Saturday, June 20, 2020

Weekly Indicators for June 15 - 19 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

Almost all of the metrics have improved off of their worst readings. Enough of the short leading indicators have improved so much that the short term forecast was upgraded to neutral as of this week.

As usual, clicking over and reading should bring you “up to the moment” on the economy, and it also rewards me with a penny or two for the effort I put into the endeavor.

Friday, June 19, 2020

Coronavirus dashboard for June 19: infections and hospitalizations have increased; it may be too late for Arizona

- by New Deal democrat

Let’s start with the basics: total US coronavirus infections are 2,191,371. Total US deaths from coronavirus are 118,436. Those are official numbers; the real numbers are obviously higher.

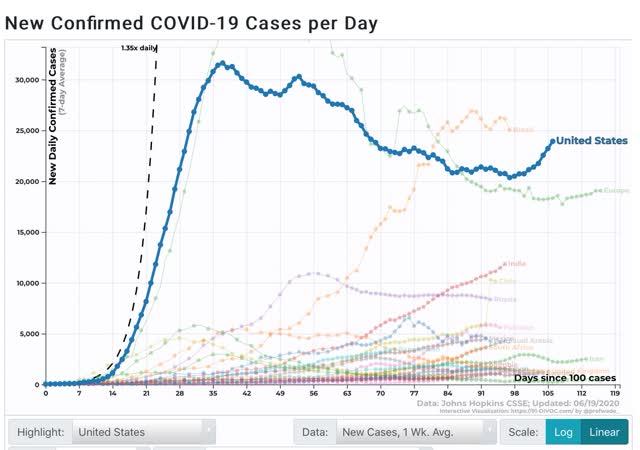

The number of daily new infections averaged over a week has started to rise decisively. After a low of 20,357 on June 9, as of the 18th it has risen to 23,923:

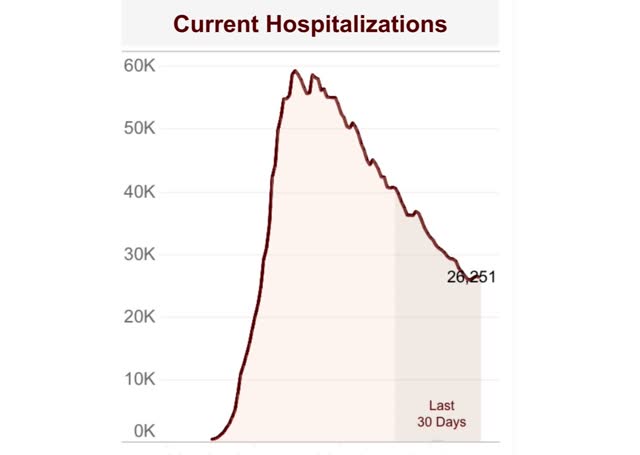

Not all States keep track of hospitalizations, so most dashboards don’t cover them. Conor Kelly does, and his measure shows that hospitalizations have also increased over the past three days as well:

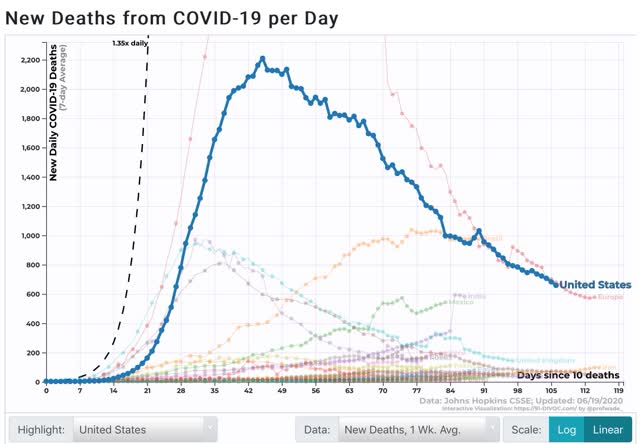

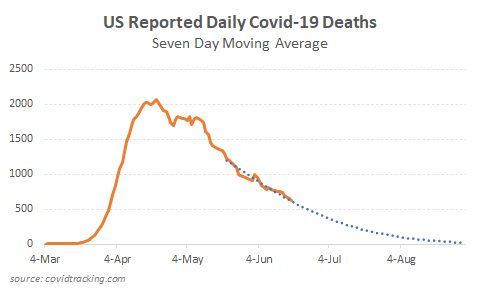

Deaths, however, have continued to decrease, down to 679 over the past 7 days vs. the peak of 2,210 on April 18:

One Stanford statistician claims that COVID-19 deaths are following a “Gompertz function,” I.e., they have all but completed burning through the available victims, and that deaths will drop to zero within 60 days:

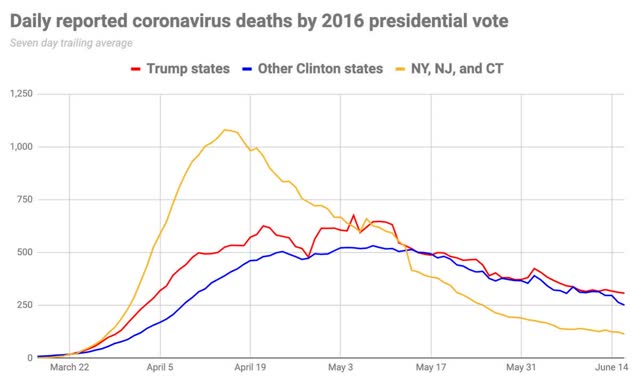

It is certainly interesting that, while new infections declined only 1/3 from peak, deaths have declined 2/3 from peak. But I suspect that the curve-fitting is skewed by the period that hospitals were overwhelmed by the NYC outbreak. When we remove the NYC metro from the data, deaths are not declining towards zero at all:

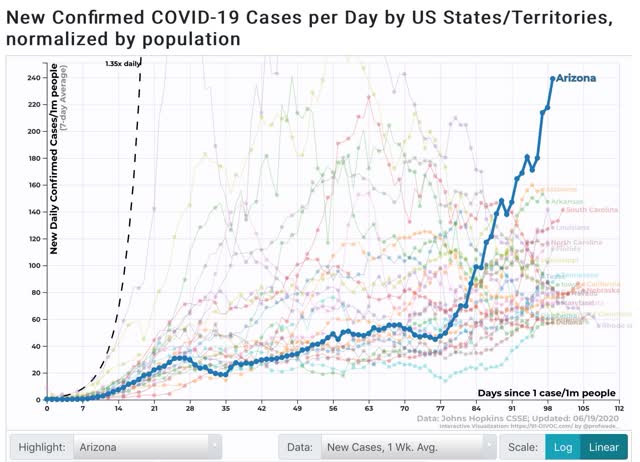

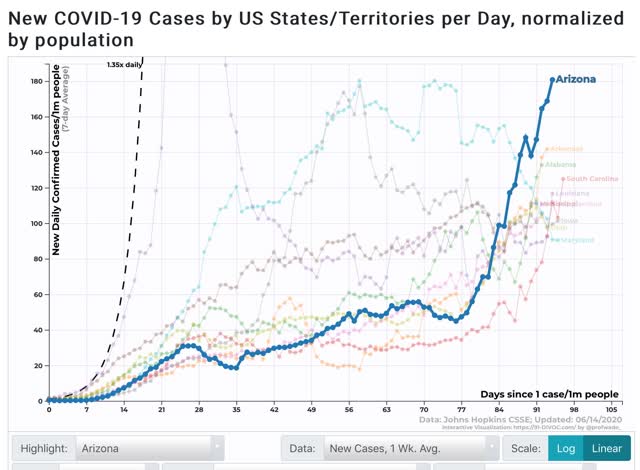

Turning to the situation in the recklessly reopened States, Arizona’s rate of new infections has gone exponential:

At this rate, within about 10 days Arizona will be as bad on a per capita basis as NY was at its peak. And remember, those who will present with symptoms in the next 5-7 days have already been infected. Aside from Utah, all of the other top 10 States are from the Confederacy, and their rates of infection have been growing. Texas has risen to #11.

