Boston: First District retailers report mixed sales results for the period from January through early March, with comparable same-store sales ranging from modest decreases to mid-single-digit increases. Several respondents note the negative impact that inclement weather had on sales. Sales of apparel, accessories, groceries, and home furnishings are strong, as the consumer continues to seek value.

NY: Retailers generally report strong results for February and March. One major retail chain notes that sales were ahead of plan in February and March, while another describes sales as on plan. Two major malls in western New York State also characterize sales as steady and strong, continuing to be buoyed by a flow of Canadian shoppers. A number of retail contacts note that, due to the later Easter this year, sales were modestly lower in March than a year earlier, but this effect is expected to be reversed in April. Unseasonably cool weather was not considered a major factor. Two major retail chains note that New York City under-performed the rest of the region in terms of sales growth last month. Inventories are generally reported to be at desired levels, and prices are reported to be stable, though one large retailer notes that it is testing out price increases on certain lines of merchandise.Auto dealers in upstate New York--metropolitan Rochester and Buffalo--characterize sales of new vehicles as exceptionally strong since the last report. Sales of used cars were also relatively robust, and dealers report that business at service departments remains brisk. Retail credit conditions continued to improve.

Confidence surveys have given mixed results since the last report. Siena College's survey of New York State residents shows consumer confidence among NY State residents leveling off in March, after falling in February. The Conference Board reports that residents of the Middle Atlantic states (NY, NJ, Pa) became considerably less confident about the near-term outlook, in March, but that their assessment of current conditions improved for the 4th straight month.

Philly: Third District retailers generally reported slight year-over-year increases in sales in March. One merchant said, "Things are getting a little better, but there is no move to stronger growth." Retailers indicated that sales of furniture and home goods have risen recently, but sales of spring apparel have been slow to pick up, which retailers attributed to unseasonably cold weather and the late Easter date this year. Some retailers said they have experienced shortages of a few goods produced by Japanese companies, mainly electronic products, but as of late March there did not appear to be a widespread interruption of imports of consumer goods from the Far East. Store executives surveyed for this report expect the current modest rate of sales growth to continue through the spring.

Third District auto dealers generally reported that sales were above the year-ago level in March and were continuing to move up. Some dealers of various brands noted the beginning of supply interruptions due to halts of vehicle and parts production in Japan resulting from the earthquake and subsequent problems there. These dealers said the supply problem had not yet become serious, but they did not know how extensive it might become or how long it might last. Dealers reported that demand for large vehicles has not declined yet despite the recent increase in the price of gasoline. Dealers said they see evidence of "pent-up demand" and they expect sales to remain strong as long as economic conditions are improving and the price of gasoline does not rise much higher.

Cleveland: Reports from retailers indicate that sales for the period from mid-February through mid-March were generally on or ahead of plan, and were mostly higher relative to year-ago levels. Sales of warm-weather apparel and recreational products have picked up. A few of our contacts reported that the low- to mid-market segments still face considerable stress. For the second quarter of 2011, retailers expect transactions to rise on a year-over-year basis, with several anticipating low to mid-single digit gains. We continued to hear about increasing prices from vendors, which were primarily attributed to a rise in the cost of agricultural commodities. Accordingly, some retailers have raised their prices, especially for food products. Profit margins were generally steady or showed a slight improvement. Capital spending is mainly for store remodeling, new store openings, and e-business expansion, with a corresponding increase in payrolls. No change in employment is expected at existing stores.

Auto dealers reported that new-vehicle sales improved between mid-February and mid-March when compared to the prior 30-day period, while on a year-over-year basis, vehicle purchases rose substantially for most of our contacts. Several noted that they are beginning to see a pickup in sales of more fuel-efficient cars. Dealers expressed concern about a potential slowdown in the pace of the recovery. As a result, they are more cautious in their outlook for vehicle purchases during the spring and summer months. A majority of our contacts said that new- and used-vehicle inventories are too lean. Used-vehicle prices are trending up. Reports about lenders loosening credit requirements were fairly widespread, with credit prices remaining very competitive. Dealers are waiting for more details from automakers before committing to major capital investments in their facilities. However, several of our contacts said that they are currently undertaking some minor upgrades. Most auto dealers are beginning to hire on a selective basis.

Richmond: District retail sales remained anemic in recent weeks. A store manager at a discount chain department store in central North Carolina noted, "Sales petered out after early tax refunds were spent," while the store manager at another discount chain store in Virginia Beach said sales were "slow but steady." Suppliers' prices rose rapidly for cotton and petroleum-based fabrics. At a Maryland mall, a department store manager told us that rising cotton prices were "a big deal," preventing acquisition of inventory such as clothing, sheets, and towels. An analyst for a major hardware store chain stated that sales were "a little better," with shoppers spending more but not on major home improvements. Big-ticket sales weakened, according to surveyed contacts, primarily in wholesale construction materials and furniture. Vehicle sales were generally sluggish or unchanged; a dealer in the Tidewater area of Virginia reported "sales have been stagnant." Another dealer reported that he was facing restrictions on ordering certain car colors, because those paints come from Japan; he also noted availability problems with car components originating in Japan. Retail prices rose at a slightly quicker pace in recent weeks; a large grocer indicated that his wholesale price increases were being passed through to consumers.

Atlanta: Most District merchants reported that retail activity improved in February and March following a lackluster January. Retailers reported that they do not plan to make any changes to the tight inventory management practices currently in place. The outlook among District retail contacts remains optimistic; however, rising gasoline prices and its potential impact on consumer confidence and spending was a concern. Automobile dealers described robust sales growth and a strong demand outlook. A few noted that an improvement in consumers' access to credit contributed to the increase in sales.

