Saturday, October 31, 2015

Weekly Indicators for October 26 - 30 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com .

Nothing scary this Halloween. Just weakness, but steady as she goes.

Friday, October 30, 2015

Ed Morrissey Shows His Amateurish Economic Abilities ... Again

I haven't picked on ol' Ed in awhile. Frankly, it seemed that he passed on the economic writing to the far more competent Steve Eggleston. But after yesterday's GDP print of 1.5%, I had a feeling Ed would chime in with his, "the economy really sucks" line of thought. Thankfully, he didn't disappoint. So, let's explain why his analysis is incredibly amateurish.

He starts by correctly noting that PCEs were very strong, coming in over 3%. It would have been a bit better if he'd actually looked at the report's detail, however. Had he done so, he would have found that durable good spending was up a very strong 6.7% while non-durable spending increased 3.5% (see table 1 from the accompanying Excel information; it's on the right hand side of the BEA release). Why is this important? Because durable goods require financing, meaning consumers don't make these purchases unless they think they'll be able to make payments for a few years. This is why the strong level of new car sales (that's a durable good, Ed) is so important; recessions don't happen when the consumer is buying bigger goods. And this is the second quarter in a row this reading has been strong; 2Q DGs M/Ms were up 4.3%. In short, this data alone tells us that the release probably isn't the harbinger of doom.

But then Ed shows is analytical failings. And I mean his amazingly amateurish "abilities." He notes that Reuters mentioned the large inventory drag. But then Ed drops the ball when he notes, "That might be the case, but the big decline in business investment was in structures rather than inventory."

Actually, Ed, if you had looked at the accompanying Excel sheet, ESPECIALLY TABLE 2, you would have seen that an inventory correction subtracted 1.44% from GDP growth. See especially cell T48 of Table 2, Ed. In fact, Ed, according to the same table, total fixed investment added .47% to total growth.

In contrast to Ed's perma-bear routine, people who know how to read tables and data and who also watch more than the one data point, yesterday's report wasn't nearly as fatal as Ed makes out. As my co-blogger noted:

The big issue this year has been the effect of the 20% increase in the broad trade weighted dollar. Yesterday's report indicates that

(1) the consumer has not been harmed, and continues to power the US economy forward;

(2) the bleeding in the import/export sector has been staunched; and

(3) affected industries are making progress working through their accumulated inventories.

This isn't to say there aren't reasons for concern. As I've noted in my weekly equity columns for a number of months, corporate earnings may have peaked for this cycle. And the shallow industrial recession caused by a combination of the strong dollar, oil sector contraction and weak international environment continues. But ol' Ed doesn't mention any of these. Instead, he continues in the same pattern he has since 2008: he waits for news he can spin negatively and then does so.

In short, Ed is a partisan hack, who's analysis is poor and whose understanding of the topic is weak.

He really needs to stop writing about econ; he's that bad.

He starts by correctly noting that PCEs were very strong, coming in over 3%. It would have been a bit better if he'd actually looked at the report's detail, however. Had he done so, he would have found that durable good spending was up a very strong 6.7% while non-durable spending increased 3.5% (see table 1 from the accompanying Excel information; it's on the right hand side of the BEA release). Why is this important? Because durable goods require financing, meaning consumers don't make these purchases unless they think they'll be able to make payments for a few years. This is why the strong level of new car sales (that's a durable good, Ed) is so important; recessions don't happen when the consumer is buying bigger goods. And this is the second quarter in a row this reading has been strong; 2Q DGs M/Ms were up 4.3%. In short, this data alone tells us that the release probably isn't the harbinger of doom.

But then Ed shows is analytical failings. And I mean his amazingly amateurish "abilities." He notes that Reuters mentioned the large inventory drag. But then Ed drops the ball when he notes, "That might be the case, but the big decline in business investment was in structures rather than inventory."

Actually, Ed, if you had looked at the accompanying Excel sheet, ESPECIALLY TABLE 2, you would have seen that an inventory correction subtracted 1.44% from GDP growth. See especially cell T48 of Table 2, Ed. In fact, Ed, according to the same table, total fixed investment added .47% to total growth.

In contrast to Ed's perma-bear routine, people who know how to read tables and data and who also watch more than the one data point, yesterday's report wasn't nearly as fatal as Ed makes out. As my co-blogger noted:

The big issue this year has been the effect of the 20% increase in the broad trade weighted dollar. Yesterday's report indicates that

(1) the consumer has not been harmed, and continues to power the US economy forward;

(2) the bleeding in the import/export sector has been staunched; and

(3) affected industries are making progress working through their accumulated inventories.

This isn't to say there aren't reasons for concern. As I've noted in my weekly equity columns for a number of months, corporate earnings may have peaked for this cycle. And the shallow industrial recession caused by a combination of the strong dollar, oil sector contraction and weak international environment continues. But ol' Ed doesn't mention any of these. Instead, he continues in the same pattern he has since 2008: he waits for news he can spin negatively and then does so.

In short, Ed is a partisan hack, who's analysis is poor and whose understanding of the topic is weak.

He really needs to stop writing about econ; he's that bad.

Q3 2015 GDP report: pretty d*#$!d good for +1.6%

- by New Deal democrat

I have a new post up at XE.com , explaining why yesterday's GDP report is probably the best +1.6% you could ever see.

Thursday, October 29, 2015

The decline in prime age labor force participation: the smoking gun (part 2 of 2); comparing June Cleaver and Roseanne Conner

- by New Deal democrat

I recently wrote about the compelling evidence that the biggest reason for the decline in the prime working age labor participation rate was the "child care cost crunch," i.e., the increase in the number of second-earner spouses who decided to stay at home and raise their children, occasioned by the particularly significant decline in wages among lower quintile jobs, together with the soaring costs of outside day care.

In my post yesterday, I showed that the biggest reason why the percentage of both mothers and fathers of minor children who have dropped out of the labor force has increased, is in order to care for their children -- not discouragement, not disability, not education, and not any other reason.

But that is not the end of the story, even though over 80% of men and women eventually become parents of minor children. In particular, there are other studies which put the spotlight on an increase in disability claims. In particular, the Atlanta Fed went to the trouble of decomposing the monthly data as to why people aren't in the labor force over the last 16 years. The graphs are interactive, and illuminating.

What can explain this shift from homemakers to disabled former workers over age 50? Was there a group,who formerly, say before the 1970s, were largely homemakers, who entered the labor force as young people, say in the 1970s and 1980s, and who are older now and, because they were working, can go on SS disability?