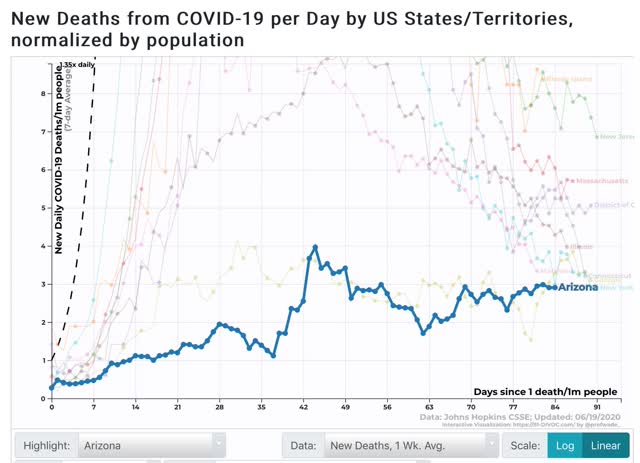

As to deaths, which lag, on a per capita basis 7 of the top 10 States are from the Northeast megalopolis. Illlinois is also included. But all 8 of these are declining. Both Georgia and Arizona have now joined, at #9 and 10, respectively, and their numbers are generally slowly growing:

It remains to be seen how brutally reality will have to hammer these States before they see the light, if ever. The governors of both Arizona and Texas have reluctantly allowed municipalities to mandate mask-wearing if they choose, and many of Arizona’s biggest municipalities have already done so.

Thursday, June 18, 2020

New and continued jobless claims level off, as spreading secondary impacts and job recalls balance

- by New Deal democrat

Weekly initial and continuing jobless claims give us the most up-to-date snapshot of the continuing economic impacts of the coronavirus on employment. Three full months after the initial shock, the overall damage remains huge, with recalls to work roughly balanced with spreading new secondary impacts.

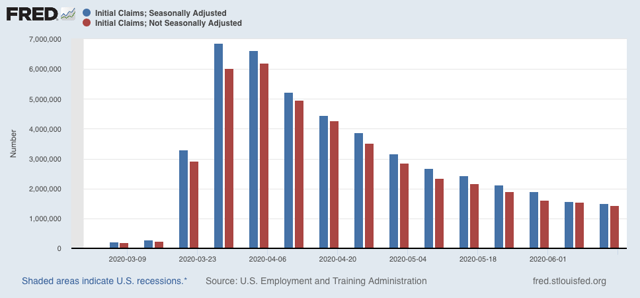

First, here are initial jobless claims both seasonally adjusted (blue) and non- seasonally adjusted (red). The non-seasonally adjusted number is of added importance since seasonal adjustments should not have more than a trivial effect on the huge real numbers:

There were 1.433 million new claims, which after the seasonal adjustment became 1.508 million. This is “only” 58,000 less than last week’s number - the smallest weekly decline since the worst reading in April, but nevertheless is the lowest so far since the virus struck.

These new claims show objectively huge second-order impacts continuing to spread.

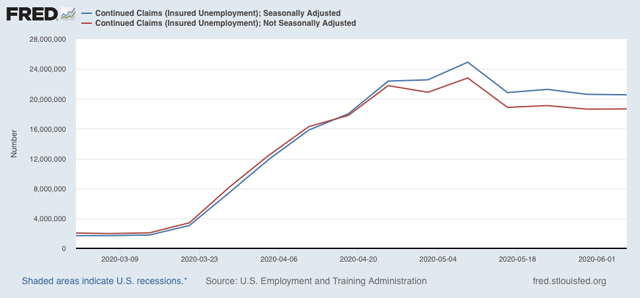

The “less bad” trend has leveled off in continuing claims, which lag one week behind. In the past four weeks, both the non-seasonally adjusted number (red), and the less important seasonally adjusted number (blue) have remained nearly stationary. This week the former declined by only 62,000 to 20.544 million, 4.368 below its peak of 24.912 million four weeks ago; while the latter actually rose slightly by 26,000 to 18.654 million, but still 4.140 million below its peak of 22.794 million reading four weeks ago:

These new claims show objectively huge second-order impacts continuing to spread.