Chicago: Consumer spending increased from the previous reporting period. Consumers continued to be drawn toward promotional items, now in part because they are dealing with the impact of higher food and energy prices on household budgets. The expiration of manufacturers' incentives contributed to a slight decline in auto sales in March. Auto dealers reported inventories were relatively low given the recent strength of sales. Contacts noted that potential production disruptions stemming from the events in Japan and the effects of rising gas prices on demand add a good deal of uncertainty to the outlook for the auto sector. Some dealers have already seen a shift in sales from new trucks to more fuel efficient vehicles.

Minneapolis: Consumer spending increased. A major Minneapolis-based retailer reported that same-store sales in February were up almost 2 percent compared with a year earlier. A mall manager in North Dakota reported that recent sales were up slightly from a year ago. A representative of a retailers association expects restaurant growth during 2011 in Sioux Falls, S.D. However, retailers noted that March sales may finish lower than March 2010 sales due to the late Easter holiday.

A representative of a Montana auto dealers association reported improving sales; gas prices were not yet a factor in buying decisions. Recent North Dakota vehicle sales were healthy, and dealers were optimistic about 2011, according to an auto dealers association. A domestic auto dealer in Minnesota said that March sales were "excellent."

KC: Consumer spending picked up following weather-reduced sales in the last survey period. After firming in late February and March, retailers expected sales to rise in the next three months. Store managers noted an uptick in sales of apparel and decorative items. One jewelry store, however, noted that high gasoline prices were cutting disposable incomes and trimming sales. After slowing in the last survey, auto dealers reported robust sales, particularly for used cars, fuel efficient vehicles, and SUVs. Dealers were optimistic that sales would rebound further. Restaurant operators reported stronger sales despite a continued decline in the average check amount. Tourism activity edged up, and vacation destinations were hiring for the summer. Colorado resorts reported the number of skiers this season exceeded year-ago levels. Some District hoteliers raised room rates in response to higher occupancy rates.

Dallas: Eleventh District retail sales rebounded from weather-related sluggishness in the previous reporting period and grew modestly compared to the prior year. Home furnishings sales benefitted from strong seasonal trends. According to one large retailer, the Eleventh District continues to grow at a stronger pace than the nation, on average. Expectations are for a modest improvement in 2011 over 2010.

Automobile sales continued to improve; however, respondents note concern over potential supply chain disruptions due to the ongoing natural disaster and nuclear calamities in Japan. Aside from these concerns, automobile dealers reported a favorable outlook for the balance of 2011 due to strong foot traffic consisting of high-quality customers.

Frisco: Retail sales continued to improve overall. Traditional department stores and discount retail chains alike reported further increases in sales. Similarly, sales revenues rose for grocers; contacts attributed the gains in part to higher food prices in addition to increased sales volumes. Despite some indications of rising appetites for discretionary spending, consumers remained largely focused on necessities and lower-priced options across a wide spectrum of products. Retailers of major appliances and furniture reported that activity remained subdued. Demand for new automobiles strengthened further, propelled partly by manufacturers' rebates and improved availability of credit. Looking forward, some retail contacts expressed concern that elevated gasoline prices will reduce sales of other items.

Some observations, in no order of importance

-- Overall, the tone of the report is positive. While some of the gains are small, they are still gains. Overall, there was more consumer spending.

-- Several districts noted that rising prices were an issue. This is obviously a concern

-- Car sales are doing very well which is encouraging. One district referred t pent-up demand. I'm assuming he was referring to the impact of low auto sales during the recession and the increase in the overall age of the nation's car fleets. In addition, several districts noted an increase in demand for fuel efficient cars for obvious reasons.

-- Japan was already having an effect on the nation's supply chain. While this report showed that effect primarily in the car sector, one district noted problems associated with consumer electronics.

-- Several districts noted the negative impact of high energy prices on consumer spending, especially discretionary spending.

-- One district noted that lower-priced merchants were having a harder time with sales.

While we're on the topic, let's look at some data on consumer spending:

Total real PCEs are above pre-recession levels and are still in a clear uptrend.

Services -- which comprise about 65% fo PCEs, are slightly above pre-recession levels. However, notice these expenditures have stalled over the last four months.

Non-durable goods expenditures are also above pre-recession levels, but, like the service component, this component has stalled for the last five months. This expenditure category exhibited the exact same behavior last spring during the slowdown caused by the EU crisis.

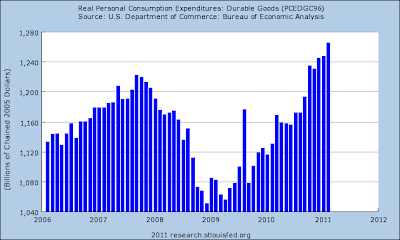

Durable goods expenditures are above pre-recession levels and are still moving higher. Here we are seeing some of the pent-up demand from the recession showing an influence.

Light vehicle sales dropped last month, but are moving higher. They have quite a ways to go before getting to pre-recession levels -- if they will ever reach that level during this expansion.

Real retail sales dropped last month, but the overall trend is still higher. This data series also stalled a bit last year during the spring.

Right now, the data shows a continued increase in spending by consumers. While the pace is slowing (probably due to high gas prices) we are still seeing an increase in activity. However, I am still cautious about this data set going forward due to the continue high rate of unemployment and commodity price increases taking away purchasing power.