The fall of 2008 was marked by panic. After the fall of Lehman Brothers, there was widespread talk of a "deflationary spiral," which is:

... a situation where decreases in price lead to lower production, which in turn leads to lower wages and demand, which leads to further decreases in price.[7] Since reductions in general price level are called deflation, a deflationary spiral is when reductions in price lead to a vicious circle, where a problem exacerbates its own cause. The Great Depression was regarded by some as a deflationary spiral. Whether deflationary spirals can actually occur is controversial.

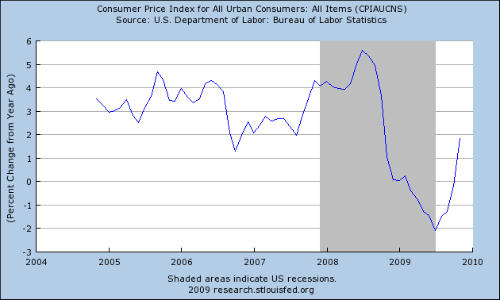

Here is a chart of the year over year percentage change in US inflation for the last five years:

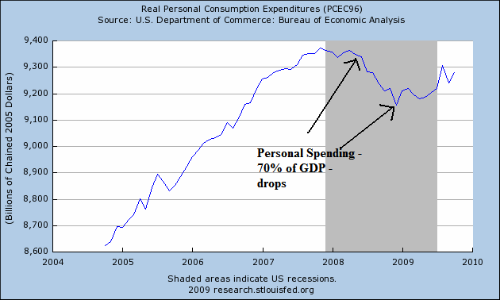

Note the "cliff diving" that occurs in mid-2008: prices literally fell off a cliff. This situation is one of the most serious that can occur in an economy; it says that people have literally stopped buying things en masse. Here is a chart of real personal consumption expenditures (PCEs) for the last five years that shows the drop:

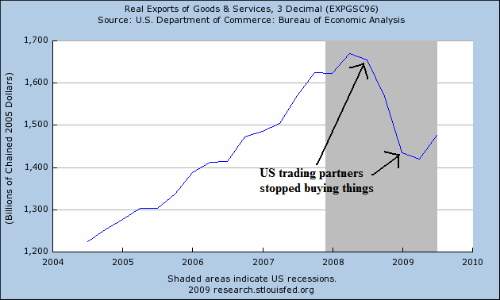

This was the first drop in over 10 years indicating that something fundamental had changed in the US economy. Because PCEs comprise 70% of the US economy, this drop was extremely concerning. However, PCEs weren't the only thing dropping. Real exports were dropping:

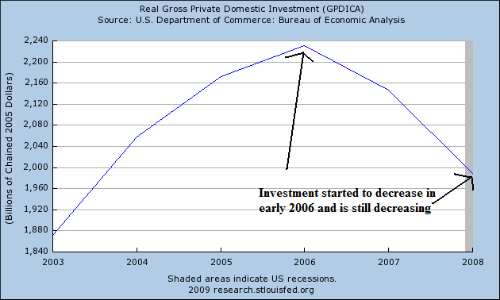

As was total domestic investment:

At this point, it's important to remember the GDP equation: personal consumption expenditures plus investment plus net exports (or exports - imports) plus government spending = GDP. In other words by the end of 2008 every major element of GDP was dropping hard and fast.

In other words, by the end of 2008 -- early 2009, it was obvious the economy was at the beginning of an economic death spiral. This is exactly the same situation the country faced in 1929-1933 -- which was originally mishandled horribly.

So, that's how we started the year. In the next article we'll take a look at the economic numbers for the year to see how the economy is faring.