Of course! The aging of women who entered the labor force is the answer. First of all, here's the familiar graph showing the big secular increase of women in the workforce between 1965 and 1995:

In my post yesterday, I showed that the biggest reason why the percentage of both mothers and fathers of minor children who have dropped out of the labor force has increased, is in order to care for their children -- not discouragement, not disability, not education, and not any other reason.

But that is not the end of the story, even though over 80% of men and women eventually become parents of minor children. In particular, there are other studies which put the spotlight on an increase in disability claims. In particular, the Atlanta Fed went to the trouble of decomposing the monthly data as to why people aren't in the labor force over the last 16 years. The graphs are interactive, and illuminating.

To cut to the chase, the Atlanta Fed found that the single biggest reason for the increase in labor force non-participation was disability claims:

A similar graph was compiled in a separate report:

So that's it, the real reason for the increase isn't the "child care cost crunch" but disability, right? Well, yes and no. To see why, let's go into the Atlanta Fed's interactive database a little more closely.

At age 50 and above, there has been an outsized increase in the percentage of labor force participants who say they are disabled. That is the lion's hsare of the increase in disability claims:

Part of this is simply the overall aging of the labor force during that time. Older people are more likely to be disabled.

But the big news is the mirror image big decline in people aged 50 and over saying they are homemakers between 1998 and 2014:

Aside from this huge anomaly that begins at age 50, what we are left with is a sustained increase in people in their 30s and 40s who are staying home to take care of thier children.

What can explain this shift from homemakers to disabled former workers over age 50? Was there a group,who formerly, say before the 1970s, were largely homemakers, who entered the labor force as young people, say in the 1970s and 1980s, and who are older now and, because they were working, can go on SS disability?

Of course! The aging of women who entered the labor force is the answer. First of all, here's the familiar graph showing the big secular increase of women in the workforce between 1965 and 1995:

Consider the two cases of June Cleaver, 1950s homemaker, and Roseanne Conner, 1980s blue collar mother. When June Cleaver got older and more infirm, presumably she have told the Census Bureau that she was still a homemaker. Contrarily, when Roseanne Conner became older and more infirm, she would probably tell the Census Bureau that she was disabled, not that she had chosen to be a homemaker.

In short, homemakers don't go on disability. The big surge in those identifying as disabled in their 50s after 1999 probably reflects the fact that they are the group of women who when they were 18-25, entered the workforce between 1965 and 1995.

-----

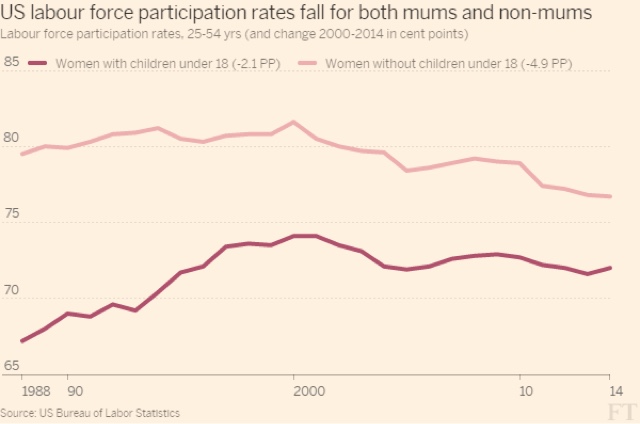

Another source of pushback against the idea that the decline of wages for second earners compared with the price of daycare for children came from the Financial Times.

As an initial matter, the FT's article clearly shows that the most striking feature of the change in the US labor force since 2000 in comparison with every single other country, has been the big decline in women in the labor force:

There is no such equivalent defference for men.

But the FT then pointed out that among the prime working age demographic, the percentage of women who were not in the labor force actually declined *more* for women who were not mothers of minor children. ere's their graph:

Here the problem is at the other end of the age spectrum. Look at the below graphic of the age at which women have typically have their first child over the last 30 years:

For most of the last decade, an absolute majority of 25 year old women had not yet had their first child -- and that age is still increasing!

And now let's go back to the Altnata Fed's interactive graphs, and show what has happened among younger adults who say they are not working because they are pursuing an education:

This shows a big increase in people in their 20s who are not in the labor force because they are continuing their educational studies. That's the explanation for the statistic cited by the Financial Times. The relatively big increase in childless women age 25 -54 who are not in the labor force (note: only about 18% of women ultimately fall into this category) is because of the big increase in this population at the youngest end of the range, and we know why that group is not in the labor force.

-------

In conclusion, put together this information with that published by the Pew Foundation, and we have a pretty complete picture of why there has been a decline in the prime age labor force since 1999:

1. There has been a spike in the relative number of disability claims among older workers, with a concomitant downward spike in the relative number of homemakers among older workers, as the demographics of women in the workforce has aged.

2. Parents of both sexes of minor children have been leaving the labor force in order to care for their minor children, driven by declining real wages for those jobs held by the second earner, and exacerbated by the surging costs of child day care.

3. A smaller part of the increase is explained by young adults seeking a competitive advantage in the workplace by staying in college longer to obtain deboth undergraduate and graduate degrees.

The mystery has been solved.

Wednesday, October 28, 2015

The decline in prime age labor participation: the smoking gun (Part 1of 2)

- by New Deal democrat

I recently wrote about the compelling evidence that the biggest reason for the decline in the prime working age labor participation rate was the increase in the number of second-earner spouses who decided to stay at home and raise their children, occasioned by the particularly significant decline in wages among lower quintile jobs, together with the soaring costs of outside day care.

Since that time (and I'd like to think in part because of my argument), the issue of the "child care cost crunch" has become much more visible, with the candidates in the recent Democratic Presidential debate weighing in, in support of more assistance for working mothers.

For example, Fortune magazine repored that:

Since that time (and I'd like to think in part because of my argument), the issue of the "child care cost crunch" has become much more visible, with the candidates in the recent Democratic Presidential debate weighing in, in support of more assistance for working mothers.

For example, Fortune magazine repored that:

the Economic Policy Institute (EPI), a worker advocacy group, finds that caretaking costs have become so exorbitant that in most parts of the U.S., families spend more on childcare than they do on rent (included in that number: babysitting, nannies, and out-of-home day care centers.

I think [the cost of childcare] plays a role in a woman’s decision to go to work,” says Gould. “It is taking a toll on labor force participation and therefore on the economy.”

Measuring child care costs against a variety of benchmarks—including the cost of college tuition, the HHS’s 10 percent affordability threshold, and median family incomes—demonstrates that high quality child care is out of reach for working families.

And the Pew Research Foundations updated its study of the impact of child care on the careers of mothers in the labor force:

[W]hile 42% of mothers with some work experience reported in 2013 that they had reduced their work hours in order to care for a child or other family member at some point in their career, only 28% of fathers said the same. Similarly, 39% of mothers said they had taken a significant amount of time off from work in order to care for a family member (compared with 24% of men). And mothers were about three times as likely as men to report that at some point they quit a job so that they could care for a family member (27% of women vs. 10% of men).

