- by New Deal democrat

Monthly data reported this past week included August personal income, spending, and savings, all up. Case=Shiller home prices increased, as did new home sales. Durable goods were essentially flat. The Conference Board's consumer confidence index declined, but the U. Michigan consumer confidence index increased.

We are told that the September jobs report may not get published on Friday if the government shuts down. Two years ago, during the debt ceiling debacle, it was consumer spening holding up that told me that the economy would not tip back into recession. Consumers may be behaving differently this time around. Let's start this edition of the high frequency weekly indicators by looking at that:

Consumer spending

- ICSC -1.0% w/w +1.6% YoY

- Johnson Redbook +3.9% YoY

- Gallup daily consumer spending 14 day average at $85 up $9 YoY

Steel production from the American Iron and Steel Institute

- +1.8% w/w

- +7.2% YoY

Steel production over the last several years has been, and appears to still be, in a decelerating uptrend. It had been negative YoY, but turned positive two weeks ago.

Transport

Railroad transport from the AAR

- -4300 carloads down -1.5% YoY

- +1200 carloads or +0.7% ex-coal

- +8600 or +3.4% intermodal units

- +4400 or +0.8% YoY total loads

- Harpex unchanged at 403

- Baltic Dry Index up +142 to 2043

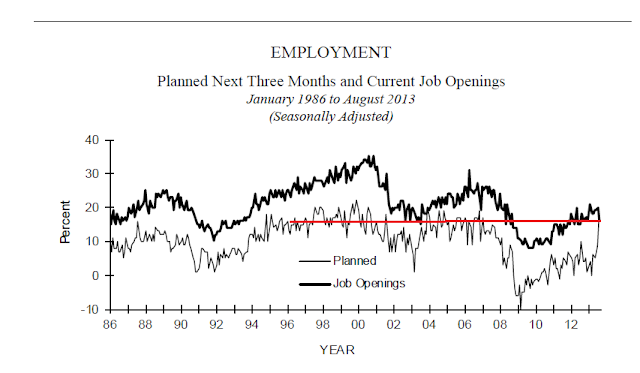

Employment metrics

Initial jobless claims

- 305,000 down -4,000

- 4 week average 308,000 down -6750

The American Staffing Association Index was up 2 to 100. It is up +5.1% YoY

Tax Withholding

- $139.6 B for the first 13 days of September vs. $125.2 B last year, up +14.4 B or +11.5%

- $150.3 B for the last 20 reporting days vs. $135.2B last year, up +15.1 B or +11.1%

We can now estimate that after adjusting for state reporting glitches, one week ago initial jobless claims were ~327,000, still a 6 year low, and the 4 week average was 325,250. Jobless claims remain firmly in a normal expansionary mode. Like each of the last three years that this same, a good, downside breakout has occurred.

Temporary staffing had been flat to negative YoY in spring, but has broken out positively in the last two months. The only time it has ever been higher was one week in 2006 and in the second half of 2007. Tax withholding, after a relatively poor August, is again posting better (but just average) comparisons.

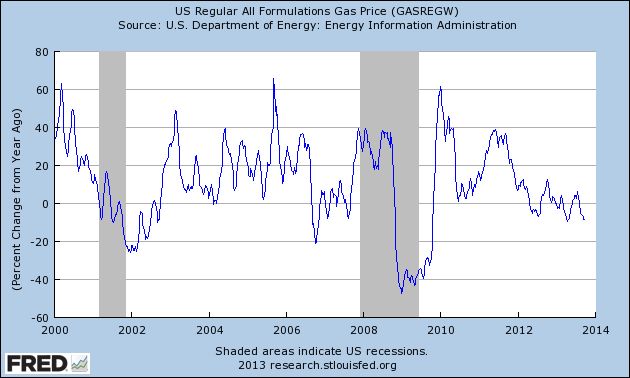

Oil prices and usage

- Oil down -$1.88 to $102.87 w/w

- Gas down -$0.05 at $3.50 w/w

- Usage 4 week average YoY up +0.9%

Interest rates and credit spreads

- 5.49% BAA corporate bonds down -0.05%

- 2.79% 10 year treasury bonds -0.13%

- 2.70% credit spread between corporates and treasuries up +0.08%

Housing metrics

Mortgage applications from the Mortgage Bankers Association:

- +7% w/w purchase applications

- +7% YoY purchase applications

- +5% w/w refinance applications

Housing prices

- YoY this week +10.9%

Real estate loans, from the FRB H8 report:

- +0.2% w/w

- -0.7% YoY

- +1.4% from its bottom

Money supply

M1

- -0.1% w/w

- +0.7% m/m

- +6.2% YoY Real M1

M2

- unchanged w/w

- +0.4% m/m

- +4.9% YoY Real M2

Bank lending rates

- 0.243 TED spread down -0.003% w/w

- 0.180 LIBOR up +0.001 w/w

JoC ECRI Commodity prices

- down -0.73 to 123.76 w/w

- -0.54 YoY

The overall story this week remains as it has been for the last several months. The long leading indicators of interest rates, mortgage refinance applications and real estate loans have all turned negative, although they were less so this week. Purchase mortgage applications do remain slightly positive YoY. Money supply is also decelerating although still positive. Spreads between corporate bonds and treausries also were negative again this week.

The shorter leading indicators of initial jobless claims are very positive, even adjusting for California's computer problems. Temporary employment has turned strongly positive in the last two months. The oil choke collar has disengaged. Commodities are neutral.

The coincident indicators of transportation -- rail traffic and shipping - remain positive. Steel production is positive. Bank lending rates are at or near or at record lows. Tax withholding has also improved moderately in the last couple of weeks. House prices remain strongly positive.

A new concern, however, has to be consumer spending. Both Gallup and the ICSC have become quite weak, although still positive. Johnson Redbook, on the other hand, is strongly positive. Two years ago, during the debt ceiling debacle, it was consumer spending especially as reported by Gallup, that showed that consumers were voting very positively with their wallets, and we were not slipping into a double-dip recession. With Washington once again on the verge of destroying economic growth, higher interest rates may be causing the consumer to spend much more cautiously. This is really unfortunate because left to its own devices, the economy appears to be picking up steam for the rest of the year. I still remain much more cautious about 2014.

Have a nice weekend!