Saturday, April 14, 2018

Weekly Indicators for April 9 - 13 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

The long leading indicators keep tiptoeing closer and closer to neutrality.

Friday, April 13, 2018

February 2018 JOLTS report: positive trend revised away

Last month I wrote that the January JOLTS report reflected very positive trends. Today they got revised away.

As a refresher, unlike the jobs report, which tabulates the net gain or loss of hiring over firing, the JOLTS report breaks the labor market down into openings, hirings, firings, quits, and total separations.

I pay little attention to "job openings," which can simply reflect that companies trolling for resumes, or looking for the perfect, cheap candidate, and concentrate on the hard data of hiring, firing, quits and layoffs.

The first important relationship in the data is that historically, hiring leads firing. While the one big shortcoming of this report is that it has only covered one full business cycle, during that time hires have peaked and troughed before separations.

And here, there has been an important revision. Here is the historical relationship on a quarterly basis between hiring (red) and total separations (blue) as it existed through the end of the third quarter of 2017:

The updated graph shows hiring exceeding its prior peak in the second halfof 2017 with its last monthly peak in October. Significantly, hiring for the previous month was revised downward below this peak.

Meanwhile separations actually peaked before then, in July of last year, with a clear downtrend since, another significant revision since last month. *if* both have made their expansion highs, needless to say that would be important.

Meanwhile separations actually peaked before then, in July of last year, with a clear downtrend since, another significant revision since last month. *if* both have made their expansion highs, needless to say that would be important.

Further, in the previous cycle, after hires stagnated, shortly thereafter involuntary separations began to rise, even as quits continued to rise for a short period of time as well:

[Note: above graph show quarterly data to smooth out noise]

Here are voluntary quits vs. layoffs and discharges on a monthly basis for the last 2 years:

If we have established the expansion peaks in hiring and total separations, I would expect quits to continue to improve for a short while (as they have) before also beginning to decline. As in the last expansion, separations appear to have bottomed.

This month's report acts as a caution about revisions, most importantly by the downward revision in hiring and separations. Last month the trend appeared clearly positive for both, but as revised it is more questionable as to hires, and looks negative as to separations. That being said, I don't even see a yellow flag until hires and separations go negative YoY, as they did before well before the last recession (quarterly through Q4 2017 in the graph below):

They haven't yet:

If three months from now we haven't established any new highs in hires and total separations, and they are hovering at or below zero YoY, then we can talk about a late-cycle trend.

UPDATE: And for those of you -- I'm looking at you, Dave Wessel and Matt Yglesias -- shouting 'Huzzah!' because the ratio of job openings to the unemployment rate is back where it was in 1999 and 2000:

If those job openings corresponded with actual hires, you'd have a point:

They don't, and you don't

Thursday, April 12, 2018

Real average hourly and aggregate earnings: March 2018 update

- by New Deal democrat

Here's a look at two more labor market measures, now that we have the inflation data for March as well.

First, here is real average hourly earnings for ordinary workers, normed to 100 as of its peak last July:

With -0.1% deflation for the month, and +0.1% nominal growth, there was a little improvement, but we are still -0.6% below the peak over half a year ago.

We are less than +0.1% better than one year ago, and truth be told, there hasn't been any significant improvement at all in over two years.

Second, here is real aggregate payrolls:

This tells us how much more income is flowing to workers as a whole in the expansion, by accounting for changes in hours worked and growth in the number of persons employed.

Real aggregate payrolls have still been growing, albeit at a slower pace in the last two years and in particular since last July.

Basically the economy is going to continue to be OK so long as consumers continue to buy new houses and purchase other durables like vehicles. Since 2016 they've gone into savings to do so. Meanwhile consumer credit standards generally have been slowly tightening:

although standards for GSE mortgage loans remain loose:

Due to a glitch, the last several quarters aren't shown on the FRED graph, but as of Q1 they remained a loose -8.3.

Next week we'll start to get the March data on housing.

Wednesday, April 11, 2018

Further decelerataion in several long leading indicators

- by New Deal democrat

Since the beginning of this year, I have noted the deceleration in real M1 and in purchase mortgage applications.

While neither has turned negative, there has been further deterioration in the positive readings of each.

This post is up at XE.com.

Tuesday, April 10, 2018

Is raising wages becoming a taboo?