The “less bad” trend has leveled off in continuing claims, which lag one week behind. In the past four weeks, both the non-seasonally adjusted number (red), and the less important seasonally adjusted number (blue) have remained nearly stationary. This week the former declined by only 62,000 to 20.544 million, 4.368 below its peak of 24.912 million four weeks ago; while the latter actually rose slightly by 26,000 to 18.654 million, but still 4.140 million below its peak of 22.794 million reading four weeks ago:

In other words, the spreading new damage shown by the continued huge numbers of new jobless claims is about equal to the callbacks to work from various sectors “reopening.”

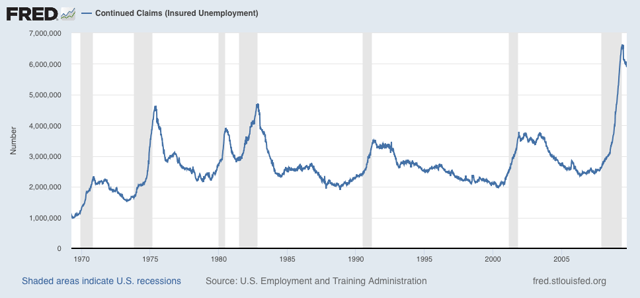

On a more long-term note, historically continuing claims have peaked at the end of or just after the end of recessions. Here’s the graph showing that from the beginning of the series through 2009:

Since this week the “King of Coincident Indicators,” industrial production was reported to have risen in May, and real retail sales also rebounded strongly, the decline in continuing claims over the past month is consistent with a determination by the NBER that a very short recession has already ended.

Because there is increasing evidence of renewed exponential spread by the coronavirus in States that recklessly reopened, all of the improving economic data (improving from absolutely horrible levels of course) may come to an abrupt end in the next few weeks.

Wednesday, June 17, 2020

Coronavirus dashboard for June 17: the second wave of the tsunami comes ashore

- New Deal democrat

As of yesterday, there were 2,137,731 total documented coronavirus infections in the US. Total known deaths were 116,963.

As I have stated several times in the past month, I believe that coronavirus infections and deaths will wax and wane around the April-May plateau of roughly 20-25,000 new daily infections and 500-2000 daily deaths, at least as long as Trump remains President. This is because, absent competent Federal leadership, the US lacks the political and social will to do what is necessary - distancing + mask-wearing + tracing - in order to “crush the curve” as almost every other industrialized European and Asian country has been able to do.

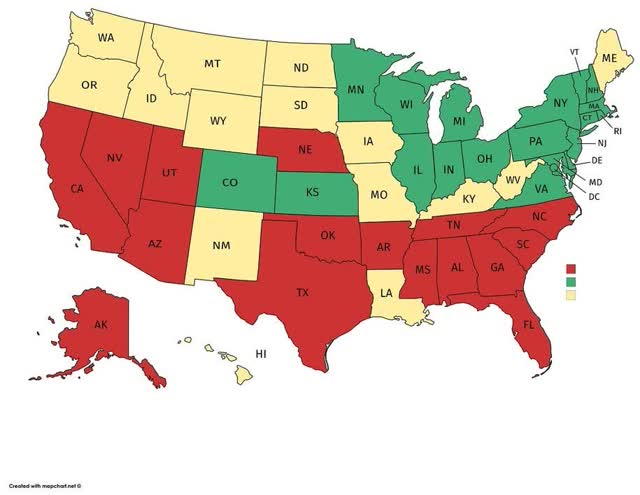

The current situation in the US is divided by region. In the early hard-hit areas of the Northeast and Midwest, effective measures were put in place and have been relaxed more gradually. As a result the infection rates there have continued to decline. By contrast, in the Confederacy, the High Plains, and the Southwest, lockdowns were put in place late if at all, and lifted early without any meaningful restrictions. As a result infection rates have begun to rise, in a few States at an exponential rate.

