Saturday, January 18, 2020

Weekly Indicators for January 13 - 17 at Seeking Alpha

- by New Deal democrat

My Weekly Indicators post is up at Seeking Alpha.

The short term forecast has been volatile recently - and was again this week.

As usual, clicking over and reading rewards me a little bit for the effort I put in.

Friday, January 17, 2020

Housing BOOM! 2

- by New Deal democrat

Housing is a very important long leading indicator, and it reflects both the consumer and producer sides of the economy. And this morning, at least in terms of starts, it hit a grand slam.

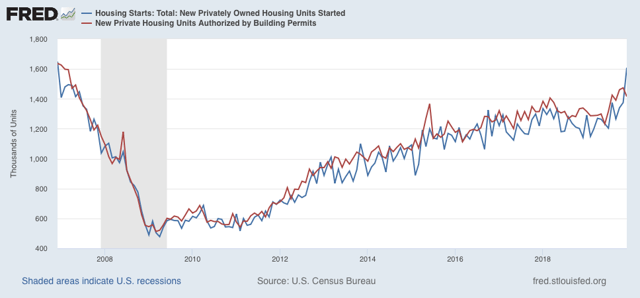

Total housing starts were 1.608 million units annualized, the highest number since the end of 2006. The less volatile and slightly more leading permits declined slightly to 1.416 million units annualized, but the three month average of each made new expansion highs:

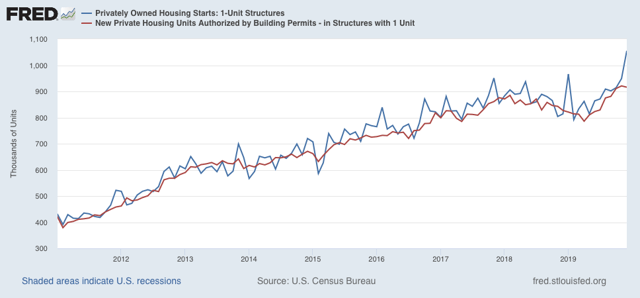

The story is the same with the less volatile single family starts and permits:

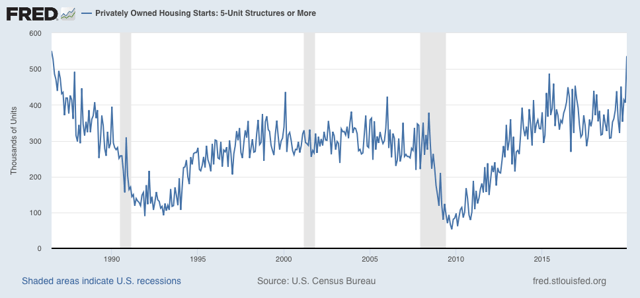

Finally, one point of difference I have had with That Other Blogger who writes about housing is that, because multi-unit housing, especially for younger buyers, can be something of a “substitution good” where single family house prices are beyond reach, I have suspected that multi-unit housing had not yet made its high for the cycle. And in terms of starts, that’s what this morning showed (permits made a huge spike high about 5 years ago the month a special housing program in NYC expired). Not only that, but multi-unit starts made a nearly 25 year high last month:

Lower mortgage rates have done what I expected them to do. It is an important reason why I expect the overall economy to improve later this year. And it is a *very* big argument against the producer slowdown turning into a full-blown recession.

