It's that time of the week again. I'll be back on Monday; NDD will be here over the weekend with the high frequency numbers. Until then:

Friday, February 22, 2013

A few notes for Friday

- by New Deal democrat

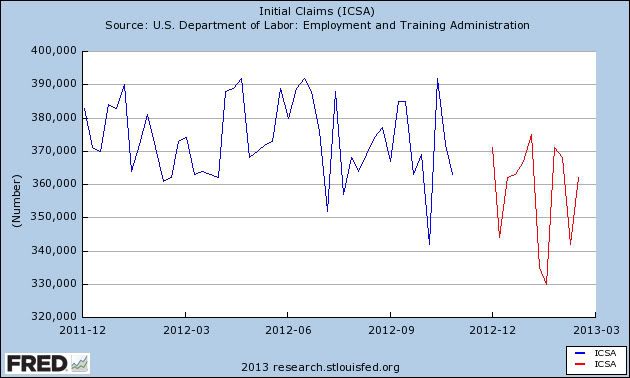

1. While it is true that yesterday's initial jobless claims report was no better than this week one year ago, the post-Sandy trend of a lower range for claims remains intact:

If we get a number over 375,000 or if we stop getting numbers under 350,000 I'll be concerned. Not until then.

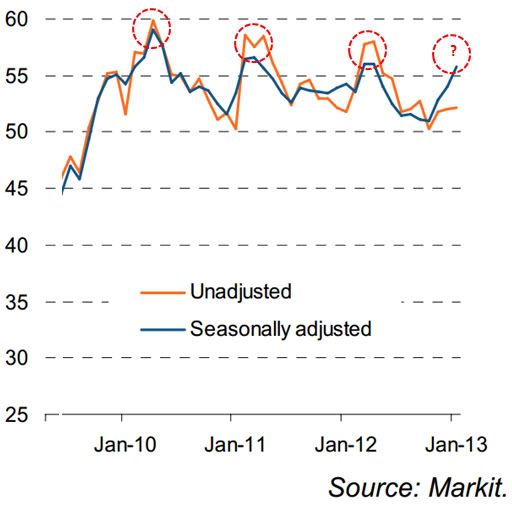

2. It looks like there is a seasonal cycle in manufacturing, that strengthens in winter and peters out in summer (from Sober Look via Yves Smith):

The concern is that this year's winter peak is lower than that of the last three years, so how bad might things be getting by summer? My preferred explanation for this is the Oil Choke Collar. Add in the hike in payroll taxes, and the imminent Sequester, and it looks like Good Times! /snark

3. David Atkins a/k/a thereisnospoon at Digby notices Young-Broder-in-training:

Ezra Klein has a habit of beginning with some genuinely honest, non-conventional-wisdom arguments in his posts, then concluding with some nonsensical both-sides-do-itisms that almost invalidate the excellent points with which he began.

4. If Washington does succeed in causing a new recession this year, what are the consequences in 2014? Who pays?

A final note to our readers who have followed us since our Daily Kos days. The top-rated diary over there on any given day might have about 2500 readers. My nerdy little piece yesterday about quantifying the impact of the payroll tax hike got reposted at Seeking Alpha, and also at Business Insider under the sexed-up title The Poor Are Getting Slammed By Tax Hikes While The Rich Spend With Wild Abandon, where as of this writing it is closing in on 7000 reads. The Hitler "Downfall" parody I spotted Monday morning on YouTube got reposted, with a little help from our friend Invictus, at Big Picture and at Bill McBride's Calculated Risk, as well as a bunch of other economic blogs, within 24 hours thereafter, and got tweeted by Joe Weisenthal of Business Insider. Meanwhile original economic analysis, vs. copying-and-pasting "Krugman sez..." type articles has all but disappeared from DK.

There's simply no reason for me to go back there. I am a nerd. I have always been a nerd. I will always be a nerd. I am home.

Europe's Growth Problems Continue

From Markit:

The Markit Eurozone PMI Composite Output Index fell to 47.3 in February from 48.6 in January, according to the flash estimate. The decline signals a steepening of the economic downturn, contrasting with the easing trend seen in the previous three months. Business activity has now declined throughout the past year-and-a-half, with the exception of a marginal increase in January last year.

Despite accelerating, the rate of contraction in February remained slower than the post-crisis record seen in October, and the average drop in activity in the first quarter so far is less severe than the trend for the fourth quarter of last year.

Let's take a look at the accompanying graphs:

The chart above shows that the index has been below the 50 reading for about a year, indicating the EU region has had slumping growth for an extended period of time.

Note how the only country doing sell is Germany. France is in terrible shape and the rest of the Eurozone is still printing numbers showing a contraction.

The German numbers from yesterday were good:

German private sector business activity increased for the third month running in February, largely supported by a robust expansion of service sector output. Adjusted for seasonal factors, the Markit Flash Germany Composite Output Index posted 52.7, down from 54.4 in January but comfortably above the 50.0 value that separates expansion from contraction. The latest reading was close to the long-run series average (53.0) and signalled a solid rise in overall business activity during February.

The French numbers in contrast were terrible, showing a worsening trend:

Latest Flash PMI data indicated that the downturn in French private sector output deepened in February. January’s Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, slipped from 42.7 in January to 42.3, its lowest reading since March 2009.

The steeper fall in overall output was driven by an accelerated decline in the service sector, where activity contracted at the fastest pace in four years. Manufacturers signalled a slightly slower decrease in production compared with one month previously, albeit still sharper than signalled in the service sector.

Earlier today, Germany released 4Q12 GDP figures, which were not good.

The German economy suffered a setback towards the end of 2012. As the Federal Statistical Office (Destatis) already reported in its first release of 14 February 2013, the gross domestic product (GDP) decreased by 0.6% - upon price, seasonal and calendar adjustment - in the fourth quarter of 2012 compared with the previous quarter. The result for the entire year of 2012 remained unchanged at +0.7% (calendar-adjusted: +0.9%).

In a quarter-on-quarter comparison (adjusted for price, seasonal and calendar variations), positive contributions were made only by domestic final consumption expenditure. The final consumption expenditure of both households (+0.1%) and government (+0.4%) was slightly up. Gross fixed capital formation, however, decreased. For construction, it was slightly down on the third quarter of 2012 (–0.1%). Gross fixed capital formation in machinery and equipment decreased by 2.0% and thus has shown a downward trend for over a year now. For total domestic uses, however, a slight increase on the previous quarter was recorded (+0.2%).

Foreign trade, however, had a negative effect on the German economic development in the last quarter of 2012, according to the provisional calculations. Exports of goods and services were down 2.0% compared with the third quarter of 2012 (adjusted for price, seasonal and calendar variations). Although imports fell, too, the relevant decrease (–0.6%) was markedly smaller than for exports. Thus the balance of exports and imports had a negative effect on the GDP development in the reference period (–0.8 percentage points).

The bottom line is the all the "good news" coming out of Europe right now is projection; the ECB says growth will return in the 2H13, traders see the Markit manufacturing data as indicating a positive trend that is developing, etc... A large majority of the hard data emerging from the region is negative.

The Markit Eurozone PMI Composite Output Index fell to 47.3 in February from 48.6 in January, according to the flash estimate. The decline signals a steepening of the economic downturn, contrasting with the easing trend seen in the previous three months. Business activity has now declined throughout the past year-and-a-half, with the exception of a marginal increase in January last year.

Despite accelerating, the rate of contraction in February remained slower than the post-crisis record seen in October, and the average drop in activity in the first quarter so far is less severe than the trend for the fourth quarter of last year.

Let's take a look at the accompanying graphs:

The chart above shows that the index has been below the 50 reading for about a year, indicating the EU region has had slumping growth for an extended period of time.

Note how the only country doing sell is Germany. France is in terrible shape and the rest of the Eurozone is still printing numbers showing a contraction.

The German numbers from yesterday were good:

German private sector business activity increased for the third month running in February, largely supported by a robust expansion of service sector output. Adjusted for seasonal factors, the Markit Flash Germany Composite Output Index posted 52.7, down from 54.4 in January but comfortably above the 50.0 value that separates expansion from contraction. The latest reading was close to the long-run series average (53.0) and signalled a solid rise in overall business activity during February.

The French numbers in contrast were terrible, showing a worsening trend:

Latest Flash PMI data indicated that the downturn in French private sector output deepened in February. January’s Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, slipped from 42.7 in January to 42.3, its lowest reading since March 2009.

The steeper fall in overall output was driven by an accelerated decline in the service sector, where activity contracted at the fastest pace in four years. Manufacturers signalled a slightly slower decrease in production compared with one month previously, albeit still sharper than signalled in the service sector.

