- by New Deal democrat

Yesterday I wrote a post for XE.com pointing out that the more international trade increased as a share of the overall US economy, the more important the trade-weighted US$ has become. Specifically, industrial production peaked 5 months after the US$ began to appreciate strongly in July 2014. By March 2015 things like steel production and transportation had rolled over, and they rolled over further with a further pulse of US$ strengthening several months ago.

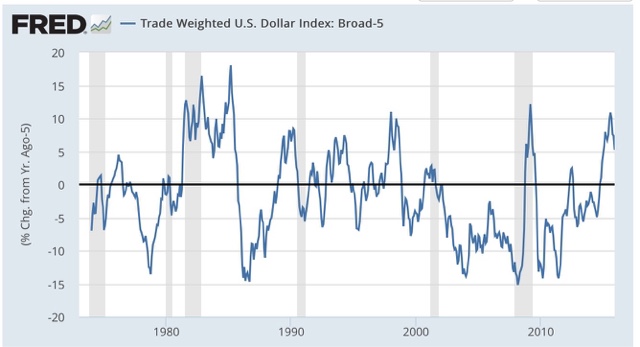

While rapid strengthening of the US$ has not always led to recession, it has correlated on a number of occasions, and particularly so where the US$ has appreciated by more than 5% annually, as shown in the graph below:

That makes me think that the US$ ought to have a place in the index of *short* leading indicators, with a weighting on the order of +/-0.1% in the LEI for every +/-1% change in the trade weighted value of the dollar. Here is the LEI for the last two years:

and here is the monthly change in the value of the US$, inverted, for the last 5 years:

The US$ would not meaningfully have changed the value of the strong LEI values during the first half of 2014, but would have subtracted -.1 or -.2 in the last half of 2014 into 2015, and again during the 3rd quarter of 2015. This would correlate well with the relative weakness of the economy in the early part of 2015, and strongly suggests rough patch this winter into next spring.

Another important correlation is that, for the last 25 years, the inverse of the value of the US$ (blue) has increasingly tightly correlated with gas prices (red):

In a sense, this just restates the truism that commodity prices are short leading indicators. But it highlights the difference in the manner in which those prices (and in particular gas prices) are transmitted into the US domestic economy. There is less domestic manufacturing, so less of a direct transmission. Rather, weak commodity prices correlate with a strengthening US$, which in turn transmits weakness via those sectors most exposed to the global economy.

Finally, let's look at gas prices themselves over the last 15 years:

Unless you think that gas prices are going to fall below their 2008 bottom and give up all of their secular increase since 1999, we are much closer to the bottom than the top in gas prices, which strongly suggests that - all else being equal - we should be much closer to the top rather than the bottom in the value of the US$. Of course the Fed is tightening so all else may not be equal, but if the US$ is near its peak, then its drag on the LEI is also mainly done. In other words, the YoY comparison in things like steel production, trucking, and rail should become much less negative, and perhaps turn positive, by spring sometime, unless Fed tightening causes the US$ to continue to strengthen.