- by New Deal democrat

This morning’s December new home sales report raises the question: is the “housing choke collar” kicking in?

The idea of a “housing choke collar” is that house prices are at such a high multiple of the average household’s ability to pay that even with lower interest rates, there is not much room for the housing market to withstand housing price increases.

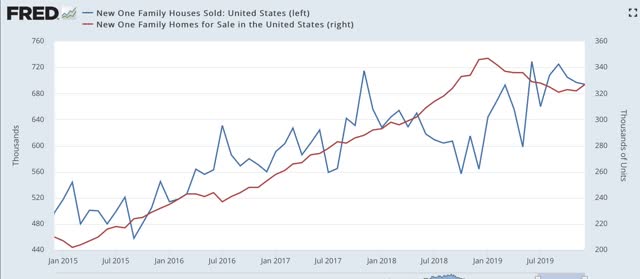

First, to the data: new home sales declined slightly from a downwardly revised November. This data series is very volatile, and heavily revised, but it remains the case that there has been no new high established since last 6 months (blue) (inventory is in red):

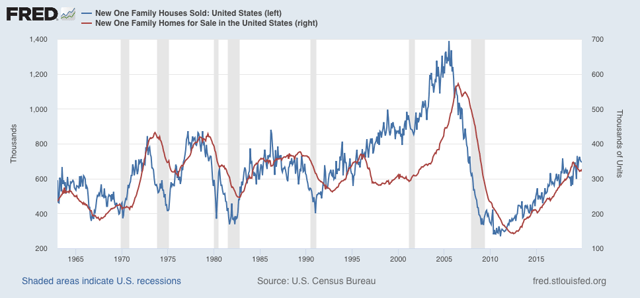

In the long term view, note that new home sales have peaked well before the beginning of recessions. Inventory has reliably followed, and with the exception of the shallow 1970 and 2001 recessions, continued to decline throughout the next downturn:

That inventory turned up slightly in December therefore suggests (slightly) that housing is not on a recession trajectory. Also remember that last week housing permits made a new expansion high (sales do typically peak or trough even before permits, but as pointed out above, are much more volatile).

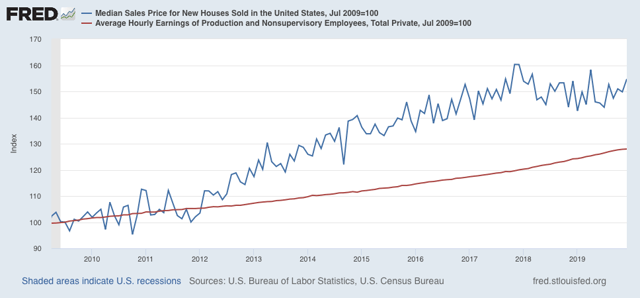

That brings us to median new home prices, which increased sharply, and have been on a pronounced uptrend in the past few months (blue):

The red line represents average hourly wages for non-supervisory personnel. It’s pretty easy to see that, after declining relative to wages in 2018, prices are now outpacing wage growth again.

Remember that last week we saw that existing home prices had increased by more than 9% in 2019.

If I am right, then there is very limited upside for sales growth. Since sales lead prices, new home sales may be telling us that we are reaching the limit of affordability without even lower mortgage interest rates.