- by New Deal democrat

This morning’s JOLTS report for October showed a jobs market recovery that, for one month at least, paused. Openings and quits were up (good), but layoffs and discharges were also up (bad) while hires were down (bad).

While the JOLTS data is a deep dive into the dynamics of the labor market, since it only dates from 2001, there are only 2 previous recoveries with which to compare the present. Nevertheless it is worthwhile to make the comparison.

In the two past recoveries:

Let’s examine each of those in turn. In each case, I break out 2001-19 in a first graph and then this year in a second.

While the JOLTS data is a deep dive into the dynamics of the labor market, since it only dates from 2001, there are only 2 previous recoveries with which to compare the present. Nevertheless it is worthwhile to make the comparison.

In the two past recoveries:

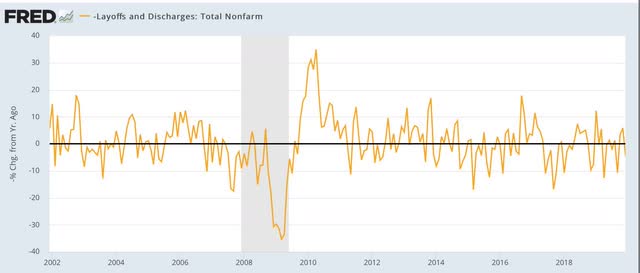

- first, layoffs declined

- second, hiring rose

- third, job openings rose and voluntary quits increased, close to simultaneously

Let’s examine each of those in turn. In each case, I break out 2001-19 in a first graph and then this year in a second.

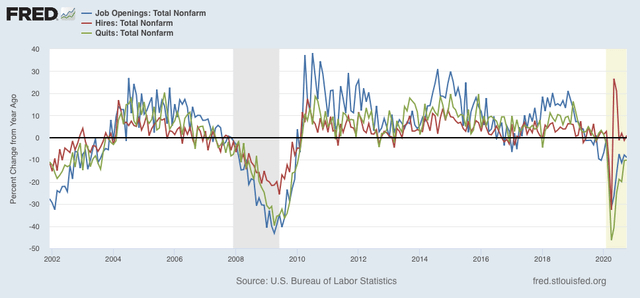

What appears below is that, although there has been some variation, the past several months have recapitulated the pattern from the last two early recoveries: the first two data series to turn - layoffs and hires - have indeed turned, while the last two - job openings and voluntary quits - have appeared to bottom but have had a much less dramatic rise.

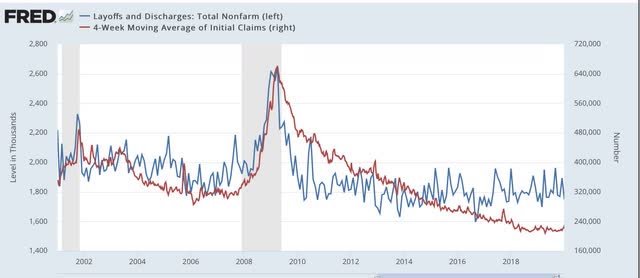

This first graph compares layoffs and discharges (blue) with the 4 week average of initial jobless claims (red):

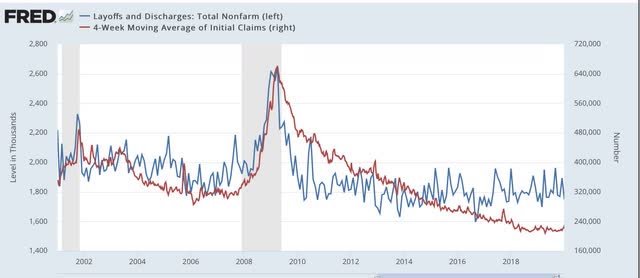

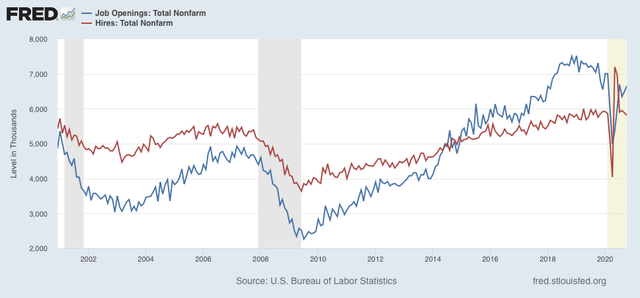

Next, here is the historical relationship between hires (red) and job openings (blue):

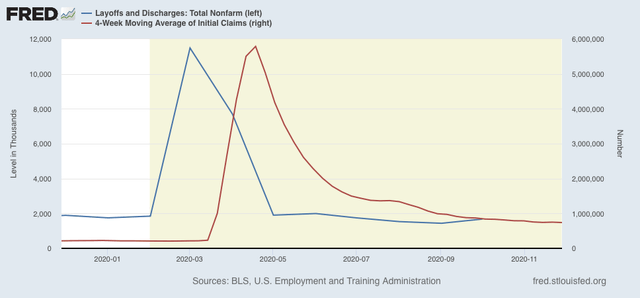

This first graph compares layoffs and discharges (blue) with the 4 week average of initial jobless claims (red):

You can see that, by the end of the recessions, layoffs were already declining, and continued to decline steeply over the next 3-8 months before reaching a “normal” expansion level. The turning point coincides exactly with the much less volatile, but more slowly declining, level of initial jobless claims.