Earlier today, Germany released 4Q12 GDP figures, which were not good.

The German economy suffered a setback towards the end of 2012. As the Federal Statistical Office (Destatis) already reported in its first release of 14 February 2013, the gross domestic product (GDP) decreased by 0.6% - upon price, seasonal and calendar adjustment - in the fourth quarter of 2012 compared with the previous quarter. The result for the entire year of 2012 remained unchanged at +0.7% (calendar-adjusted: +0.9%).

In a quarter-on-quarter comparison (adjusted for price, seasonal and calendar variations), positive contributions were made only by domestic final consumption expenditure. The final consumption expenditure of both households (+0.1%) and government (+0.4%) was slightly up. Gross fixed capital formation, however, decreased. For construction, it was slightly down on the third quarter of 2012 (–0.1%). Gross fixed capital formation in machinery and equipment decreased by 2.0% and thus has shown a downward trend for over a year now. For total domestic uses, however, a slight increase on the previous quarter was recorded (+0.2%).

Foreign trade, however, had a negative effect on the German economic development in the last quarter of 2012, according to the provisional calculations. Exports of goods and services were down 2.0% compared with the third quarter of 2012 (adjusted for price, seasonal and calendar variations). Although imports fell, too, the relevant decrease (–0.6%) was markedly smaller than for exports. Thus the balance of exports and imports had a negative effect on the GDP development in the reference period (–0.8 percentage points).

The bottom line is the all the "good news" coming out of Europe right now is projection; the ECB says growth will return in the 2H13, traders see the Markit manufacturing data as indicating a positive trend that is developing, etc... A large majority of the hard data emerging from the region is negative.

Morning Market Analysis; Is A Bigger Sell-off In the Cards?

Today, I wanted to take a somewhat different angle on the morning analysis by tying together a few threads.

1.) As NDD has pointed out a few times, we're closer to the next recession largely as a function of time. The expansion started in June 2009 and has been incredibly weak. It won't take much to tip us into recession right now -- although I don't think we're currently in a recession.

2.) With the exception of China, the rest of the world is limping along. The latest readings from the EU were terrible. And we're starting to see the effect of the payroll tax increase and will see the sequester hit next week. In short, the macro environment is just not that exciting.

3.) The latest Fed minutes show the Fed is concerned with the effects of QE. As the Money Supply blog noted, most of the discussion at the January meeting was from non-voting members. But the tone of the minutes indicates there are some serious questions being asked about the programs efficacy and costs.

4.) The general consensus is that we'll see a mild sell-off. And that should worry us:

Everyday I speak with investors from all walks of life: hedge fund managers, stock brokers, retail investors, high net-worths, buddies both in and out of the industry, etc. There seems to be this ongoing consensus that the inevitable stock market pullback is going to be just that, a pullback. In fact, everyone is sure of it.

From an investment psychology perspective, this worries me. Remember, when everyone is so sure of something, it typically pays to at least consider the alternative. What if this is not just a pullback?

.....

So do we short everything and not cover until S&Ps are down 40%? No. But I do think it’s worth pointing out that the consensus seems to be that this will be a shallow pullback. We’re at least considering the possibility that it isn’t. There’s no harm in that. The foul would be not to.

5.) The latest rally is pretty close to over. The SPYs have broken trend,

As have the IWMs.

The DIAs are now moving sideways

The QQQs never really got started,

So -- let's tie this into the bigger cycle:

The charts above are from ETF Corner. They are hypothetical. However, given the underlying fundamentals, they are hardly out-of-the-norm.

1.) As NDD has pointed out a few times, we're closer to the next recession largely as a function of time. The expansion started in June 2009 and has been incredibly weak. It won't take much to tip us into recession right now -- although I don't think we're currently in a recession.

2.) With the exception of China, the rest of the world is limping along. The latest readings from the EU were terrible. And we're starting to see the effect of the payroll tax increase and will see the sequester hit next week. In short, the macro environment is just not that exciting.

3.) The latest Fed minutes show the Fed is concerned with the effects of QE. As the Money Supply blog noted, most of the discussion at the January meeting was from non-voting members. But the tone of the minutes indicates there are some serious questions being asked about the programs efficacy and costs.

4.) The general consensus is that we'll see a mild sell-off. And that should worry us:

Everyday I speak with investors from all walks of life: hedge fund managers, stock brokers, retail investors, high net-worths, buddies both in and out of the industry, etc. There seems to be this ongoing consensus that the inevitable stock market pullback is going to be just that, a pullback. In fact, everyone is sure of it.

From an investment psychology perspective, this worries me. Remember, when everyone is so sure of something, it typically pays to at least consider the alternative. What if this is not just a pullback?

.....

So do we short everything and not cover until S&Ps are down 40%? No. But I do think it’s worth pointing out that the consensus seems to be that this will be a shallow pullback. We’re at least considering the possibility that it isn’t. There’s no harm in that. The foul would be not to.

5.) The latest rally is pretty close to over. The SPYs have broken trend,

As have the IWMs.

The DIAs are now moving sideways

The QQQs never really got started,

So -- let's tie this into the bigger cycle:

The charts above are from ETF Corner. They are hypothetical. However, given the underlying fundamentals, they are hardly out-of-the-norm.

Thursday, February 21, 2013

South Korea Continues to Have Growth Problems:

The top chart shows the quarter to quarter percentage change of various contributors to SK GDP. Notice that both manufacturing and construction have been experiencing negative or slow growth for most of the last 5 quarters.

The bottom chart shows the overall structure of Korean GDP going back 8 quarters. Here we see a few interesting trends, starting with the extremely negative impact of gross capital formation, which has been negative in 6 of the last 8 quarters. Also note that both exports and imports have been negative in 3 of the last five quarters.

Last quarter, the economy was hit by negative contributions from government spending, investment and exports, leading to a .4% growth rate. If it wasn't for private consumption, the economy would have been in far worse shape.

Quantifying the payroll tax quandary

- by New Deal democrat

In the last few weeks, it has almost seemed like there are two (or three) contradictory economies when it comes to hiring and spending. Did the economy suddenly tank in January (Daily Treasury Statement suddenly pulling in much less than expected, WalMart fearful of a sudden decline in sales)? Or is the consumer on a tear (Gallup Daily Spending making, and continuing, new post-recession highs)? Or is it somewhere in between (ICSC and Johnson Redbook same store sales at the lower end of their 2012 YoY range)?

The payroll tax increase is real. It ought to be showing up in either decreased spending, decreased savings, increased credit, or some mix of the three. This is a real quandary, and being a total nerd, I did what total nerds do: I made a spreadsheet of the data to see if there were any tell-tales about what is the actual state of the consumer and employment. And lo and behold, there are some very telling clues. It looks like there really are three results. As we'll see below, low end consumer spending is getting hammered, midlevel consumers are impacted but holding their own, and high end consumers, gifted with income moved forward from 2013 to 2012, have been spending with wild abandon - so far.

So first of all, let's go to the data. Below is a chart of the YoY percentage change in the weekly ICSC and JR same store sales. Next is the YoY $ change for the 14 day rolling average of Gallup Daily Consumer Spending. The final column is the YoY percentage change for the 20 days of withholding taxes paid. These are all series that I report on each Saturday. The chart starts with the week of November 3, 2012, and continues up through last week. The last two lines are the December average vs. the average of the last four weeks:

| Week | ICSC | JR | Gallup | Daily Treas. Stmt |

|---|---|---|---|---|

| Nov 3 | 2.8% | 1.8% | -$5 | 2.0% |

| Nov 10 | 1.4% | 0.8% | -$6 | 3.6% |

| Nov 17 | 1.8% | 1.6% | -$6 | -2.0% |

| Nov 24 | 2.5% | 1.8% | $1 | 4.7% |

| Dec 1 | 4.0% | 4.0% | $8% | 5.6% |

| Dec 8 | 3.2% | 2.1% | $9 | 7.9% |

| Dec 15 | 3.2% | 2.2% | $8 | 13.0% |

| Dec 22 | 3.5% | 2.4% | $5 | 6.1% |

| Dec 29 | 3.2% | 2.9% | $8 | 9.7% |

| Jan 5 | 2.7% | 2.9% | $12 | 10.6% |

| Jan 12 | 4.2% | 2.1% | $15 | 23.7% |

| Jan 19 | 3.3% | 1.9% | $19 | 24.6% |

| Jan 26 | 3.2% | 1.8% | $10 | 36.8% |

| Feb 2 | 2.0% | 1.6% | $12 | -1.5% |

| Feb 9 | 2.6% | 1.5% | $20 | 7.9% |

| Feb 16 | 2.1% | 2.4% | $26 | 4.5% |

| Dec avg | 3.3% | 2.4% | $7.5 | 9.2% |

| last 4 weeks avg | 2.5% | 1.8% | $17 | 11.9% |

All 4 of these series show the marked impact from Hurricane Sandy in November. By the beginning of December, however, all of them have bounced back. The differences start appearing at the end of December. Both same store sales series start to show decelertion YoY. They are still positive, but at the low end of their recent ranges. Both Gallup and withholding taxes, however, show a very strong increase. In the case of withholding taxes, the increase totally reverses to outright declines by the end of January, while Gallup consumer spending continues to be very strong.