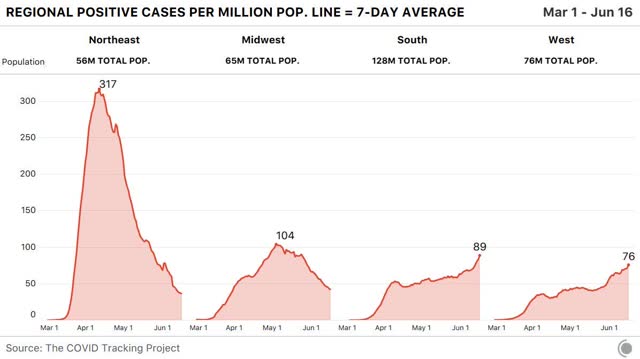

Yesterday the COVID Tracking Project finally released graphs for each region per capita, shown below:

In the Northeast and Midwest, the 7 day moving average of new infections has fallen to roughly 40 and 45 per million, respectively. In the South and West, it has risen to 89 and 76 per million, respectively.

Here is a map showing which States have falling rates of new infections (green), relatively flat rates (yellow), and increased rates of new infections (red):

The regional pattern is obvious.

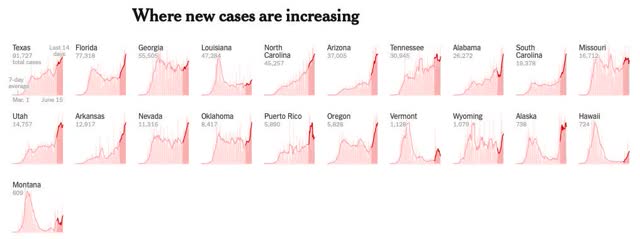

Here are the thumbnail graphs of all States with recent increases in new infections, ranked in order from highest to lowest number of *total* infections over time:

The last half dozen States shown, including, e.g., Oregon, Montana, Alaska, and Hawaii, have such small total numbers that the recent increases aren’t really significant; whereas the first shown, Texas, isn’t even in the “top 10” for the per capita rate of new infections (it’s #17. California is #14)).

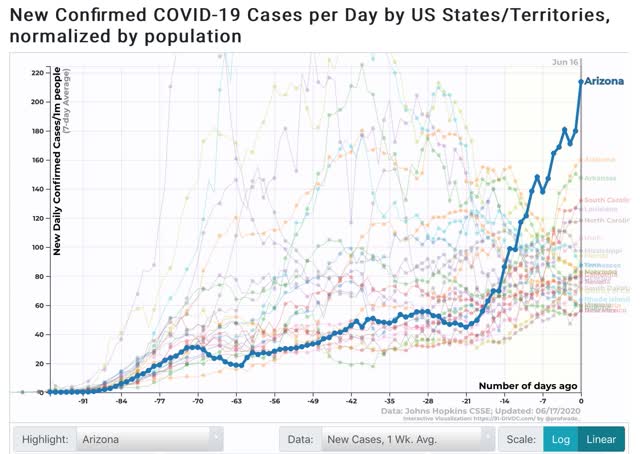

The “leader of the pack” among the recklessly reopened States is Arizona, which saw a huge increase in new cases yesterday, bringing its 7 day average up to 214 per million:

As shown in the graph above, the remaining “top 10” are all States in the Confederacy, High Plains, and Mountain West. In order, (showing rates of new infections per million as of June 15 in parentheses) they are: Alabama (156), Arizona (150), South Carolina (125), Louisiana (127), North Carolina (117), Utah (102), Mississippi (98), Florida (83), and Iowa (83).

