Also -- starting next week there will be some different thing here, so keep you eyes open.

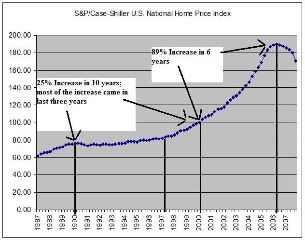

The bottom of the market doesn't appear in sight, given that the supply of homes for sale soared to 11 months, the highest in almost three decades. The average price and median price for a new home fell at double-digit rates from a year ago.

While the sales data are subject to monthly volatility, "this is just gruesome and leaves no other conclusion than that the downturn in the U.S. housing market is still in full swing," ING Bank economist Dimitry Fleming wrote in a research note.

ixty percent of the public say they are now less comfortable about making a a big-ticket financial commitment, such as buying a home or a car, than they were just six months ago, underscoring their more circumspect behavior, according to the RBC Cash poll conducted by Ipsos, an international polling firm, in early April. A year ago, 48 percent said they were less comfortable about making a major purchase.

"I'm feeling more cautious about buying a house. We were thinking about that, but we'll be waiting a little bit longer than we otherwise would have," says Rockwell, 53, a homemaker in Baltimore, Md. She described the current economic climate as being fraught with insecurity. "A larger number of people are really hurting and even people fairly well off are feeling insecure," she says.

BIGresearch, a firm that tracks consumer behavior, said 53.6 percent of people they polled focused more on what they needed, rather than what they wanted, during their shopping trips over the last six months.

U.S. home builders have slashed their prices by a record amount, but sales still plunged by 8.5% to a 17-year low in March, the Commerce Department estimated Thursday.

The decline in new-home sales to a seasonally adjusted annual rate of 526,000 was much weaker than the 577,000 pace expected by economists surveyed by MarketWatch. See Economic Calendar.

The report gives little hope that the housing market is near a bottom. February's sales pace was revised lower to 575,000 from 590,000.

New-home sales are down 36.6% compared with a year ago and are down 62% from the peak in July 2007.

The figures likely overstate the number of sales because they don't account for canceled sales, which have ballooned. The report is based on contracts signed, not sales closed.

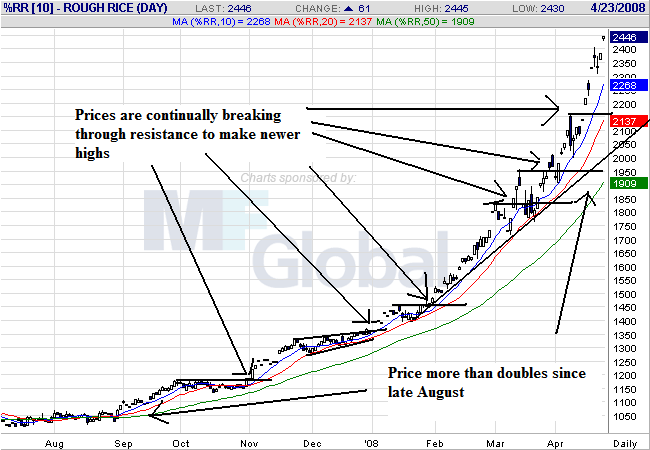

Food-related protests have been occurring worldwide, and in the U.S. now major discounters are seeing runs on products, particularly rice, as both Sam’s Club, the Wal-Mart Stores Inc. operated discounter, and Costco Wholesale Corp. have seen shelves cleaned out of rice as consumers worry about higher prices. “It is just unreal what can happen when we get fear being spread as it is now, and when the general populace goes out and starts doing idiotic things like lining up at the Sam’s Club and the Costco and not buying one bag but buying 10 bags just because they might run out,” says Neauman Coleman, introducing broker at Neauman Coleman & Co. in Brinkley, Ark. Sam’s Club has decided to put limits (or rations, if you will) on the amount of 20-pound bags customers can purchase every week, and Costco earlier this week said it was considering such limits as well, which in a way is just as panicky a response.

Benchmark Thai rice prices leapt more than 5% to a record high above $1,000 a ton Thursday. Meanwhile, Brazil has temporarily halted rice exports to ensure domestic supply amid rising world prices for the grain.

Brazil grows more rice than it consumes and has a reserve that will safeguard the country's supply, Agriculture Minister Reinhold Stephanes said in a statement. Sales abroad will nevertheless be blocked to make sure the country has enough of the grain for the next six to eight months.

.....

Brazil follows on the steps of India and Vietnam, the world's second- and third-largest rice exporters in 2007, in imposing export curbs of rice in a bid to keep prices of the grain under control. Brazil, which is not a major global rice supplier, exported 313,000 tons of rice last year.

Lewis [Bank of America's President] acknowledged the housing crisis wasn't over but said Bank of America paid a fair price for Countrywide and continues to perform deep due-diligence.

"There is a great long-term value embedded in Countrywide's business," he said.

Mueller did not identify any of the companies under scrutiny. The Justice Department reportedly is looking into whether the nation's largest mortgage lender, Countrywide Financial Corp., misrepresented its financial position and the quality of its mortgage loans.

Congress is considering legislation to help half a million or more struggling homeowners get into lower-cost mortgages amid a darkening economic outlook that seems to be sinking into a recession.

Credit Suisse Group, Switzerland's second-biggest bank, may report the first quarterly loss in almost five years on writedowns linked to deteriorating credit markets and securities that had been intentionally mispriced.

