Until then, here is a dose of dog cuteness.

The unemployment rate rose from 4.8 to 5.1 percent in March, and nonfarm payroll employment continued to trend down (-80,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Over the past 3 months, payroll employment has declined by 232,000. In March, employment continued to fall in construction, manufacturing, and employment services, while health care, food services, and mining added jobs. Average hourly earnings rose by 5 cents, or 0.3 percent, over the month.

The number of unemployed persons increased by 434,000 to 7.8 million in March, and the unemployment rate rose by 0.3 percentage point to 5.1 percent. Since March 2007, the number of unemployed persons has increased by 1.1 million, and the unemployment rate has risen by 0.7 percentage point.(See table A-1.)

In March, the number of persons unemployed because they lost jobs increased by 300,000 to 4.2 million. Over the past 12 months, the number of unemployed job losers has increased by 914,000.

For another month, the data was worse than expected, and the previous months were revised lower, and futures markets are quickly adjusting from previous lofty levels. This is the worst jobs figure since March of 2003, and stock futures have backed off a bit, although those markets were already pulling back prior to the release.

Nonfarm payrolls fell by 80,000 in March, and January and February figures were revised lower as well. Both months were revised to a loss of 76,000 jobs, according to the Labor Department. The unemployment rate rose to 5.1% from 4.8% in February.

Struggling to cope with record oil prices and a weakening economy, Northwest Airlines Corp. said it will raise fares, fuel surcharges and baggage fees and cut its domestic flight schedule by 5%.

The move is the latest by a major carrier to trim service and pile extra fees on customers as relentless growth in the cost of fuel threatens the industry's attempt to put a half-decade slump and a round of bankruptcies behind it.

Northwest also said it has suspended plans to hire more pilots and flight attendants and will cut capital spending that doesn't involve airlines by about $100 million this year, to $150 million. Employees' pay won't be cut, and any job losses will happen through attrition if possible.

"Over the past several months, the price of oil has risen dramatically to all-time highs and there is no reasonable basis to conclude that oil prices will materially decline anytime soon," Chief Executive Doug Steenland said. "These increased costs are significant and call for a strong response from us."

.....

This week, three airlines have announced they would close: ATA Airlines Inc., Aloha Airgroup Inc. and Champion Air.

India's inflation accelerated at the fastest pace in more than three years in the week ended March 22. Philippine inflation quickened at the fastest pace in 20 months in March. Consumer prices gained 8.7 percent in February in China, an 11-year high. Food prices in the country, based on a government index, jumped 28 percent in February, the most since July.

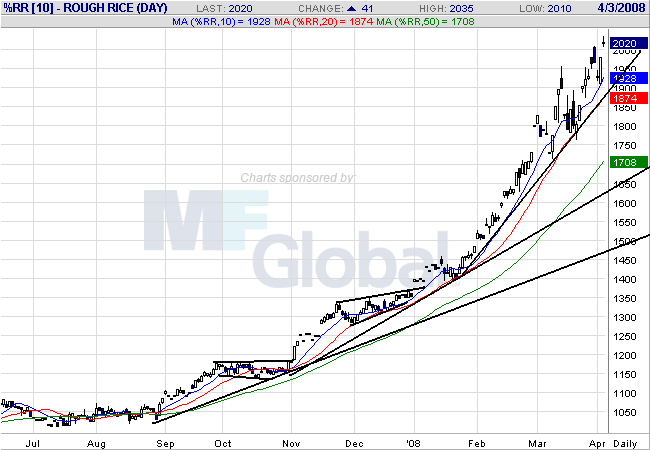

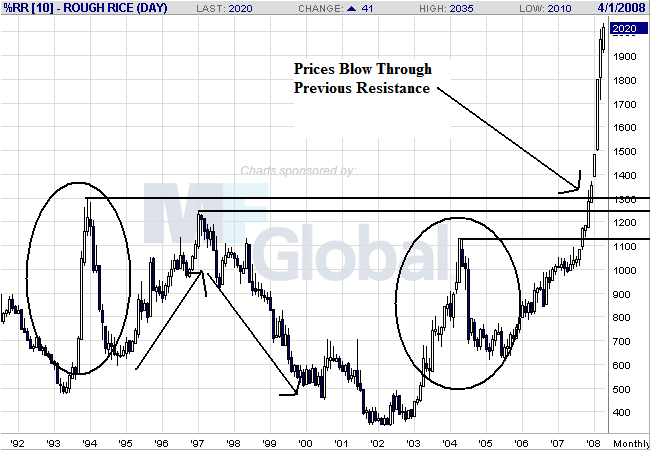

Thailand, the world's biggest rice exporter, pledged to maintain supplies and India vowed to crack down on hoarding as shortages drove prices to a record and threatened to trigger protests in Asia and Africa.

