- by New Deal democrat

[Note: I’ll comment on industrial production in a separate post later]

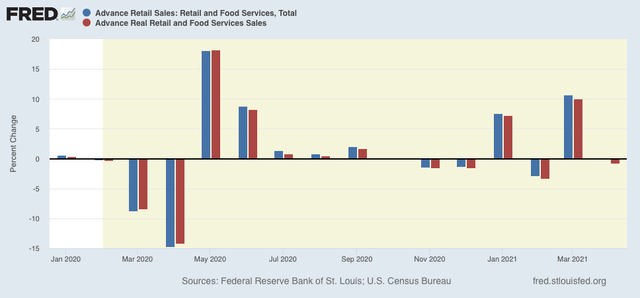

At first glance, April’s retail sales report looks like another Big Miss. Nominally (blue) sales increased less than 0.1% (rounded to unchanged). Adjusted for inflation (red), they declined -0.7%:

But the important point is that the big jump in March didn’t get taken back. As I wrote last month: “if the big March gain in sales isn’t taken back in the next month or two, then there’s likely to be a similarly large jump in employment by the end of summer.” Further, as I wrote a couple days ago in response to the inflation report, I fully expected the big jump in sales and income fueled by stimulus payments to peter out over the next few months, just as they did last year.

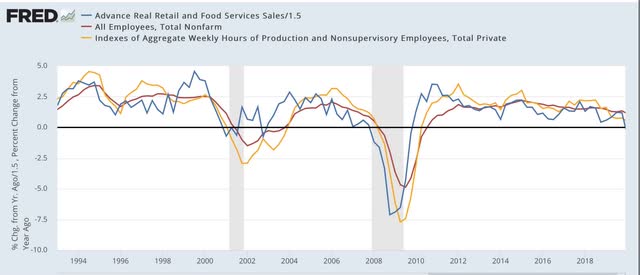

As I have pointed out many times, real retail sales (blue in the graph below, /1.5 for scale) tend to lead employment (red) by about 3-4 months. Here’s the long term YoY look from 1993 through February 2020, averaged quarterly to cut down on noise:

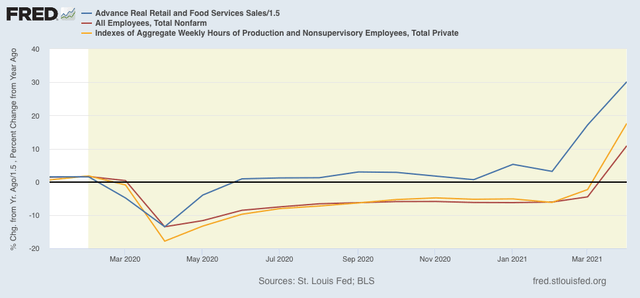

And here is the monthly update since the beginning of 2020 (note the huge difference in scale!):

I’ve also included aggregate hours (gold) in the above. Hours tend to be cut more than jobs in recessions, and increase faster in recoveries. The pandemic has been somewhat unique in that, for obvious public health reasons, jobs were cut entirely rather than just hours. Note also the “China shock” in the first few years after 1999, when both jobs and hours continued to be cut, even after sales had rebounded.

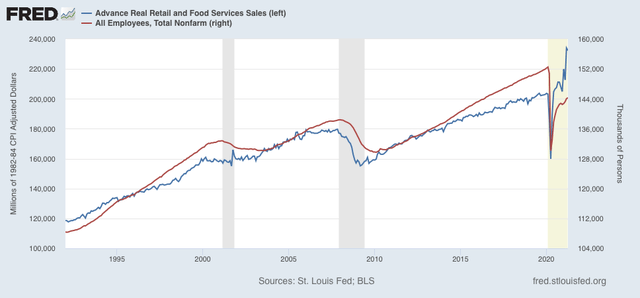

But saying that there is likely to be a big YoY jump in jobs in the next several months is hardly surprising, given the 22 million loss in jobs last April. So the below graph compares the absolute data, sales on the left scale, and employment on the right:

Again, the brief lag with which employment follows sales is obvious. So I still believe the most important takeaway is that, with the stimulus gains “sticking” so far, there’s likely to be a similarly large jump in employment by the end of summer. A gain of another 4 to 6 million jobs, to close to the pre-pandemic peak, is quite possible.