- by New Deal democrat

For the past few months, I have been forecasting a jobs slowdown. That has been based in part on the natural progression of a downturn in long leading indicators, then short leading indicators, and finally to coincident indicators of which jobs along with industrial production are the Queen and King, respectively.

Further, I have pointed out that, even when the spread between short and long term bonds simply gets tight, even if there is no outright inversion, employment growth almost always falters. And goods-producing employment - including manufacturing and construction jobs - has *always* faltered in the past 60 years.

Finally, since temporary jobs are a well-known leading indicator for jobs as a whole, I have been expecting them to slow down if not turn down.

March’s jobs report delivered all of this in spades.

But I received a little blowback on this point, suggesting that the declines were trivial or that I was retrospectively cherry-picking to support a Doomish hypothesis. Far from it: this is something I’ve been forecasting for months in specific sectors, and in the last three months, even in the face of big overall employment gains, it has shown up.

So, to set the record straight, before I get to the March graphs, let me recap the literally 15 times I warned of a coming slowdown in manufacturing, construction, and temporary jobs, and in the goods sector generally. If you don’t want to read the “I told you so” part, just scroll right past number 15 to the bolded headline and you’ll get right to the March jobs graphs.

The 15 times I forecast an oncoming slowdown in leading employment sectors

1. Last August: the simple tightening of the yield curve suggests a subsequent jobs slowdown

2. In January, discussing The consumer nowcast and economic forecast

5. I followed that up with a post showing how manufacturing, construction, and temporary jobs have led the overall jobs numbers prior to each of the last three recessions, including the following three graphs .

2000-01

2006-07

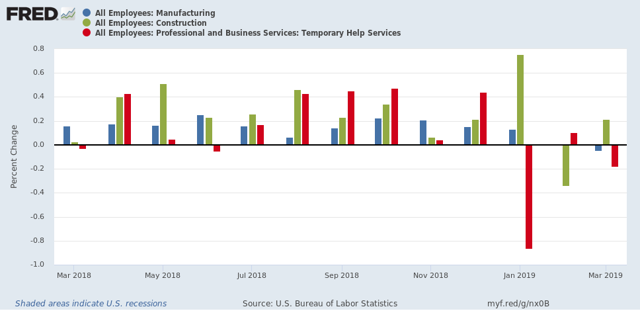

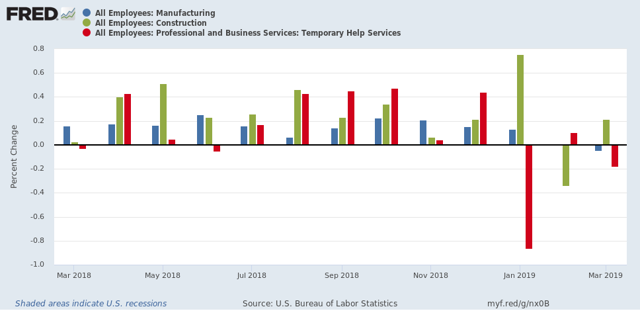

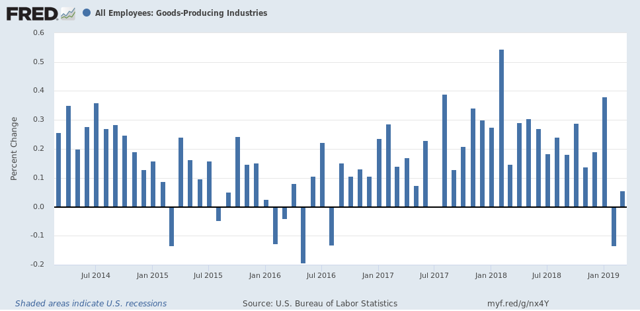

First, here is a m/m graph of manufacturing, construction, and temporary jobs, all of which are leading sectors for jobs as a whole:

In the past three months, all three have faltered, with decelerating or outright declines in jobs. Note how similar this looks to the trend in the three pre-recession graphs of these sectors I posted under article #5 above.

