On Friday, the BEA reported that second quarter GDP

came in at 3.4%. Now it appears the debate is if this pace is sustainable.

There are a few points to make regarding this debate.

1.) Probably the best way to look at the second quarter GDP report is to combine it with the first quarter number and average the results. This would give us growth of about 2%, which seems the most likely real underlying rate of growth.

2.) Second quarter growth got a big boost from government spending increases, which accounted for .82 of the 3.4% growth. In addition, there was a huge bump in nonresidential investment. These rates of growth aren't going to repeat

in the third quarter. Stronger investment in nonresidential structures, up 22.1%, and government spending, up 4.2%. Neither of these are remotely sustainable.

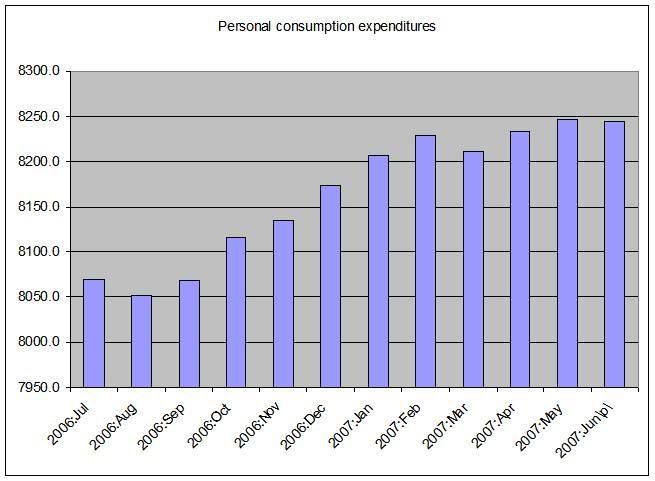

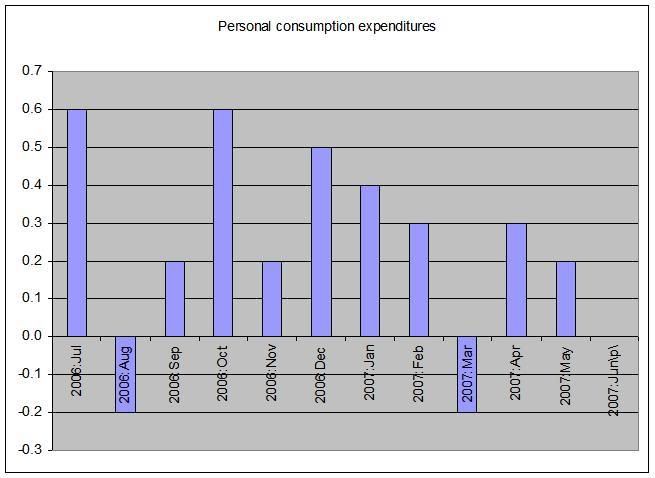

4.) Personal consumption expenditures increased 1.5%. This is the result of high gasoline prices.

Don’t read too much into the sharp moderation in real consumer spending — it is entirely attributable to the spike in gasoline prices… While the housing market is likely to show further deterioration, the biggest source of uncertainty in the outlook at this point is actually the future direction of gasoline prices.

To an extent, I agree with this analysis. Gasoline prices are very cyclical, rising in the summer and falling in the winter. However, this year the country had very high gas prices in the Spring. They rose very quickly and to very high levels starting in about February. Wal-Mart and other low-income targeting retailers mentioned these prices in their respective earnings reports. WM has started to mention high gas prices in their ads. The point here is gas prices broke with their usual cyclical pattern, rising when consumers weren't expecting them to rise. Now we're in the increasing part of the cycle when consumers are expecting higher gas prices. In addition, prices have come down a bit, although they are still high. This could have a somewhat positive effect on consumer behavior.

On the negative side of consumer spending, we now have a volatile stock market. Will the market dampen consumer sentiment? The chances are it will have an impact, but the degree remains to be seen. Frankly, what happens over the next few weeks will be very important from this perspective. If the decline is short lived, the chances it will impact consumer sentiment are small. But the longer this lasts and the more volatile it is, the more pronounced the effect on consumer behavior.

And there is housing, which has been declining for over a year and shows no signs of forming a bottom anytime soon. Inventory levels are at all time highs and credit is contracting. Frankly, I've been surprised this hasn't had a negative impact on consumer spending over the last year. However, this housing slowdown is somewhat atypical. Usually the economy slows, which leads to a faltering housing market. This time around, the housing slowdown happened during an economic expansion. This may have limited the downward economic pressure from the housing slowdown. But now that GDP growth has slowed, housing may start to increase in prominence from a consumer spending perspective.

Here's a good summation of the

consumer spending situation:"Maybe the equilibrium we had where jobs, wages and equities were offsetting the negatives of higher energy price and housing head winds has shifted to where we move to a slower growth profile for consumer spending," Gregory said. "We'll see in the next month or two, but that's definitely the risk that's out there."

3.) Net exports added 1.18 of the 3.4% increase. While this number might not come in as high in the third quarter, the dollar is cheap and other economies are growing. There is no reason to expect this number to not add positively to GDP in the third quarter.

4.) Business spending outside of structures added just .17 to the 3.4% number. This is a very weak area of the economy and runs counter to what some people have been arguing would happen (including myself). Although business balance sheets are in good shape, corporate boards may move to a more conservative perspective, arguing to ride out the weak domestic economy with their high levels of cash rather than increase money on expenditures. This would make a great deal of sense for most companies.