Until then....

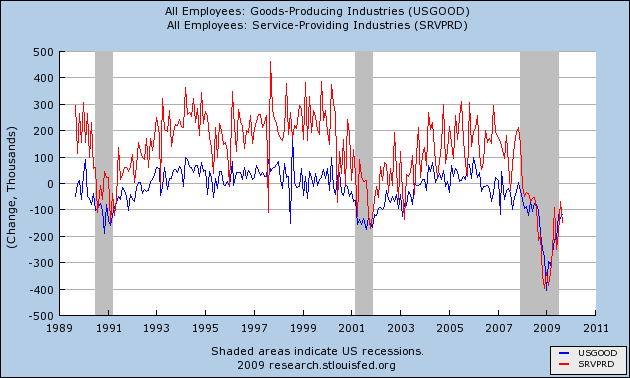

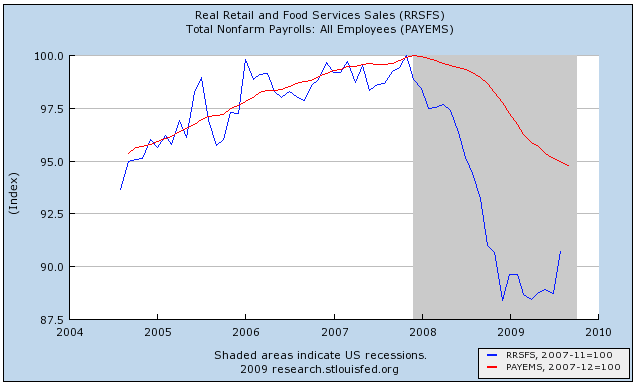

The unemployment rate rose from 9.8 to 10.2 percent in October, and nonfarm payroll employment continued to decline (-190,000), the U.S. Bureau of Labor Statistics reported today. The largest job losses over the month were in construction, manufacturing, and retail trade.

In September, payrolls fell by a revised 219,000, compared with the previous estimate of a 263,000 loss. The unemployment rate was 9.8% in September.

Initial jobless claims are clearly on the decline, down 20,000 in the Oct. 31 week to 512,000 (prior week revised 2,000 higher to 532,000). The four-week average is down for the ninth straight week, 3,000 lower at 523,750 for a 25,000 decrease from late September. Continuing claims are also declining but here the change is likely a negative, due largely to the expiration of benefits. Continuing claims, in data for the Oct. 24 week, fell 68,000 to 5.886 million for the seventh decline in a row. The unemployment rate for insured workers is unchanged at 4.4 percent, a level that is down 8 tenths from a peak in late June. In contrast, the overall employment rate has continued to climb, at 9.8 percent in September and is expected to increase another 1 tenth in Friday's data for October. Remember, improvement in both initial and continuing claims during September did not correlate to improvement in either payrolls or the household survey.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

