- by New Deal democrat

No economic news today, but let me show you one important reason I am not concerned about the supply chain or inflation issues at this point, despite some DOOOMMsaying about a likely punk GDP reading for Q3 that will be reported on Thursday.

There is no one foolproof indicator that always has indicated recession in advance. For example, as I have noted many times, the yield curve never inverted between 1932 and 1957, even though there were a number of recessions during that time.

But if inflation were such a bugaboo, why hasn’t the Fed raised rates? In the modern era, the Fed raising rates has always been a reason that the economy has slowed down. But let’s go further back. Because even before the Fed undertook a systematic raising/lowering interest rate regime, in fact even before there even *was* a Fed, there were commercial paper rates.

And short term commercial paper rates (basically short term commercial loans) almost always increased substantially before the economy tipped over into contraction - and indeed the increase in those rates was probably a factor in why the economy did so.

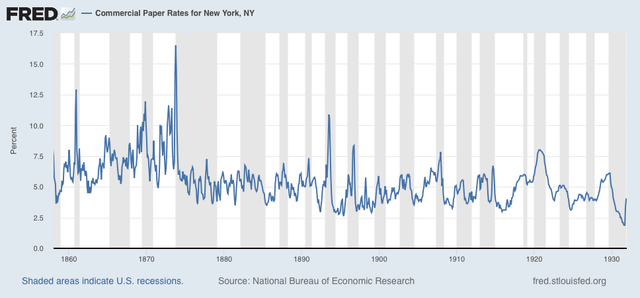

Here are short term commercial paper rates going all the way back to before the Civil War:

Note they always increased before every 19th or early 20th century recession.

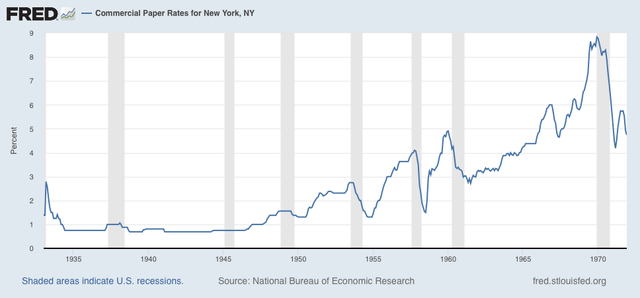

Here are the same rates from the Great Depression through 1971:

The only cases where they did not rise appreciably were in 1938 and 1945. The former was a recession caused by a sudden contraction in fiscal spending. I’ll come back to the latter in a bit.

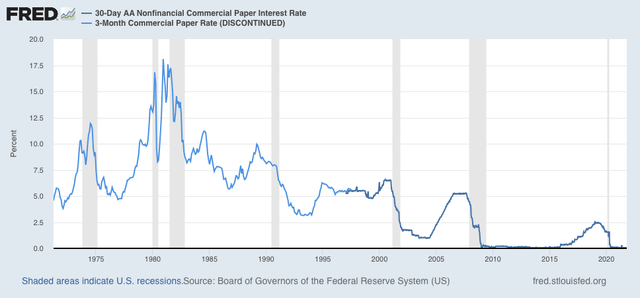

Here are the last 50 years:

Once again, we have appreciable increases, mirroring the increases in Fed short term rates, before every recession.

In summary, we have over 150 years of history telling us that, even if the central bank does not raise rates, commercial lenders will if they think they need to protect themselves, and that tightening of credit provision helps bring about a recession.

And there is *no* such tightening going on now.

Finally, let me come back to 1945, the one possible example that might be similar to our own situation. That was a recession brought about by the end of World War 2, and the sudden synchronous stoppage of war production in factories all over the US. It took time to convert back to civilian production!

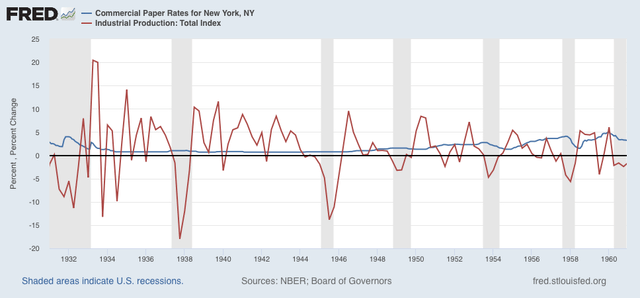

So let’s overlay the quarter over quarter change in industrial production over commercial paper rates for that era:

In both 1938 and 1945 industrial production suddenly contracted by over 10% in one quarter alone.

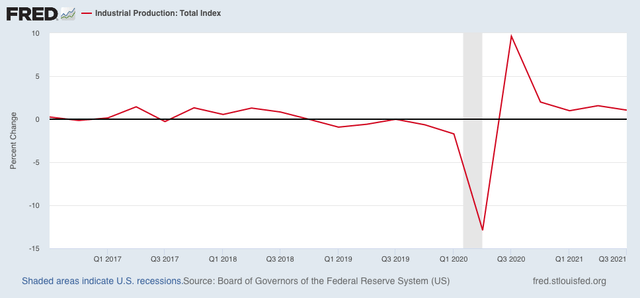

Now here is the quarter over quarter change in industrial production over the past 5 years, including Q3 this year that just ended:

Industrial production *rose* 1.1% in Q3 compared with Q2.

There simply is no indication that either inflation or supply chain issues have caused an actual contraction in economic activity.