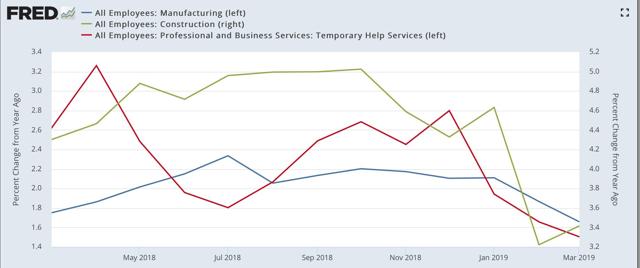

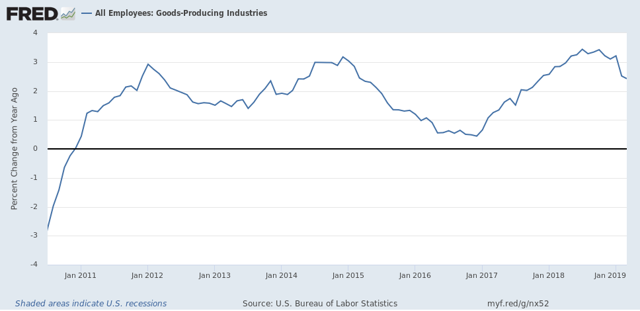

Here is the YoY look at the same three sectors, showing that all three have decelerated substantially:

Further, I have pointed out that, even when the spread between short and long term bonds simply gets tight, even if there is no outright inversion, employment growth almost always falters. And goods-producing employment - including manufacturing and construction jobs - has *always* faltered in the past 60 years.

Finally, since temporary jobs are a well-known leading indicator for jobs as a whole, I have been expecting them to slow down if not turn down.

March’s jobs report delivered all of this in spades.

But I received a little blowback on this point, suggesting that the declines were trivial or that I was retrospectively cherry-picking to support a Doomish hypothesis. Far from it: this is something I’ve been forecasting for months in specific sectors, and in the last three months, even in the face of big overall employment gains, it has shown up.

So, to set the record straight, before I get to the March graphs, let me recap the literally 15 times I warned of a coming slowdown in manufacturing, construction, and temporary jobs, and in the goods sector generally. If you don’t want to read the “I told you so” part, just scroll right past number 15 to the bolded headline and you’ll get right to the March jobs graphs.

The 15 times I forecast an oncoming slowdown in leading employment sectors

1. Last August: the simple tightening of the yield curve suggests a subsequent jobs slowdown

Four times during the 1980s and 1990s the difference in the interest yield between 2 and 10 year treasury bonds got about as low as it is now [Note: i.e., August 2018] (blue in the graphs below). That occurred in 1984, 1986, 1994, and 1998.

Even though on none of those 4 occasions a recession followed, on 3 of 4 of those occasions YoY employment gains ... subsequently declined ...

In other words, even if the Fed stops raising rates now [as of August 2018], and the yield curve does not get tighter or fully invert, my expectation is that monthly employment gains will decline to about half of what they have recently been -- i.e., to about 100,000 a month -- during the next year or so.

Keep an eye on these three areas (new orders, temp hiring, and new jobless claims). If these turn outright negative, that will be a very strong sign that poor public policy is causing what otherwise would just be a slowdown to tip all the way into recession.

Unsurprisingly, building permits lead construction employment. The lead time between the former turning negative YoY vs. the latter has varied between 5 and 23 months, but usually has been between 10 and 14 months. Currently, with the exception of one month, permits have been negative YoY since August.

[C]onstruction employment has usually turned down YoY before a recession....

4. Saying to also watch manufacturing jobs in the January jobs report

The number of manufacturing jobs themselves has also turned down in advance of recessions ever since 1974.

...the absolute number of manufacturing jobs reliably decelerates from peak before a recession begins, and usually declines, even if the YoY change does not turn negative.

At present, while the manufacturing work week has declined in recent months, the absolute number of manufacturing jobs has not followed.

The second conclusion, building on my last post concerning construction jobs, is that with the sole exception of the oil shock of 1974, no recession has ever started without at least one of the two - construction or manufacturing jobs - having moved down first.

5. I followed that up with a post showing how manufacturing, construction, and temporary jobs have led the overall jobs numbers prior to each of the last three recessions, including the following three graphs .

1989-90

2000-01

2006-07

6. After the January jobs report, pointing out some deterioration in the leading jobs sectorsh

7. Pointing out that the poor December retail sales report added to the evidence of an impending jobs slowdown

If the poor December ( retail sales) number isn’t revised away, or reversed by a big gain in the next months’ report, this portends a significant deceleration in jobs growth in the monthly employment reports over about the next 6 months.

8. Discussing how the Downturn in the American Staffing Index portended weaker temporary jobs numbers

All of which makes me think that the deceleration of temp jobs in the monthly report for the last three months, ... hasn’t just been noise, but - while still positive - is demonstrative of real weakness.

The bottom line is that almost all of the other economic data has been validating the “slowdown” forecast I made beginning last summer, and I expect employment to follow — and temporary jobs will probably lead the way.

Tomorrow I am looking for continued gains in both manufacturing and construction, but a cooling in manufacturing vs. continued trend growth to a slight deceleration in construction. In both cases this means gains of less than 30,000, and possibly as low as 5,000. Because the economy is slowing, and this should show up in jobs numbers, if there is a surprise in either or both, it will likely be to the downside.

