Saturday, October 28, 2017

Weekly Indicators for October 23 - 27 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

This week there was a surge in interest rates, causing mortgage rates to turn into a negative again.

Friday, October 27, 2017

Weekend Pit Bull

I started this blog in 2006 -- over 10 years ago (where does the time go?). NDD started blogging over here a few years after that. About three years ago, we started writing over at XE.com, which we still do. I pretty much bailed on this site after the shift, largely because of time considerations. Since then, NDD has kept the BD blog going, providing consistently great content to the readers on a regular basis. I owe him a great debt of thanks and gratitude for all his work.

For a number of reasons, I started back here a few weeks ago. We still have some new things brewing, but they're going to take a bit longer to bring to market.

When I started the blog, I had two Weimaraners - Kate and Sarge. Unfortunately, both are now gone, as are a few other pups that I and Mr$. Bonddad have taken care of. Now we have two pit bulls -- Pibbles -- named Mumph and Lita.

Your weekend pit bull means the week is over; it's time to think about anything except economics and financial markets. To that end, here's Lita (top) and Mumph (bottom, with Elmer the pig).

Leading indicators in GDP report negative for second straight quarter

- by New Deal democrat

Three months ago, when the preliminary read on second quarter GDP was released, I started out with, "While Q2 GDP increased at a smart rate, there was bad news in both of the long leading indicators that are contained in the release."

Today's preliminary report on Q3 GDP makes it two quarters in a row.

Today's preliminary report on Q3 GDP makes it two quarters in a row.

There are two long leading indicators in the GDP report: real private residential investement and corporate profits. Since the latter is not released until the second or third revision, the less leading proxy of proprietors' income serves as a placeholder.

Real private residential investment declined at a -6.0% annual rate, following a revised -7.8% annual rate for Q2 (blue in the graph below). That's even worse when you take into account that the best measure is housing investment as a share of GDP (red). Since housing investment declined and GDP rose, that's an even bigger hit.

Secondly, proprietors' income rose slightly, only +0.2% overall and +0.6% on a nonfarm basis, before adjusting for inflation, which ran over 1% last quarter, meaning that on a real basis, both declined. The below graph compares nominal proprietors' income with corporate profits adjusted for unit labor costs, which had increased very slightly in Q2 (and hasn't been reported yet for Q3):

One quarter could just be noise. But two quarters in a row later in the expansion is at very least a yellow flag.

In the last month I have downgraded my long leading forecast from positive to neutral. I'm NOT negative now, but any further significant spreading or deterioration will cause me to turn negative for the first time since late 2006.

In the last month I have downgraded my long leading forecast from positive to neutral. I'm NOT negative now, but any further significant spreading or deterioration will cause me to turn negative for the first time since late 2006.

I'll update later with graphs once FRED posts the info. UPDATED

Thursday, October 26, 2017

September new home sales: the back end of the hurricanes

- by New Deal democrat

As promised yesterday, here is my detailed post at XE.comon the September new home sales report.

The bottom line is that, when you do a three month moving average, and account for the transfer of many sales in the South from August to September, you have a metric that is no longer declining, but is not advancing either.

I had a problem posting the final graph, and rather than continue to fight with that platform, here is the graph that compares monthly with quarterly YoY changes in median prices:

The trend in new home prices is outpacing median household income growth this year.

About the "Treasury Market is Predicting Doom" Argument...

The top chart is the IEIs, which represent the 3-7 section of the treasury curve. The middle chart is the IEFs, which are the 7-10 year section of the curve, while the bottom chart is the TLTs, which represent the 20+ year section of the curve. All three fell through technical support yesterday; all are below their respective 200-day EMAs.

There are two reasons for this. First, the market believes Trump will nominate a more hawkish Fed governor, probably John Taylor. Second, the market is betting the Republicans will pass a large tax cut. Traders believe this will lead to higher growth and more inflation. Therefore, they are selling bonds, which under-perform in a higher growth, higher inflation environment.

If this trend continues, we'll see the treasury curve widen. That sends the "yield curve is at its lowest level in years, we're doomed" argument out the window.

Wednesday, October 25, 2017

A quick note on new home sales

- by New Deal democrat

I don't know why, but FRED always seems to take its time posting data from the monthly new home sales report.

So, graphy goodness tomorrow, but in the meantime, the bulletpoint takeaway:

- Needless to say, a good report, with a new expansion high, and

- the three month moving average has stopped declining, BUT

- the big increase this month was all about the hurricane affected South, which contributed over 80,000, and

- the three month moving average is nevertheless below its high from this past March, and

- keep in mind that outliers in this report are frequently revised largely away come the next month

Stay tuned!

