Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2010, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.7 percent.

The Bureau emphasized that the third-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see the box on page 3). The "second" estimate for the third quarter, based on more complete data, will be released on November 23, 2010.

The increase in real GDP in the third quarter primarily reflected positive contributions fro personal consumption expenditures (PCE), private inventory investment, nonresidential fixed investment, federal government spending, and exports that were partly offset by a negative contribution from residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The small acceleration in real GDP in the third quarter primarily reflected a sharp deceleration in imports and accelerations in private inventory investment and in PCE that were partly offset by a downturn in residential fixed investment and decelerations in nonresidential fixed investment and in exports.

Let's take a look at the individual data points, starting the PCEs

Real PCEs overall are increasing at a decent rate. Also note the pace of quarter to quarter increases in increasing slightly.

Services, which account for the largest percentage of PCEs increased strongly last quarter, in line with the pre-recession pace.

Non-durable goods expenditures are also increasing in line with their pre-recession levels.

Non-durable goods expenditures are also increasing in line with their pre-recession levels.

And durable goods purchases are also increasing.

Bottom line: the consumer is adding to the recovery. This time around the consumer was responsible for 2% of overall growth.

Let's turn to investment:

Non-residential structures increased slightly last month, although I would not count on this being a strong area of growth going forward as there is a tremendous oversupply in this area.

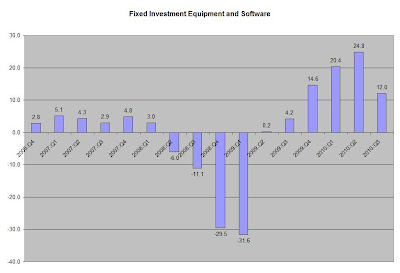

Fixed equipment and software increased, although the pace of increase is decreasing.

Fixed equipment and software increased, although the pace of increase is decreasing.

After adding to growth last quarter, residential investment subtracted from growth last month.

Gross private domestic investment added 1.54 to the overall growth rate, meaning the US is economy is adding sufficient investment to move forward.

Once again, imports took a big bite out of GDP, subtracting 2.61 from overall growth. This is a very big deal and indicates the import situation is developing into a primary problem going forward.