- by New Deal democrat

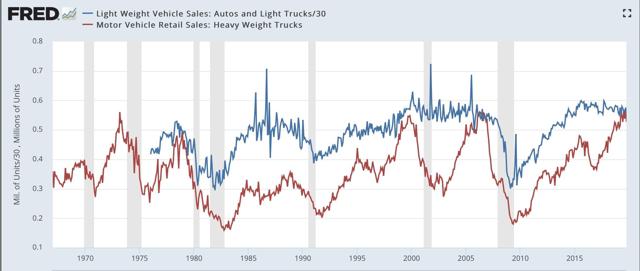

Vehicle sales are a significant short leading indicator. They tend to react after housing, but before broader consumer sales. Although domestic vehicle manufacturers are now reporting only quarterly rather than monthly, this metric is still an important one to watch.

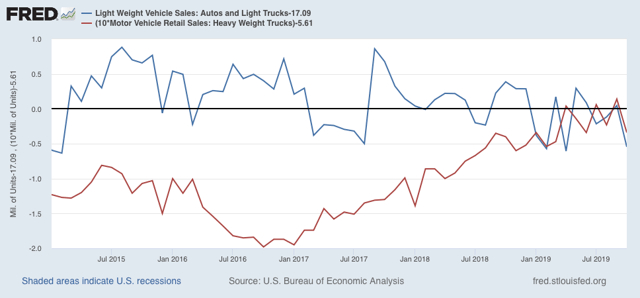

Yesterday car and light truck sales were reported at 17.09 million units annualized for November (blue in the graphs below). Heavy trucks were reported at .561 million annualized (red):

Note that heavy truck sales are a much clearer indicator, declining typically by about -20% a number of months before the onset of a recession (with 1969 being the exception). Car sales typically have declined by more than -10% on a three month rolling average, and it is much more difficult to distill signal from noise.

With that in mind, here is the last five years, including the 2015 peak for car sales. Since FRED carries the data with a one month delay, I have subtracted the November reading from each, so that the respective November numbers if shown would be zero:

While heavy truck sales have turned flattish this year, November is still extremely close to the peak readings. Car sales averaged for the past three months are only a little more than -5% off peak.

As I’ve been saying a lot recently, the consumer is still alright. Meanwhile businesses may not be expanding, but they’re not meaningfully contracting either.