It’s important to note that when we asked people whether they regretted taking these steps, the resounding answer was “No.”

To briefly recapitulate my posts from August, against a backdrop of surging costs for child care, and declining real wages for the lower quintile jobs occupied by second earners, the number of stay-at home dads has increased from 1.1 million to 2.0 million between 2000 and 2012, and the increase in the percentage of stay-at-home dads who are caring for their children is the primary reason:

Further, the percentage of mothers who are staying at home has also increased, going from 23% in 1999 to 29% of all mothers of minor children in 2012, as shown in the graph below:

In 1999, approximately 10% of stay at home mothers said they were home due to disability, and approximately 82% said they were home to take care of their home and family.

The Pew study found that as of 2012 the vast majority -- 85% -- of stay at home married mothers say the reason for not working is to take care of their children. Including both married and single mothers, the number of stay-at-home moms is about 10 times the number of stay at home dads.

What we didn't have was the *reason* those mothers have dropped out of the labor force since 1999. That was the missing " smoking gun." Until now.

What we didn't have was the *reason* those mothers have dropped out of the labor force since 1999. That was the missing " smoking gun." Until now.

Thanks to Gretchen Livingston of the Pew Foundation, who provided me with additional information, I was able to generate the following chart detailing the relative increases in mothers who dropped out of the labor force due to discouragement, child care, disability, and other reasons including education and retirement:

1999

|

2012

|

Change

| |

|---|---|---|---|

Can't find

job |

0.2

|

1.7

|

+1.5%

|

Child care

|

18.9

|

21.4

|

+2.5%

|

Disability

|

2.3

|

3.2

|

+0.9%

|

All Other*

|

1.6

|

2.5

|

+0.9%

|

TOTAL

|

23

|

28.9 (29)

| +5.9 |

*includes education, retirement, and other

This is the smoking gun. As you can see, the number of mothers who dropped out of the labor force in order to raise their minor children outstripped all other reasons including those who wanted a job, consituting nearly half of the total. Note by the way that the number of those who are out of the labor force but want a job now has declined by about 1 million since 2012, so the likelihood is that as of 2015, the effect of rising day care costs and declining real lower quintile wages is even stronger.

Since According to the Census Bureau, by age 40, 81% of all women have borne at least 1 child, the number of mothers utterly dwarfs the number of prime age women who are not mothers (and, ahem, by necessity of reproductive biology, it is similarly true of men). Together, the numbers of women and men who are staying at home to raise their children, solve the mystery of the decline in the labor force participation rate among the prime working age population.

In Part 2, I will address issues raised by an Atlanta Fed study of the microdata, and in prticular, disability. I will also address some pushback against the "child care cost crunch" meme by the Financial Times.

Tuesday, October 27, 2015

The Underpants Gnomes Theory of how the US imports a global recession

- by New Deal democrat

It used to be said that "When America sneezes, the world catches a cold." Sometime later this century, maybe even 20 years from now that will probably be updated to "When China sneezes, the world catches a cold." But I don't see how we are there yet.

The domestic consumer economy is still 70% of US GDP. International trade only accounts for about 15% of GDP. So it should take a really, really major dislocation of that international trade to overcome domestic strength.

This morning's negative durable goods report is yet another reminder that the shallow industrial recession is real. Rail shipments are down YoY, truck shipments are down YoY, the regional Fed indexes are negative, industrial production and capacity utilization are down. That seems to have become widely accepted. I hasten to add that it showed up in February in the Weekly Indicators and has been there relentlessly since -- another reason not to wait for the lagging monthly reports.

At the same time, housing, cars, real retail spending and real personal consumption expenditures have continued to power ahead. And that is the problem for scenarios whereby the US imports a global recession.

I have read a number of articles over the last several months, including one this past week, all of which can be summarized as follows:

1. China is undergoing a downturn.

2. This has spread to China's suppliers, who are undergoing worse downturns.

3. ?????

4. This will bring about a US recession.

This is the "underpants gnomes" theory of how the US will import a global recession (if you don't know what this meme is, Google is your friend). None of the articles had any detailed or credible explanation of what step 3 is. It is all vagueness and hand-waving.

The weakness in the Oil patch, and generally in the industrial exporting sector will continue and will send ripples out into the wider pond, including layoffs and cutbacks in manufacturing, leading to I suspect one or more monthly employment reports that will be under 100,000 by the end of this winter.

But there is no reason to think that those ripples will be enough to overcome the positive ripples out from housing construction and vehicle production. And there is reason to believe that, contrary to expectations that the gas price dividend will peter out this fall, the US consumer is in the process of getting yet another boost, as gas prices are still over $.80 less than they were ago, and look like they will break below $2.02 (last January's bottom) before they seasonally bottom out this year:

The below is a graphic I cribbed from ECRI. They used it to explain how a consumer slowdown to propagate into a supplier recession, but the converse is just as valid:

Until someone comes up with a credible scenario for Step 3, all we have is the Doomer version of the Underpants Gnomes.

The domestic consumer economy is still 70% of US GDP. International trade only accounts for about 15% of GDP. So it should take a really, really major dislocation of that international trade to overcome domestic strength.

This morning's negative durable goods report is yet another reminder that the shallow industrial recession is real. Rail shipments are down YoY, truck shipments are down YoY, the regional Fed indexes are negative, industrial production and capacity utilization are down. That seems to have become widely accepted. I hasten to add that it showed up in February in the Weekly Indicators and has been there relentlessly since -- another reason not to wait for the lagging monthly reports.

At the same time, housing, cars, real retail spending and real personal consumption expenditures have continued to power ahead. And that is the problem for scenarios whereby the US imports a global recession.

I have read a number of articles over the last several months, including one this past week, all of which can be summarized as follows:

1. China is undergoing a downturn.

2. This has spread to China's suppliers, who are undergoing worse downturns.

3. ?????

4. This will bring about a US recession.

This is the "underpants gnomes" theory of how the US will import a global recession (if you don't know what this meme is, Google is your friend). None of the articles had any detailed or credible explanation of what step 3 is. It is all vagueness and hand-waving.

The weakness in the Oil patch, and generally in the industrial exporting sector will continue and will send ripples out into the wider pond, including layoffs and cutbacks in manufacturing, leading to I suspect one or more monthly employment reports that will be under 100,000 by the end of this winter.