What caught my eye was the extremely sudden spike in positive YoY withholding taxes paid in the 20 day average once the end of December and beginning of January were added in. This coincides with the huge gain in personal income reported for December. Twenty reporting days later, the spike completely reversed. I wondered if there was an anomaly, so I checked each individual day, and compared it with the prior year. And sure enough, it turns out that in just 2 days - December 31, 2012 and January 2, 2013, $70 Billion in withholding taxes were reported! A comparison with the 2011-2012 shows that while $30 Billion was also reported on January 2, 2012, only $11 Billion was reported on December 31, 2011 vs. $45 Billion on December 31, 2012!

In other words, there was a huge shift in payroll tax reporting from 2013 to 2012. Undoubtedly a large share if not an outright majority represented things like enhanced bonuses paid to beat the presumed tax increase in 2013 (remember that the "fiscal cliff" wasn't resolved until just hours before the end of the year, so employers had no way of knowing that tax rates would be kept constant, e.g., on incomes up to $400,000 or higher).

This is of a piece with the huge spike in personal income reported for December -- about a 2.5% increase in just one month, where 0.1% or 0.2% increases are more the norm. Further, much or most of those huge bonuses, etc., being "found money", were likely to be splurged on goods - and the money wasn't all necessarily going to be spent in January. That looks like the explanation for the continuing surge in Gallup's daily consumer spending report.

But how do we square that with the ICSC and JR same store sales reports, and the WalMart emails of sales falling off a cliff at the beginning of February?

We know that WalMart accounts for a huge share of lower end spending. Further, they no longer participate in the same store sales reports. This means that the ICSC and JR reports are almost certainly skewed away from low end sales. Comparing December and January, the ICSC and JR YoY percentage increases have decelerated by about 30%. That suggests that the consumers they are measuring are absorbing about 70% of the payroll tax increase and replacing it with spending out of savings and/or increased credit. WalMart's shoppers, who are more likely to be living paycheck to paycheck, can't do that and are bearing the full brunt of the payroll tax increase. (This morning it is reported that WalMart is laying most of this off on delayed tax refunds. Since their results aren't transparent on a weekly or monthly basis, there's no way to know how much this impacts my analysis).

But what about Gallup? Gallup's sample certainly includes WalMart shoppers. But Gallup is reporting the average, rather than the median, daily spending of consumers, and it is also catching the very high end. Suppose the ICSC and JR reports do not sufficiently capture the high end? Then the surge in high-end spending is only showing up in the Gallup report, which is, for now, being overwhelmed by that surge.

If that is true, then the data from all four series, and the WalMart reports, all make sense. WalMart shoppers, with little savings, are buying markedly less than before the payroll tax kicked in, perhaps spending a full 2% less. Middle brow shoppers are taking some money out of savings or increasing their use of credit, and are pulling back less than 1%. High end shoppers are still spending the enorumous sums of discretionary income that they received in Decmeber to beat the tax increase.

There will be two keys to the unfolding of this scenario. One is to watch for when the bonus money runs out. This will be reflected in Gallup's Daily Consumer Spending report. There is some evidence that this may already be happeining. In the last 6 reporting days, the average of consumer spending has fallen back below $80.

The second key will be to watch for when tax withholding returns to a more normal YoY pattern. That will tell us when the decrease in 2013 income due to it being pulled forward into 2012 is over. That could be happening now, or it might not happen for several more months.

Until that happens, I fully expect the bite from the payroll tax increase to intensify.

Morning Market Analysis; Is the Rally Dead?

Brief Summary: The SPYs broke their uptrend yesterday on both the 60 minute and daily chart. The DIA didn't confirm the trend break but the IWMs did. The dollar rallied through resistance.

On the international front, the Eastern European ETF has formed a rounding top and is heading lower after breaking trend at the end of last month. The Malaysian market has broken trend on the weekly chart, indicating an important shift.

On the 60 minute SPY chart (top chart), the SPYs broke long-term support, first started with a trend line that began in early February. On the daily chart (bottom chart) the SPYs also broke trend, this time the trend line started at the beginning of the year. Also note the high volume on yesterday's sell-off. Finally, consider the MACD's overall position: it's been moving slightly lower for the last month, not confirming the rally in the overall market.

The DIAs (top chart) still have support at the 138 and 139 level; yesterday's sell-off wasn't that sever. However, the IWMs (bottom chart) had a sharp sell-off, breaking their month-long trend. Prices moved through two Fib levels as well.

The dollar has been trading between the 21.6 and 22 level since the beginning of December. Yesterday price broke through upside resistance printing a very strong bar on decent upside volume. The MACD is confirming this change in trend.

The Eastern Europe ETF broke its uptrend at the end of January. It's been moving lower in a disciplined sell-off. Prices are now below all the shorter EMAs (10, 20 and 50) with the shorter EMAs moving lower. The MACD is negative and the CMF is weakening. The next logical price target is the 61.8% Fib level.

The Malaysian market continues to weaken. On the daily chart (top chart) prices sold-off to the previous level of 14.30, tried to rally but hit resistance at the 50 day EMA and have since sold off back to the 14.30 level. The damage, however, is on the weekly chart (bottom chart). Prices have broken the trend started at the end of 2010 -- a very important technical development.

On the international front, the Eastern European ETF has formed a rounding top and is heading lower after breaking trend at the end of last month. The Malaysian market has broken trend on the weekly chart, indicating an important shift.

On the 60 minute SPY chart (top chart), the SPYs broke long-term support, first started with a trend line that began in early February. On the daily chart (bottom chart) the SPYs also broke trend, this time the trend line started at the beginning of the year. Also note the high volume on yesterday's sell-off. Finally, consider the MACD's overall position: it's been moving slightly lower for the last month, not confirming the rally in the overall market.

The DIAs (top chart) still have support at the 138 and 139 level; yesterday's sell-off wasn't that sever. However, the IWMs (bottom chart) had a sharp sell-off, breaking their month-long trend. Prices moved through two Fib levels as well.

The dollar has been trading between the 21.6 and 22 level since the beginning of December. Yesterday price broke through upside resistance printing a very strong bar on decent upside volume. The MACD is confirming this change in trend.

The Eastern Europe ETF broke its uptrend at the end of January. It's been moving lower in a disciplined sell-off. Prices are now below all the shorter EMAs (10, 20 and 50) with the shorter EMAs moving lower. The MACD is negative and the CMF is weakening. The next logical price target is the 61.8% Fib level.

The Malaysian market continues to weaken. On the daily chart (top chart) prices sold-off to the previous level of 14.30, tried to rally but hit resistance at the 50 day EMA and have since sold off back to the 14.30 level. The damage, however, is on the weekly chart (bottom chart). Prices have broken the trend started at the end of 2010 -- a very important technical development.

Wednesday, February 20, 2013

I'm not the only one who thinks that Ezra Klein is Young Broder in training

- by New Deal democrat

The other day I wrote about why I considered Ezra Klein to be the successor to David Broder (with all the negative that conveys). I failed to note adequately in that post that Ezra's hostility to social insurance programs for seniors - which they've paid into for their entire working lives - is in part because of his presumptuous ignorance of how the bait-and-switch is played out, precisely because he is only 28 years old.

Ezra blithely assumes that turning Social Security and Medicare into quasi-welfare programs won't erode their constituency, because he has no actual recollection of that history. He doesn't recall that Clinton and the GOP Congress cut back federal welfare programs in 1996 because he was in 7th grade at the time! He doesn't know that a large part of the vitriol against public employee benefits exists because private pensions were already being wiped out before he was even born! Likewise, the 1983 Greenspan plan which created the Social Security trust fund so that enough would be set aside to pay for Boomer retirements is ancient history to him, not part of a decades'-long social contrat by which over 100 million people have guided their lifelong plans. Simply put, the wisdom of those who have lived that history is meaningless to him.