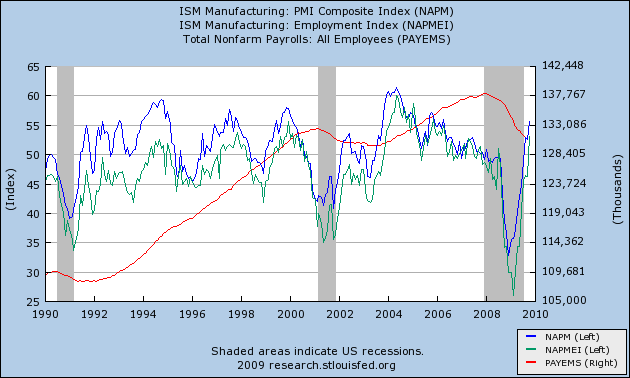

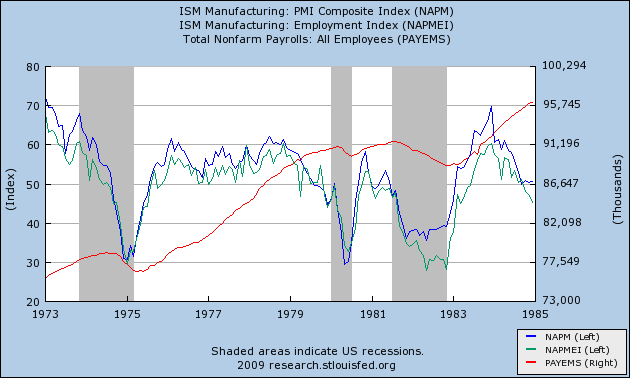

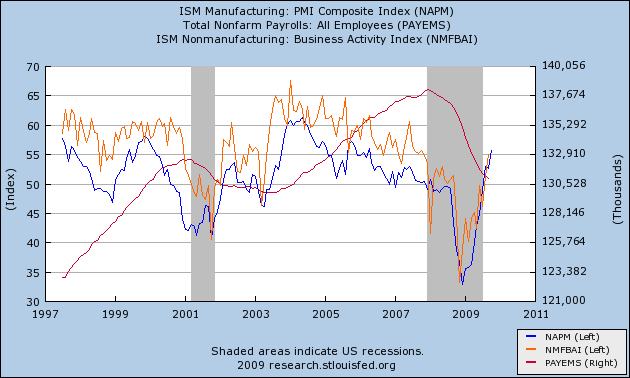

[W]e believe that there is more upside to the ISM index. Our hard-data based inventory demand ratio is to indicating a heavy production back-log in the US economy. This measure of future manufacturing activity is currently sending the most positive signal for the ISM seen in the past 40 years. Furthermore, this is supported by our model, which provides a year-end target for the ISM at 60 and indicates some possibility of even further strength early next year. That said, the recent deterioration in the ISM new orders-inventory ratio suggests that future improvement is likely to happen at a slower rate. In summary, today’s report underpins our forecast for around 4% GDP growth in the current and the coming quarters driven by substantial positive contributions from slower inventory depletion.

A financial intermediary that performs a variety of services. This includes underwriting, acting as an intermediary between an issuer of securities and the investing public, facilitating mergers and other corporate reorganizations, and also acting as a broker for institutional clients.

The recovery in manufacturing strengthened in October as the PMI registered 55.7 percent, which is 3.1 percentage points higher than the 52.6 percent reported in September, and the highest reading for the index since April 2006 (56 percent). A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

A PMI in excess of 41.2 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the PMI indicates growth for the sixth consecutive month in the overall economy, as well as expansion in the manufacturing sector for the third consecutive month. Ore stated, "The past relationship between the PMI and the overall economy indicates that the average PMI for January through October (44.6 percent) corresponds to a 1.1 percent increase in real gross domestic product (GDP). However, if the PMI for October (55.7 percent) is annualized, it corresponds to a 4.5 percent increase in real GDP annually."

ISM's New Orders Index registered 58.5 percent in October, 2.3 percentage points lower than the 60.8 percent registered in September. This is the fourth consecutive month of growth in the New Orders Index. A New Orders Index above 48.8 percent, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders (in constant 2000 dollars).

ISM's Production Index registered 63.3 percent in October, which is an increase of 7.6 percentage points from the September reading of 55.7 percent. An index above 50.4 percent, over time, is generally consistent with an increase in the Federal Reserve Board's Industrial Production figures. This is the fifth consecutive month the Production Index has registered above 50 percent.

ISM's Employment Index registered 53.1 percent in October, which is 6.9 percentage points higher than the 46.2 percent reported in September. This is the first month of growth in manufacturing employment following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

Overall, this isa very good report. New Deal described it as a blow-out. While I am loathe to use hyperbole when writing about economic numbers, I would say this is an incredibly positive number across the board. And the internals are especially positive.

Personal income decreased $0.1 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $0.2 billion, or less than 0.1 percent, in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $47.2 billion, or 0.5 percent. In August, personal income increased $17.4 billion, or 0.1 percent, DPI increased $14.1 billion, or 0.1 percent, and PCE increased $139.8 billion, or 1.4 percent, based on revised estimates.

Here we see the impact of cash for clunkers -- a big spike followed by a fall.

But also notice that we have other areas of spending increasing.