- by New Deal democrat

I didn’t post anything yesterday, so I’ll make up for it with two posts today.

This morning we finally got the very delayed first look at Q4 GDP. As per my usual practice, I am less interested in what happened in the rear view mirror, which was an annualized gain of +2.6%, than what the number tells us about what lies ahead.

The two forward-looking components of GDP are (1) private fixed residential investment, and (2) corporate profits. Both of these are long leading indicators, I.e., giving us an idea about where the overall economy will be a year or more out from here.

In that regard, the news was mixed.

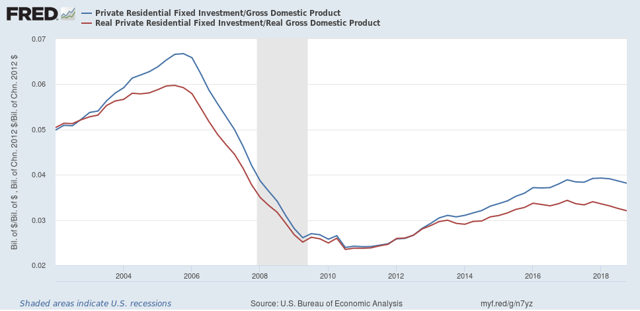

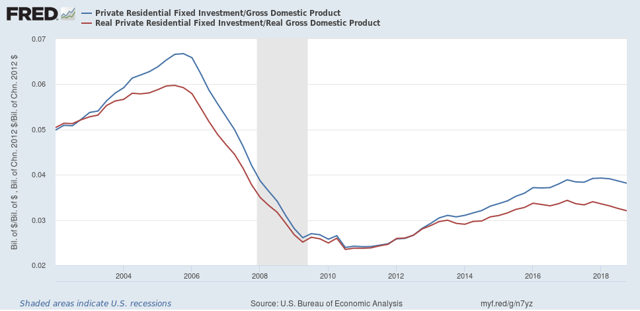

Private residential fixed investment declined -0.9% q/q. This is in keeping with the downturn in housing construction that we have seen in the monthly data. Note that residential investment as a share of GDP declined in both nominal (blue) and real (red) terms:

Private residential fixed investment declined -0.9% q/q. This is in keeping with the downturn in housing construction that we have seen in the monthly data. Note that residential investment as a share of GDP declined in both nominal (blue) and real (red) terms:

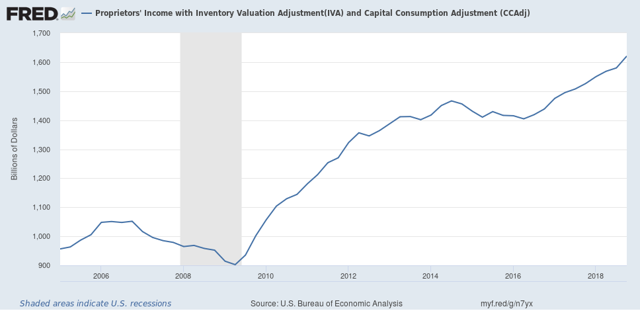

Meanwhile, corporate profits as is usual won’t be reported until the final revision in GDP one month from now, but proprietors’ income rose, was. While it does not always move in the same direction as corporate profits, and sometimes lags, it a good placeholder. Here the news was positive, as proprietors’ income rose +2.6% q/q:

I’ll supplement the above with graphs later. (UPDATE: DONE)

But the takeaway is, that in the rear view mirror, there was no recession in Q4. While one important leading sector of the economy, housing, continued to deteriorate, the producer side of the economy in the form of proprietors’ income, kept humming along. While enough long leading indicators of the economy did decline in 2018 to continue to justify being on “recession watch” for later in this year, and particularly Q4, there is no sign of deterioration on the producer side of the economy, so if a recession does develop, it will likely be centered on consumers and secondarily on manufacturing.

But the takeaway is, that in the rear view mirror, there was no recession in Q4. While one important leading sector of the economy, housing, continued to deteriorate, the producer side of the economy in the form of proprietors’ income, kept humming along. While enough long leading indicators of the economy did decline in 2018 to continue to justify being on “recession watch” for later in this year, and particularly Q4, there is no sign of deterioration on the producer side of the economy, so if a recession does develop, it will likely be centered on consumers and secondarily on manufacturing.