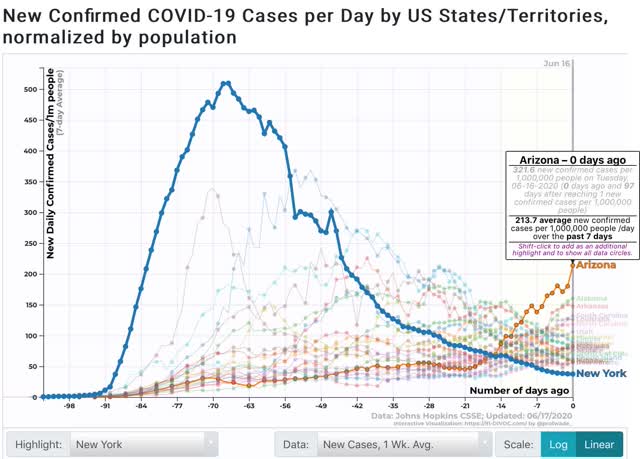

To put this in perspective, here is the same graph but superimposing NY’s trend-line:

Even now, Arizona is not nearly as bad as NY, NJ, CT, or LA were at their peaks. But at its current rate of doubling, roughly every 9 days, if this continues I n about 2 weeks AZ will be as bad as NY was at its worst.

Tuesday, June 16, 2020

The Coronavirus Recession may already (technically) have ended: sales and production both increased in May

- by New Deal democrat

Sales and production are two of the four things that economists look for in gauging whether the economy is in expansion or recession, and this morning both of them - retail sales and industrial production - were released for May.

So it’s true: as defined by the NBER, the Coronavirus Recession may have only lasted two months, from February through April. That’s because, just as February was the peak of economic activity before the coronavirus hit, April may well have been the trough. And recessions technically end, not when the economy becomes objectively “good” or “fair,” but simply when the level of activity is less awful than before. If the trajectory is positive, and activity goes from really awful, to slightly less really awful, the recession has ended, even if the economy is still, well, awful.

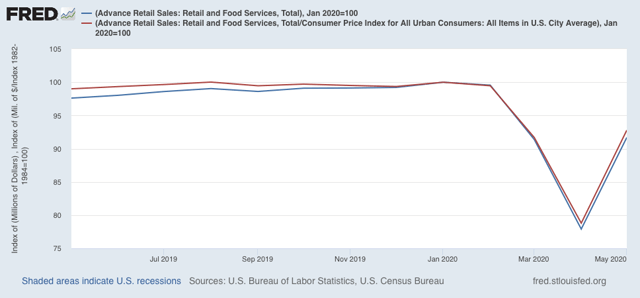

To the graphs! First, here are retail sales, both nominally and as adjusted for inflation:

Both increased 17.7% in May, after declining over 14% in April. Both are also slightly higher than their levels in March. Clearly the “reopening” of the economy in large portions of the country led to a splurge in spending.

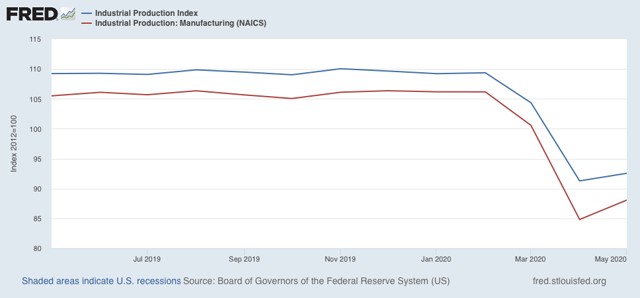

Next, here is total industrial production (blue) along with manufacturing production (red):

Both increased slightly.

