- by New Deal democrat

Absolutely no monthly data of any significance was reported during the last week, except for the actual surplus the US government ran last month. So let's get directly to the high frequency weekly indicators and start again with transport:

Transport

Railroad transport from the AAR

- +7700 or +2.8% carloads YoY

- +5200 or +3.1% carloads ex-coal

- +6700 or +2.8% intermodal units

- +14,400 or +2.8% YoY total loads

- Harpex up 1 to 397

- Baltic Dry Index up 6 to 884

Consumer spending

- ICSC -1.0% w/w +2.4% YoY

- Johnson Redbook +2.3% YoY

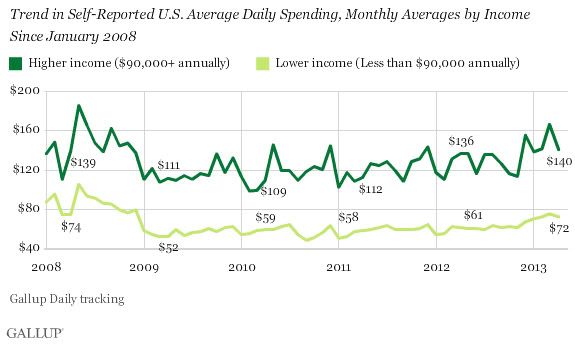

- Gallup daily consumer spending 14 day average at $90 up $23 YoY

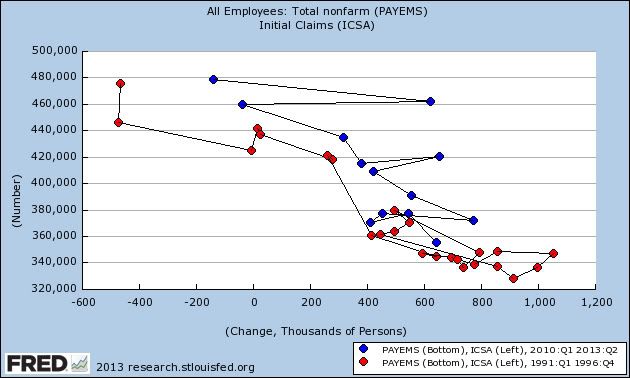

Employment metrics

Initial jobless claims

- 323,000 down 1,000

- 4 week average 336,750 down 5,500

- 93 up 1 w/w, up +0.2% YoY

Daily Treasury Statement tax withholding

- $130.5 B (adjusted for 2013 payroll tax withholding changes) vs. $135.1 B, or -3.4% YoY for the last 20 days. The unadjusted result was $151.5 B for a 12.4% increase.

- $56.2 B was collected for the first 7 days of May vs. $50.0 B unadjusted in 2012, a $6.2 B or a +12.4% increase YoY.

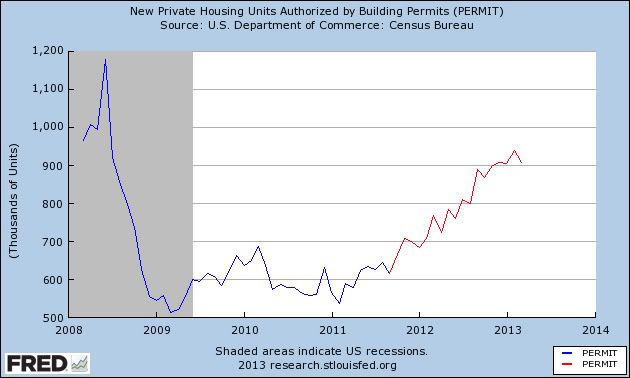

Housing metrics

Housing prices

- YoY this week +6.6%

Real estate loans, from the FRB H8 report:

- up 9 or +0.3% w/w

- up 16 or +0.5% YoY

- +2.4% from its bottom

Mortgage applications from the Mortgage Bankers Association:

- +2% w/w purchase applications

- +12% YoY purchase applications

- +8% w/w refinance applications

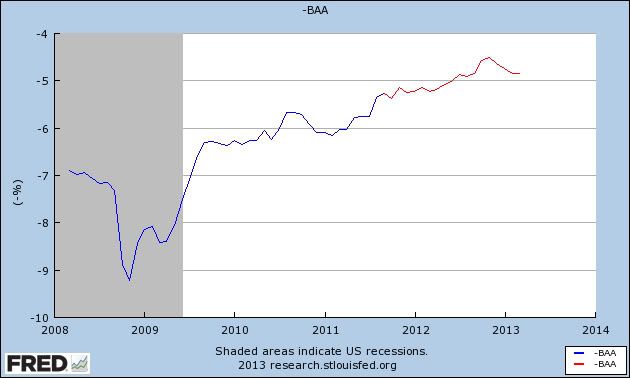

Interest rates and credit spreads

- 4.52% BAA corporate bonds down -0.01%

- 1.70% 10 year treasury bonds down -0.03%

- 2.82% credit spread between corporates and treasuries up +0.02%

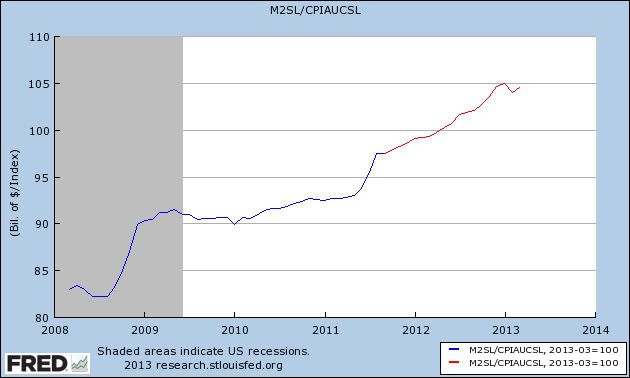

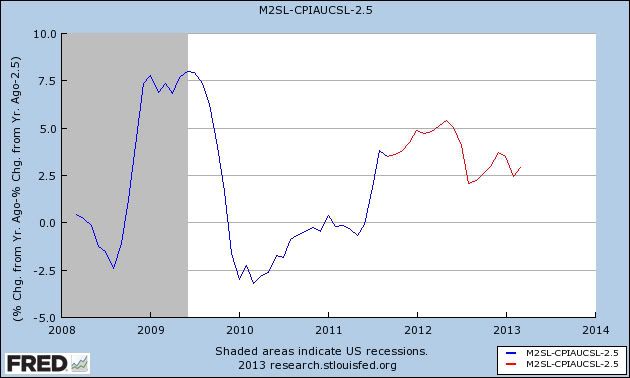

Money supply

M1

- +1.0% w/w

- +3.0% m/m

- +11.8% YoY Real M1

M2

- +0.3% w/w

- +0.2% m/m

- +5.4% YoY Real M2

Oil prices and usage

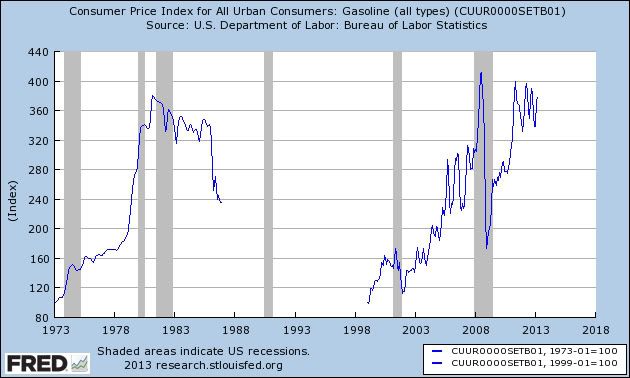

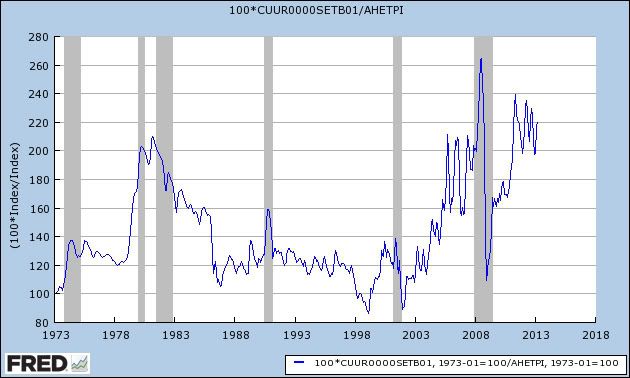

- Oil $96.04 up +$0.43 w/w

- Gas $3.54 up +$0.02 w/w

- Usage 4 week average YoY -2.4%

Bank lending rates

- 0.25 TED spread unchanged w/w

- 0.2000 LIBOR unchanged w/w

JoC ECRI Commodity prices

- up 0.15 to 125.58 w/w

- +2.25 YoY

Positives included house prices, and both purchase and refinancing mortgage applications. Initial claims continued their terrific recent run. Money supply was positive. Overnight bank rates are somnolent. Consumer spending as mesured by same store sales is decent. Gallup consumer spending continues on a tear. Rail traffic had the best week in over a month. Even tax withholding, when compared with its adjusted YoY results over the last four months, had its best comparative weekly result yet.

This is about as good a weekly batch of statistics as could be hoped for, and I'll take it. Have a nice weekend.