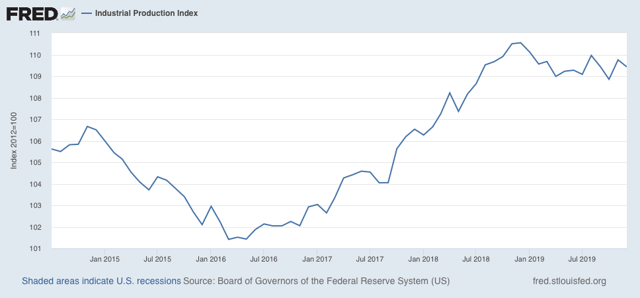

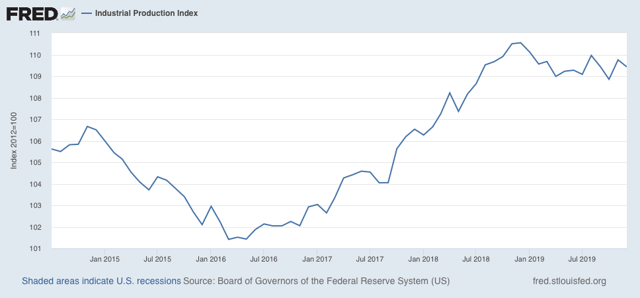

UPDATE: We also got December industrial production this morning, down -0.3%. Industrial production is the King of Coincident Indicators. Here’s what it looks like since July 2014:

Note that, while it is down (in fact it is down -1.0% YoY), it hasn’t gotten any worse since last spring. And it isn’t down nearly as much as it was during the 2015-16 shallow industrial recession. This is one more brick in the wall of slowdown vs. recession.

UPDATE: We also got December industrial production this morning, down -0.3%. Industrial production is the King of Coincident Indicators. Here’s what it looks like since July 2014:

Note that, while it is down (in fact it is down -1.0% YoY), it hasn’t gotten any worse since last spring. And it isn’t down nearly as much as it was during the 2015-16 shallow industrial recession. This is one more brick in the wall of slowdown vs. recession.

Thursday, January 16, 2020

The consumer is (probably) still alright: initial jobless claims and retail sales

- by New Deal democrat

While the producer side of the US economy is almost certainly in a shallow recession, the consumer side has been holding up pretty well. That was confirmed in two important releases this morning.

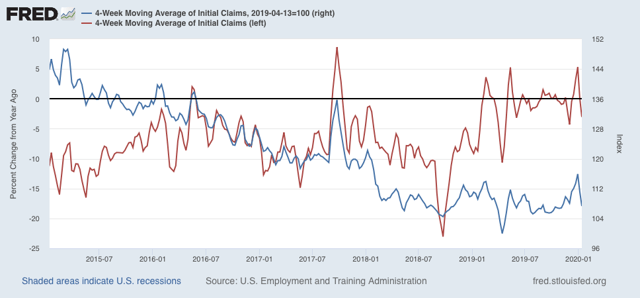

First, initial jobless claims declined to 204,000, one of the lowest numbers during this entire expansion. As a result, the 4 week average, at 216,250 is only about 7% higher than its lowest point during that time, and the first two weeks of January, at 209,000, are more than -10% lower than the January average last year. In short, both of my metrics for rating jobless claims have flipped back to positive. Here are both metrics, with the YoY measure in red, left scale, with the measure normed from the April bottom at 100 on the right scale:

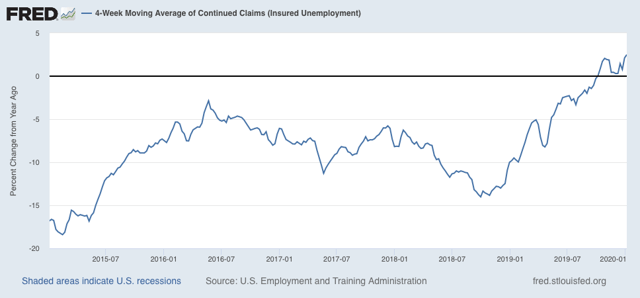

Only continuing claims, less leading but less noisy, continue to flash yellow: the 4 week average, at 1,755.5 million, is 2.5% higher than one year ago (I would need a reading of 5% higher or more YoY for this to flash red):

