- by New Deal democrat

Ok, FRED is back up and running, so here is my economic post of the day.

Vehicle sales used to be reported monthly by all manufacturers. Then, one by one, they switched to reporting only once a quarter, which makes their data much less interesting, since it is largely 90 days old by the time it is available. Not terribly helpful for looking ahead.

But the BEA also reports vehicle sales monthly, although for reasons unknown FRED does not post them until 4 weeks later.

Which is a too-lengthy introduction to saying that the BEA has reported October results, although the FRED graphs below only show through September.

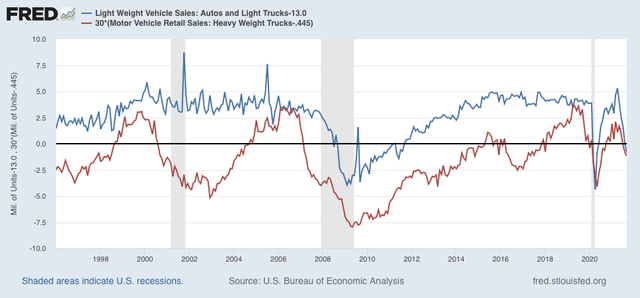

In October both light vehicle and heavy duty truck sales were up vs. September, the former to 13.0 million units annualized, and the latter to 0.445 million units annualized. The below graph subtracts that amount from each so that it shows as zero (and truck sales are multiplied x30 for scale):

There have been significant declines in both car and truck sales this year. Light vehicle sales peaked at 18.3 million annualized in April, and truck sales at 0.515 million annualized in March.

The reading is mixed. In the past, heavy truck sales have been a much earlier and more reliable leading indicator for a recession. This year they have not declined by nearly so much as prior to other recessions. Meanwhile light vehicle sales, which are typically very noisy, have declined by much more than is usually the case before a recession.

We know that much of this decline is due to the inability of manufacturers to get all the parts they require. This in turn has driven up prices sharply, which has caused a decline in sales as well.

I read this as showing that there is little economic stress on the producer side of the economy (that purchases heavy trucks); but there will be ramifications on vehicle manufacturers that will ripple through the economy. Overall I do not read this as recessionary - at least not at this point. As with last month, this Friday’s jobs report should be watched for both the number of jobs and hours added or lost in the manufacturing sector.