But beyond that, I am not simply an isolated reader who sees Klein morphing into Broder. Take, for example, Ryan Cooper of the Washington Monthly writing about The trajectory of Ezra Klein:

I’ve been reading Ezra since around 2006 or so, and it’s been interesting to watch the way he has changed as he has gotten more and more successful....[my emphasis]

[D]uring this time, he got rather dull. Where Old Ezra once was quick, witty, and not afraid of seeming partisan, New Ezra is bloodless, ponderous, and scrupulously nonpartisan to a fault. In other words, he sounds like a Washington Post writer. Take this column [by Klein] on the Romney campaign ....:

So at about 1 a.m. Thursday, having read Ryan’s speech in an advance text and having watched it on television, I sat down to read it again, this time with the explicit purpose of finding claims we could add to the “true” category....

.... Quite simply, the Romney campaign isn’t adhering to the minimum standards required for a real policy conversation. Even if you bend over backward to be generous to them ... you often find yourself forced into the same conclusion: This doesn’t add up, this doesn’t have enough details to be evaluated, or this isn’t true.

I don’t like that conclusion. It doesn’t look “fair” when you say that. We’ve been conditioned to want to give both sides relatively equal praise and blame, and the fact of the matter is, I would like to give both sides relatively equal praise and blame. I’d personally feel better if our coverage didn’t look so lopsided.

If Cooper isn't prominent enough for you, how about Charles Pierce of Esquire Magazine, writing about, inter alia, Klein's embrace of the proposed debt deal involiving raising the Medicare eligibility age:

Jonathan Chait and Ezra Klein have both been taking a terrible hiding for suggesting — and, in Chait's case, recommending — that raising the eligibility age for Medicare might be the the key to breaking the impasse as we slouch toward the Gentle Fiscal Incline. I disagree with both of them, for reasons we'll get to in a minute, but I'm not inclined to crank up the Enola Gay on this issue. I would just gently point out that almost every part of the primary rationale for doing what they suggest — that any deal is better than none, and that some Democratic blood-sacrifice on entitlements is required so that John Boehner is not cannibalized by his caucus — is pure Beltway group-think in that it renders almost insignificant the human cost out in the country of the policy proposed to solve what is essentially a conundrum devised by unaccountable elites.[my emphasis]

There's a theme to all of these criticisms, and it is that Klein has internalized High Broderism. I'm not the only one who sees it.

Italy's New Orders Index Shows Weakness

Last week when I looked at Italy, I referenced the Markit manufacturing number, which made the following point about the Italian manufacturing industry:

The downturn in Italian manufacturing continued to ease at the start of 2013, as signalled by a rise in the seasonally adjusted Markit/ADACI Purchasing

Managers’ Index® (PMI®) to a ten-month high of 47.8 in January, up from December’s mark of 46.7. A principal factor behind the increase in the

headline number was a much slower drop in output than seen in December. The latest decline in production levels was only modest, and the least marked over the current spell of contraction that began in October 2011.

Yesterday, the Italian statistics bureau issued its industrial turnover and orders number. Unfortunately, this number does not bode well:

Click for a larger image

While the turnover number was higher, the new orders number was not. In fact, new orders are down 1.8% from November and are down 3.7% from the third quarter.

The reason this is important is that Italian manufacturing was a bright spot for the Italian economy. This report indicates that all is not well with the sector.

The downturn in Italian manufacturing continued to ease at the start of 2013, as signalled by a rise in the seasonally adjusted Markit/ADACI Purchasing

Managers’ Index® (PMI®) to a ten-month high of 47.8 in January, up from December’s mark of 46.7. A principal factor behind the increase in the

headline number was a much slower drop in output than seen in December. The latest decline in production levels was only modest, and the least marked over the current spell of contraction that began in October 2011.

Yesterday, the Italian statistics bureau issued its industrial turnover and orders number. Unfortunately, this number does not bode well:

Click for a larger image

While the turnover number was higher, the new orders number was not. In fact, new orders are down 1.8% from November and are down 3.7% from the third quarter.

The reason this is important is that Italian manufacturing was a bright spot for the Italian economy. This report indicates that all is not well with the sector.

India's Growth Problems in Detail

On February 7, the government of India revised its growth forecast for India down to 5%:

Gross Domestic Product (GDP) at factor cost at constant (2004-05) prices in the year 2012-13 is likely to attain a level of Rs.55,03,476 crore, as against the First Revised Estimate of GDP for the year 2011-12 of Rs. 52,43,582 crore, released on 31st January 2013. The growth in GDP during 2012-13 is estimated at 5.0 per cent as compared to the growth rate of 6.2 per cent in 2011-12.

These are of course estimates, or someone's best statistical analysis based on current factors. In other words, it could change at any time.

However, there are other structural problems, as pointed out in a recent IMF report:

The economy is in a weaker position than before the GFC, with strictly circumscribed policy space and greater domestic and external vulnerabilities. Inflation and the fiscal deficit remain among the highest in EMs. At the same time, the financial positions of banks and corporates, both strong before 2009, have deteriorated. The current account deficit (CAD) widened to 4.2 percent

of GDP in 2011/12 and other external vulnerability indicators have deteriorated, which led to a sharp depreciation of the rupee in 2011 and early 2012.

Put another way, this is not the relatively simply situation where a country that supplies cheap labor to the world sees a period of slow growth because the rest of the world is slowing down, and therefore not purchasing that labor. There are other issues that are contributing to the slowdown.

The IMF has identified three problems on the supply side that are hurting growth:

Rising policy uncertainty. In particular, high profile tax policy decisions announced in the 2012/13 Budget have reduced foreign investors’ interest in India, while the increasing difficulty of obtaining land use and environmental permits have raised regulatory uncertainty for infrastructure and other large-scale projects.

Delayed project approvals and implementation. As a reaction to recent high-profile governance scandals, project approvals, clearances, and implementation have slowed sharply.

Supply bottlenecks are particularly pronounced in mining and power, with attendant consequences for the broader economy, especially manufacturing.

In addition, India has a high budget deficit:

And current account deficit:

The biggest problem faced by India is that as its rate of growth slows, it won't be able to absorb its population growth into the ranks of the employed. Remember that with a population of over 1 billion, India needs a very high growth rate just to keep up with population growth. Slow economic growth down and you get an increase in poverty.

Gross Domestic Product (GDP) at factor cost at constant (2004-05) prices in the year 2012-13 is likely to attain a level of Rs.55,03,476 crore, as against the First Revised Estimate of GDP for the year 2011-12 of Rs. 52,43,582 crore, released on 31st January 2013. The growth in GDP during 2012-13 is estimated at 5.0 per cent as compared to the growth rate of 6.2 per cent in 2011-12.

These are of course estimates, or someone's best statistical analysis based on current factors. In other words, it could change at any time.

However, there are other structural problems, as pointed out in a recent IMF report:

The economy is in a weaker position than before the GFC, with strictly circumscribed policy space and greater domestic and external vulnerabilities. Inflation and the fiscal deficit remain among the highest in EMs. At the same time, the financial positions of banks and corporates, both strong before 2009, have deteriorated. The current account deficit (CAD) widened to 4.2 percent

of GDP in 2011/12 and other external vulnerability indicators have deteriorated, which led to a sharp depreciation of the rupee in 2011 and early 2012.

Put another way, this is not the relatively simply situation where a country that supplies cheap labor to the world sees a period of slow growth because the rest of the world is slowing down, and therefore not purchasing that labor. There are other issues that are contributing to the slowdown.

The IMF has identified three problems on the supply side that are hurting growth:

Rising policy uncertainty. In particular, high profile tax policy decisions announced in the 2012/13 Budget have reduced foreign investors’ interest in India, while the increasing difficulty of obtaining land use and environmental permits have raised regulatory uncertainty for infrastructure and other large-scale projects.

Delayed project approvals and implementation. As a reaction to recent high-profile governance scandals, project approvals, clearances, and implementation have slowed sharply.

Supply bottlenecks are particularly pronounced in mining and power, with attendant consequences for the broader economy, especially manufacturing.

In addition, India has a high budget deficit:

And current account deficit:

The biggest problem faced by India is that as its rate of growth slows, it won't be able to absorb its population growth into the ranks of the employed. Remember that with a population of over 1 billion, India needs a very high growth rate just to keep up with population growth. Slow economic growth down and you get an increase in poverty.

Morning Market Analysis; BRiCs Looking Weak

Brief Overview: Copper sold off yesterday. While the daily chart is now at key trend support, the weekly chart shows a continued consolidation. The BRICs are looking weak, with the exception of China. India and Russia have broken trend and Brazil has hit upside resistance. Even China is looking a bit weak.

