- by New Deal democrat

Since tomorrow is the Big Holiday, initial and continuing claims were reported today. [Also, on a programming note, later this morning I will also post about the ISM non-manufacturing survey once it is published, since it now plays an increased role in my forecasting].

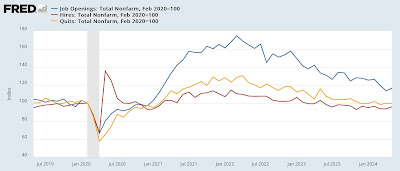

Initial claims rose 4,000 last week to 238,000, while the four week average increased 3,250 to 238,500. Continuing claims, with the usual one week delay, also increased, by 26,000 to 1.858 million, the highest level since the end of November 2021:

I continue to suspect that unresolved post-pandemic seasonality is playing a role in these numbers, since we had a similar spike last year. And on that score, the YoY% changes in initial claims continued to be down, by -4.0%, and the four week average by -5.3%. Continuing claims are higher YoY by 5.1%:

While for forecasting purposes the YoY declines mean they are positive, it is also noteworthy that the YoY trends are “less positive” for initial claims and “slightly more negative” for continuing claims. So in addition to unresolved seasonality, there probably is some signal of relative weakness in the recent increase in claims.

Finally, on Friday we will get the employment report. Here is the update of initial and continuing claims vs. the unemployment rate:

As I’ve written many times, there is nearly a 60 year reliable history of initial and continuing claims leading the unemployment rate. The few exceptions happened coming out of recessions when the labor force increased sharply. That may be what is happening now, as I wrote several weeks ago. There has been a huge influx, on the order of 6 million, immigrants in the past several years. The employment market has likely cooled enough that it cannot absorb all of them any more.

So, it would be *extremely* unusual for the unemployment rate to continue moving higher even as initial and continuing claims declined this spring. In short, the historical record says the unemployment rate should move down, or at least be flat. If it moves higher, it is almost certainly about the aforesaid immigration issue, and would likely be an exception to the “Sahm rule.” We’ll see on Friday.