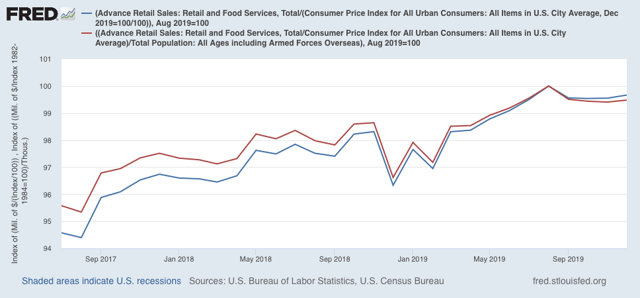

Second, nominal retail sales increased by +0.3% in December, and November was revised slightly higher to +0.3% as well. Since consumer inflation averaged a little less during those two months, real retail sales increased +0.1%. On a per capita basis, they were flat.

Here are both measures, normed to 100 as of their most recent peak in August:

We’ve had similar periods of flatness previously during this expansion, for example late 2018 as shown in the above graph. It would take two more months of readings below the August peak for me to flip this to neutral. For now it remains a weak positive.

The bottom line is that, while there is some flatness, there are no signs of the consumer actually rolling over. Without that, a shallow downturn on the producer side is not enough to tip the whole economy into recession.

Wednesday, January 15, 2020

Producer sales not keeping up with producer price inputs

- by New Deal democrat

Not much economic news today, and I normally don’t spend time on the producer price index, but considering the shallow producer recession and whether it will get deeper or not, as it happens the PPI does play into one metric.

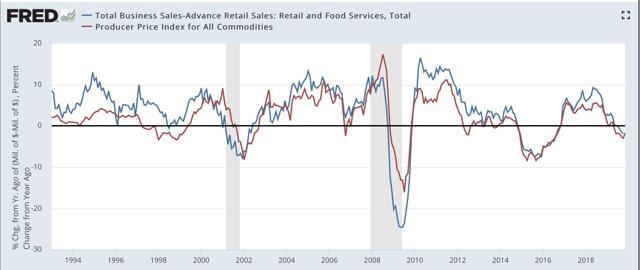

Below is a YoY graph of *nominal* manufacturing + wholesale sales (blue) since the inception of the series 25+ years ago vs. the PPI for all commodities (red):

There have only been three times that commodity prices have outpaced producer sales for longer than 2 months during that whole period: late 2002 when economists were worried about a “double dip” recession after 2001, and leading into and during the 1991 and 2008 recessions.

In other words, when commodity price increases outpace sales increases, the producer side of the economy is in trouble.

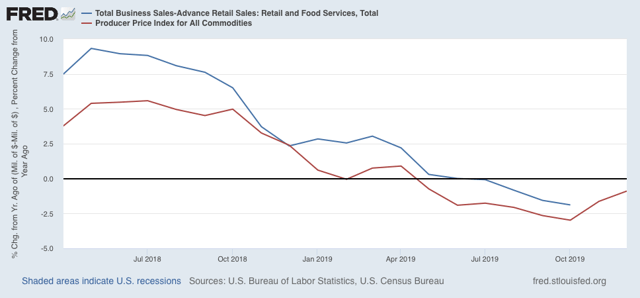

Now here are the last 20 months including December producer prices:

We’ll get manufacturing and wholesale sales for *November* tomorrow. But the obvious point is, unless we get significantly better sales numbers than we got one year ago (and November and December 2018 stunk, so it’s certainly possible!), producer sales won’t have kept pace with producer prices, yet another sign after poor ISM manufacturing and YoY heavy truck sales readings, that the producer side recession has taken hold.

Tomorrow will also give us retail sales, the gold standard for the consumer sector, so stay tuned.

