- by New Deal democrat

Since new home sales as well as the repeat sales price indexes were both reported this morning, let’s update the entire housing market all at once, including existing home sales, which I didn’t report on last week.

NEW HOME SALES

As per usual, remember that while new home sales are the most leading of all housing metrics, they are very noisy and heavily revised. February showed a 1.8% increase from an upwardly revised (by 9,000 annualized) January, to 676,000. This is almost exactly in the middle of this metric’s two year range of 611,00 - 741,000. Also as per usual, the below graph compares with with single family permits, which lag slightly but are much less noisy:

Both demonstrate the recent rangebound behavior.

Turning to prices, the bugaboo of heavy revisions reared its ugly head, as last month’s reported $22,000 spike in median prices was almost entirely revised away, and this month declined further:

On a YoY basis, the median price of a new home is down -0.9%:

Finally, the inventory of new houses pulled back very slightly (-2,000) from January’s 15+ year high, but continued their 8% trend YoY gains. This is actually “good” news - for the moment - because as the below long term historical graph shows, recessions have in the past happened after not just sales decline, but the inventory of new homes for sale - which also consistently lag - also decline (as builders pull back):

I would need to see a more robust downturn in housing for sale that breaks the YoY trend before I would become concerned.

EXISTING HOME SALES

Existing home sales have been in a tight range for the past 2 years, of a piece with mortgage rates generally between 6% and 7%. That continued in February, as sales clocked in near the top end of that range, at 4.26 million annualized:

There was relief when it came to price appreciation, which is not seasonally adjusted and so can only be usefully compared YoY. After a jump to 6.0% in December, the median price gain declined YoY to 4.8% in January and now 3.6% in February, the lowest since Septebmer’s equal YoY% gain:

Meanwhile inventory continued its slow climb from its COVID lows, as total inventory in February was 1.24 million units, a 17% increase YoY, and the highest February total since 2019. Nevertheless, the longer term declining trend in inventory that predates COVID by over five years is still in place:

REPEAT SALES PRICES

The unwelcome news in repeat home sales that I noted last month continued this month.

On a seasonally adjusted basis, in the three month average through January, according to the Case-Shiller national index (light blue in the graphs below) on a seasonally adjusted basis prices rose 0.6%, and the somewhat more leading FHFA purchase only index (dark blue) rose 0.2%. Both of these continue the trend of re-acceleration we have seen in house prices in the second half of 2024 [Note: FRED hasn’t updated the FHFA data yet]:

Both indexes also continued to accelerate on a YoY basis, as the Case Shiller index by 0.2% to a 4.1% gain, and the FHFA index by +0.1% to a 4.8% YoY increase:

Because house prices lead the measure of shelter inflation in the CPI, specifically Owners Equivalent Rent by 12-18 months, the acceleration in sales prices is likely to lead to an even slower deceleration in the official CPI measure of shelter, although I continue to believe that OER will trend gradually towards roughly a 3.5% YoY increase in the months ahead, particularly as the most leading rental index, the Fed’s experimental all new rental index, indicated a median YoY *decrease* in new apartment rents of -2.4%, with all rents including existing rentals coming in at +3.2% as of Q4 of last year:

Here is the updated calculation of the house prices vs. the YoY% change in Owners Equivalent rent:

CONCLUSION

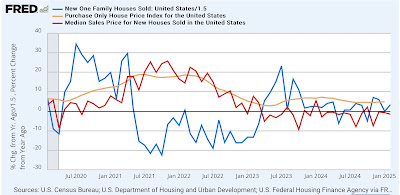

My theme from the past few months has been looking for a rebalancing of the new vs. existing homes market. For that to happen we need price increases to abate in existing homes, and prices to remain flat or still declining in new homes. Since sales lead prices, and are best viewed in a YoY% comparison, the below graph shows sales (/1.5 for scale) and median prices of new homes (red) in that format, together with the YoY% change in the FHFA repeat sales index (gold):

Last month I was concerned that there was renewed inflation rather than rebalancing. With this month’s new data as well as the revisions to last month’s new home prices, it appears that the rebalancing story is back on track, with continued slow price declines in new homes and abating price increases in existing homes. Meanwhile the increases in inventory in both should result in further release of pricing pressures.

Nevertheless, we continue to have problems with mortgage rates that continue near levels last seen 15 years ago, and a longer term sharp decline in the number of existing homes for sale. This needs to be resolved to address the issue of housing unaffordability.