The nation ``has enough rice for export to neighboring countries'' and may be able to deliver as much as 1.2 million tons a month, Prasert Gosalvitra, head of the rice division of the farm ministry, said today in Bangkok. Thailand has shipped about 1.1 million tons a month since October, he said.

Rice, the staple food for about 3 billion people, gained 1 percent to its highest ever in Chicago today after doubling in the past year. Higher imports by the Philippines, the biggest buyer, and export cuts by China, India, Egypt and Vietnam pushed up prices, contributing to food riots in Ivory Coast and anti- hoarding campaigns in Pakistan and the Philippines.

``We expect a significant rise in prices, well above the long-term average, in the short-to-medium term,'' Les Gordon, president of the Rice Growers Association of Australia, said today. Population growth, urban encroachment on land, and rising grain prices are contributing to the increase.

Although our recent actions appear to have helped stabilize the situation somewhat, financial markets remain under considerable stress. Pressures in short-term bank funding markets, which had abated somewhat beginning late last year, have increased once again. Many lenders have been reluctant to provide credit to counterparties, especially leveraged investors, and have increased the amount of collateral they require to back short-term security financing agreements. To meet those demands, investors have reduced their leverage and liquidated holdings of securities, putting further downward pressure on security prices.

Credit availability has also been restricted because some large financial institutions, including some commercial and investment banks and the government-sponsored enterprises (GSEs), have reported substantial losses and writedowns, reducing their available capital. Several of these firms have been able to raise fresh capital to offset at least some of those losses, and others are in the process of doing so. However, financial institutions’ balance sheets have also expanded, as banks and other institutions have taken on their balance sheets various assets that can no longer be financed on a standalone basis. Thus, the capacity and willingness of some large institutions to extend new credit remains limited.

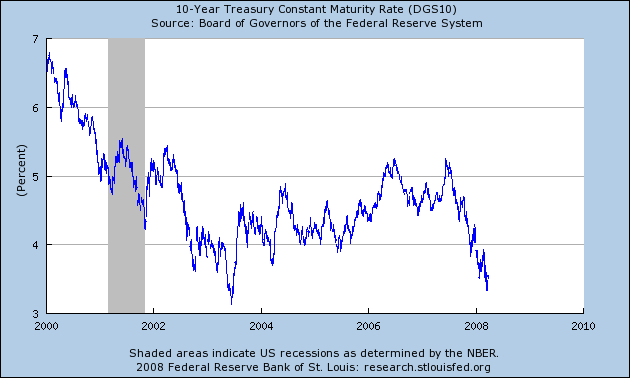

The effects of the financial strains on credit cost and availability have become increasingly evident, with some portions of the system that had previously escaped the worst of the turmoil--such as the markets for municipal bonds and student loans--having been affected. Another market that had previously been largely exempt from disruptions was that for mortgage-backed securities (MBS) issued by government agencies. However, beginning in mid-February, worsening liquidity conditions and reports of losses at the GSEs, Fannie Mae and Freddie Mac, caused the spread of agency MBS yields over the yields on comparable Treasury securities to rise sharply. Together with the increased fees imposed by the GSEs, the rise in this spread resulted in higher interest rates on conforming mortgages. More recently, agency MBS spreads and conforming mortgage rates have retraced part of this increase, and conforming mortgages continue to be readily available to households. However, for the most part, the nonconforming segment of the mortgage market continues to function poorly.

