Housing construction is a long leading indicator, indeed along with interest rates probably the most important one. So those commentators who say that we won't get housing improvement until we have job improvement have causation exactly backwards. Rather, it is much more likely that we won't get more meaningful job improvement until we have more meaningful housing improvement. Further, the decline in housing starts and permits after the expiration of the $8000 housing credit was probably an important factor in the slowdown in GDP earlier this year, and probably plays a role in ECRI's recession call.

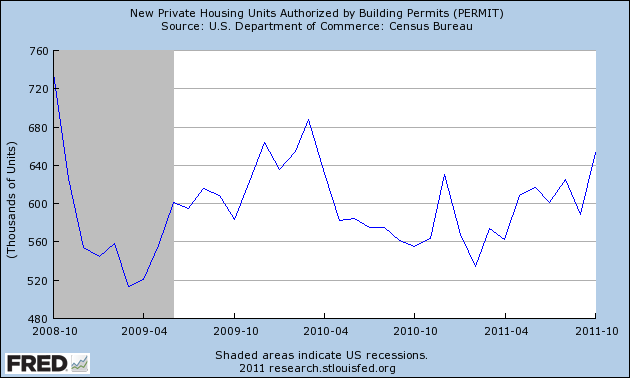

With that in mind, housing permits coming in at 653,000 on Wednesday is a significant positive. It confirms the uptrend we've been seeing in housing permits this year, and is the first reading over 650,000 in a year and a half:

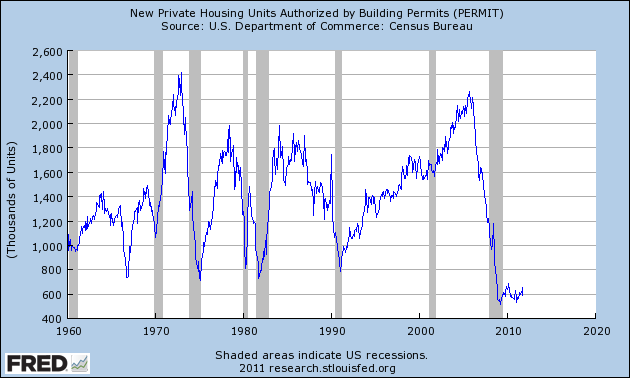

This time we were led out of the bottom of the recession by manufacturing and exports, but obviously they need help. In the past it has typically taken an improvement of 200,000 housing starts from the bottom to signal that a housing-led expansion has begun:

With October's report we are 70% of the way there from the March 2009 bottom of 513,000.

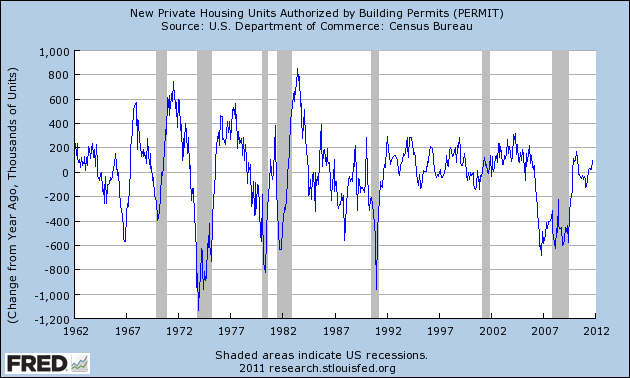

Another way of looking at housing and expansions is to measure the YoY improvement in the raw numbers. Typically in expansions there have been sustained periods of 200,000+ growth YoY:

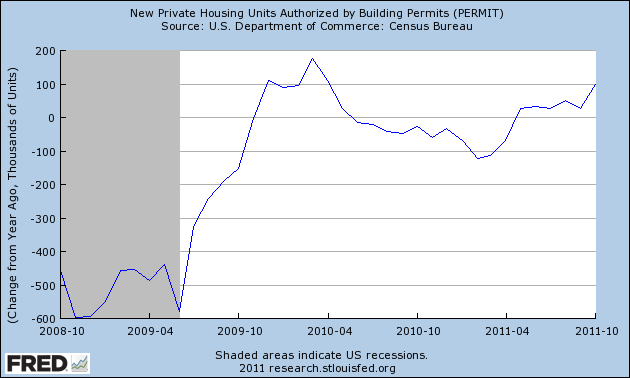

With Wednesday's number we are half the way there, for the first time without help from the housing credit:

It is worth keeping in mind that Bill McBride a/k/a Calculated Risk has shown the strong leading relationship between housing starts and the unemployment rate, so a confirmed uptrend should mean at least a small reduction in the unemployment rate.

As Bonddad described earlier this morning, in the past week we have had a raft of very good economic reports. Housing permits was probably the most significant of them all. While by no means are we at the end of the housing bust (although the bottom was probably put in two years ago in terms of permits and starts), Wednesday's number was significant. If the trend continues, we may have 200,000+ improvement off the bottom within 6 to 12 months. In short, we may be at least at the beginning of the end.