- by New Deal democrat

May monthly data reported this past week included the Index of Leading Indicators, up 0.1 and showing no imminent recession, the Empire State and Philly manufacturing indexes, both of which improved, consumer prices up slightly, housing starts and existing home sales up, and permits down. The 6 month trend in housing is up, but at a more muted pace than over the previous year.

Prof. Geoffrey Moore identified 4 long leading indicators, which take over a year to feed into the general economy: bond interest rates, real M2 money supply, housing permits, and corporate profits after taxes. Three of the four (using purchase mortgage applications as a reasonable proxy for permits) are updated in our look at the high frequency weekly indicators, so let's start with them:

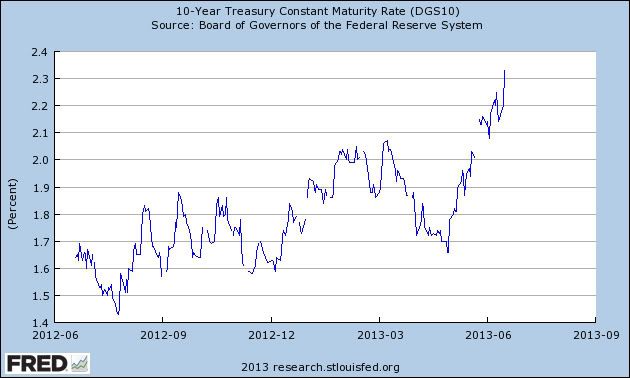

Interest rates and credit spreads

- 5.11% BAA corporate bonds up +0.12%

- 2.20% 10 year treasury bonds up +0.08%

- 2.91% credit spread between corporates and treasuries up +0.04%

Housing metrics

Mortgage applications from the Mortgage Bankers Association:

- -3% w/w purchase applications

- +12% YoY purchase applications

- -3% w/w refinance applications

Housing prices

- YoY this week +7.9%

Real estate loans, from the FRB H8 report:

- +0.4% w/w

- up +1.1% YoY

- +2.7% from its bottom

Money supply

M1

- -4.4% w/w

- +1.8% m/m

- +11.4% YoY Real M1

M2

- +0.1% w/w

- +0.4% m/m

- +5.6% YoY Real M2

Employment metrics

American Staffing Association Index

- 93 up 1 w/w, down -0.5% YoY

- 354,000 up +20,000

- 4 week average 348,250 up +3000

- $111.9 B for the first 14 days of June vs. $103.5 B last year, up +8.4 B or +8.1%

- $151.0 B for the last 20 reporting days vs. $140.1 B last year, up $10.9 B or +%7.8

Transport

Railroad transport from the AAR

- +1500 or +0.5% carloads YoY

- +1900 or +1.1% carloads ex-coal

- +4300 or +1.7% intermodal units

- +5900 or +1.1% YoY total loads

- Harpex unchanged at 403

- Baltic Dry Index up 127 to 1027

Consumer spending

- ICSC +0.3% w/w +2.5% YoY

- Johnson Redbook +2.9% YoY

- Gallup daily consumer spending 14 day average at $93 up $23 YoY

Oil prices and usage

- Oil $93.69 down -$4.16 w/w

- Gas $3.63 down -$0.03 w/w

- Usage 4 week average YoY -0.4%

Bank lending rates

- 0.23 TED spread unchanged w/w

- 0.193 LIBOR up +0.003% w/w

JoC ECRI Commodity prices

- down -1.88 to 121.33 w/w

- +6.53 YoY

Positives included strong consumer spending once again. More positives included house prices, YoY purchase mortgage applications, overnight bank rates, both rail and shipping transport, and gas prices. Jobless claims and commodity prices rate as neutrals this week.

The sharp rise in interest rates is definitely of concern, but it hasn't lasted long enough to seriously signal a recession next year. Housing is weakening but still positive. In terms of coincident indicators of the economy, consumer spending is still quite positive, and initial jobless claims, while trending sideways for the last month or so, show no signs of rolling over.

Have a nice weekend.