In corporate debt markets, yields and spreads on both investment-grade and speculative-grade corporate bonds rose through mid-March before falling more recently. Issuance of investment-grade bonds by both financial and nonfinancial corporations has been quite robust so far this year, but issuance of new high-yield debt has stalled. Strains continue to be evident in the commercial paper market as well, where risk spreads remain elevated and the quantity of commercial paper outstanding, particularly asset-backed paper, has decreased. Commercial and industrial loans at banks grew in January and February, but at a considerably slower pace than in previous months.

Notably, in the housing market, sales of both new and existing homes have generally continued weak, partly as a result of the reduced availability of mortgage credit, and home prices have continued to fall.1 Starts of new single-family homes declined an additional 7 percent in February, bringing the cumulative decline since the early 2006 peak in single-family starts to more than 60 percent. Residential construction is likely to contract somewhat further in coming quarters as builders try to reduce their high inventories of unsold new homes.

Private payroll employment fell 101,000 in February, after two months of smaller job losses, with job cuts in construction and closely related industries accounting for a significant share of the decline. But the demand for labor has also moderated recently in other industries, such as business services and retail trade, and manufacturing employment has continued on its downward trend. Meanwhile, claims for unemployment insurance have risen somewhat on balance, and surveys indicate that employers have scaled back hiring plans and that jobseekers are experiencing greater difficulties finding work. The unemployment rate edged down in February and remains at a relatively low level; however, in light of the sluggishness of economic activity and other indicators of a softer labor market, I expect it to move somewhat higher in coming months

After rising at an annual rate of about 3 percent over the first three quarters of last year, real disposable income has since increased at only about a 1 percent annual rate, reflecting weaker employment conditions and higher prices for energy and food. Concerns about employment and income prospects, together with declining home values and tighter credit conditions, have caused consumer spending to decelerate considerably from the solid pace seen during the first three quarters of last year. I expect the tax rebates associated with the fiscal stimulus package recently passed by the Congress to provide some support to consumer spending in coming quarters.

In the business sector, the pullback in hiring that I noted earlier has been accompanied by some reduction in capital spending plans, as weaker sales prospects, tighter credit, and heightened uncertainty have made business leaders more cautious. On a more positive note, the nonfinancial business sector remains financially sound, with liquid balance sheets and low leverage ratios, and most firms have been able to avoid unwanted buildups in inventories. In addition, many businesses are enjoying strong demand from abroad. Although the prospects for foreign economic growth have diminished somewhat in recent months, net exports should continue to provide considerable support to U.S. economic activity in coming quarters.

The mostly negative news has caused a surge of buying interest, with the thrifts & mortgages (+8.7%), diversified financials (+7.0%), and consumer finance (+6.7%) groups posting steep gains. However, there were similar rallies on negative news as early as October on hopes that the worst of the subprime mess was over--which clearly was not the case. Whether this really ends up being the turning point remains to be seen, but as of now there is a bullish bias prevalent within the market.

More investment-banking jobs will have to go at UBS in light of another $19 billion in write-downs that the Swiss banking giant will take, the company's chief executive said Tuesday.

Fresh cuts will come on top of the 1,500 job losses that UBS announced in October. They'll likely be focused on the fixed-income side of the company's business, where other firms have also been shedding jobs in recent months.

"The environment is tough, and we will have to review our capacity," said CEO Marcel Rohner on a conference call with analysts.

Over the last five years, financial services has reached a swollen 20-21% of U.S. GDP -- the largest sector of the private economy.

Manufacturing led financial services by 2:1 back in the 1970s, but by 2006 beaten goods production had shrunk to just 12% of GDP.

During Greenspan's 1987-2005 tenure, the sum of public and private debt in the United States quadrupled from just over $10 trillion to $43 trillion.

UBS AG, battered by the biggest writedowns from the collapse of the U.S. subprime mortgage market, reported a 12 billion-franc ($11.9 billion) quarterly loss and said Chairman Marcel Ospel will step down.

The bank will seek 15 billion francs in a rights offer to replenish capital, on top of 13 billion francs raised from investors in Singapore and the Middle East. UBS will write down $19 billion on debt securities, bringing the total to almost $38 billion since the third quarter of 2007. Zurich-based UBS also said today it will cut jobs at the investment bank.

