First, some background. I was against Bush's deficit spending for a large part of his administration. One reason was I was against the Iraq War more or less from the beginning. From an economic perspective, war is a horrible utilization of resources. In addition, Bush made the same fiscal mistake Reagan made: he decreased revenues by cutting taxes and increased spending. This is a recipe for increasing debt, which was the final result of Bush's policies. Total debt outstanding at the end of Bush's first year in office (9/30/01) was $5,807,463,412,200.06. When he left office 9/30/08) that number was $10,024,724,896,912.49.

However, I supported most of the current spending (see this article and this article for more information). The reason for that is simple: read A Monetary History of the US by Milton Friedman -- especially the chapter titled "The Great Contraction". Starting with the announcement of Bear Stearns in the summer of 2007 that two of its hedge funds were suffering major losses the US financial system has been in a shooting gallery. What really made the great depression worse were the financial events of 1929-1933 when the US went through major financial turmoil. That essentially shut down the economy, leading to a contraction of more than "50% in current prices from 1929 to 1933". This time the situation was no different. In addition, by the end of 2008 it was obvious the country's greatest threat was a deflationary spiral. In short, the government had two choices: do nothing and practically guarantee economic freefall or do something to prevent it.

Throughout the above statements is the idea that government should act prudently during good times in order to spend during bad times -- that is, use its spending muscle during the bad times to limit the economic damage of a slowdown while cutting its spending and letting the private sector take over when the economy turns around. At least -- that's the ideal. It has yet to happen in real practice (although the 1990s came pretty close).

All that being said, let's take a look at where we are now. According to the Bureau of Public Debt, total US debt is $11,406,012,959,882.55 while total nominal US GDP is $14.089 trillion, making the debt/GDP ratio 80.956%. That's not good, but not catastrophic either. However, the budget projections from the CBO provide the following deficits for the years 2009-2012: $-1.845, $1.379, $-.970 and $-658. So, assuming these estimates are correct, by the end of fiscal 2012 we'll have $4.852 trillion more in debt. Tacking that onto the current daily total of all debt outstanding we get $16.258 trillion. Now -- assuming we have no growth for the next four years and our nominal GDP stays at $14 trillion we would have a debt/GDP ratio of 116% by the end of fiscal 2012. That is not a good development. That does assume there will be no GDP growth over the next 4 years which is also not likely. However, no matter how you slice the information it is not a healthy way to run an economy.

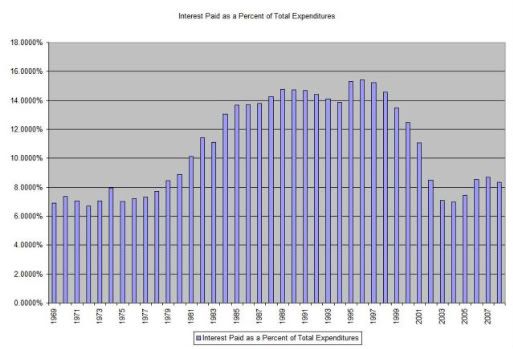

But let's look at this from another angle: interest paid on the debt. Let's assume we don't retire any debt (which we won't) buy only pay interest on the debt. Can we at least afford that? Here is a chart of the percentage of interest payments as a percentage of total federal expenditures.

This number was at its highest in the late 1980s to the early 2000s when it fluctuated between (roughly) 14% and 15%. It dropped during the first part of this decade thanks to record low interest rates. Those will not remain for the next four years. However, the above chart indicates the interest payments are not so high we will face current problems. In addition, we do have room for upward movement on interest rates.

So -- the overall conclusion is we're going to be pushing the envelope of US finances which is never good. Overall debt/GDP will most surely be at 100% by the end of fiscal 2012. In addition, the interest component of the federal budget will surely increase as well. Now -- is this development fatal? No. But are we adding more stress to the system? Yes. But finally, do we have a choice? That is, is there another viable option right now? No. Fiscal conservatives (who by the way don't exist in the Republcan party's policy implementation arm) will argue to do nothing. But given the precarious nature of the economy right now that is still a recipe for economic suicide.