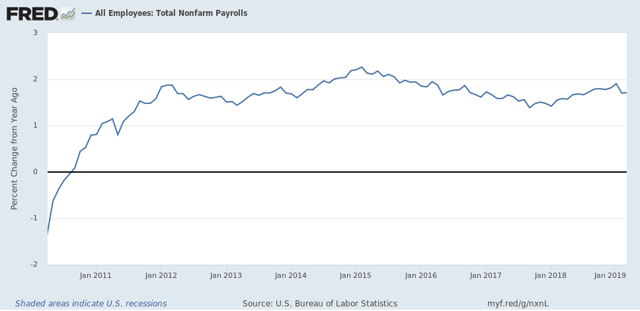

Finally, I expect YoY overall jobs growth to begin to decelerate from its peak last month:

11. Discussing how the February jobs report did show weakness in the leading sectors

this month’s report actually went beyond taking back January’s report. The YoY change in construction, manufacturing, and total jobs for the last two months combined are all lower than they were in December.

In summation, I suspect this month marked the first month in which the economic slowdown showed up in the jobs report.

12. Again, Discussing the February jobs report

The bottom line is that, even averaging January with February, all of the leading employment indicators show some deterioration, but none of them are at a point where I would expect them to be if a recession were imminent.

13. In March, reiterating my August forecast for a slowdown in employment based on the tight yield curve:

...Even if the Fed starts to lower rates soon, I strongly suspect that January was the YoY peak in employment, and we have started down the road to roughly 100,000/month employment gains - if not worse - later this year.

14. Discussing how continued poor readings in the American Staffing Index forecast a poor number in temporary jobs in the March jobs report

After the 2015-16 shallow industrial recession, the growth in temp jobs picked up decently. But in the last four months, only about 2250 temp jobs per month have been added. I am looking for this decelerating trend to continue, and the decline in the Staffing Index indicates we shouldn’t be surprised if there is an outright loss in temp jobs in the report on Friday.

15. Pointing out that A tight or inverted yield curve has always led to a stall or downturn in goods-productions jobs, in the context of what to watch for in the March jobs report:

Note that in *every* case that the interest rate spread has inverted, or just decreased to nearly zero, within about 18 months YoY growth in goods-producing jobs has declined to less than 0.5%, and usually outright declined. That translates to an annual pace of not more than 7000 goods producing jobs a month. By contrast, in the past several years at least 20,000 goods productions jobs have been addedvirtually every month ...

So if history is a guide, a sharp slowdown in goods producing jobs growth should begin very soon, if not having already begun in February.

To the graphs: the jobs reports in the last three months have borne out my forecast for a deceleration or decline in the leading semployment sectors

First, here is a m/m graph of manufacturing, construction, and temporary jobs, all of which are leading sectors for jobs as a whole:

In the past three months, all three have faltered, with decelerating or outright declines in jobs. Note how similar this looks to the trend in the three pre-recession graphs of these sectors I posted under article #5 above.

Here is the YoY look at the same three sectors, showing that all three have decelerated substantially:

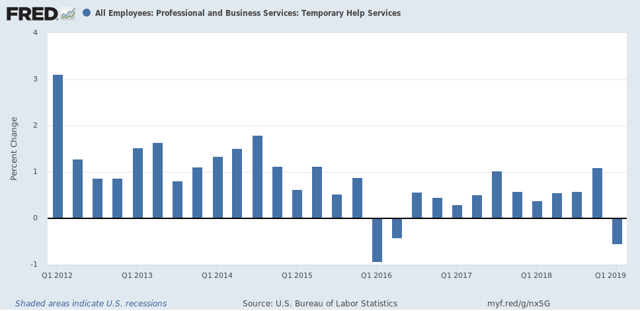

On a six month basis, temporary jobs are up by 500 out of 3 million! Here are the quarterly numbers, showing that Q1 of this year marked the first decline, aside from the downturn of 2015-16, since the end of the Great Recession:

By the way, if you don’t believe me that temporary jobs are a leading sector for jobs overall, then how about University of Oregon Professor Tim Duy, who wrote in connection with Freiday’s report that it contained “A Hint of Weakness;”

On the surface, this is another “Goldilocks” report – strong job growth, low and steady unemployment and nothing in the wage data to support inflation concerns. A hint of weakness, however, is visible in the temporary help numbers:

Next, here are goods-producing jobs (which include but are not limited to manufacturing and construction). Last week I wrote that I expected these to slow down to a rate of +7000/month. In the past two months, there was a loss of -28,000 in February, followed by a gain of +12,000 in March:

Here is the YoY look:

The last two months average to -8,000 per month.