Ospel, 58, who led the creation of UBS in a merger a decade ago, will be replaced by 58-year-old general counsel Peter Kurer. Deutsche Bank AG said today that market conditions have become ``significantly more challenging'' in recent weeks, after rising U.S. mortgage defaults caused about $230 billion in credit losses and writedowns at financial companies. UBS rose as much as 10 percent in Swiss trading on optimism Switzerland's largest bank will recover from its subprime losses.

``Behind closed doors they have been cleaning up very swiftly and the capital increase will put them back onto a solid foundation,'' said Joerg de Vries-Hippen, who oversees about $26 billion, including UBS shares, as chief investment officer for European stocks at Allianz Global Investors in Frankfurt. Still, ``it will take years to repair the bank's reputation,'' he said.

UBS, the world's biggest money manager for the wealthy with about 2.3 trillion francs in private-banking assets, said clients in Switzerland withdrew funds in the first quarter. Those redemptions were offset elsewhere and net investments were ``slightly positive,'' Chief Executive Officer Marcel Rohner said on a conference call today.

Lehman Brothers Holdings Inc., the fourth-largest U.S. securities firm, is seeking to raise at least $3 billion from a share sale after speculation it's short of capital drove the stock down 42 percent this year.

Lehman is offering 3 million convertible preferred shares in a sale that will be ``an endorsement of our balance sheet by investors,'' Chief Financial Officer Erin Callan said in an interview yesterday. Demand for the stock was three times greater than the amount on sale as of 6:30 p.m. in New York, according to a person familiar with the offering who declined to be identified before the sale ends today.

Chief Executive Officer Richard Fuld is trying to restore confidence after Lehman shares plunged as much as 48 percent on March 17 on speculation the New York-based firm would face the same cash shortage that broke Bear Stearns Cos. Merrill Lynch & Co., Citigroup Inc. and Morgan Stanley have also raised cash from investors after more than $200 billion of writedowns and losses tied to the collapse of mortgage markets at the world's biggest financial companies.

....

``We still maintain that we don't need capital, but we've realized that perception is the dominant issue in today's markets,'' Callan said.

The firm's net income declined 57 percent in the quarter, less than analysts estimated, because of a $1.8 billion writedown on mortgage assets. Merger advisory fees jumped 34 percent, investment-management revenue surged 39 percent and equities rose 6 percent.

Fuld, 61, has announced plans to cut 5,300 jobs, or 19 percent of the workforce, and closed mortgage units during the past seven months. He also has expanded in Europe and Asia to gain market share in stock trading as part of his initiatives designed to help Lehman grow faster than its peers once markets recover.

Deutsche Bank AG, Germany's biggest bank, will write down a record 2.5 billion euros ($3.9 billion) in loans and asset-backed securities as contagion from the subprime-market collapse spreads to Europe's largest financial companies.

``Conditions have become significantly more challenging during the last few weeks,'' the Frankfurt-based bank said today. Deutsche Bank will cut the value of leveraged-buyout and commercial real-estate loans and residential mortgage-backed securities.

Deutsche Bank, which increased profit last year as it skirted the worst of the subprime meltdown, said a week ago its 2008 pretax profit target is under threat. Swiss rival UBS AG announced today Chairman Marcel Ospel will step down after reporting an additional $19 billion of writedowns.

Chief Executive Officer Josef Ackermann, attending a banking conference in London today, wouldn't answer questions.

Deutsche Bank spokesman Christian Streckert cited last week's annual report when asked today about the 2008 pretax profit forecast of 8.4 billion euros, which excludes one-time effects. The bank on March 26 said writedowns and a worsening economy would ``adversely affect our ability to achieve our pretax profitability objective.''

``The market was prepared,'' said Thomas Nagel, a Frankfurt-based trader at Equinet AG. ``Bank stocks could even being nearing a turnaround because the drops have been exaggerated.''

Deutsche Bank said today markdowns on assets backed by residential mortgages ``principally'' involve 7.91 billion euros of so-called ALT-A mortgages, which fall between subprime and prime.

Thornburg Mortgage Inc., a residential-finance company hit hard by the credit crunch, said Monday it had succeeded in raising new capital to stave off bankruptcy.

