Saturday, January 14, 2017

Weekly Indicators for January 9 - 13 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com.

Short term indicators are almost uniformly positive. Meanwhile the "Trump election effect" is fading.

Friday, January 13, 2017

How close are we to "full employment"?

- by New Deal democrat

Paul Krugman ignited a small kerfluffle this week when he suggested that we are close enough to full employment that any fiscal stimulus would lead to "crowding out." Jared Bernstein disagreed.

I think Bernstein is correct. We aren't yet at full employment.

One way to look at this is to compare the UNemployment rate (U3) with the UNDERemployment rate (U6):

In the above graph, we see that in the last two expansions, the U6 rate was at its current 9.5% rate, when U3 was about 5.3%. In other words, our current situation is akin to what we had at 5.3% unemployment in the last two expansions -- not a recession rate to be sure, but not full employment either.

An even better way, I think, is to look at two perennially lackluster employment series: "Not in the Labor Force, but Want a Job Now" and "Part Time for Economic Reasons."

In the below graphs I show how they compare with the official unemployment rate during this expansion vs. the prior two expansions (the "part time" series only goes back to 1994).

Here is Not in Labor Force, but Want a Job Now:

During the best years of both expansions since 1994, about 4.6 million people +/-300,000, put themselves in this category. As of December 2016, this was at about 5.6 million people -- or 1 million over periods of full employment.

Here is Part Time for Economic Reasons:

During the best years of the 1990s expansion, a little over 3 million people put themselves in this category. During the weaker 2000s expansion, it was a little over 4 million. This too as of December 2016 stood at about 5.6 million people.

In other words, to get to the best years of even the weaker 2000s expansion, we would need 1 million people who want a job to enter the workforce, plus another 1.5 million part-timers to find full time employment.

As of last month, the civilian labor force was 159,640,000 people. Thus we need a little over 1.5% improvement in the employment situation (2.5 million of 160 million) to get to what constituted full employment in the last two expansions.

Thursday, January 12, 2017

Corporate profits lead stock prices, year-end 2016 update

-by New Deal democrat

Corporate profits, as a long leading indicator, tend to lead stock prices, which are a short leading indicator. I've updated this analysis through year-end 2016, This post is up at XE.com.

As an aside, I will post my forecast for the second half of 2017 once Q4 GDP, which will include the long leading indicators of private residential investment and proprietors' income, is reported in two weeks.

Wednesday, January 11, 2017

Gas prices set to drive inflation over Fed's target

- by New Deal democrat

In case you hadn't already noticed, that big decline in gas prices you saw at the pump has come to an end. At the moment gas prices are up about 20% YoY. Thus gas prices are one of my five graphs to watch in 2017.

Which means, this is a good time to revive a back-of-the-envelope calculation I used to do when gas prices of $4 would act as a choke collar on economic growth.

The calculation goes like this: core inflation has reliably run at +0.1% or +0.2% a month. Almost all of the variability in the remaining number is due to gas prices. Based on past experience, take the change in gas prices in any given month, divide it by 10, and add that to the underlying core inflation rate. That will give you the non-seasonally-adjusted inflation rate for any given month, +/-0.1%.

Here's what that looks like over the last year. Blue is the average change in gas prices in the month divided by 10, red the non-seasonally-adjusted inflation rate, and green the seasonally adjusted inflation rate:

Note that gas prices rose in December 2016, unlike December 2015. That suggests that December 2016 inflation, after seasonal adjustment, is likely to be about +0.2%. Since December 2015 was -0.3%, that will raise the YoY inflation rate from 1.7% to over 2%.

Since consumer inflation bottomed in February of last year, here's what consumer inflation looks like since then:

Tuesday, January 10, 2017

Taiwan Isn't Large Enough to Meaningfully Leverage Against China

China has a GDP of a little over 11 Trillion dollars while Taiwan's is 523 billion. China is over 20 times as large as Taiwan. It simply isn't large enough to leverage against China.

