- by New Deal democrat

This morning we got two important data points on consumer durable goods. Typically, after housing turns, consumer purchases of vehicles and then other durable goods (like major appliances) turn down. Broader consumer purchases are the last to turn down before a recession.

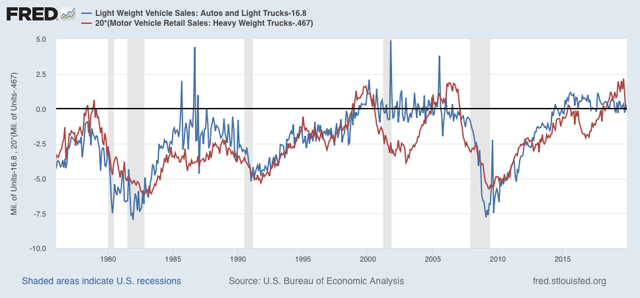

Light vehicle sales in January were estimated by the BEA at 16.8 million annualized (blue in the graph below). This is a little soft, but not nearly so much as would presage a recession. For that I would expect to see a number below 16.25 million:

Meanwhile heavy truck sales came in at 0.467 million annualized (red). This is the third poor reading in a row, and demonstrates the producer downturn - although it is consistent with previous slowdowns and is not quite as severe as before the last two recessions. Note also that in the graph above I have normed the January numbers to zero, better to show the recent trend.

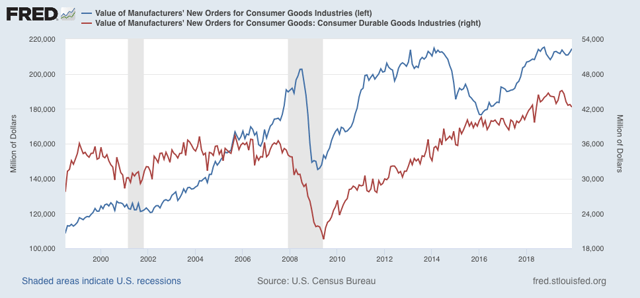

Secondly, new orders for consumer goods were also reported. While the broad measure is holding up, new orders for consumer durable goods declined:

The decline in consumer durable new orders is on par with that before the Great Recession, but not with that before the producer-led 2001 recession.

In sum, yet more evidence of weakness, but most consistent with a slowdown.