But there is no reason to think that those ripples will be enough to overcome the positive ripples out from housing construction and vehicle production. And there is reason to believe that, contrary to expectations that the gas price dividend will peter out this fall, the US consumer is in the process of getting yet another boost, as gas prices are still over $.80 less than they were ago, and look like they will break below $2.02 (last January's bottom) before they seasonally bottom out this year:

The below is a graphic I cribbed from ECRI. They used it to explain how a consumer slowdown to propagate into a supplier recession, but the converse is just as valid:

Until someone comes up with a credible scenario for Step 3, all we have is the Doomer version of the Underpants Gnomes.

Monday, October 26, 2015

Price appreciatioin of new homes has completely stopped. Here's why

- by New Deal democrat

I have a new post up at XE.com .

Price appreciation in new homes has completely stopped over the last 11 months. That is partly due to the feeding through of the 2014 stall in construction, and partly due to the disappearance of the Chinese cash purchaser.

BTW, tomomrrow we will get the Q3 report on median rents, and that will complete the overall picture of the housing market.

Sunday, October 25, 2015

Saturday, October 24, 2015

Condolences to BooMan

- by New Deal democrat

One of the places I always stop by for political analysis is the BooMan Tribune. Yesterday Booman's brother suddently passed away, and he is in mounring.

Blogs are easy places to bring out the worst in people (see just about any comment section). It is important to recognize that there are real live human beings, with real feelings, behind those posts.

So, condolences to BooMan, and a hope that he will find peace again as mourning permits.

Weekly Indicators for October 19 - 23 at XE.com

-by New Deal democrat

My Weekly Indicator piece is up at XE.com .

The changes were all positive this week, but the Big Story remains the effects of the strong US$.

Friday, October 23, 2015

Forecasting the Presidential election: simply knowing whether the economy is expanding or in recession gives you the correct answer more than 2/3 of the time

- by New Deal democrat

If you want a quick and dirty guide to whether an incumbent political party will retain control of the White House in a Presidential election, simply knowing whether the economy will be in expansion or recession in the 3rd or 4th quarter of the election year gives you the correct answer more than 2/3's of the time.

The NBER maintains the official list of US recessions going back over 160 years to 1854. During that time, there have been 33 recessions, and 40 Presidential elections. Eleven of those Presidential elections have taken place during a recession (measured by the 3rd or 4th Quarter of the election year).

In only 3 cases has the incumbent party been successful maintaining control of the White House (and in one of those cases, the incumbent party's candidate lost the popular vote, but won in the Electoral College). In the other 8 cases, the incumbent party lost, including at least 3 of the biggest political turning points in US history (1860, 1932, 1980).

Similarly, of the 29 times the economy has been expanding during the 3rd and 4th Quarter of an election year, the incumbent party has retained control of the White House nearly 3/4 of the time.

Here's the complete list:

Recession, incumbent party maintains control (3 elections):

1876 - Hayes (R, succeeds R Grant)*

1900 - McKinley (R re-elected)

1948 - Truman (D, elected)**

Recession, incumbent party loses control (8 elections):

1860 - Lincoln (R, replaces D Buchanan)

1884 - Cleveland (D, replaces R Arthur)

1896 - McKinley (R, replaces D Cleveland)

1920 - Harding (R, replaces D Wilson)

1932 - FDR (D, replaces R Hoover)

1960 - Kennedy (D, replaces R Eisenhower)

1980 - Reagan (R, replaces D Carter)

2008 - Obama (D, replaces R Bush)

Economic expansion, incumbent party retains control (21 elections):

1856 (D Buchanan succeeds D Pierce)

1864 (R Lincoln re-elected)

1868 (R Grant replaces R Johnson)

1872 (R Grant re-elected)

1880 (R Garfield succeeds R Hayes)

1904 (R Teddy Roosevelt elected)**

1908 (R Taft succeeds R Teddy Roosevelt)

1916 (D Wilson re-elected)

1924 (R Coolidge elected)**

1928 (R Hoover succeeds R Coolidge)

1936 (D FDR re-elected)

1940 (D FDR re-elected)

1944 (D FDR re-elected)

1956 (R Eisenhower re-elected)

1964 (D Johnson elected)**

1972 (R Nixon re-elected)

1984 (R Reagan re-elected)

1988 (R Bush succeeds R Reagan)

1992 (D Clinton re-elected)

2004 (R GW Bush re-elected)

2012 (D Obama re-elected)

Economic expansion, incumbent party loses (8 elections):

1888 (R Harrison replaces D Cleveland)

1892 (D Cleveland replaces R Harrison)

1912 (D Wilson replaces R Taft)

1952 (R Eisenhower replaces D Truman)

1968 (R Nixon replaces D Johnson)

1976 (D Carter replaces R Ford)

1992 (D Clinton succeeds R Bush)

2000 (R Bush succeeds D Clinton)*

*lost popular vote; decided in Electoral College

**predecessor of same party died in office

Bottom line: while an ongoing recession at the time of the election does not always mean that the incumbent party will lose control of the White House, it spells DOOM by better than a 2:1 ratio.

Similarly, while an ongoing economic expansion at the time of the election does not guarantee that the incumbent party will retain control of the White House, it has been a meant success by better than a 2:1 ratio.

UPDATE: If we go by popular vote rather than Electoral College victory, then the elections of 1876 and 2000 fall into line, meaning that the popular vote in fully 80% of all Presidential elections correlates positively with whether or not the economy has been in recession or not at the time of the election.

By the end of next week, all but one of the long leading indicators, designed to tell us 1+ year out whether the economy will be expanding or in recession, will have been reported for Q3, meaning that we should have visibility through the 3rd Quarter of next year.

UPDATE: If we go by popular vote rather than Electoral College victory, then the elections of 1876 and 2000 fall into line, meaning that the popular vote in fully 80% of all Presidential elections correlates positively with whether or not the economy has been in recession or not at the time of the election.

By the end of next week, all but one of the long leading indicators, designed to tell us 1+ year out whether the economy will be expanding or in recession, will have been reported for Q3, meaning that we should have visibility through the 3rd Quarter of next year.

Wednesday, October 21, 2015

September housing permits: a pause, but rising trend still intract

- by New Deal democrat

I have a new post up at XE.com , taking a look at the trends in housing permits and starts.

Tuesday, October 20, 2015

Forecasting the 2016 election: the "gatekeeper" role of social and moral issues

- by New Deal democrat

Tom Schaller made a convincing case in "Whistling Past Dixie" that in the South, moral and social issues are threshold issues, writing that there, Democrats "flunk the litmus test:"

Why do Democrats struggle so mightily in the South? .... The short answer [ ] is that social and cultural isues tend to trump economic considerations for many voters in the South....