Linkfest

What if NAFTA becomes a Zombie deal? (FT)

About the Phillips Curve breakdown (Gavyn Davies)

The 3-Equation New Keynesian Model (PDF)

Have smartphones destroyed a generation? (the Atlantic)

Trump nixes cutting 401(k) contributions (NYT)

China's business leaders are having a difficult time with the government (NYT)

The 7 men now run China (NYT)

Xi is now one of the most powerful leaders in China's history (NYT)

It's looking like treasuries want to rally higher (BB)

About the Phillips Curve breakdown (Gavyn Davies)

The 3-Equation New Keynesian Model (PDF)

Have smartphones destroyed a generation? (the Atlantic)

Trump nixes cutting 401(k) contributions (NYT)

China's business leaders are having a difficult time with the government (NYT)

The 7 men now run China (NYT)

Xi is now one of the most powerful leaders in China's history (NYT)

It's looking like treasuries want to rally higher (BB)

Tuesday, October 24, 2017

Why does anybody pay attention to Deutsche Bank's economic forecast?

- by New Deal democrat

So this morning I read that OMG yield curve tightest since 2007!!!! Head for the hills!!! Recession coming!!! from Mike "Mish" Shedlock.

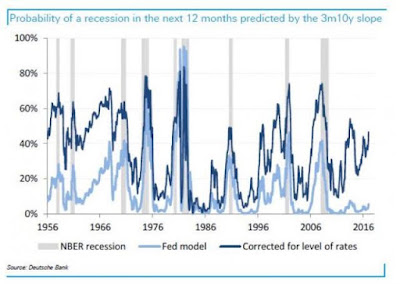

And here is the accompanying graph:

Sure enough, yes, if we focus strictly on the time period from 2008-present, (and don't you dare let your eyes wander to the left of the graph!), the yield curve now is the tightest it has been.

But unless you think the universe came into existence in 2007, you really *should* cast your eyes to the left of the graph, where you will see that the spreads among the various treasury maturities are about where they were in early 2005. Two and one-half years before the last recession.

Oh.

This made me remember a similar recession call by Deutsche Bank almost two years ago:

What are plummeting interest rates saying about the outlook for the economy? The spread between the yield on 10-year U.S. Treasury notes and two-year notes is the narrowest since 2007. A model maintained by Deutsche Bank analyst Steven Zeng, who adjusts the spread for historically low short-term interest rates, suggests the yield curve is now signaling a 55 percent* chance of a U.S. recession within the next 12 months. That marks the highest probability generated by the model so far in this expansion ....[*That was in February 2016. When long term rates made new lows in July, they upped the chances to 60%!]

Here is a graph which accompanied Deutsche Bank's presentation:

In response, I noted the following:

Here's the problem. Cast your eye to the left end of the graph, the 1960s. You know, probably the best economy the US has had since, well, forever? What does the graph show then?

Apparently, the US was teetering on the edge of recession throughout the entire decade. Hoocoodanode?

Next look towards the middle. There is the 1990s tech boom, second only to the 1960s as the best US economy of our lifetimes. Well, apparently the US was teetering on the edge of recession through that period as well!

So here is a helpful hint. When your Killer App for foreceasting recessions forecast a recession during the two best economies that the US has had in the last 60 years, your Killer App is crap.

Apparently Deutsch Bank figures that once the Fed starts tightening, it will continue pretty much until it sees a recession looming like an iceberg dead ahead. That may have made sense half a century ago when the US was primarily a manufacturing economy, which was much more volatile -- a GDP that fell from 4% to 2% quarter over quarter was likely headed to 0 or below in another quarter. That's simply not the case in our service based economy now.

So what was Deutsche Bank saying just a few months ago? This:

[Deutsche Bank] estimated the probability of a U.S. recession from now to June 2018 at less than 10 percent.Here's their updated graph (which, note, now conveniently omits the entire 1960's):

They're back to extreme bearishness now. Who cares? Why should anybody be paying the slightest bit of attention to a model which has 5 false positives for 6 correct ones?

If Deutsche Bank wants be right, how about hiring me? I'll accept 1/4 of your current crew's pay. Sounds like a win-win move to me.

--From Bonddad

I haven't read Mish is forever. Now I remember why; this analysis is, well, ridicules.