The daily chart for the copper (top chart) ETF is very weak. There is no upward momentum in the chart and minimal volatility. While there is a strong volume flow into the security, it's not translating into a rally. Yesterday, prices sold-off to the 200 day EMA and upward trend line. On the weekly chart (lower chart) notice that prices area still consolidating. Again, notice the remarkable lack of momentum.

The Indian ETF has broken trend. It has fallen through support and is currently in the middle of a quick upside bounce. Momentum is dropping and the CMD is negative. This is a decent shorting opportunity.

The Russian ETF hit resistance around the 31 area and started to move sideways with a slight downward trend. Prices are now below the 10 and 20 day EMA and looking to use the 50 day EMA as support. Also note how the MACD peaked and started to move lower before the market topped (the MACD's peak was in early January while the market peaked in late January) telegraphing the sell-off.

The Chinese market had a big sell-off yesterday, with prices moving through the 10 day EMA. Also note how the recent MACD print was at the same level as the previous high. At the same time, prices moved higher, indicating the momentum was dropping a bit.

The Brazilian ETF rallied about 15% from the beginning of December to the beginning of January (50 to 57.5). However, since then, prices have stalled. We see a slight dip at the beginning of February but we're still above the 200 day EMA. While the MACD is declining, this MACD pattern is also present when prices consolidate. The big question for this chart is if it holds about the 200 day EMA; a move below would lead to further selling.

The daily chart for the copper (top chart) ETF is very weak. There is no upward momentum in the chart and minimal volatility. While there is a strong volume flow into the security, it's not translating into a rally. Yesterday, prices sold-off to the 200 day EMA and upward trend line. On the weekly chart (lower chart) notice that prices area still consolidating. Again, notice the remarkable lack of momentum.

The Indian ETF has broken trend. It has fallen through support and is currently in the middle of a quick upside bounce. Momentum is dropping and the CMD is negative. This is a decent shorting opportunity.

The Russian ETF hit resistance around the 31 area and started to move sideways with a slight downward trend. Prices are now below the 10 and 20 day EMA and looking to use the 50 day EMA as support. Also note how the MACD peaked and started to move lower before the market topped (the MACD's peak was in early January while the market peaked in late January) telegraphing the sell-off.

The Chinese market had a big sell-off yesterday, with prices moving through the 10 day EMA. Also note how the recent MACD print was at the same level as the previous high. At the same time, prices moved higher, indicating the momentum was dropping a bit.

The Brazilian ETF rallied about 15% from the beginning of December to the beginning of January (50 to 57.5). However, since then, prices have stalled. We see a slight dip at the beginning of February but we're still above the 200 day EMA. While the MACD is declining, this MACD pattern is also present when prices consolidate. The big question for this chart is if it holds about the 200 day EMA; a move below would lead to further selling.

Tuesday, February 19, 2013

The BOJ Gets It Right On Europe; EU Analysis Redux

From the latest BOJMinutes:

Members shared the recognition that economic activity in the euro area had

receded slowly. A few members pointed out that the negative effects had been spreading even to core countries such as Germany. As for the outlook, members shared the view that the euro area economy would likely still lack momentum for recovery on the whole as fiscal austerity measures would continue to be implemented for the time being, particularly in peripheral countries.

That's about right. Last week I looked at the EU and its four largest countries (see here, here, here, here and here). The region is still a mess. While there are some positive developments (German manufacturing and services indices are increasing, Italy's manufacturing sector's problems are easing), three of the four largest economies (France, Spain and Italy) are still either in a recession (Spain and Italy) or barely printing any growth (France). And the region as a whole is still enthralled with the idea of expansionary austerity, which will continue to hurt growth as pointed out above.

While the ECB continues to say the EU will pull out of the recession starting in the 3Q12, there is little evidence of that now.

Members shared the recognition that economic activity in the euro area had

receded slowly. A few members pointed out that the negative effects had been spreading even to core countries such as Germany. As for the outlook, members shared the view that the euro area economy would likely still lack momentum for recovery on the whole as fiscal austerity measures would continue to be implemented for the time being, particularly in peripheral countries.

That's about right. Last week I looked at the EU and its four largest countries (see here, here, here, here and here). The region is still a mess. While there are some positive developments (German manufacturing and services indices are increasing, Italy's manufacturing sector's problems are easing), three of the four largest economies (France, Spain and Italy) are still either in a recession (Spain and Italy) or barely printing any growth (France). And the region as a whole is still enthralled with the idea of expansionary austerity, which will continue to hurt growth as pointed out above.

While the ECB continues to say the EU will pull out of the recession starting in the 3Q12, there is little evidence of that now.

Payroll Tax Increase Starts to Bite

Several weeks ago, I noted that we have two macro-level policy issues emanating from Washington that will slow growth, one of which is the payroll tax increase. It appears that we're starting to see that increase bite:

Wal-Mart Stores Inc. had the worst sales start to a month in seven years as payroll-tax increases hit shoppers already battling a slow economy, according to internal e-mails obtained by Bloomberg News.

“In case you haven’t seen a sales report these days, February MTD sales are a total disaster,” Jerry Murray, Wal- Mart’s vice president of finance and logistics, said in a Feb. 12 e-mail to other executives, referring to month-to-date sales. “The worst start to a month I have seen in my ~7 years with the company.”

.....

Murray’s comments about February sales follow disappointing results from January, a month that Cameron Geiger, senior vice president of Wal-Mart U.S. Replenishment, said he was relieved to see end, according to a separate internal e-mail obtained by Bloomberg News.

“Have you ever had one of those weeks where your best- prepared plans weren’t good enough to accomplish everything you set out to do?” Geiger asked in a Feb. 1 e-mail to executives. “Well, we just had one of those weeks here at Walmart U.S. Where are all the customers? And where’s their money?”

Wal-Mart Stores Inc. had the worst sales start to a month in seven years as payroll-tax increases hit shoppers already battling a slow economy, according to internal e-mails obtained by Bloomberg News.

“In case you haven’t seen a sales report these days, February MTD sales are a total disaster,” Jerry Murray, Wal- Mart’s vice president of finance and logistics, said in a Feb. 12 e-mail to other executives, referring to month-to-date sales. “The worst start to a month I have seen in my ~7 years with the company.”

.....

Murray’s comments about February sales follow disappointing results from January, a month that Cameron Geiger, senior vice president of Wal-Mart U.S. Replenishment, said he was relieved to see end, according to a separate internal e-mail obtained by Bloomberg News.

“Have you ever had one of those weeks where your best- prepared plans weren’t good enough to accomplish everything you set out to do?” Geiger asked in a Feb. 1 e-mail to executives. “Well, we just had one of those weeks here at Walmart U.S. Where are all the customers? And where’s their money?”

A few tardy notes about employment

- by New Deal democrat

I've taken a little bit of a mental health break the last couple of weeks, and truth be told, there isn't a lot exciting happening, with the exception of waiting to see how the payroll tax increase plays out.

In the final analysis, the economy is supposed to serve the people, not the other way around. Hence my particular focus on employment vs. other issues, e.g., ones that mainly investors watch. Thus it has been disappointing to watch a recovery which already wasn't "good enough" downshift into one just barely moving forward, or what I've called "shambling along."

The most recently reported monthly data has done nothing to cause me to change that appraisal.

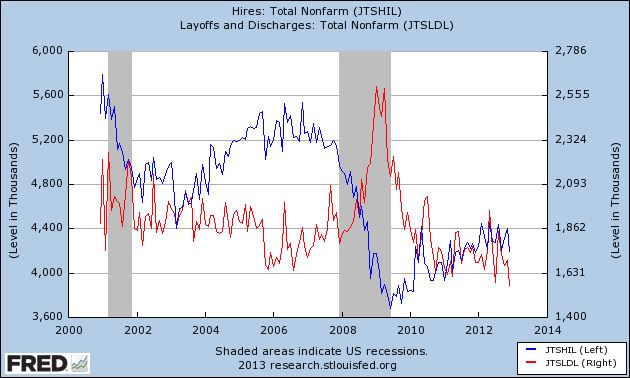

One of my themes has been that "hiring leads." In that regard, last week's JOLTS data continued a strengthening warning that hiring is in decline. Specifically, here is the JOLTS hiring graph:

While we don't have a long history with this series, it does support the idea that hiring actually declines well before the onset of a recession. And the last 6 months or so clearly show a small decline in hiring.