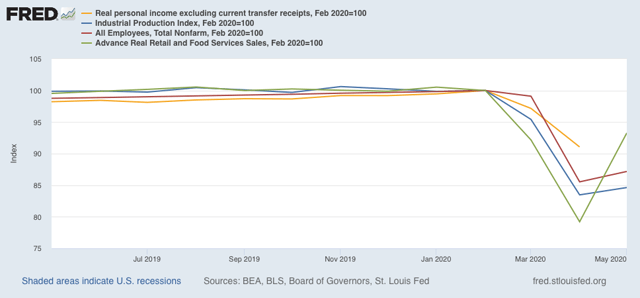

Since employment also increased in May, that makes three of four sectors included in recession measurements that - as of now - are off their lows, as shown in the graph below:

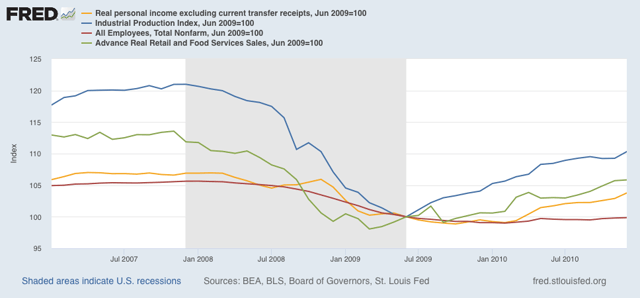

Personal income less transfer receipts for May won’t be reported for another couple of weeks, but even if it is lower, the NBER may still decide that the recession has ended. That’s because industrial productions is the King of Coincident Indicators, and carries more weight than the others in recession calls. For example, here is the period of time including the Great Recession:

The NBER determined that the recession ended in June 2009. That’s when industrial production bottomed. Real retail sales had already bottomed several months before. Both employment and real income were close to but had not yet reached their bottoms.

So, even though the economy as measured by all four sectors is still awful, it was a little less awful in May than it was in April, and that may be enough for the NBER.

Two important caveats:

(1) I don’t expect the NBER to be so quick with this call as they were with their recession onset call, because they will want to be sure that this is not a false start; which leads even more importantly to

(2) the virus is still in control. Those States which have recklessly opened without waiting for infections to abate, and without effective testing, tracing, and quarantining protocols - which is almost all of them, particularly in the South, High Plains, and Mountain West - are seeing new infections start to rise again, and in some cases - Arizona, Alabama, Arkansas, Texas, and South Carolina for example - the graphs are beginning to look exponential again. It would not be surprising at all if renewed panic were to set in, with new lockdowns put in place, or at very least consumers pulling back from face-to-face activity. In other words, the increases in industrial production, employment, and sales may well prove temporary.

Monday, June 15, 2020

Abbreviated Coronavirus dashboard for June 15: tracking the four horsemen of the reopening apocalypse

- by New Deal democrat

There’s no big economic news out today. So let me follow up on my post Friday about the cost of reopening recklessly coming due.

Here is the graph from 91.divoc.com of the 10 States with the highest per capita infection rate over the past 7 days ending Saturday:

With the exception of rapidly declining Maryland, the focus has almost entirely shifted away from the Northeast and Midwest and instead to the Confederacy plus Iowa, Utah, and Arizona. The 4 “leading” States are Arizona, Alabama, Arkansas, and South Carolina.

I’m having problems with the 91-divoc site this morning, but the raw data through Sunday shows a slight decline for Arizona, but a 12% increase for Alabama and a whopping 25% increase for Arkansas, bringing it up to Arizona’s level. South Carolina is steady.

Among the other States with recent big increases, North Carolina saw a 6% further increase as of Sunday. Utah and Iowa had slight increases. Mississippi had a 13% decrease in the 7 day average.

Finally, although they aren’t among the 10 States with the highest per capita new infections, both Florida and Texas have also seen big increases in cases in the past two weeks (both have had about 60 cases per million per day as of several days ago). Through Sunday, Florida’s rate increased another 8%, while Texas saw another 3% increase.

Bear in mind that, at its worst, NY had over 500 new infections per day per million population, so even Arizona and Arkansas are less than 40% of that rate. It remains to be seen how much pain these States can take before they decide to change their ways - if ever.

Subscribe to:

Comments (Atom)