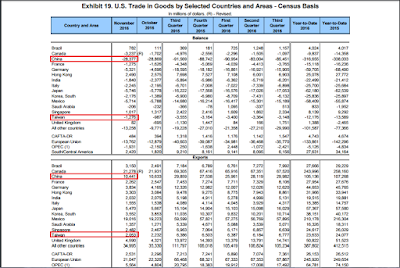

We see the same thing when we look at the most recent trade information from the Census Bureau:

Our balance of trade with China is 22x larger than that with Taiwan (top panel). Our exports to China are 5x larger than those with Taiwan.

Trying to use Taiwan against China is a fool's errand from the start.

We see the same thing when we look at the most recent trade information from the Census Bureau:

Our balance of trade with China is 22x larger than that with Taiwan (top panel). Our exports to China are 5x larger than those with Taiwan.

Trying to use Taiwan against China is a fool's errand from the start.

Monday, January 9, 2017

Why John Taylor -- a Leading Candidate to Replace Yellen -- Shouldn't Be Fed President

From Bloomberg:

With just over a year remaining on Janet Yellen's current term as chair of the Federal Reserve, comments from three of her potential successors at this this weekend's annual American Economic Association meeting are noteworthy. Glenn Hubbard of Columbia University, along with Stanford University’s John Taylor and Kevin Warsh, are all seen by Fed watchers as potential future chairs should President-elect Donald Trump decide not to re-nominate Yellen. All three criticized the U.S. central bank for trying to do too much, and suggested interest rates would be higher if they were in charge.

There are two reasons Taylor should not lead the Fed:

1.) He is the leading proponent of having the Fed use mechanical rules to determine policy. Taylor authored the "Taylor Rule," an equation that he believes should completely govern the Fed's interest rate policy. The rule is very useful as a basis for policy discussion. Despite that benefit, Taylor's argument assumes his equation is infallible -- that it will always be correct in any circumstance. That assumption is incorrect; nothing, especially in economics, is that simple. There is always "another hand" that should offer policy guidance. And binding the Fed's hands would have prevented them from engaging in the extraordinary measures during and after the Great Recession.

2.) Taylor continually compared the Obama recovery to the Reagan recovery, an economic apples to oranges comparison. The Federal Reserve caused the recession preceding Reagan: They increased interest rates to wring inflation out of the economy -- a policy that worked brilliantly. Once rates started to move lower, the economy faced little to no structural headwind to naturally slow economic growth. Perhaps just as important, Reagan's tenure began just as the baby-boomers were beginning their peak earnings time in life. This started a long period when the labor force participation rate increased, adding additional stimulus to the economy.

Obama's recovery was preceded by an entirely different precursor: a debt-deflation recession and recovery. This is an entirely different economic scenario then that faced by Reagan and one that leads to a far slower recovery. In a post-debt deflation economy, consumers are burdened by debt values that, ins some cases, are higher than asset values, leading to slower spending as consumers allocate additional resources to paying down debt rather than other goods. The de-leveraging process can take years, acting as a slight to large drag on economic growth. And unlike Reagan, Obama faced a declining LFPR as the baby boomers started to retire, which also lowered GDP growth.

Taylor has yet to acknowledge either fact in his analysis. There are two possible reasons for his oversight. 1.) He is unaware of the difference between the recoveries. Given Taylor's stature, this is highly doubtful. But it this is the reason is is automatically disqualifying because it belies a profound ignorance of economic history. 2.) He is aware of the differences, but for political reasons refused to acknowledge them. This is the more likely reason. Taylor is a University of Chicago economist; he is inherently biased against government action and activist policy. However, if this is the reason, it is also disqualifying because it indicates he is more interested in political outcomes than positive economic outcomes.

With just over a year remaining on Janet Yellen's current term as chair of the Federal Reserve, comments from three of her potential successors at this this weekend's annual American Economic Association meeting are noteworthy. Glenn Hubbard of Columbia University, along with Stanford University’s John Taylor and Kevin Warsh, are all seen by Fed watchers as potential future chairs should President-elect Donald Trump decide not to re-nominate Yellen. All three criticized the U.S. central bank for trying to do too much, and suggested interest rates would be higher if they were in charge.