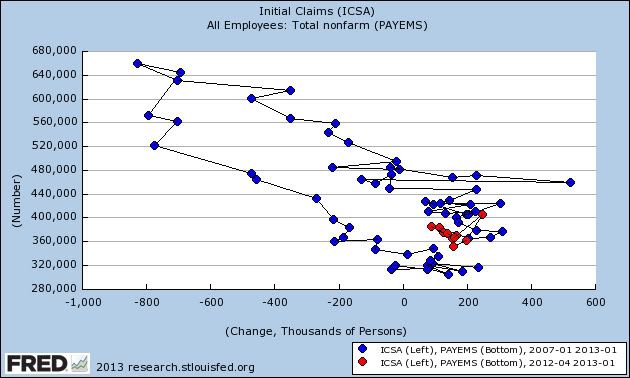

Another graph I have used to plot the same idea has been a scattergraph of jobs vs. initial jobless claims. The point here is that, as a recession approaches, we get less "bang for the buck," i.e., for any given level of new layoffs, we show fewer countervailing jobs added. In the graph below, this shows up as a shift towards the left at the same level of initial claims. This relationship clearly weakened beginning in April of last year (red), and that weakness continues:

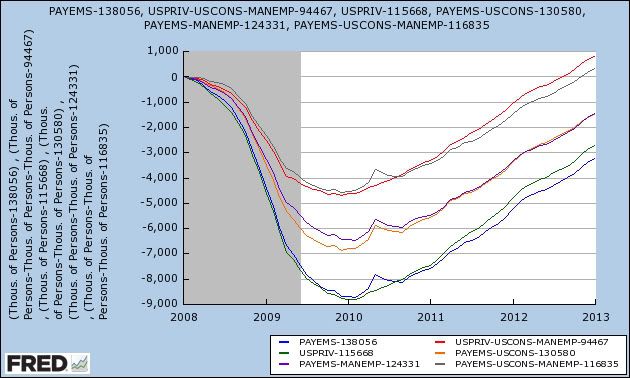

Also, the concentration of the weakness in job growth since employment bottomed 3 years ago continues. Here is a graph from January 2007 to the present of the number of total job losses in the economy (blue), compared with job losses ex-construction (orange), job losses ex-manufacturing (purple), job losses ex- manufacturing + construction (green), and job loss ex- manufacturing, construction, and government jobs (red):

It is encouraging that, excluding the three most impacted areas, or even just manufacturing and construction, all of the jobs lost in the "great recession" have now completely been made up.

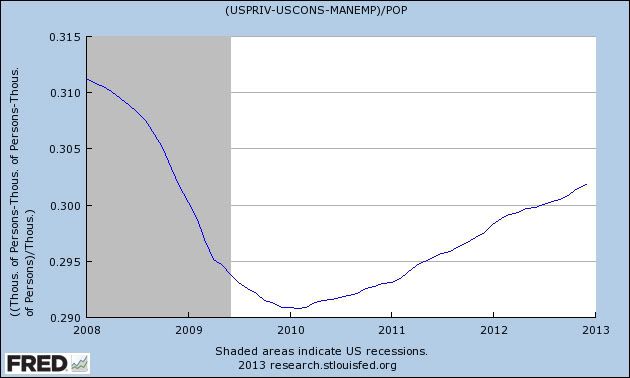

But when we take into account population growth, even exclusing the job sectors at "ground zero" - manufacturing and construction - only about half of all the jobs we need to add back into the economy have materialized.

I have become increasingly pessimistic that this poor situation will be where we start the next recession, whenever it happens.

Hitler "Downfall" parody: ECRI learns that their recession call has blown up

- by New Deal democrat

I don't know who did this (the subscriber line says "becky quick" but I would take that with a few tons of salt especially since "she" lives in Australia!), and maybe it's a reader of this blog, but in any event it is too funny!

From Bonddad: NDD -- or whoever sent him this link -- almost owed me a new computer over this.

Morning Market Analysis

I originally posted this yesterday AM, but forgot that the market was closed. So, here is the analysis going into the new week.

Let's begin with my current thesis of the market. While there are bullish economic arguments to be made (housing is rebounding, manufacturing is recovering), the negative effects of the sequester and payroll tax hikes are too large to overcome and will slow growth in the first half of the year. We're already seeing the effects of the payroll tax hike hit the sales of retailers like Wal-Mart. There is also little good news coming from the international arena, save for China.

The real cause for the rally is a new round of liquidity from massive 2012 dividend payments is hitting the equities market -- a source of money that will dry up by the end of the third quarter if not sooner. Finally, market breadth indicates we're already very overbought at these levels.

The daily SPY chart (bottom chart) shows that the rally continues unabated. All the EMAs are still rising and the CMF indicates a positive volume inflow. However, the MACD has given a sell signal, indicating potential weakness. The 60 minute chart (top chart) adds to the concerns about the strength of the rally. After prices broke through the 151.25/151.5 level they rallied to the 152.5 level twice only to fall back. The move from 151.25 5o 152.5 is less than 1%, so the lack of continued upward momentum is a bit concerning.

The DIA's 60 minute chart (top chart) shows prices moving sideways with support coming from both 138 and 139 and resistance coming from 140. The daily chart (lower chart) shows prices broke their uptrend at the beginning of February and have been trading sideways ever since. Also note the MACD has given a sell signal.

The IWMs -- which I use as a proxy for risk based capital investment -- are still going strong. The 60 minute chart (top chart) shows that since the February 7 the market has been in a higher high, higher low pattern, a fact that is confirmed by the daily chart (lower chart), where we see a strong, upward movement in prices and rising EMA picture.

The QQQs have an apple problem. Because of Apple's recent fall, the 60 minute QQQ chart (top chart) and daily chart (bottom chart) show this index has had little to no effect on the overall market rally we've been seeing.

With the exception of the IWMs, all the other major averages rallies appear to be stalling. The DIAs have been in a tight range on their 60 minute chart while the SPYs 60 minute chart may have printed a double top over the last week. The QQQs have yet to make a meaningful rally. However, the IWMs continue to move higher. Overall, the sum picture of all the averages is one of a weakening market.

Let's begin with my current thesis of the market. While there are bullish economic arguments to be made (housing is rebounding, manufacturing is recovering), the negative effects of the sequester and payroll tax hikes are too large to overcome and will slow growth in the first half of the year. We're already seeing the effects of the payroll tax hike hit the sales of retailers like Wal-Mart. There is also little good news coming from the international arena, save for China.

The real cause for the rally is a new round of liquidity from massive 2012 dividend payments is hitting the equities market -- a source of money that will dry up by the end of the third quarter if not sooner. Finally, market breadth indicates we're already very overbought at these levels.

The daily SPY chart (bottom chart) shows that the rally continues unabated. All the EMAs are still rising and the CMF indicates a positive volume inflow. However, the MACD has given a sell signal, indicating potential weakness. The 60 minute chart (top chart) adds to the concerns about the strength of the rally. After prices broke through the 151.25/151.5 level they rallied to the 152.5 level twice only to fall back. The move from 151.25 5o 152.5 is less than 1%, so the lack of continued upward momentum is a bit concerning.

The DIA's 60 minute chart (top chart) shows prices moving sideways with support coming from both 138 and 139 and resistance coming from 140. The daily chart (lower chart) shows prices broke their uptrend at the beginning of February and have been trading sideways ever since. Also note the MACD has given a sell signal.

The IWMs -- which I use as a proxy for risk based capital investment -- are still going strong. The 60 minute chart (top chart) shows that since the February 7 the market has been in a higher high, higher low pattern, a fact that is confirmed by the daily chart (lower chart), where we see a strong, upward movement in prices and rising EMA picture.

The QQQs have an apple problem. Because of Apple's recent fall, the 60 minute QQQ chart (top chart) and daily chart (bottom chart) show this index has had little to no effect on the overall market rally we've been seeing.

With the exception of the IWMs, all the other major averages rallies appear to be stalling. The DIAs have been in a tight range on their 60 minute chart while the SPYs 60 minute chart may have printed a double top over the last week. The QQQs have yet to make a meaningful rally. However, the IWMs continue to move higher. Overall, the sum picture of all the averages is one of a weakening market.

Monday, February 18, 2013

Ezra Klein: no progressive hero, but Young-Broder-in-training

- by New Deal democrat

[Note: regular economic blogging will resume tomorrow. Today I really feel the need to get this off my chest.]

Professor Brad DeLong has lionized Ezra Klein, defending him against charges of being a Washington DC cocktail weenie circuit social climber in a series of posts in the last week here, here, here, and here.

