- by New Deal democrat

As usual, we begin the new month’s data with the ISM manufacturing index. This index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession. Recessions have typically started once the overall index falls below 50, and usually below 48.

Which means that today’s report for November comes very close to meeting all of the above criteria. The overall index declined below 50 for the first time since May 2020, at 49.0. The new orders subindex declined -2 to 47.2, the 5th time in the past 6 months that it has been below 50, and only 0.1 above its September low of 47.1:

This is a reading on the very cusp of recession.

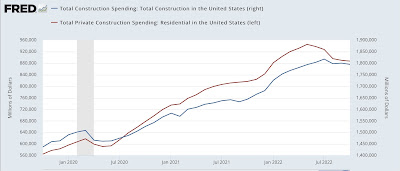

Construction spending for October was also reported, and also showed declines of -0.3% for both total and residential spending:

Total construction spending is -1.3% below its July peak, while the more leading residential construction spending is -7.1% below its early May peak.

Since construction spending is a series with only a 30 year history, there is no reliable recession marker, except that residential spending turns down in advance.

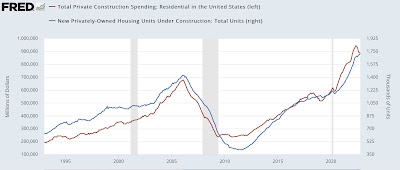

Finally, below is a comparison of total residential construction spending vs. housing units under construction from the permits and starts report:

While there is a general concordance, there is no set pattern as to which turns first or simultaneously. I continue to expect housing units under construction to follow permits and starts and turn down shortly.

In sum, our two final reports of the day show declines in both leading sectors of manufacturing and construction, the former more seriously than the latter.