Tuesday, January 14, 2020

Real wages declined slightly in Q4 2019; nearly flat since last January

- by New Deal democrat

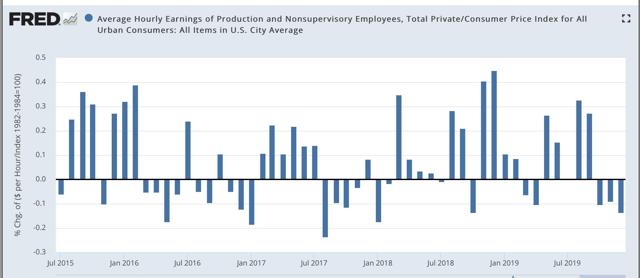

In December consumer inflation was +0.2%. Since in last Friday’s jobs report average hourly earnings also increased +0.1%, real average hourly earnings declined slightly:

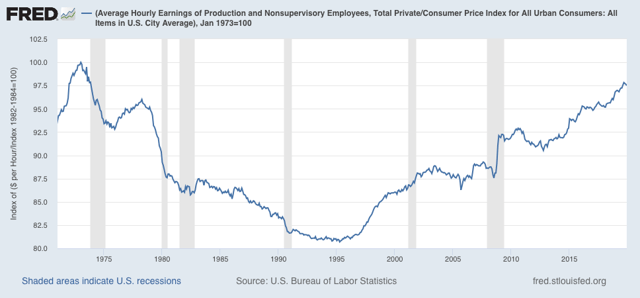

In a longer term perspective, this means that real wages also declined from 97.8% to 97.5% of their all time high in January 1973:

The YoY measure of real average wages also declined sharply from +1.6% to +0.7%:

[Note however that this is subject to the same quirks as I discussed yesterday in terms of YoY nominal wage growth for December, so a rebound in January would hardly be a surprise]

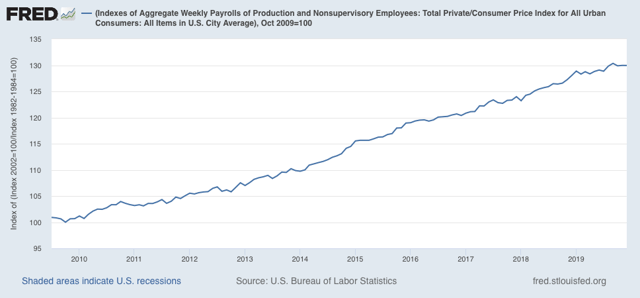

Aggregate hours and payrolls improved significantly between July and September, but have declined slightly in the three months since, so real aggregate wages - the total amount of real pay taken home by the middle and working classes - have declined from 30.4% to 30.0% above their October 2009 trough at the beginning of this expansion:

Real aggregate wage gains have only been +0.8% in the past 11 months. As with so much other data, this is on the cusp of warranting at least a yellow flag. I’ll have more to say once retail sales are reported later this week.

Monday, January 13, 2020

Scenes from the December jobs report: leading jobs sectors and wages

- by New Deal democrat

Let’s take a more detailed look at last Friday’s December jobs report.

First, as usual for the past few months, let’s look at the more leading jobs sectors. This month, let’s also take a more detailed look at wage growth and why it may have suddenly decelerated.

As an initial note, revisions going back to late 2017 are going to be available next month, and preliminarily it was already indicated that these will be strongly negative to the tune of several hundreds of thousands overall. In short, as weak as some of the numbers look now, they are likely to be even weaker when we see them next month.

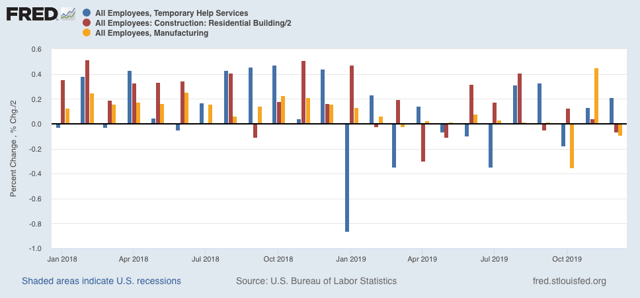

Here is this month’s update to the three leading sectors of employment that I have been tracking: temporary help (blue in the graph below), manufacturing (gold), and residential construction (red). Here’s what they look like compared with 2018, showing the slowdown this year (remember that the GM strike is responsible for the big swings in manufacturing in October and November):

In November, residential construction had looked like it had rebounded from its losses earlier this year, more confirmation of the rebound in the long leading housing sector - but that was revised away this month!