Much as I respect the Professor's opinion, I thoroughly disagree. While Ezra Klein unearths some good economic analysis, in my opinion he has become the neoliberal "new democrat" successor to David Broder. He is the designated conduit for acceptable "liberal" DC conventional wisdom reflected back on itself, and further, he defines the acceptable limit of that opinion, with any analysis to his left being dismissed out of hand as unrealistic -- even if correct.

Nowhere is that more serious, and more enraging, than his open and repeated embrace of a bad "grand bargain" now vs. a real solution to our longer term debt problems later. The Obama Administration doesn't float its trial balloons of cuts to Social Security and Medicare benfits via Klein because of his brilliance, but rather because of his receptivity to those cuts -- even though he knows that they aren't really implicated in the problem.

Readers of this blog know that I'm all about the data. And in this case, the data is Klein's own words, on the record and in context. So I am going to quote him at length and let his own words convict him.

Back in 2009, Klein knew that "entitlement reform" was code for "Social Security and Medicare cuts." In a piece ironically subtitled "Why progressives should stop worrying and learn to love today's White House fiscal summit" he said:

Fiscal responsibility has, in this town, long been an anodyne synonym for entitlement reform. The "responsible" part signaled that you were courageous enough to cut treasured social programs in service of the national debt....Of course, the "White House Fiscal Summit" that Klein said progressives shouldn't fear ultimately gave birth to the Simpson-Bowles (a/k/a Catfood) Commision. While the Commission was unable to agree on any recommendations, its two Chairmen went ahead and issued their own "report." In response, Klein wrote:

Today's "While House Fiscal Summit" .. will feature ... breakout sessions ... to work on health care, Social Security [and other items].... Notice what's not in there: Entitlement Reform.

What was notable about the Fiscal Commission's final report was the way it opened up the playing field on the budget. It went after tax revenues, tax expenditures, the military, Social Security, Medicare, Medicaid, domestic spending, government reform and more. Most everyone disagreed with some of the specifics in the report, but plenty of folks on both sides of the aisle were happy to see so many cows demoted from sacred status. The report itself stood little chance of passing -- it couldn't even get the required 14 of 18 votes on the commission -- but it heralded, many thought, a more open and honest budget debate, where things like entitlements and the mortgage-interest tax deduction could finally be discussed plainly.As Dean Baker notes ad infinitum, there was no final report by the Commission! There was only a report endoresed by Simpson and Bowles pesonally, and their positions have long been known. In fact, that "report" went beyond the Commission's mandate by proposing that federal expenditures be capped at 18% of GDP -- a level that couldn't possibly sustain even scaled back expenditures. But more to the point, Klein clearly endorses "discuss[ing] plainly" "things like entitlements" -- as opposed to, you know, returning to Clinton-era tax rates that actually balanced the budget.

Indeed, in the 2009 article dsicussed abovve, Klein at one point let slip his hostility to social insurance programs:

Medicare and Medicaid ... are unsustainable. They need to be slashed.Shortly after Simpson and Bowles released their "report," Klein openly described "entitlements" as a "problem" as to which discussion discussion was "about time:"

I was wondering when this would finally happen: "Senate Democratic leaders, seeking to break an impasse over Republican-backed spending cuts, on Tuesday proposed broadening the scope of budget negotiations into more politically volatile terrain that includes taxes, subsidies and entitlement programs." It's about time. There's not much money to begin with in non-security discretionary spending, and because it's such a popular place to search for cuts, there's not much waste, either. It's like trying to clean your house by doing more and more to organize the hallway closet. It might help the first few times, but eventually, you have to head elsewhere.In fact, if in 2009 Klein knew that "entitlement reform" was anathema to progressives, by early 2011 he fully embraced it explicitly and by name:

We're not going to find any real answers to our budget woes by cutting discretionary spending. That's not where the problem is. Entitlements, tax expenditures and rates, and even defense spending make more sense for a deficit-reduction deal.

The GOP says it wants to work with Obama on entitlement reform, and that the budget House Republicans are writing will give specifics on how. Obama [likewise] says he wants to work with the GOP on entitlement reform . . . . So, with the president and his congressional opposition committed to the effort, entitlement reform should be a sure bet, right?[my emphasis]

We'll see. I wouldn't be surprised if Obama has his name on a broader deficit-reduction bill at this time next year. .... [H]is administration is stocked with deficit hawks -- the same folks who actually balanced the budget under Bill Clinton. And similarly, Republicans want to deliver on the deficit-reduction promises they've made to their base. In theory, everyone's incentives and ideologies are pointing in the same direction. That's a good sign for progress.

That's not somebody else's opinion about "entitlement reform" being "progress" that Ezra is quoting. That is his own opinion, nakedly expressed.

And here he is again, one month later:

The political incentives for the GOP are clear: tread lightly on entitlements for seniors and heavily on programs for the poor. Which isn’t to say they will: Ryan could come out with an ambitious and comprehensive set of entitlement reforms. If his budget focuses on Medicaid, however, you’ll know why.Once again, "entitlement reform" is reflexively assumed to be a positive.

Readers may also recall that, during the health care reform debate, progressives were arguing for an extension of single-payer -- in essence, coming as close as possible to "Medicare for all." Although it appeared the measure might be able to pass the Senate with F51 votes as a budget resolution, Obama quietly worked against it, causing the much-derided "Firebagger" Jane Hamsher to wonder if Obama didn't want private-insurnace-sourced ObamaCare to replace Medicare (sorry, I can't find the link). According to Ezra Klein in June 2011, that would be a good thing:

Ironically, bringing ObamaCare to Medicare is an obvious long-term compromise on health care. If ... the Affordable Care Act’s exchanges work to control costs and improve quality, it’d be natural to eventually migrate Medicaid and Medicare into the system. Liberals would like that because it’d mean better care for Medicaid beneficiaries and less fragmentation in the health-care system. Conservatives would like it because it’d break the two largest single-payer health-care systems in America and turn their beneficiaries into consumers.... You can’t transform Medicaid and Medicare until you’ve proven that what you’re transforming them into is better. Only the Affordable Care Act has the potential to do that.Does Ezra Klein want to end Medicare and Medicaid and replace them with "premium support" programs? Yes he does.

So Bachmann is perhaps right to say that the president is moving us towards a day when ObamaCare — or, to put it more neutrally, “premium support” — might come to Medicare. He’s seeing whether it works in the private health-care market first and, if it does, there’s little doubt that the political pressure to extend it to other groups will be intense.

He is also in favor of means-testing:

Raising the retirement age is the worst of all possible options for reforming Social Security.... Means-testing would be much better."Means testing" social insurance programs means that, comparing those with equivalent lifettime earnings histories, those who lived frugally during the decades of their working yeears and saved a nest-egg for retirement, have their Social Security and Medicare taken from them and given to the spendthrifts who lived the high life during and, come retirement, find that the cupboard is bare. Suckers! He reiterated his approval of means testing here.

Now, as if in direct response to support by people like Professor DeLong, Klein has found a new reason to arrive at his desired result:

“Looking solely at the federal budget, an elderly person receives close to seven federal dollars for every dollar received by a child.”This is very close to a blunt endorsement of bait-and-switch. Why should any citizen trust any promise of deferred compensation again? Last week, Klein finally laid out barely his - and apparently Obama's - hostility to honoring lifelong commitments that workers have relied upon:

[T]he reason to worry about the deficit today — and, more to the point, the trends in government spending and taxation that drive it — is that the most worthwhile kinds of government spending are getting squeezed out.So there we finally have it. Far from not having to worry about "entitlement reform," Ezra Klein finally says that explicit cuts in social insurance benefits have been a goal of the Obama Administration. And one he agrees with.

The key insight behind this theory is that some forms of government spending rise automatically and rapidly, and are very politically difficult to cut, while other forms of government spending need congressional approval every single year and have few constituencies to protect them. In the first category are Medicare and Medicaid and Social Security, all of which are projected to consume much more of the federal budget in the coming years. In the second category are things like education funding, research and development, stimulus, infrastructure investment, and even the military. And the fear is the first category is squeezing out the second category.

.... “Growth of entitlements is crowding out programs for younger families and their kids and are likely to impair social mobility,” says Isabelle Sawhill, co-director of the Center on Children and Families and the Budgeting for National Priorities Project at Brookings.

The Obama administration agrees. They’ve spent years trying to reach a deal with Republicans in which entitlement cuts would be paired with tax increases — and investments in the future would be spared and even increased....

