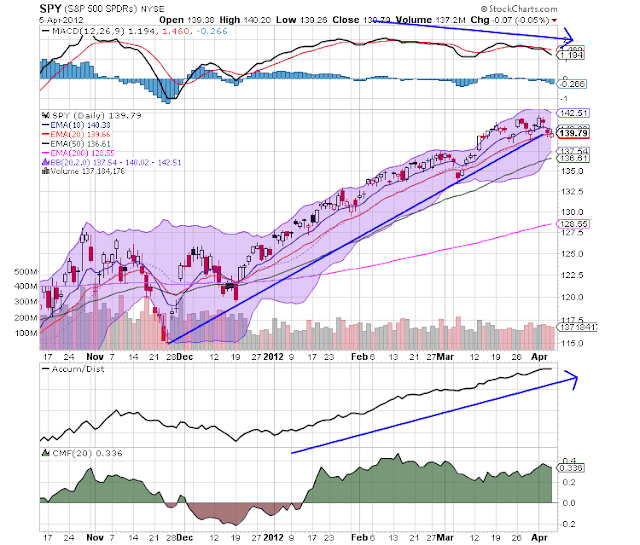

Both the QQQs and SPYs are either right at critical support (the QQQs) or just beyond it (the SPYs). Put another way, both markets are one bad trading day away from moving through very important trend lines. Also note the declining momentum for both charts; the QQQs have given a sell signal and the SPYs have been showing declining momentum for the last few months. However, note the rising A/D for both, indicating more money is coming into the market.

As I've noted before, the IWMs are the problem child of the market; while the QQQs and SPYs were rallying, the IWMs were stuck in a rut, unable to advance.

The Treasury ETFs all share the same characteristics. After selling off in reaction to the Fed minutes release, they have all since rallied back to key levels. Prior to the sell-off, one of my concerns (and others) was that the treasury market was taking money away from the equity market. The sell-off gave us hope that that situation was reversing. However, the rally over the last few weeks indicates the safety play may be returning to the market. This will take money away from the equity markets, preventing their rally.