Temporary help had seemed to defy the gloomy weekly statistics that have been worsening this year in the American Staffing Association report - except that, month after month for 12 months, there has been a consistent pattern of downward revisions. Below are the original number for the last six months on the left, followed by the first and then final revisions to the right:

JUL +2200 -7300* -10,500 (Net -12,700)

AUG +15,400 +14,500 +9500 (Net -5900)

SEP +10,200 +20,100 +9900 (Net -300)

OCT -8100 +3800 -5400 (Net +2700)

NOV +4800 +4000* (Net -800)

DEC +6400

*1st revision only

A similar pattern has emerged for manufacturing employment (initial and final numbers only):

APR +4. +3 (-1)

MAY +3 +2 (-1)

JUN +17 +10 (-7)

JUL +16 +4 (-12)

AUG +3 +2 (-1)

SEP -2 +2 (+4)

OCT -36 -45 (-9)

NOV +54 (+4)*

DEC -12

*1st revision only

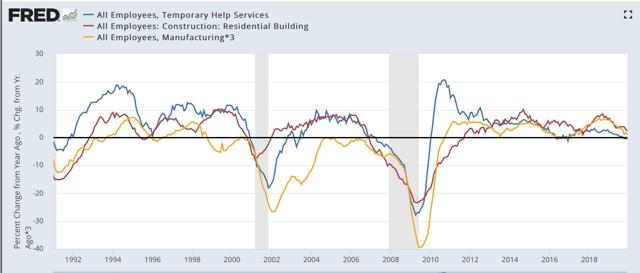

Here are the same three sectors but measured YoY for the past 30+ years:

Note that all three turned negative months before either of the past two recessions (the manufacturing and residential construction jobs series existed before then; they were both negative YoY before the 1991 recession as well). Only temporary help is negative YoY right now.

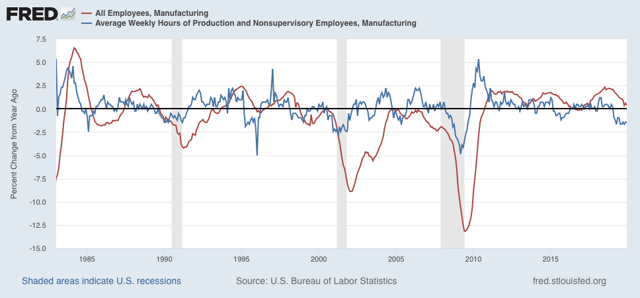

Next, the average manufacturing workweek is now down a full 1.0 hour per week YoY from its peak. Although I only show data from 1983 onward below, going back 70 years there have only been 2 occasions where such a decline lasted longer than one month without a recession happening (1953 and 1966). In the modern era shown, only in 1985 and 1995 for one month apiece were there 1 hour declines without a recession following. A look at the YoY% change in manufacturing hours for the past 35 years also shows that such losses have *always* led to actual YoY losses in manufacturing jobs:

In short, in 2019, manufacturing only added 46,000 jobs, or less than +0.4%, and we should expect more and significant actual losses in manufacturing jobs going forward.

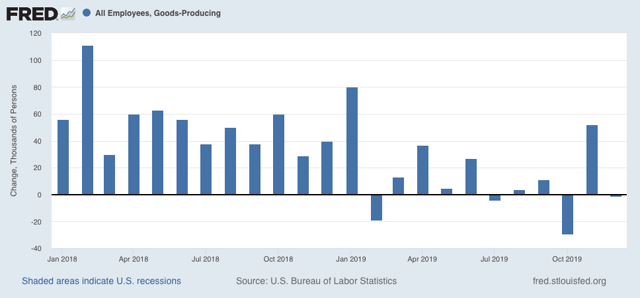

More broadly, only 176,000 jobs were added in the entire goods-producing sector all year (and 80,000 of those were in last January):

There were YoY losses in goods-producing jobs before all of the past 3 recessions, and going back 70 years, counting 12 recessions, in all but 3 there has been steep deceleration before and actual losses no later than two months into the recession, with only 2 false positives (1966 and 1985). Thus the current situation is consistent with at very least a severe slowdown.