In other words, only candidates whose views on those issues are acceptable then get their economic positions considered. In other words, a socially liberal Democrat with historically populist economic positions stands no chance in the Old South.

I think Schaller's analysis is more universally true than he considered, and is equally applicable to the left. For example, in 2012 Huckabee had very populist anti-Wall Street positions. Was there the slightest feeling on the left that he might be an acceptable GOP candidate? Hell no! Because of his position on social issues. In other words, I think Dixie only stands out because its moral "screen" is half a standard deviation to the right of that of the relatively conservative Midwest or Mountain states.

In the last few weeks, we have had two more demonstrations of this "gatekeeper" role of social and moral issues. Jim Webb, an economic populist with RW views on a number of social and foreign policy issues, got zero traction as a democrat and is considering running as an independent.

More importantly, look at what just happened in Canada. The NDP was leading until its leader made comments about the Muslim face covering, the naqib. At that point their poll numbers collapsed and their voters turned to the Liberals as an acceptable second choice even though apparently the Liberals are within the "neoliberal" economic mainstream.

BTW, historically this same tension has played out in countries like Mexico and in Europe, where RW parties come to power by highlighting socially unacceptable positions held by economically populist LW parties.

The bottom line is, there isn't just a trade-off between social and economic issues. Rather, voters will vote their pocketbook, but they will only vote their pocketbook from among those candidates who hold acceptable positions on social and moral issues.

Monday, October 19, 2015

Steven Hayward Continues the Long History of Powerline's Economic Stupidity

As I previously pointed out, Powerline has a long history of being 100% wrong on the economy. From the "Fed is printing money so inflation will spike" garbage, to "the CRA caused the housing crisis" to the latest "Dodd Frank is crushing small business lending" meme, these guys have not been able to get one thing right.

Steven Hayward continues that trend. On October 8th, he argued that interest rates would spike because China was selling treasuries. He concluded:

The Fed may have to raise interest rates whether it wants to or not in order to get more suckers buyers for our bonds.

As usual, he was dead wrong.

The buying has been crucial in keeping a lid on America’s financing costs as China -- the largest foreign creditor with about $1.4 trillion of U.S. government debt -- pares its stake for the first time since at least 2001. Yields on benchmark Treasuries have surprised almost everyone by falling this year, dipping below 2 percent last week.

It’s not the scenario that doomsayers predicted would leave the U.S. vulnerable to China’s whims. But the fact that Americans are pouring into Treasuries may point to a deeper concern: the world’s largest economy, plagued by lackluster wage growth and almost no inflation, just isn’t strong enough for the Federal Reserve to raise interest rates.

“As you develop a more pessimistic view on global growth, inflation, and rates, asset managers are going to buy Treasuries in that environment,” said Brandon Swensen, the co-head of U.S. fixed-income at RBC Global Asset Management, which oversees $35 billion.

If anything, Powerline continues their long and solid history of being a great contrarian indicator. Do the opposite of what they project and you'll make out like a bandit.

PS: I'm sure that Hayward will print a clarification any day now ...

Steven Hayward continues that trend. On October 8th, he argued that interest rates would spike because China was selling treasuries. He concluded:

The Fed may have to raise interest rates whether it wants to or not in order to get more suckers buyers for our bonds.

As usual, he was dead wrong.

The buying has been crucial in keeping a lid on America’s financing costs as China -- the largest foreign creditor with about $1.4 trillion of U.S. government debt -- pares its stake for the first time since at least 2001. Yields on benchmark Treasuries have surprised almost everyone by falling this year, dipping below 2 percent last week.

It’s not the scenario that doomsayers predicted would leave the U.S. vulnerable to China’s whims. But the fact that Americans are pouring into Treasuries may point to a deeper concern: the world’s largest economy, plagued by lackluster wage growth and almost no inflation, just isn’t strong enough for the Federal Reserve to raise interest rates.

“As you develop a more pessimistic view on global growth, inflation, and rates, asset managers are going to buy Treasuries in that environment,” said Brandon Swensen, the co-head of U.S. fixed-income at RBC Global Asset Management, which oversees $35 billion.

If anything, Powerline continues their long and solid history of being a great contrarian indicator. Do the opposite of what they project and you'll make out like a bandit.

PS: I'm sure that Hayward will print a clarification any day now ...

Sunday, October 18, 2015

Forecasting the 2016 election economy: social issues + the long arc of history

- by New Deal democrat

This week housing permits will be reported. That will give us most of the long leading indicators for Q3, and that means we can begin meaningfully talk about whether things like GDP, employment, and personal income will still be positive in Q3 2016. Since these are some of the better-rated economic indicators found by Nate Silver as predictive of Presidential elections, it also means we can begin to talk meaningfully about whether the incumbent Democrats or the opposition Republicans are likely to win the 2016 election.

But this is a good time to note that, to paraphrase Bill Clinton's famous slogan, "it's not *just* the economy, stupid!" There are social and moral issues, and unless you think the Vietnam War, the Civil Rights Acts, Watergate, Willie Horton, the Lewinsky affair, and the Swiftboating of Kerry were irrelevant, I submit that they have had an effect on election outcomes.

If the sole determinant of an election were whether or not the economy is in a recession in the 3rd or 4th quarter of the election year, then Dewey would have won in 1948, Stevenson in 1952, Humphrey in 1968, Ford in 1976, Bush in 1992, and Gore in 2000.

Even adjusting to trend, almost all economic indicators weren't just positive, but *very* positive in 1968 and 2000. Humphrey and Gore shouldn't have just won, but won in a landslide.

So clearly the economy isn't the sole determinant of winning the Presidential election.

Probably the best analysis of the relative import of social vs. economic issues was contained in Thomas Schaller's "Whistling Past Dixie," the tome which forecast Obama's winning electoral coalition. Schaller wrote that, in Dixie, social issues are gatekeepers. Candidates' views on the economy aren't even considered until they pass through a social "screen" of acceptability. Schaller was writing from the Democratic point of view, but I suspect a similar dynamic plays out on the left. If there were a candidate with Bernie Sanders' economic populist views, but right wing views on abortion, gun control, and gay rights, would progressives really be interested? In 2012 GOP Gov. Mike Huckabee of Arkansas was pretty much that, and I recall zero interest in his candidacy by the left.

The bottom line is, I believe voters do in fact vote their pocketbooks, among those candidates whose views on moral or social issues they find basically acceptable. Thus much effort is expended in campaigns to make the opposing candidate simply morally unacceptable.

Prof. Douglas Hibbs' "Bread and Peace" model takes at least one moral issue - war - and integrates it into his analysis, which makes use of the number of military casualties during a President's term. This method does at least partially explain Humphrey's loss, and subtracted at least a little from Gore's total (Serbia) and George W. Bush's and McCain's (Iraq and Afphanistan).