The underpinnings of Klein's ideology are perhaps best expressed in this report on a July 2011 GOP debate:

The losers in tonight’s debate were anyone who wants to see the sort of compromise necessary for the political process to work, and anyone who has been convinced that they can achieve their goals simply by restating their convictions.This is precisely the essence of High Broderism, where the myth of good faith bipartisanship is venerated as pragmatism, no matter how false the premise or how noxious the result. To Ezra Klein, "a deficit reduction deal" is a Holy Grail. If it includes cuts in social insurance programs in the mix, so be it. A bad grand bargain now is better than an actual fair plan along the line that "poll after poll" shows most Americans support, that may have to wait for a better political climate in Washington.

But I'll let him speak up in his own defense of that ideology, which he did in this post in 2011:

1) The question is “now or later”: Over the next 75 years, the Social Security shortfall is a bit less than 1 percent of GDP. That equals out to trillions of dollars, but the jaw-dropping nature of that sum says more about the size of our economy than the size of the shortfall. One percent of GDP is very manageable. And, eventually, someone is going to manage it. So the question isn’t, as some would have it, whether Social Security should be reformed. The question is whether you think now is a better or worse time than later. The argument for now is that pro-Social Security Democrats control the Senate and the White House. That might not be true in a few years, and if Social Security reform is left until then, the outcome may be worse. The argument for later is that it might be better to attempt Social Security reform at a time when people aren’t thinking about everything in terms of deficits. I can see both sides of it.To the contrary, as Dean Baker and others have argued for years, it is Medicare and Medicaid costs due to spiralling inflation, not Medicare and Medicaid beneifts that need to be slashed. As Baker has tirelessly pointed out, if you bring medical costs in the US down to European levels, the deficit and national debt problems completely disappear.

2) How important is universality? In the column, I suggest lifting the cap on payroll taxes. I’m also open to things like reducing benefits for upper-income beneficiaries, particularly if the money is used to increase the minimum benefit, which is badly needed. But some of Social Security’s friends reject that approach as they worry that it’ll reduce the program’s support from high earners and thus its political viability. I just don’t think there’s much evidence for this.... [T]hese social service programs are more popular than people give them credit for, and Social Security is so beloved, and targeted at such a sympathetic group, that I think it’s doubly true in that case.

3) .... Social Security’s defenders are unnecessarily afraid that any process of reform will lead to cuts.... Cutting Social Security benefits has been popular in Washington circles for a long time, but it doesn’t make it into policy very often. And that’s because it’s really, truly, extremely unpopular in the country itself....

To sum up, I think a lot of people agree that Social Security — and our retirement-security infrastructure more broadly — could be better designed. But I also think a lot of people see Social Security as an existing win that now needs to be defended, as opposed to a popular policy that can be perfected and even expanded. Increasingly, I’m not sure that’s the right way to look at it. Social Security is popular. The right solutions to Social Security are popular (indeed, lifting the payroll tax cap is the only popular solution). And my hunch is the right policies for expanding retirement savings will be popular, too.

Ezra thinks that turning Social Security and Medicare into quasi-welfare programs won't be their downfall. Well, we used to have a federal welfare program. Did Ezra never hear of Clinton's 1990s "welfare reform" that severely cut it? Does he not realize that one the main reasons for the assault on public sector pensions is because private sector employees have lost theirs? Does he not think that once upper income earners get little benefit out of Social Security and Medicare, they will resent their payroll taxes, which they paid over an entire lifetime, being directed to the poor?

And in terms of the minor changes to shore up Social Security more or less forever, that can be accomplished with modest increase in payroll taxes, which has been laid out in great detail by Bruce Webb in his Northwest Plan. Indeed, recent polling shows that Americans are willing to accept an increase in taxes, including their own payroll taxes, if it keeps Social Security intact.

It's a shame, because once upon a time Ezra Klein seemed to "got it." In that same piece I quoted at the beginning of thie piece, Klein wrote:

"Where a decade ago the looming fiscal threat of entitlement spending led economists and policy wonks to wear out their policy beads, today a more subtle understanding of our fiscal future dominates. In this telling, there's no such program as SocialSecurityandMedicareandMedicaid. There's Social Security, which has modest long-term liabilities and needs little, if any, help. And then there's health-care reform....That is just as true now as it was then. Had the democrats enacted Bruce Webb's Northwest Plan in 2009 or 2010 when they had majorities in both Houses, via budget reconciliation if necessary, Social Security would already be solvent forever and could be declared off the table. There is simply no need to enter into a "grand bargain" with madmen, a grand bargain that as Professor DeLong himself has noted, won't last even two years into the next GOP Presidency.

Dean Baker ... points to ... a graphic that shows what deficits look like in every country with longer life expectancies than us and what the deficit looks like going 70 years with the same per-capita health-care costs of that country.

It's a startling image. That orange line shooting into orbit? That's our projected deficit. That blue line levitating gently upward? That's our deficit if health costs grew more slowly. And those other lines sinking downward? They're our deficit if we had the per-peron health costs of countries like France, Germany, and Canada. In all cases, Social Security spending remains unchanged.

If anything, the connections showing Ezra Klein's Internet neighborhood, look like a family tree of Beltway conventional wisdom (Paul Krugman being the crazy uncle who has to be invited). Beyond that, Ezra Klein epitomizes the callow wisdom of a 28 year old as to fairness towards his elders who have paid into a system for decades that promised them their social contract would be honored. For his willingness to throw his seniors under the bus in a vapid adoration of bipartisanship, he has earned Jim Newell's wry observation that "the only thing separating Ezra Klein from David Broder at this point is six feet of dirt."

Not Everyone From Texas is Bat Shit Insane

I had forgotten that today is President's day, so the markets are closed, making this a three day weekend. That being the case, allow me to apologize for the sorry state of Texas politicians.

I've been in Texas since college. I was first attracted to the state because of its music. During my formative years as a guitar player, I was attracted to early ZZ Top, Johnny Winter, the Fabulous Thunderbirds and Stevie Ray Vaughn. As a result, I wanted to be in Texas, eventually winding up at Trinity University in San Antonio in the late 1980s and gravitating to Austin in the early 1990s. I've been in the state ever since, but I've been in Houston since 1995.

However, for the last few years, Texas politicians have been a national embarrassment. Whether it's

I simply wanted to state that not everyone from Texas is nuts. Unfortunately, we've become a hotbed of political crazy over the last 10 years, for which I heretoforth apologize for.

I've been in Texas since college. I was first attracted to the state because of its music. During my formative years as a guitar player, I was attracted to early ZZ Top, Johnny Winter, the Fabulous Thunderbirds and Stevie Ray Vaughn. As a result, I wanted to be in Texas, eventually winding up at Trinity University in San Antonio in the late 1980s and gravitating to Austin in the early 1990s. I've been in the state ever since, but I've been in Houston since 1995.

However, for the last few years, Texas politicians have been a national embarrassment. Whether it's

- John Cornyn threatening to shut down the government,

- Ted Cruz doing is best imitation of McCarthy,

- Louis Gohmert actually opening his mouth about anything (babies becoming terrorists),

- Steve Stockman inviting Ted Nugent to the State of the Union, or

- our governor's complete inability to remember three government agencies in the middle of a presidential debate,

I simply wanted to state that not everyone from Texas is nuts. Unfortunately, we've become a hotbed of political crazy over the last 10 years, for which I heretoforth apologize for.

Morning Market Analysis

Let's begin with my current thesis of the market. While there are bullish economic arguments to be made (housing is rebounding, manufacturing is recovering), the negative effects of the sequester and payroll tax hikes are too large to overcome and will slow growth in the first half of the year. We're already seeing the effects of the payroll tax hike hit the sales of retailers like Wal-Mart. There is also little good news coming from the international arena, save for China.

The real cause for the rally is a new round of liquidity from massive 2012 dividend payments is hitting the equities market -- a source of money that will dry up by the end of the third quarter if not sooner. Finally, market breadth indicates we're already very overbought at these levels.

The daily SPY chart (bottom chart) shows that the rally continues unabated. All the EMAs are still rising and the CMF indicates a positive volume inflow. However, the MACD has given a sell signal, indicating potential weakness. The 60 minute chart (top chart) adds to the concerns about the strength of the rally. After prices broke through the 151.25/151.5 level they rallied to the 152.5 level twice only to fall back. The move from 151.25 5o 152.5 is less than 1%, so the lack of continued upward momentum is a bit concerning.

The DIA's 60 minute chart (top chart) shows prices moving sideways with support coming from both 138 and 139 and resistance coming from 140. The daily chart (lower chart) shows prices broke their uptrend at the beginning of February and have been trading sideways ever since. Also note the MACD has given a sell signal.