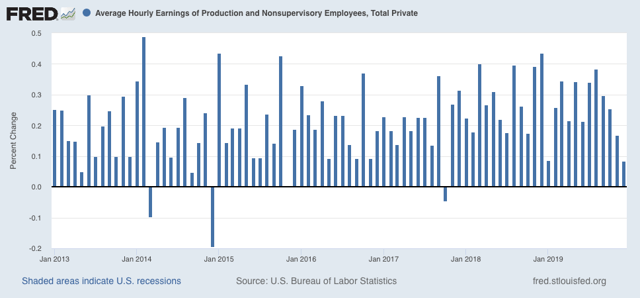

Now let’s turn to wages. December’s nominal growth of +$.02 per hour, or less than +0.1%, was one of the weakest readings in the past 7 years:

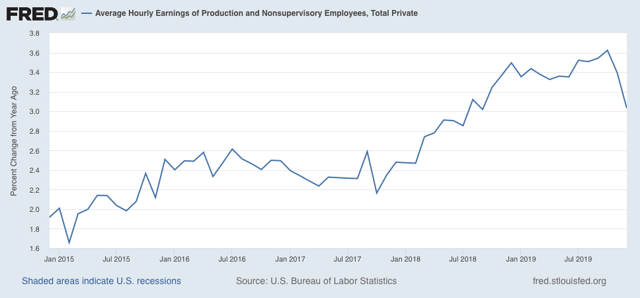

As a result, nominal YoY wage growth for non-managerial workers declined sharply to +3.0% from a peak of +3.6% only two months ago:

This has already received a lot of attention since Friday, but let me call your attention to two points. The first is that, as you can see from the first graph above, there is something of an anomaly in that not only did December replace an exceptionally strong reading from December 2018, but January 2019’s wage gains were also very week. In other words, if we get a decent number next month, the YoY% change will rebound significantly.

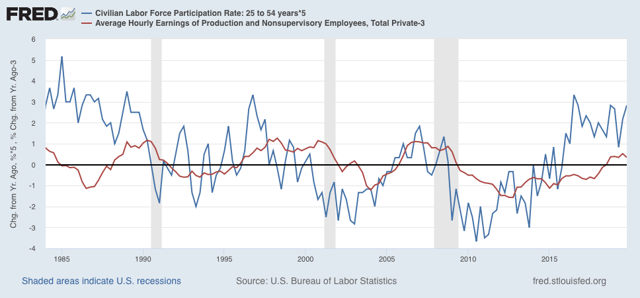

Secondly, there seems to be something of an inverse relationship in the short term (I.e., over a year or less) between big gains/declines in labor force participation and wage growth. Here’s what the two look like, averaged quarterly to cut down on noise, for the past 35 years:

While *cyclically* the two move in the same direction, with a significant lag between participation and wage growth (wage growth being a long lagging economic indicator), over the shorter term we can see where a big decline in participation coincides with or precedes with a few month delay a stabilization in wage growth, while a big increase in participation coincides with or precedes with a few month delay a halt or decline in wage growth. It’s possible this is due to the mix of jobs being different, if lower-paying jobs grow more than other job categories. It may also be that the increased competition for jobs due to more participants acts to suppress wage growth.

In any event, we had a surge in participation in the latter part of last year, and so it is not a big surprise that there would at least be a pause in wage growth.

Sunday, January 12, 2020

The 2020 Electoral College playing field expands for Democrats

- by New Deal democrat

Polling firm Morning Consult has an interactive graph measuring Trump approval by State for each month since January 2016. You can visit it here.