After a struggle of more than a week, the real-estate investment trust, specializing in making large mortgages to people with good credit, said it raised $1.35 billion through selling bonds, warrants to purchase its common shares and interests in certain mortgage assets. The company plans to use the proceeds from the offering to satisfy a capital-raising requirement set by its lenders, who gave the company an extension through Monday to raise $948 million or risk losing funding.

To sell the bonds, Thornburg is paying a high price. Buyers of the bonds will get 18% interest initially and warrants to buy Thornburg shares for a penny a share. Thornburg said last night it had received $1.15 billion of the proceeds from the offering. The remaining $200 million of the offering proceeds is being held in escrow and will be delivered to the company upon the completion of a tender offer for its preferred stock.

The funding problem for Thornburg, based in Santa Fe, N.M., underscores the challenges facing many financial firms at a time when the credit-market turmoil has severely curtailed access to capital. Unlike subprime lenders -- those catering to people with poor credit -- Thornburg has prided itself on a low default rate and a $35 billion portfolio of adjustable-rate mortgages and mostly highly rated mortgage securities.

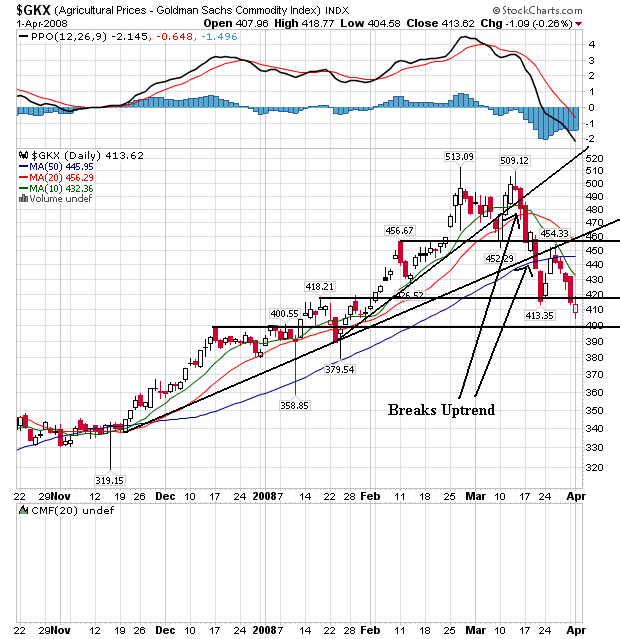

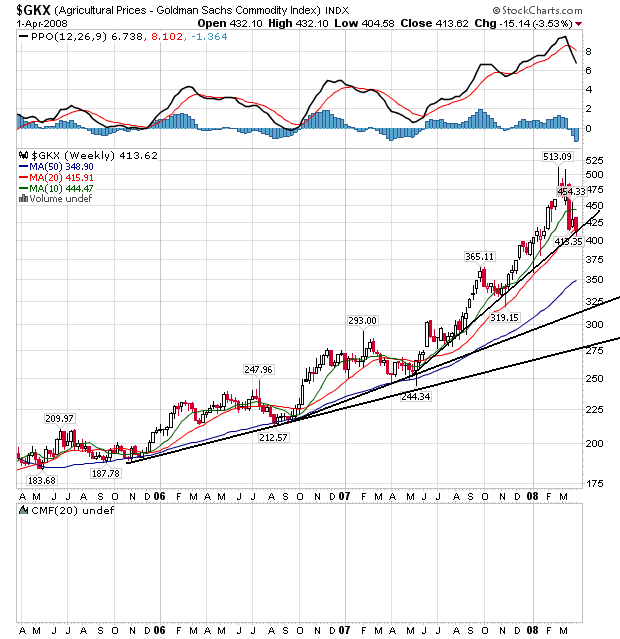

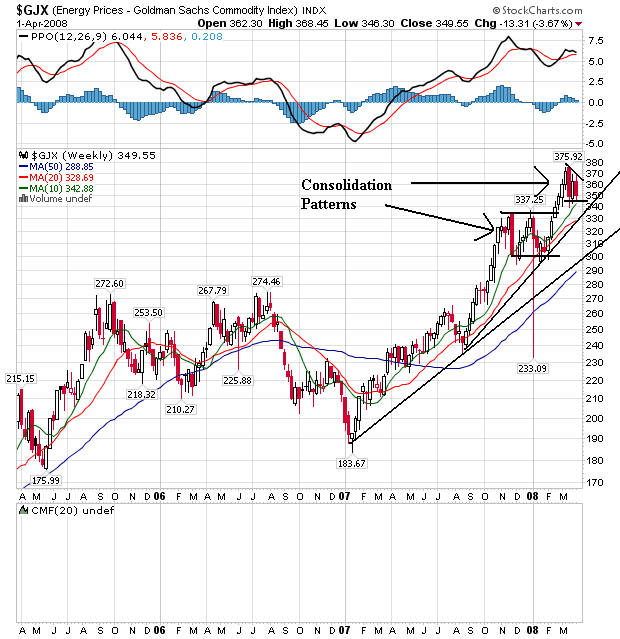

Here's the problem [with all of the bullish bets on commodities]: The speculators' bullishness may be way overdone, in the process lifting prices far above fair value. If the speculators were to follow the commercial players -- the farmers, the food processors, the energy producers and others who trade daily in the physical commodities -- they'd be heading for the exits. For right now, the commercial players are betting on price declines more heavily than ever before, says independent analyst Steve Briese.

For example, in the 17 commodities that make up the Continuous Commodity Index, net short positions by the commercials have been running more than 30% higher than their previous net-short record, in March 2004.

Briese, author of the recent book The Commitments of Traders Bible and editor of the Website CommitmentsOfTraders.org, was one of the first to recognize that information on the bets made by the commercials could provide rare insights into how the "smart money" views the price outlook. These days, the data suggest, the smart money clearly believes that the market's exuberance has turned irrational.

Indeed, the great commodities bubble started springing its first leaks two weeks ago: Oil, gold and other major commodities posted their steepest weekly drop in half a century. Though prices have since firmed, they could eventually drop 30% as speculators retreat. The only real question is when.

.....