It is well beyond my competence to try to incorporate other "moral issue" into an election model. It is simply well worth it to remember that such issues are important. If the economy is going well, the opposition will focus on them. If the economy is doing poorly, there is barely a need.

A second limitation of the model can be filed under "what have you done for me lately?" There is a line of thought that, after two terms of one party, there is an increase in voters restless for change, regardless of what the economy is like. That certainly helps explain 1968 and 2000, but there aren't enough data points to enable reliable comparison.

But this is a good time to note that, to paraphrase Bill Clinton's famous slogan, "it's not *just* the economy, stupid!" There are social and moral issues, and unless you think the Vietnam War, the Civil Rights Acts, Watergate, Willie Horton, the Lewinsky affair, and the Swiftboating of Kerry were irrelevant, I submit that they have had an effect on election outcomes.

If the sole determinant of an election were whether or not the economy is in a recession in the 3rd or 4th quarter of the election year, then Dewey would have won in 1948, Stevenson in 1952, Humphrey in 1968, Ford in 1976, Bush in 1992, and Gore in 2000.

Even adjusting to trend, almost all economic indicators weren't just positive, but *very* positive in 1968 and 2000. Humphrey and Gore shouldn't have just won, but won in a landslide.

So clearly the economy isn't the sole determinant of winning the Presidential election.

Probably the best analysis of the relative import of social vs. economic issues was contained in Thomas Schaller's "Whistling Past Dixie," the tome which forecast Obama's winning electoral coalition. Schaller wrote that, in Dixie, social issues are gatekeepers. Candidates' views on the economy aren't even considered until they pass through a social "screen" of acceptability. Schaller was writing from the Democratic point of view, but I suspect a similar dynamic plays out on the left. If there were a candidate with Bernie Sanders' economic populist views, but right wing views on abortion, gun control, and gay rights, would progressives really be interested? In 2012 GOP Gov. Mike Huckabee of Arkansas was pretty much that, and I recall zero interest in his candidacy by the left.

The bottom line is, I believe voters do in fact vote their pocketbooks, among those candidates whose views on moral or social issues they find basically acceptable. Thus much effort is expended in campaigns to make the opposing candidate simply morally unacceptable.

Prof. Douglas Hibbs' "Bread and Peace" model takes at least one moral issue - war - and integrates it into his analysis, which makes use of the number of military casualties during a President's term. This method does at least partially explain Humphrey's loss, and subtracted at least a little from Gore's total (Serbia) and George W. Bush's and McCain's (Iraq and Afphanistan).

It is well beyond my competence to try to incorporate other "moral issue" into an election model. It is simply well worth it to remember that such issues are important. If the economy is going well, the opposition will focus on them. If the economy is doing poorly, there is barely a need.

A second limitation of the model can be filed under "what have you done for me lately?" There is a line of thought that, after two terms of one party, there is an increase in voters restless for change, regardless of what the economy is like. That certainly helps explain 1968 and 2000, but there aren't enough data points to enable reliable comparison.

That being said, it is certainly interesting that the concept of parties only lasting in power typically through two presidential terms is a relatively recent phenomenon. In the long arc of US history, it is fair to consider the US as being a rising economic power from its inception through the 1940s, at its apogee in the 1950s and 1960s, and relatively speaking at least being a waning power from at least 1974 on. Now let's compare against the frequency with which control of the White House shifted from 1800 to 1952:

Democratic-Republicans: 1800-28 (28 years)

Jacksonian Democrats: 1828-40 (12 years)

1840-60: multiple changes of power

1860-1884: Republicans (24 years)

1884-96: 3 changes of power

1896-1912: Republicans (16 years)

1912-20: Democrats

1920-32 Republicans (12 years)

1932-52: Democrats: (20 years)

Since 1952, however, control of the White House has changed every 8 years with the exception of 1976-92, a single Democratic term followed by 12 years of GOP control.

While the US economy was in its ascendancy, voters were willing to trust a single governing party with control for long periods of time, switching when economic progress stalled. Only the 20 years of turmoil leading up to the Civil War stand out as different. Since the US economy reached its relative apogee, voters have behaved as if they felt the parties had no solution to the relative decline in their fortunes.

Although we probably can't measure it in any accurate statistical way, over the long term US voters are behaving as we would expect them to if they were voting on the waxing and waning of their economic well-being.

Although we probably can't measure it in any accurate statistical way, over the long term US voters are behaving as we would expect them to if they were voting on the waxing and waning of their economic well-being.

Saturday, October 17, 2015

Weekly Indicators for October 12 - 16 at XE.com

-by New Deal democrat

My Weekly Indicator post is up at XE.com .

The employment picture is really coming into focus, in the context of the shallow industrial recession and inventory correction.

Friday, October 16, 2015

Inndustrial production ex-Oil Patch

- by New Deal democrat

By now I'm sure you know that industrial production not only declined again in September, but has also failed to make a new high in almost a year.

But what happens when we remove mining and utilities, and focus on manufacturing? Here's what happens:

Manufacturing (blue) continues to be in an uptrend, although it is slightly off (-0.3) of its high two months ago, which is actually pretty darned good considering the strong dollar.

Yes the US is in a shallow industrial recession. But it is focused and limited, and hasn't translated into any downdraft in the consumer economy (see: real retail sales) which is 70% of the total.

The JOLTS report for August continues to underwhelm

- by New Deal democrat

I continue to be underwhelmed by the monthly JOLTS reports. Most commentators focus only on the job openings number without paying attention to the pattern of this series during the 2002-07 expansion.

As an initial matter, while this series looks extremely useful, because there is only 15 years of history, there is only one complete business cycle with which to compare. During that cycle, hiring peaked well before job openings. As shown above, the peak in hiring (and the trough in voluntary quits, not shown) was the first signal that the expansion was decelerating.

Now let's zoom in on the last year:

Once again, while job openings have skyrocketed, actual hires have stalled. It is only because August 2014 featured an anomalous decline in hiring that the Hires series has not turned YoY negative.

This suggests to me that (1) we are past mid-cycle, as many other series also show; and (2) there is a labor market disconnect, as employers are not filling a record number of openings. As to why those openings are going unfilled, I have seen a fair amount of survey information where employers are complaining of not being able to find appropriately skilled candidates. I suspect that there are one or both of two clauses missing in those sentences, as in: "We are not able to find skilled candidates [for the wage we want to pay and/or because we refuse to pay for any on-the-job training]."

Again, this is an underwhelming report, but if the underemployment rate continues to decline, I anticipate that more and more employers will capitulate on increasing wages for new hires.