Credit Suisse will probably post a first-quarter net loss of 594 million Swiss francs ($593 million) tomorrow, compared with a 2.73 billion-franc profit a year earlier, according to the median estimate of 14 analysts surveyed by Bloomberg. Markdowns by the Zurich-based bank may amount to 5 billion francs, analysts said.

Chief Executive Officer Brady Dougan announced on March 20 that the bank would probably have a loss after ``a small group'' of traders mispriced securities and credit markets worsened. The company's losses have been dwarfed by UBS AG, its larger Swiss rival, which said on April 1 it probably lost about 12 billion francs in the first three months of the year.

``The bank hasn't covered itself in glory but it's certainly not the worst performer,'' said Matthew Clark, an analyst at Keefe Bruyette & Woods in London with a ``market perform'' rating on Credit Suisse. ``They're facing revenue headwinds but the franchise shouldn't be too much damaged by writedowns.''

HVB Group, UniCredit SpA's German banking unit, said it expects ``significant'' losses related to the credit crisis in the first quarter.

``We expect significant valuation adjustments on our securities portfolio in the first quarter as credit spreads clearly worsened since the beginning of the year,'' Chief Executive Officer Wolfgang Sprissler said at a press briefing in Munich late yesterday. He declined to be more specific. His comments were confirmed by HVB spokeswoman Claudia Bresgen.

Ambac Financial Group Inc., the world's second-largest bond insurer, posted a wider loss than analysts estimated after being crippled by writedowns for guarantees on subprime-mortgage securities.

The first-quarter net loss was $1.66 billion, or $11.69 a share, compared with $213.3 million, or $2.04, a year earlier, the New York-based company said today in a statement. The company's operating loss of $6.93 a share was larger than the $1.82 estimated by six analysts surveyed by Bloomberg.

Ambac, which was stripped of one of its three AAA ratings this year, was ``severely impacted'' by the plunging value of mortgage- related guarantees, interim Chief Executive Officer Michael Callen said in the statement. Ambac's new business slumped 87 percent and the company took a $1.04 billion provision for losses on mortgage securities. Ambac insured 1 percent of municipal bonds sold in the quarter, according to Thomson Financial.

The languid sales pace has pushed inventories of unsold homes to a 9.9 months' supply at current sales rates. That large overhang has put downward pressure on prices for months, especially in areas hit hardest by the housing crisis.

The number of homes for sale at the end of March increased by 40,000 to 4.06 million. At the current sales pace, that represented 9.9 months' worth, up from 9.6 months' worth at the end of the prior month.

``There still is an imbalance in the existing housing market that needs to be corrected through lower inventories and higher sales,'' said Michelle Meyer, an economist at Lehman Brothers Holdings Inc. in New York, which correctly forecast the sales level. ``The market will remain out of balance this year and most of next. As long as the housing market remains weak we think the economy will remain weak as well.''

U.S. drivers are doing something they haven’t done for nearly two decades — consume less gasoline.

Gas consumption so far this year is down about 0.2 percent compared to last year, according to the Energy Information Administration. The federal agency is predicting that gasoline demand will be down 0.4 percent this summer and 0.3 percent for the year.

That may not sound like much, but it would be the first time since 1991 that there’s been a decline in annual gas consumption. And it would be only the eighth year since 1951 in which demand for gasoline has declined.

The federal agency noted that the decline was occurring in part because of a slowing economy. But it also said that higher gas prices were having an effect on demand.

“Sustained higher gasoline prices are beginning to show up in lower gasoline consumption,” said Tancred Lidderdale, an analyst for the Energy Information Administration.

Both gasoline and diesel prices are now at record levels.

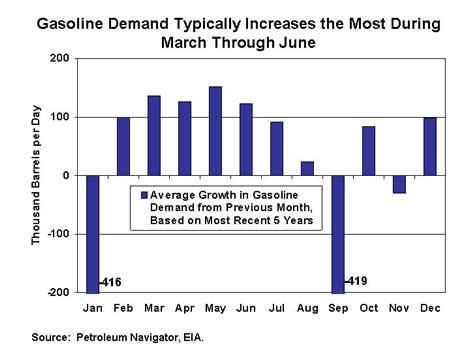

Since last fall, the average U.S. retail price for regular gasoline has been close to or above $3 per gallon in large part due to high crude oil prices. High crude oil prices are expected to remain an important reason why retail gasoline prices are projected to stay above $3 per gallon for some time to come. As the chart below indicates, we are now in the “time of the season” when gasoline demand begins to increase. As seasonal demand increases, prices tend to rise as well, all else equal. Even though U.S. gasoline demand has been lower than year-ago levels so far this year, EIA still expects that rising gasoline demand over the next few months will drive retail prices higher. So, while gasoline prices have risen above $3 per gallon mostly due to high crude oil prices, increasing gasoline demand will likely take retail gasoline prices to $3.50 per gallon and above, even if year-over-year gasoline demand is negative. The simple fact that more and more gasoline will be used over the next few months will probably be enough to cause retail gasoline prices to increase, even if crude oil prices begin declining, as EIA is currently projecting. Additionally, the cost of making “summer-grade” gasoline (“summer-grade” gasoline produces less smog) is significantly more than making “winter-grade” gasoline, helping to raise retail prices even further during the summer months, all else equal.

The company raised its provisions for loan losses 10-fold to $560 million on expected losses on mortgages, home equity credit lines and residential construction, it said.

Federal banking regulators will hire 140 new employees in an effort to reassure the public they are well-positioned to deal with a possible increase in bank failures over the next year, the Federal Deposit Insurance Corp. said Tuesday.