- by New Deal democrat

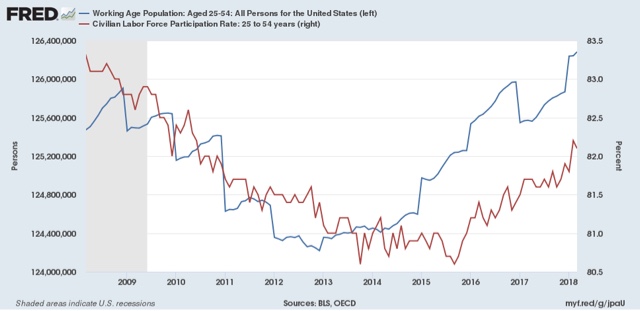

Yesterday I noted that, while the problem of lower labor market participation among the working age population hasn't *entirely* resolved, it is getting close to resolving due to the surge in entry into the jobs market in the last two years. As the graph below shows, not only has the prime age population grown by about 2 million in the last 2.5 years (blue), but nearly an additional 2 million (1.5% of 125 million) have entered the labor force (red):

But,while in accord with the last two expansions, nominal wage growth bottomed out once the U6 underemployment rate fell to roughly 9%, for nonsupervisory workers, it has languished at about 2.5%:

This is less than the roughly 4.5% peaks in the past 3 expansions.

Why?

MONOPONY VS. SKITTISHNESS VS. TABOO

One explanation is in the first graph above itself. All else being equal, even accounting for population growth, there are 2,000,000 more candidates for jobs in the prime age labor force than there were 30 months ago. More competition for jobs should act to hold down compensation.

But recently another explanation has been written about at length: monopsony in the labor market. In more plain english, this is a monopoly or at least oligopoly on the demand side for labor. Increased market power to hold down wages, it is argued, is having that exact effect:

[I]n recent years, economists have discovered another source: the growth of the labor market power of employers — namely, their power to dictate, and hence suppress, wages.....[I]n many areas of rural America, [where] large-scale employers that dominate their local economies[, w]orkers can either choose to take the jobs on offer or incur the turmoil of moving elsewhere. Companies can and do take advantage of this leverage.

Yet another source of labor market power are so-called noncompete agreements .... These agreements prohibit workers who leave a job from working for a competitor of their former employer.

Almost a quarter of all workers report that their current employer or a former employer forced them to sign a noncompete clause.....[S]tudies have found that employer concentration has been increasing over time and that this concentration is associated with lower wages across labor markets.

....{Monopsonistic f]irms [which pay less than "competitive" wages] bear the loss in workers (and resulting lowered sales) in exchange for the higher profits made off the workers who do not quit.

While the evidence appears compelling that employer market power is having *an* effect of holding down wages, I am not sure at all that it is the *primary* driver of low wages.

At least two other explanations for employers refusing to raise wages come to mind:

- employer skittishness about the durability of a strong economy.

- raising wages has become a taboo

Let me explain each.

Suppose I am an employer in competition with others. Suppose further, however, that I am skeptical that the current "good times" are going to last. After all, since 2000 there have only been about 4 years at most (2005-07 and 2017) where the economy has seemed to be operating at close to full throttle. If I raise wages now, I will attract more workers, but then when the good times end, I will be stuck with a higher paid workforce than my competitors who haven't raised wages. If I think that "bad times" are likely to exist more often than "good times" in the foreseeable future, then I might hold back on increasing my labor costs during the good times, leaving some additional profits on the table, because that will be more than offset by having relatively lowers costs during the bad times.

By an economic taboo, I mean a decision to leave profits on the table because they conflict with an even higher priority held by the employer (e.g., I refuse to higher a clearly more qualified black job applicant because I am a racist). Let's suppose that I am an employer who *does* believe that the good times are likely to last, BUT I also believe that people who come to work for me ought to be grateful to earn, say $10 per hour, and because of my firm ideological belief, I am not going to budge. If I am alone in my ideological belief, I will suffer. But if my ideological belief is shared on a widespread basis by my competitors and other businesses, I am *not* at a competitive disadvantage. Thus depressed wages may persist because raising wages has become a taboo,

USING THE JOLTS SURVEY TO DISCRIMINATE AMONG THE HYPOTHESES

So, how can we tell if the primary driver of employer decisions not to raise wages is monopsony, skittishness, or taboo?

The JOLTS survey appears to give us a good look at the likely answer. JOLTS measures job openings, actual hires, and quits, among other things. Let me show you how.

To begin with, if skittishness about the durability of a strong economy is the primary driver of lower wages, I would not expect those employers to even go looking for new employees to hire at higher wages. In other words, there wouldn't be an elevated number of job openings compared with actual hires, because skittish employers simply aren't in the market.

On the other hand, both in the cases of monopsony power and taboo, I *would* expect to see elevated job openings, as in either case those employers *do* want to hire new workers -- they just want to hire those workers at what they define as their "fair" price, And that is exactly what we see in the JOLTS data during this expansion compared with the last one:

That is pretty compelling evidence that it is not economic skittishness that is driving low wage growth.

Minneapolis Fed President Neel Kashkari appears to agree:

"Almost everywhere I go, businesses tell me they can’t find workers. I always ask them the same question: 'Are you raising wages?' Usually, the answer is ‘no.’ When you want more of something but won’t pay for it, that’s called ‘whining,’” he told the ninth Regional Economic Indicators Forum (REIF), founded and co-sponsored by National Bank of Commerce. “Until you’re paying more, I know you’re not serious.”