Sent from my iPad

Thursday, October 15, 2015

Real retail sales show expansion past mid-cycle, but no oncoming recession

- by New Deal democrat

With September inflation reported this morning, I can update one of my favorite series: real retail sales.

First of all, real retail sales rose to a new high:

The YoY% growth in real retail sales in comparison with real personal consumption expenditures are an excellent mid-cycle indicator, since reliably the former is both declining and negative the latter before recessions begin, and further the former starts to underperform the latter at about mid-cycle. Here's what they look like now:

There is increasing evidence that we are past mid-cycle.

Finally, let's look at real retail sales per capita. These typically peak one year or more before the onset of a recession:

Although population has not been updated past July, since it has been growing at about .06% a month, and since real retail sales are up about .30% in the last two months, we have made another peak. This is evidence that the economic expansion should continue at least through the 3rd quarter of 2016.

Real aggregate wage growth declines slightly in September, but trend continues positive

- by New Deal democrat

In my opinion, the single best measure of a labor market expansion is real aggregate wage growth. People don't work just for the hours, or the jobs, but for the cold hard cash they can bring home and save and spend. How much a growing economy allows them to do that is the best measure of the well-being it is delivering.

I call this the "lump of labor" approach, because sometimes, as in the 1980s and the first part of the 1990s, average wages are declining, but hours are expanding. Sometimes, nominal wages are growing, but inflation-adjusted wages falter, as in the 1970s. In the present expansion, by contrast, nominal wages and real wages have grown slowly, and hours worked have grown strongly. The current expansion, as opposed to the expansions of the 1950s and 1970s, also gets bonus points for being long-lived.

Now that we know the September inflation rate, I can update this information. Last month, nominal average wages for nonsupervisory workers grew very slowly. Prices, however, fell by -.2%, meaning that real wages actually improved. But aggregate hours work declined, meaning that aggregate real wages declined by -0.1%. Here is the long-term graph going back 50 years:

Real aggregate wages are now 16.8% above their recession trough of October 2009. It is easy to see that this expansion does not measure up to the 1960s and 1990s, but far outpaced the George W. Bush expansion of 2002-07.

Here's how the current expansion stacks up in comparison to the Reagan expansion of the 1980s:

At this point, 5 years and 11 months after the bottom, the Reagan expansion was slightly better at 18.9%. Note that about half of that increase came during 1983, whereas in the current expansion real aggregate wage growth started out slowly (as gas prices rose from $1.40/gallon to $3.95/gallon) and then picked up steam last year (as gas prices fell to less than $2/gallon).

As an aside, *if* real aggregate wage growth were to continue for 12 more months at its average pace for the last 6 years, past history going back 50 years strongly implies the democratic nominee will win the presidential election next year.

Monday, October 12, 2015

Q3 2015 update on corporate profits as a leading indicator for quarterly stock prices

- by New Deal democrat

I have an updated post at XE.com . If corporate profits are a long leading indicator, and stock prices a short leading indicator, then corporate profits should lead stock prices, at least when those prices are averaged quarterly.

With Q3 in the books for stock prices, where does this relationship stand?

Sunday, October 11, 2015

A thought for Sunday: in which I despair

- by New Deal democrat

Over the last couple of years, more and more blogs have closed down. Sometimes, it is because the person has too many other obligations. Sometimes, the person has just a few readers, but other great qualities. For example, the best political blogroll I ever encountered was at Frank Chow's now-closed blog. Recently he made access to the blog private, so even that is gone.

I admit that I too am close to despair. In the first place, the economy has been kind of boring in the last couple of years. At or near mid-cycle, as I have often said. Beyond that, I frequently feel like I am shouting into the vacuum of the Oort cloud at the long-term deterioration I have increasingly seen over my lifetime. We didn't use to have wage stagnation. We didn't use to have an increasingly desperate middle class. We didn't use to have near-daily mass shootings. We didn't use to have a crumbling infrastructure (I have taken to calling the traffic reports in my area the "failing infrastructure report" because all too often a bridge or a rail line or traffic lights or just congestion that was not planned for is the cause of problems).

Worse, the solution from the dominant faction of the Democratic Party is weak-tea rim-shot free-market tweaks. The solution from the GOP is always to double down on the insanity.

According to one of the best political books I have ever read, "Whistling Past Dixie," showed, based on reams of polling data, that white working class voters in that region -- unlike such voters in any other region -- treat candidates' positions on "social issues" as a filter. If a candidate does not make it through that screen, their economic positions don't matter. Significantly, the reactionary views in that region coincide with the first major immigration into the region -- of Latinos and relocated Yankees -- in 400 years. The old social order of the descendants of largely Scotch-Irish whites at the top, and the descendants of African slaves beneath them, is being profoundly shaken.

Just this morning, I read an article where struggling South Carolinians are interviewed about stagnant wages. They all acknowledge the problem, and are angry about it.

Economic despair is a potent political force. . . .[When] you listen to indignant voters[, d]espite the still nascent recovery, a huge number of people in the middle and lower classes say their wages have not budged in years.

And what was their mindset? What did they see as the solution. Here's a sample:

[T]o prosper, the economy has to prosper,” Mr. Lewie said, “and it’s the rich people that produce jobs.”When asked to assign blame for stagnating wages, he and his wife pointed to the federal government. Regulations and high taxes, he said, not lower wages abroad....

The operative definition of insanity.

Never mind that since at least 1981 we have gone down this road of increasing wealth at the very top, increases in corporate profits, and Federal *DE*regulation. The results are pretty damn evident if you are not self-blinded.

If it were up to me, countercyclical programs would always be in place, ready to be activated in any downturn. A WPA and CCC would always be on the books. Infrastructure projects would always be in the hopper. At 6% unemployment, the projects would automatically be prioritized. At 7% unemployment, the administrative positions in the WPA and CCC would automatically be filled. At 8% unemployment, the workers would be hired and the projects started, at pre-set levels of GDP. The agencies would be automatically wound down as the unemployment rate fell.

Similarly, automatic tax breaks, weighted towards consumers, should be in place, taking effect quarterly or at very least annually as unemployment increased, and then automatically and gradually reversed as unemployment decreased again, with an eye towards running a surplus once an economic expansion were well-established.

All of which would hardly have been a pipe dream in my youth. One can easily imagine a Lyndon Johnson or a Robert F. Kennedy or one of many other New Deal democrats proposing such a system. But no more, and certainly not with one party dominated by an adamantly opposed Dixie, and the other dominated by an elite of neoliberal milquetoasts.