Here's a long-term chart of one of my favorite indicators: the 10-year CMT - Fed Funds:

The curve inverts somewhere between 12-24 months before a recession. Right now, the spread is 123 basis points. So, we need 123 points of compression before inverting, after which time there's a strong possibility that that we'll see a recession within the next 1-2 years. Usually, it's the Fed's raising short-term rates that causes the most compression. As NDD notes, that's just not going to happen in the current environment, thanks to low inflation and a Fed now beginning to debate why inflation is so low.

Using this chart as a basis, we're at least 2 years from a recession.

Or, you could simply go to the Cleveland Fed's website, where they employ a probit model to predict recessions based on the yield curve. Here's their conclusion

The slightly steeper yield curve did lead to a slightly decreased probability of recession, but the change was minor. Using the yield curve to predict whether or not the economy will be in recession in the future, we estimate the expected chance of the economy being in a recession next September at 12.0 percent, down from the August probability of 12.5 percent (an even one-eighth chance), itself a tiny drop down from July’s 12.9 percent. So the yield curve is optimistic about the recovery continuing, even if it is somewhat pessimistic with regard to the pace of growth over the next year.

Monday, October 23, 2017

Kimberly Clark (KMB) Is Worth a Look at These Levels

Dividends are central to my investment philosophy. They not only lower portfolio volatility but also provide a continued source of funds for reinvestment. In that vein, I continually monitor a small list of companies that have consistently raised dividends for at least 25 years. When these companies are weak technically, it’s an appropriate time to examine them as a potential addition to a portfolio. I detail this process in my book The Lifetime Income Security Solution.

Kimberly Clark is currently looking attractive from a technical perspective:

The weekly chart (top chart) shows a double-top in the first half of this year followed by a consistent downtrend. Weekly prices are currently approaching the 200-week EMA. The daily chart (bottom chart) is very weak; it is below the 200-day EMA and recently gapped lower.

According to their latest 10-K, KMB has three lines of business:

- Personal Care brands offer our consumers a trusted partner in caring for themselves and their families by delivering confidence, protection and discretion through a wide variety of innovative solutions and products such as disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, and other related products. Products in this segment are sold under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Kotex, U by Kotex, Intimus, Depend, Plenitud, Poise and other brand names.

- Consumer Tissue offers a wide variety of innovative solutions and trusted brands that touch and improve people's lives every day. Products in this segment include facial and bathroom tissue, paper towels, napkins and related products, and are sold under the Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve and other brand names.

- K-C Professional ("KCP") partners with businesses to create Exceptional Workplaces, helping to make them healthier, safer and more productive through a range of solutions and supporting products such as wipers, tissue, towels, apparel, soaps and sanitizers. Our brands, including Kleenex, Scott, WypAll, Kimtech and Jackson Safety, are well-known for quality and trusted to help people around the world work better.

The company faces intense competition. This means KMB must very efficient.

Their balance sheet (as researched on Morningstar.com) isn’t as clean as I would like. But a high asset/liability ratio is less important for a multi-billion dollar company. Over the last 5 years, total assets have decreased about $5 billion, thanks to a modest decline in receivables along with a larger decline in property, plant, and equipment (about $800 billion) and inventories (about $900 billion). Turning to liabilities, the company has increased its debt levels by about $1.4 billion, which is to be expected during a period of record-low interest rates. According to their revenue statement, their interest expense is 1.75% of gross income – a manageable level.

Expenses demonstrate that management is top-notch. Over the last 5 years, their gross margin has improved by 450 basis points, their operating income has risen nearly 550 basis points and their net margin has increased almost 390 basis points. And then there is EBITDA, which is up 525 BPs. Considering the intense competition in their market, these are very important and impressive numbers.

The company is large enough to fund current expansion out of net income. This means the primary play on their cash flow statement is in their financing structure. Over the last 5 years, they’ve done a large amount of debt-refunding, which is prudent in a low rate environment. They have also been buying back stock at a solid pace – another great way to reward shareholders.

According to FINVIZ, their current yield is 3.42% -- which is about 60 basis points higher than the AAA effective yield and on par with a BBB effective yield (according to FRED) data. Their dividend coverage ratio is just south of 62%, which means they have room to raise it further.

Technically, the company is weak, which means it’s time to look at this company. While the balance sheet isn’t that impressive, the rising margins show management is very good at its job. The company has taken advantage of low interest rates to refund its debt; interest rate expenses are under control.

Overall, this KMB is currently worth a look

This post is not an offer to buy or sell this security. It is also not specific investment advice for a recommendation for any specific person. Please see our disclaimer for additional details.

This post is not an offer to buy or sell this security. It is also not specific investment advice for a recommendation for any specific person. Please see our disclaimer for additional details.

Sunday, October 22, 2017

Subscribe to:

Comments (Atom)