So, how can we decide between the other two hypotheses? The Wall Street Journal (via Fundera) seems to think that smaller firms are offering bigger wage inducements:

The WSJ says small businesses across the country are increasing their wages at a faster rate than medium-size or even large firms. All industries with businesses made up of 49 or fewer employees saw a pay bump of just over 1%.

But the evidence is anecdotal, not hard data.

Again, the JOLTS survey seems to provide an answer in two parts.

First, as mentioned in the monopsony piece above, such firms should have "higher profits made off the workers who do not quit."

So let's look at the "Quits rate" in the JOLTS survey:

Workers are quitting their jobs at virtually the same rate in this expansion as during the last one, during which wage growth was higher. There simply isn't a bigger pool of "workers who do not quit."

A second thing we ought to find, if monopsony is the primary driver of low wage growth, is that bigger firms with market power ought to have unfilled job openings at a much higher rate than firms in small, more competitive labor markets. This is backed up by a scientific study:

[I[n a competitive labor market, such “shortages” [of hiring compared with job openings as measured in the JOLTS report] should dissipate as employers competitively bid up wages to fill their vacancies. But counter to this prediction, Rothstein (2015) finds no evidence that wages have grown faster in sectors with rising job openings. Instead, the failure of hiring and wage growth to keep pace with the rise in job openings is consistent with the incentives faced by firms in an imperfectly competitive labor market; it suggests that companies have a strong interest in hiring workers at their offered wages, but have resisted bidding up wages in order to expand their workforces (Abraham 2015).

As it happens, we are able to able to infer a comparison in Rothstein's metric between large and small firms.

Above I showed job openings (blue) vs. actual hires (red) in the JOLTS survey. The National Federation of Small Business conducts a similar survey among its members. Here are their graphs of job openings and actual hiring from their most recent report:

Small business owners clearly started singing "Happy Days are Here Again" on the day after the 2016 Presidential election. And their job openings soared.

But their actual hires didn't. They are adding jobs at the same level as they did in 2014 and 2015. They are behaving as if they have a taboo against raising wages.

So in conclusion, while I have no doubt that the "monopsony" argument is measuring something real, I am more and more inclined to believe that raising wages is simply becoming an ideological taboo among businesses, a higher priority than maximizing net profits after costs.

Monday, April 9, 2018

Scenes from the March employment report: no change in ongoing trends

- by New Deal democrat

While it certainly has shortcomings, there is simply no other report that captures in timely fashion the factors that matter most to the vast majority of Americans' economic well-being than the monthly jobs report.

Let's take a look at a few of the things that stood out.

First of all, marking myself to market, last week I said I was expecting another good employment report. That didn't happen, as at least on the surface, neither of my forecasts panned out. So let's start there.

Historically, consumer spending leads hiring. I thought the surge in spending last autumn would continue to be felt in March. Not so as of the preliminary report!:

Let's take a look at a few of the things that stood out.

First of all, marking myself to market, last week I said I was expecting another good employment report. That didn't happen, as at least on the surface, neither of my forecasts panned out. So let's start there.

Historically, consumer spending leads hiring. I thought the surge in spending last autumn would continue to be felt in March. Not so as of the preliminary report!:

But even with the miss, Q1 hiring was the highest in a year. We'll see what revisions do (for example, last September's originally reported -33,000 job loss has been revised to a gain of +14,000), and I still do expect some further carryover from spending to hiring this quarter.

Incidentally, even with the surprisingly low monthly gain, it was enough so that YoY job growth still exceeds the increases in the Fed funds rate -- which would have been a "yellow flag" caution of an increased risk for a downturn in the economy under the simple employment model I have been toying with recently:

I also expected the unemployment rate to decline to a new low. That actually did happen, but not by enough when you round out to the nearest 10th, as the unemployment rate fell from 4.14% to 4.07%:

A favorable change of 40,000 in either or a combination of jobs or the civilian labor force would have been enough to lower the rounded number to 4.0%.

Until recently, the level of labor force participation has been a big issue. That isn't entirely abated, but it is abating (blue in the graph below):

What remains a big issue is the lack of wage growth (red in the graph above). Below are all wages YoY (blue) compared with wages of non-managerial workers YoY:

The 80% or workers who aren't managers or professionals are still seeing really mediocre wage growth (and virtually none at all if we factor in inflation).

We can use this to back into managerial wage growth, but that is best viewed on a quarterly basis, because the sample size is smaller (only 20% of the total) and so much noisier on a monthly basis:

I continue to believe that the surge of people back into the labor force during the last two years -- the biggest such surge in several decades -- is creating a bigger pool of job candidates and is thus at least one explanation for the poor wage growth of nonsupervisory employees.

Recently, an explanation for the quandary of poor wage growth has emerged that highlights the effects of monopsony -- that is, employers with the market power to hold down wages. I want to discuss that at some length, and consider at least two other potential explanations: skittish economic expectations and an emerging taboo against raising wages. I will do that in a separate post.

Subscribe to:

Comments (Atom)