I used to say that politically the US has shifted 1 standard deviation to the right since then. I no longer believe that. The US is now *2* standard deviations to right of where it was 50 years ago. We have a Supreme Court one vote shy of dismantling the 20th Century, and they don't have much respect for the post-Civil War Amendments either. We have a strident minority in the House of Representatives that thinks it would be cool not to pay the bills that they have already incurred on behalf of the US. We had a GOP President who endorsed torture, saturated surveillance that police can access without a search warrant, and tax rates that could not possibly fund the fiscal obligations of the country. We now have a Democratic President who has made all of these positions permanent. These are now bipartisan positions. Johnson and Kennedy would be treated as beyond the pale now.

In 2008, a majority of the country was ready for significant change. It got Obamacare and not much else. Instead, Obama co-opted and then defenestrated the netroots Progressive movement. So, 2008 was a "failed turning point," after which, as in 1989 Tiananmen Square, or 1848 Europe, the reactionary elites double down.

As bad as things are now for the middle class, the next recession is out there. I am terrified that when it comes, wages, which have only been up 2.5% YoY at their very best during this expansion, will go into outright deflation, opening the door to a wage-price deflationary spiral. In other words, unless policies are changed, the next recession is likely to be even worse than the last one.

In the meantime, especially if Hillary Clinton is the democratic nominee, the best available choice is going to be more reformist neoliberal nibbling around the edges. That means there is no real chance for economic progress until 2020, and maybe even 2024. And I am not immortal. I think I will die in a US which has turned into a Latin American-style plutocracy, a land of profoundly unequal and stultified opportunity, with no prospect of a turnaround in sight.

Saturday, October 10, 2015

Weekly Indicators for October 5 - 9 at XE.com

- by New Deal democrat

My Weekly Indicator piece is up at XE.com.

The US data got just a skosh weaker.

Friday, October 9, 2015

Whilesaler inventories and sales show shallow industrial recession ongoing

- by New Deal democrat

I have a new post up at XE.com. The shallow industrial recession is real, and is not abating yet.

Ruh roh: Labor Market Conditions Index forecasts further deterioration in monthly jobs growth

- by New Deal democrat

As I wrote several months ago, the Labor Market Conditions Index is a good leading indicator for YoY growth in employment. Based on its deceleration, I forecast that monthly jobs growth was likely to decline to less than 200,000 in the months ahead.

Here's the graph I ran at that time:

The LMCI was updated earlier this week, and the news isn't good, with the Index coming in at zero. So here is an updated look at the same relationship, zoomed in on the last 10 years:

The LMCI is forecasting further YoY deterioration in jobs growth. Even a few 5-digit increases cannot be ruled out. The silver lining is, it is not forecasting an outright YoY decline in jobs. Similar periods of weakness occurred in 1984, 1994, and 2002 without there being a recession. Even in those periods leading up to recession, generally speaking the LMCI crossed zero into negative territory well before the recession began.

Bottom line: not good news, but this expansion isn't Doomed yet.

Thursday, October 8, 2015

Population adjusted jobs growth: how weak (or not) is this recovery?

-by New Deal democrat

I've long thought that the typical mode of presentation of the jobs recovery -- i.e., number of jobs created -- is unsatisfactory, because it fails to take into account demographics.

Suppose, for example, you get 200,000 jobs created per month on average over a year. Whether that is good or bad depends on whether the population in which those jobs are being created is growing by 100,000 or 300,000. In the former case, 100,000 more members of the labor force have jobs; in the latter, 100,000 moe members of the labor force are unemployed!

Just adjusting for population isn't enough, since due to increased healthy longevity and demographics, the percentage of the population that is retired is growing strongly, and ought not to be counted.

So what we want to do is count the number of jobs as a percentage of the labor force, or alternatively by those of working age (below, I am using ages 16-64). What does this jobs recovery look like under those conditions? Below are 3 variations on that theme. As we'll see, measured that way the jobs recovery still isn't great, but it is solidly in the middle of the pack.

First, let's look at the "employment rate" which is simply 100 minus the unemployment rate:

As an initial observation, the post-WW2 era of US economic dominance that ended in 1974 stands out. Employment rates of 94%+ were the norm, and half of the time exceeded 95%. Since then, our current level of 94.9% has only been exceeded during the tech boom of the late 1990s and briefly at the end of the housing boom 10 years ago.

But how strong has the current recovery been? For that, let's see how the employment rate, as graphed above, changed on a YoY basis:

While the current recovery got off to a slow start, it has measured better YoY growth than since the early 1980s. In general, the post-WW2 job recoveries grew much faster YoY than those since 1983. As we'll see below, however, that is tempered by the fact that many of them, especially in the 1950s, were short-lived.

Second, let's look at the YoY% change in employment growth compared against the working age population, age 16 through 64:

Here the current expansion does look very weak. But not quite so bad as it might first appear. Here's the percentage of jobs added in this recovery, now 5 1/2 years old, as a share of population ages 16-64:

This growth of 5.7% is still better than the 1971-74 expansion, which added less than 5%, and 5 /12 years later was only up 1.6%:

It is also light years better than the George W. Bush expansion, which not only added a miserable 1.7% jobs at its best, but 5 1/2 years later was negative!

Finally, perhaps the best measure of all is the change in jobs vs. the labor force -- since this is basically all persons in the market for a job (I would also include those not in the labor force who want a job now, but that series only started in 1994):

Here the current jobs expansion looks pretty robust, not just improving strongly but lasting longer than many other recoveries.

Just as with our first measure, let's see how this has changed on a YoY basis:

With the exception of the year 1983, this expansion looks as strong as any other expansion since 1974, and stronger than the George W. Bush expansion. In fact, measured either compared with past peaks in employment, or 5 1/2 years from its start, this expansion is #5 out of 10 expansions since 1950:

Year

start

|

Peak

|

5 1/2 years

after start

| |||

|---|---|---|---|---|---|

1950

|

15%+

|

12.4%

| |||

1954

|

4%-

|

-0.8%

| |||

1957

|

5%+

|

5.4%

| |||

1961

|

15%

|

11.6%

| |||

1971

|

2%+

|

-1.2%

| |||

1975

|

5%+

|

3.3%

| |||

1982

|

9%+

|

8.2%

| |||

1992

|

10%+

|

7.6%

| |||

2003

|

2%-

|

-1.3%

| |||

2010

|

n/a

|

7.4%

|

As shown in the chart above, the current jobs expansion is behind the expansions of 1950, and those of the 1960s, 80s, and 90s, but better than those of 1955, 1958, both expansions of the 1970s, and the George W. Bush expansion.

In summary, when we measure the number of jobs created in this expansion on relevant population-weighted bases, it is a middling expansion, not great, but not so slow as commonly represented.

Subscribe to:

Posts (Atom)