- by New Deal democrat

Let me take a little break from discussing how one of the four horsemen of the Apocalypse is riding into town, to the quaint business of how middle and working class wages are doing through February.

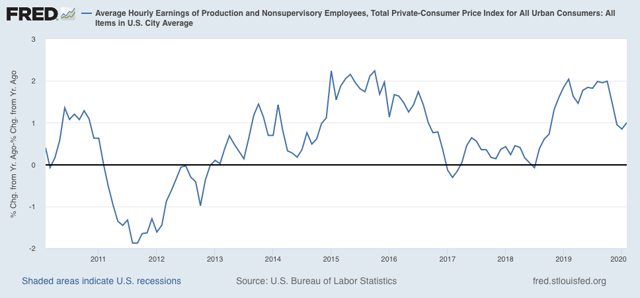

Consumer inflation for February only rose 0.1%. Since wages rose 0.3% nominally in February, that means real average wages for non-supervisory workers rose 0.2%. YoY the gains rose to 1.0%:

Real average hourly earnings have risen to 98.1% of their January 1973 peak:

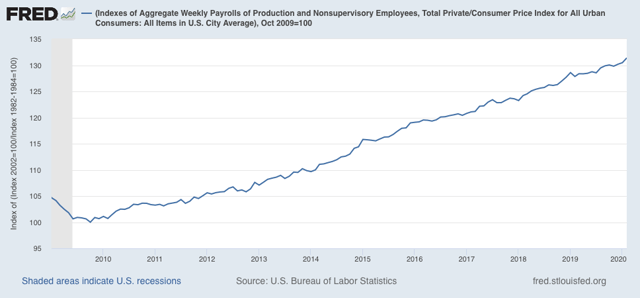

Because total hours worked rose significantly in February, real aggregate earnings - i.e., the total buying power of the middle and working class - also rose to 31.4% above its October 2009 low:

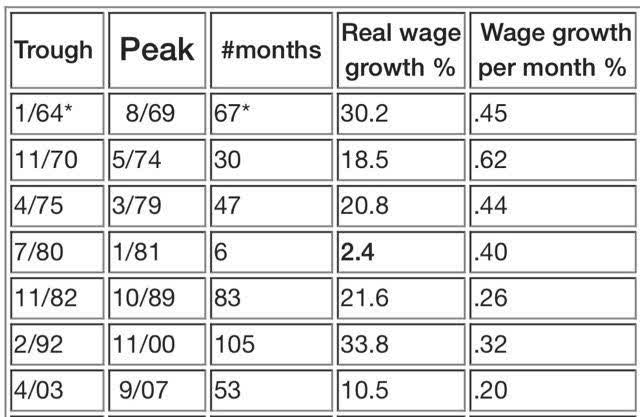

Below is a chart I haven’t shown in a long time, comparing real aggregate earnings in past expansions over the past 50+ years. At 31.4%, this expansion now only trails the 1990s for the total improvement in average workers’ real incomes:

On a monthly basis, however, dividing that 31.4% by the 124 months since the bottom gives us a little over .25% real average earnings growth per month. That’s ahead of the 2000s and just slightly below the 1980s, but well behind all other periods, and shows the weakness in labor’s bargaining power.

Because CPI is normally all about gas prices, and they have cratered in the past week, it’s a fair bet that March will show actual DEflation, and the YoY measures will decline substantially. This would be good for consumers, except that normally consumers don’t want to take the risk of dying by going out in public to consume. Which means I expect layoffs to be in full swing by April.