Commodities index funds, which arrived on the scene in the late 1990s, have come into their own in the past several years. The biggest index fund, Pimco Real Return (ticker: PRTNX), has seen its assets swell to $14.3 billion from $8 million since its inception in January 1997.

Index funds offer investors an easy, inexpensive way to gain exposure to a segment of the commodities markets or a broad-based basket of commodities. Result: The funds have drawn many private investors who have never ventured into futures, along with pension funds and other institutional players looking to diversify. But for all the virtues that the funds hold as a way of spreading bets across commodity markets, they take only long, or bullish, positions, avoiding short-selling. In other words, they trade on the naïve and potentially fatal assumption that commodities have the same tendency as stocks to rise over the long run.

European inflation accelerated to the fastest in almost 16 years in March, heightening the European Central Bank's quandary at a time when the economy is cooling and confidence is falling.

Consumer-price inflation in the euro area accelerated to 3.5 percent this month, the highest rate since June 1992, the European Union's statistics office in Luxembourg said today. That is faster than the 3.3 percent median forecast of 36 economists in a Bloomberg News survey. A separate report showed consumer and business confidence fell more than economists expected.

Rising food and energy prices are stoking inflation in the euro area, eroding consumers' purchasing power and pushing up costs at companies. ECB council member Erkki Liikanen said today that inflation expectations have ``hardened'' and the growth outlook has ``become more subdued,'' summing up the dilemma for the central bank, which is resisting cutting interest rates as inflation accelerates.

Investors in interest rate-sensitive sectors such as automobile, financial services and real-estate firms are unlikely to breathe easy this week as India's inflation threatens to run out of control, dashing earlier hopes that the monetary policy could be eased some time this year to lift slowing economic growth.

In five quick weekly steps, the country's inflation shot up to a 15-month high of 6.68% in the week ended March 15, way above expectations of less than 6%, from 4.35% in the week ended Feb. 9. The more than two-percentage point inflation shock in such a short time has jolted policy makers just as it has economists, increasing chances of both fiscal and monetary action to prevent the situation from getting out of control.

And the government seems to be moving quickly. On Friday, trade minister Kamal Nath reportedly said the government was mulling an exports ban on some types of rice, while other government officials suggested a ban on edible oil exports, along with a reduction in import duties of other commodities.