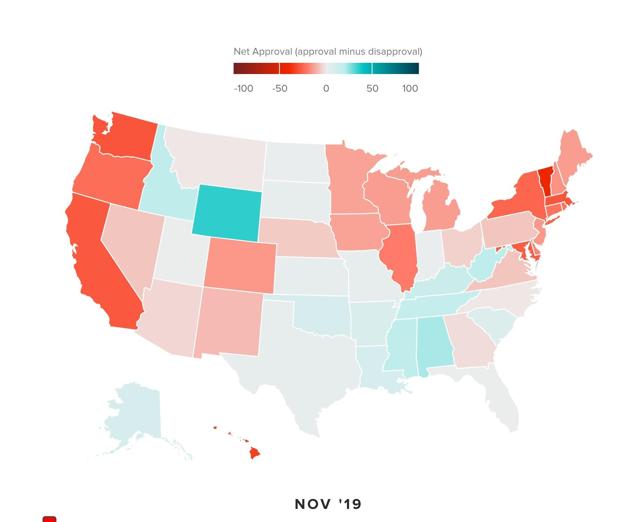

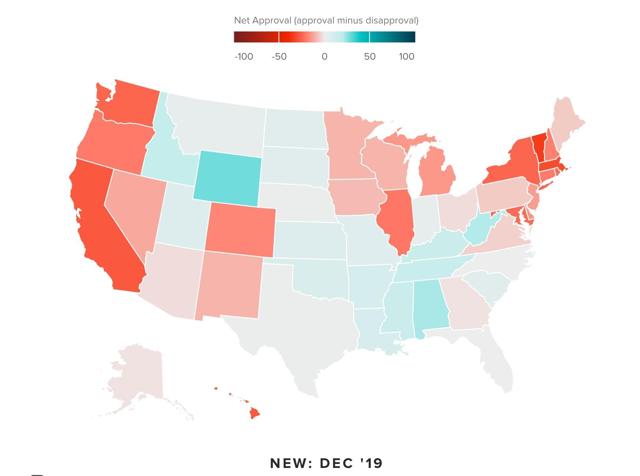

Anyway, while there is obviously some variation from month to month, the latest two months shown below in chronological order, November and December, show - in shades from light pink to red - all of those States that the Democratic candidate has the most decent chance of carrying:

November:

December:

Most of the States are obvious, but in addition to several known battlegrounds: Arizona and North Carolina in particular; there are a few States that you wouldn’t expect: Alaska, Montana, Nebraska, Iowa, and Georgia. Note also that Ohio has returned to the Democratic fold. The only negative surprise is that Florida remains pretty elusive (although for a few months in the past it has shown net disapproval).

I suspect that the impact of tariffs is the reason for the western States in the list above showing net disapproval. If the Democratic nominee pledges to take action to resolve the trade wars, it seems like there is an opening.

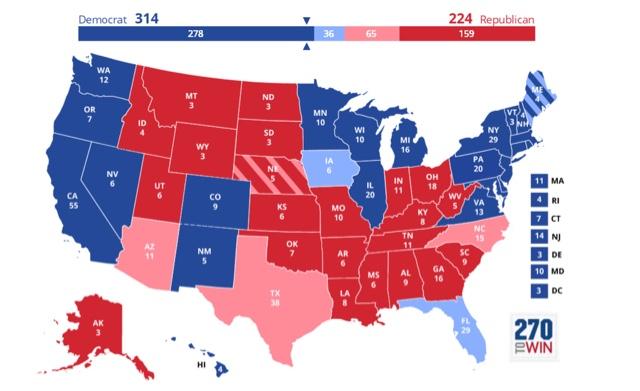

Just for comparison, here is the map of total votes by party in Congressional races for each State in 2018:

As I’ve pointed out before, in North Carolina really about 52% of all votes were cast for Democrats, so that ought to be shown in blue. But we’ve seen a further expansion of the playing field in 2019.

Subscribe to:

Comments (Atom)