Next, here is the YoY% change in nonfarm payrolls, showing a deceleration in the past two months:

This is as I forecast.

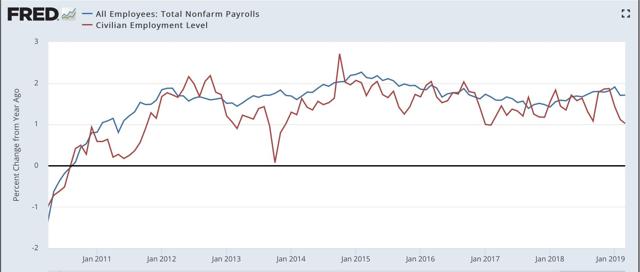

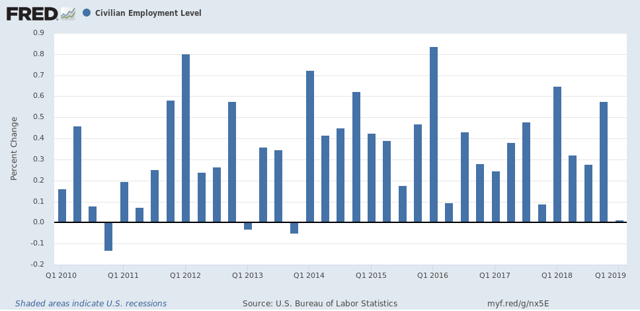

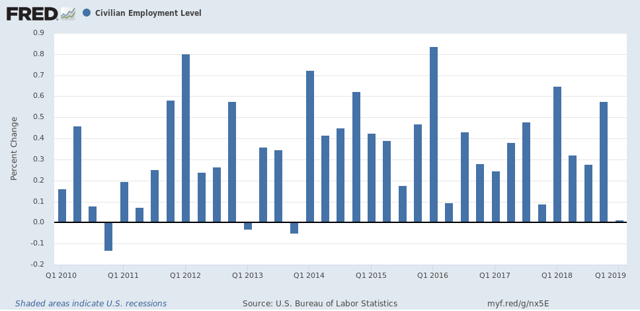

Here is a comparison of YoY changes in nonfarm payrolls as measured b the establishment report vs. jobs as measured by the household report:

What is noteworthy is that, at turning points, it appears to be the case that the household report gives warning first. in that regard, this past month was one of the worst 4 months in the past 9 years:

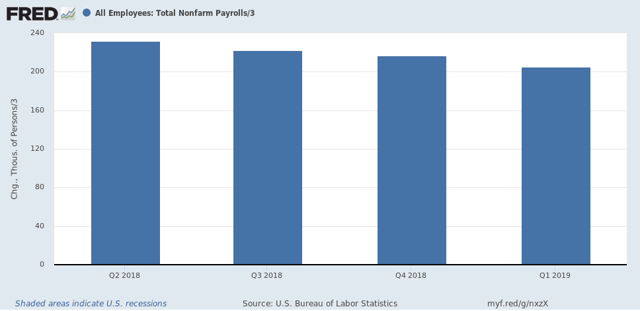

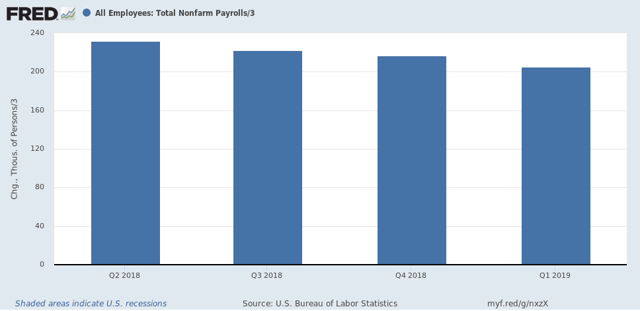

Finally, here is a graph of the quarterly changes in employment since the beginning of 2018. Jared Bernstein, who is convalescing from a stroke, typically compares the 3-, 6-. And 12-month average in employment growth to show the trend:

Here are the numbers:

3 month average: 205,000

6 month average: 208,000

Finally, here is a graph of the quarterly changes in employment since the beginning of 2018. Jared Bernstein, who is convalescing from a stroke, typically compares the 3-, 6-. And 12-month average in employment growth to show the trend:

Here are the numbers:

3 month average: 205,000

6 month average: 208,000

12 month average: 219,000

This shows a slow decline in the job growth trend overall.

This shows a slow decline in the job growth trend overall.

In sum, for three months I have been pounding the table to watch the leading sectors of manufacturing, construction, and temporary jobs. The three months since, including Friday’s jobs report, give every appearance of heralding the jobs slowdown I have been forecasting.