- by New Deal democrat

With few exceptions, the November CPI report once again demonstrated how important fictitious shelter is to its calculation, as well as how important the inflection point of $5 gas in June 2022 has been.

Headline inflation rose only 0.1% in November, and is up 3.1% YoY. Core inflation less food and energy increased 0.3%, and is up 4.0% YoY.

Shelter, which is 1/3rd of the headline index, and 40% of core, increased 0.4% for the month and was up 6.5% YoY. Perhaps more importantly, CPI ex-shelter was *down* -0.1% for the month, and up only 1.5% YoY.

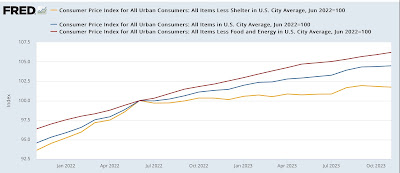

Per the above, below I show headline (blue), core (red), and CPI less shelter (gold) all normed to 100 as of June 2022:

Ex-shelter, in the past 16 months prices have risen only 1.7%, while headline inflation has risen 4.5%, and core inflation has risen 6.5%.

In other words, take out shelter and inflation is a non-issue.

The former problem areas of new and used vehicles continue to cool, with new car prices declining -0.1% in November, while used car prices increased 1.0%. YoY new car prices are up only 1.3%, while used car prices are up 3.8%.:

But for several reasons, including that people are holding on to their older vehicles longer, which means they need more repairs, as well as the fact that insurance has had to keep pace with both the prices of new cars as well as the increased costs of repairs, the “transportation services” subset of CPI increased another 1.1% for the month, and is up 10.1% YoY:

The other current problem children are food away from home (restaurants), up 0.4% m/m and 5.5% YoY, and medical care commodities, up 0.5% m/m and 5.0% YoY. But these make up relatively small weights in the index, and are not nearly the problem that shelter continues to be.

As to shelter, here’s the update of Owners’ Equivalent Rent YoY compared with the Case Shiller index (recall that the former has a history of lagging the latter by 12 or more months):

As has been the ongoing case, YoY shelter rose more gradually than house prices, and is falling more gradually, but it is continuing to fall. At its current pace of decline, it will take another 12 months or more to be back into the Fed’s comfort zone.

Finally, we can also update real aggregate payrolls. These rose nominally by 0.9% in November, so after inflation they rose 0.8% to a new all-time high:

This means that in the aggregate average working and middle class Americans have more buying power now than ever before, and is a very potent positive for the economy over the next few months.