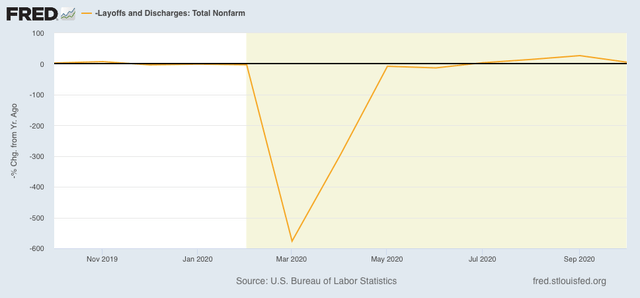

The same has been the case this year, as layoffs and discharges already declined to their “normal” level in May, while initial jobless claims peaked one to two months later, and have been declining (slowly) ever since. Whether the slight rise in the JOLTS series manifests in initial jobless claims in December will have to be seen:

The same has been the case this year, as layoffs and discharges already declined to their “normal” level in May, while initial jobless claims peaked one to two months later, and have been declining (slowly) ever since. Whether the slight rise in the JOLTS series manifests in initial jobless claims in December will have to be seen:

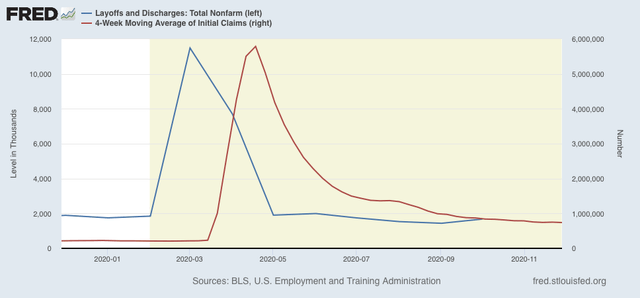

Next, here is the historical relationship between hires (red) and job openings (blue):

In the past two recoveries, actual hires started to increase one to two months before job openings.

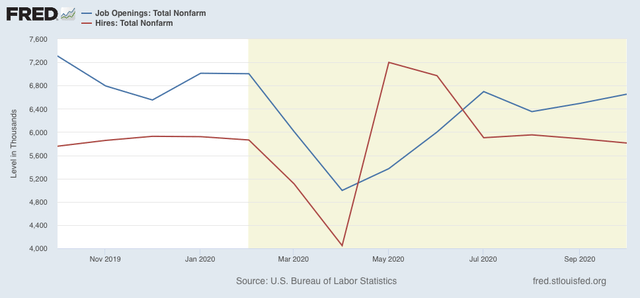

This year, both made troughs in April, but hires rebounded sharply in May and June compared with job openings. Since then both have essentially leveled off, but with hires in October having their worst month (ex-Mar and Apr) since 12 months ago:

This year, both made troughs in April, but hires rebounded sharply in May and June compared with job openings. Since then both have essentially leveled off, but with hires in October having their worst month (ex-Mar and Apr) since 12 months ago:

Again, we will have to wait and see if this just one off month, or whether hires continue to decline and openings follow.

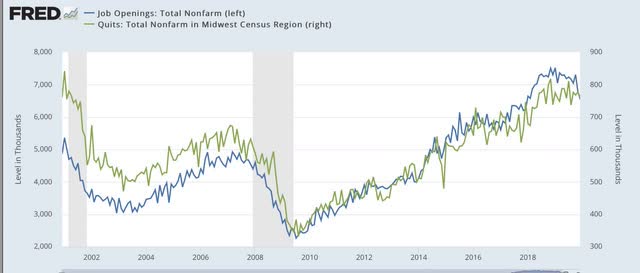

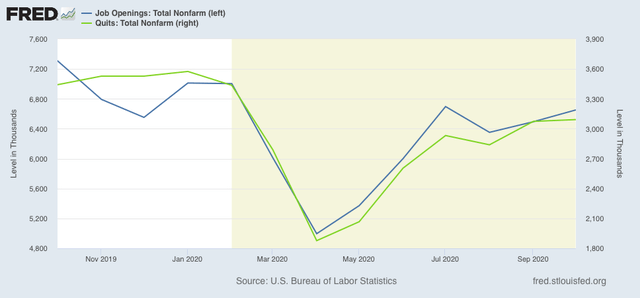

Next, here are quits (green) vs. job openings (blue):

In the past two recoveries, actual hiring started to rise slightly before quits made a bottom. After that, both rose more or less together (suggesting it is openings that leads to the increase in voluntary quits).

This year, both made a trough in April. Since then, it appears that openings have continued to slightly lead quits:

Finally, because seasonal adjustments might not be giving us a true picture because of the enormous moves during this pandemic year, here are job openings (blue), hires (red), and voluntary quits (green), measured YoY without seasonal adjustments for the entirety of the series up through the present:

We can see that, even taking out the seasonal adjustments, hires rebounded first following the 2001 and 2008-09 recessions. Quits and openings moved generally in tandem with a slight lag. The same pattern appears this year.

I have broken out layoffs and discharges separately below, because the their level in April and May of this year would obliterate all other variations (note: inverted so that fewer layoffs shows as positive):

This metric returned to normal almost immediately after both of the past two recessions, and did so again by July of this year, and while its gain decelerated in October, it is still slightly positive measured YoY:

To sum up:

1. The JOLTS report shows a pattern consistent with the past 2 recoveries, with layoffs having returned to normal levels, then hiring having increased, and finally quits and openings increasing as well; but

2. The slight increase in layoffs in October, and slight decrease in hiring might just be noise, but with the pandemic once again largely out of control, they might be the harbinger of something darker, as hiring peaked earliest in both of the past two expansions.