Initial jobless claims during the week ending January 6 rose slightly to 444,000. The 4 week moving average fell 9,000 to 440,750. On an unadjusted basis, there were 801,086 claims, up 156,165 from the week before, compared with 956,791 claims one year ago.

This week is the "high water mark" for holiday seasonal adjustments. Beginning next week, the seasonal adjustment rapidly shrinks toward neutrality. The last couple of years, the holiday seasonal adjustment has been too optimistic, as Prof. Brad DeLong points out. So I fully expect initial jobless claims to temporarily increase towards the range of 480,000 or so in the next few weeks, more in keeping with their longer-term trend, and to gradually decrease from there. Last July and August we were told that this increase was an Omen of Doom. It was wrong then and it will be wrong now.

Meanwhile, retail sales very unexpectedly declined (- 0.3%) in December. Ex-autos, they decreased (-0.2%). So, very bad. But, at the same time, November's strong grain was increased even further, from +1.3% to +1.8%, and ex-autos was increased from 1.2% to 1.9%.

Bloomberg noted:

Some of the decreases in sales last month followed gains in November, indicating problems with adjusting the data for seasonal issues may have played a role in the see-saw pattern. The mid December blizzard in parts of the eastern U.S. may also have contributed to the decrease.

Auto sales fell 0.8 after a 1.2 percent November gain. Industry data showed an increase in purchases.

Typically December is a good month for auto sales, so the decline was on a comparative basis. The net change for the two months is +0.2% in total, and +0.5% ex autos, so between the two months, not bad (hence the asterisk*).

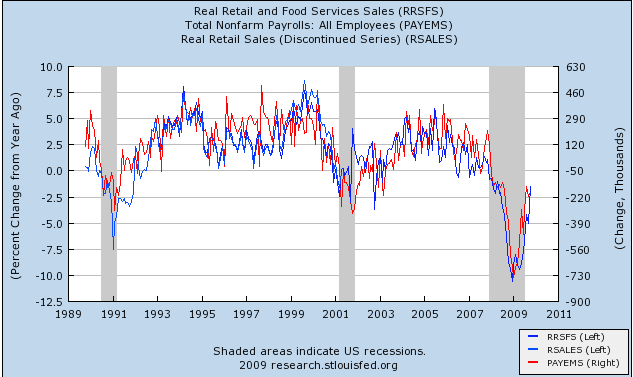

One drawback with retail sales is the constant and significant revisions to the data. Nevertheless, although the December data is very much at odds with all of the positive private results reported by the ICSC, Shoppertrak, and the automakers themselves, I wonder if it explains the surprisingly good payroll report (+4,000 as currently revised) in November, and the downbeat report (- 85,000 unrevised) in December. I have noted several times that employers are hiring exactly as if they were basing their decisions on YoY real retail sales, as shown on this graph from a month ago:

Now we have a surge in sales in November, and a pullback in December, and a surge and pullback in the trend in monthly payrolls as well. Pending further revisions (!), the relationship still holds.

----------

Update: The inventory to sales ratio for November declined to 1.28 from 1.30, showing that as of that date, businesses were still keeping a very tight rein on inventory and being chary about restocking sold products. At some point presumably very soon (or already since we don't know about December) this is going to bottom, and the restocking bounce in GDP and employment is presumably going to kick in.