- by New Deal democrat

Residential construction permits and starts bounced back from their July Hurricane-Beryl affected decline, but housing units under construction declined below the threshold for hoisting a yellow “recession watch” flag for this sector. At the same time, I continue to suspect that we are rising from lows in the most leading metrics, and no “recession warning” is warranted.

To begin with, the most leading metric, housing permits (gold), rose by 69,000 to 1.475 million, the highest level since March. Single family permits (red), which are just as leading and have very little noise, rose 26,000 to 967,000, the highest since April. Housing starts (blue), which tend to lag permits by a month or two, and are much more noisy, rose 119,000 to 1.356 million, also the highest since April:

That’s the good news, and it is what I have been expecting, given the downturn in mortgage rates.

But units under construction is the measure of real economic activity in this sector. While it is not so leading as permits and starts, it has always turned down, typically by more than -10% before a recession begins (the average is -15.1% and the median is -13.4%). Here is the long-term graph comparing total permits (blue, left scale) with housing units under construction (red, right scale):

And in August housing units under construction continued to decline, by another -29,000, to 1.509 million units, a decline of -11.8% from their 2022 peak. There is simply no valid reason to withhold raising the yellow flag at this point.

There had been a long time after single family construction turned down while multi-unit construction continued to increase and then plateaued. But this year both have declined:

So that is the bad news. But, mortgage rates red, left scale in the graph below) have been declining sharply in the past two months, and as of this morning are within .02% of their two year low of 6.09%:

And if the Fed cuts interest rates this afternoon, which seems almost certain, I expect a further decline. As a result, as I said one month ago, “we can expect permits to rise in the next several months, followed by starts,” for the simple reason that for 60+ years, mortgage rates have always led housing permits. Here is the YoY% change view of the past 10+ years (with mortgage rates inverted so that lower rates YoY show as above the 0 line), with which may be clearer:

This clearly suggests that permits are likely to turn higher YoY soon.

Last month I concluded: “That the most leading metric, single family permits, as well as mult-family permits, appear to be stabilizing, plus the likely effect of lower mortgage rates, plus the probable effect of Beryl on units under construction, together cause me to believe that raising the yellow caution flag for housing would be premature based on this month’s report. It’s very close, but I don’t think we’ve crossed the threshold yet, and there are still good reasons to believe we may not cross it at all.”

Well, contrary to my earlier belief, we have indeed crossed the threshold. But as shown in the second graph from the top above, the long historical view of housing units under construction and permits, with one exception (the tech producer-centered recession of 2001), in the case of recessions, permits continued to decline sharply even after housing units under construction crossed the -10% threshold and well after recessions had begun. In our present situation, if I am correct that permits have bottomed and are starting to increase again, then housing units under construction will not decline too much further before bottoming as well.

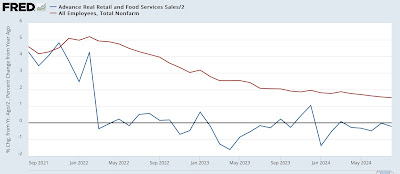

In other words, although there are some increasing warning signs that I have written about recently, including with real retail sales just yesterday (and stay tuned for jobless claims tomorrow), my base case is that this period of weakness is likely to turn around without a recession occurring. That’s why at this point there is only a housing sector “recession watch,” meaning a heightened possibility, and not a “warning,” meaning one is more likely than not.