There are two reasons Taylor should not lead the Fed:

1.) He is the leading proponent of having the Fed use mechanical rules to determine policy. Taylor authored the "Taylor Rule," an equation that he believes should completely govern the Fed's interest rate policy. The rule is very useful as a basis for policy discussion. Despite that benefit, Taylor's argument assumes his equation is infallible -- that it will always be correct in any circumstance. That assumption is incorrect; nothing, especially in economics, is that simple. There is always "another hand" that should offer policy guidance. And binding the Fed's hands would have prevented them from engaging in the extraordinary measures during and after the Great Recession.

2.) Taylor continually compared the Obama recovery to the Reagan recovery, an economic apples to oranges comparison. The Federal Reserve caused the recession preceding Reagan: They increased interest rates to wring inflation out of the economy -- a policy that worked brilliantly. Once rates started to move lower, the economy faced little to no structural headwind to naturally slow economic growth. Perhaps just as important, Reagan's tenure began just as the baby-boomers were beginning their peak earnings time in life. This started a long period when the labor force participation rate increased, adding additional stimulus to the economy.

Obama's recovery was preceded by an entirely different precursor: a debt-deflation recession and recovery. This is an entirely different economic scenario then that faced by Reagan and one that leads to a far slower recovery. In a post-debt deflation economy, consumers are burdened by debt values that, ins some cases, are higher than asset values, leading to slower spending as consumers allocate additional resources to paying down debt rather than other goods. The de-leveraging process can take years, acting as a slight to large drag on economic growth. And unlike Reagan, Obama faced a declining LFPR as the baby boomers started to retire, which also lowered GDP growth.

Taylor has yet to acknowledge either fact in his analysis. There are two possible reasons for his oversight. 1.) He is unaware of the difference between the recoveries. Given Taylor's stature, this is highly doubtful. But it this is the reason is is automatically disqualifying because it belies a profound ignorance of economic history. 2.) He is aware of the differences, but for political reasons refused to acknowledge them. This is the more likely reason. Taylor is a University of Chicago economist; he is inherently biased against government action and activist policy. However, if this is the reason, it is also disqualifying because it indicates he is more interested in political outcomes than positive economic outcomes.

Five graphs for 2017: #1, real wages and real consumer spending

- by New Deal democrat

In the last week I have described 5 relationships that bear particular watching in 2017.

#5 is the price of gas.

#4 is the value of the US$

#3 is mortgage rates and residential construction

#2 is inflation and the Fed funds rate.

#2 is inflation and the Fed funds rate.

The overall theme is that 2017 is likely to be a rather typical year of late cycle inflation, possibly also featuring a trade war.

The number one graph I am looking at this year is how consumers are affected by, and deal with, this late cycle inflationary environment.

The number one graph I am looking at this year is how consumers are affected by, and deal with, this late cycle inflationary environment.

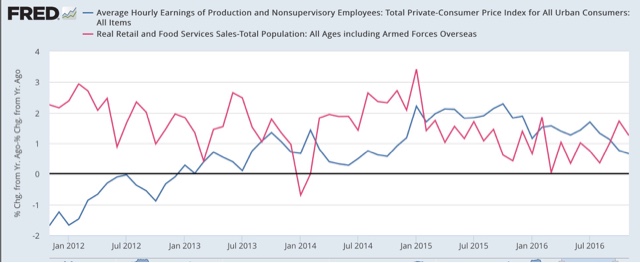

In the absence of special factors, like spouses entering the workforce in the 1980s, or the housing bubble of the early 2000s, when real wages stagnate, so does real consumer spending (as expressed by real retail sales per capita) with a bit of a lag (red).

Here is the long-term look through 2000 using the former retail sales series (first graph) and the new retail sales series which began in the early 1990s (second graph):

Here are the same two graphs expressed as a YoY%:

When not just one but both stagnate, that is a signal for an oncoming consumer recession.

During this entire expansion, nominal wages for nonsupervisory employees have not grown faster than 2.6% YoY. Since we are still adding jobs faster than the labor force is growing, there ought to be at least a little further improvement than that. But in the last 9 months alone consumer prices have increased by 1.9%, causing real wages to stagnate (blue in the graph below).

For 2017 I don't see any special factor at play, unless there is a tax cut that applies to middle and working class earners enough to boost spending.

Sunday, January 8, 2017

Subscribe to:

Comments (Atom)