- by New Deal democrat

The big news was the continuing expansion of employment in April, and the decline in the unemployment rate. Average hourly earnings increased, but the workweek decreased. As the manufacturing workweek is a component of the Index of Leading Indicators, this will be reflected in that compilation. April light vehicle sales declined. The ISM manufcaturing index was barely positive, the Chicago PMI barely negative. ISM services were positive.

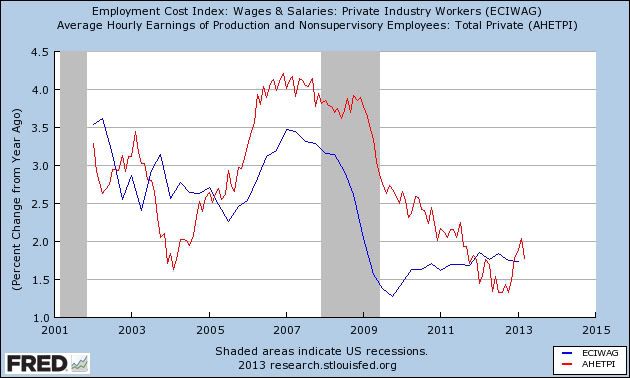

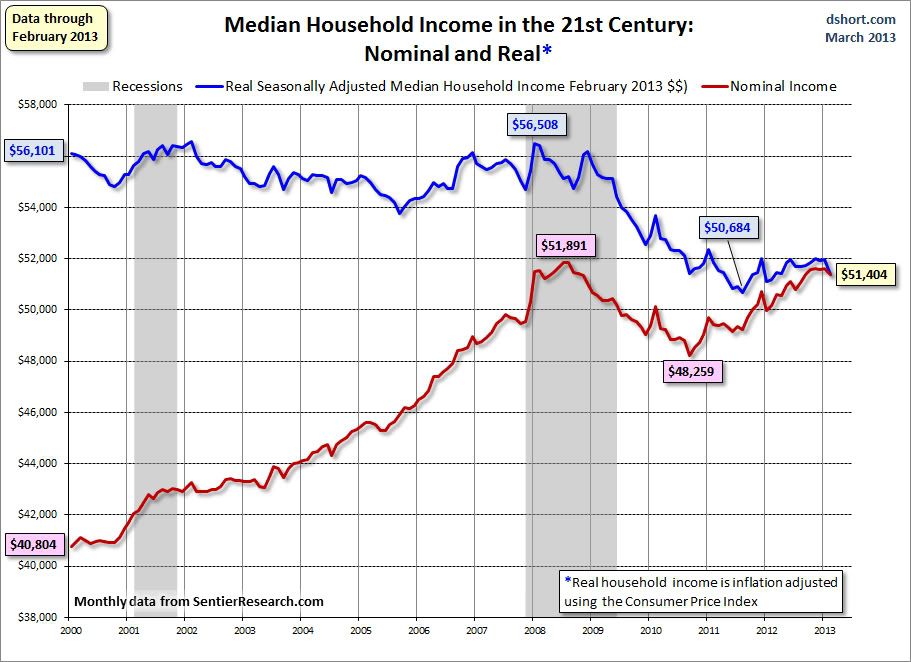

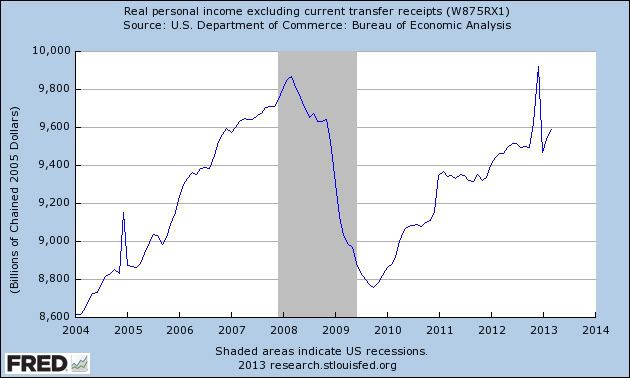

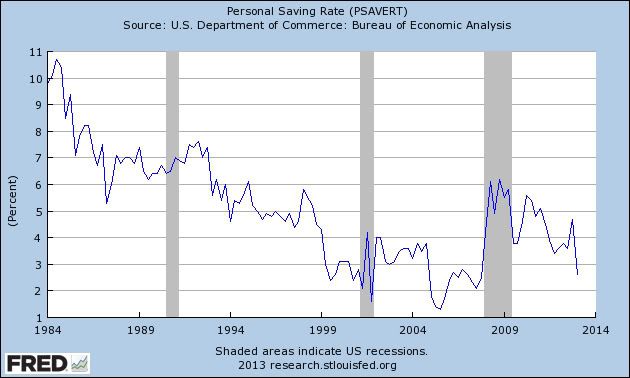

In the rear view window, Q1 productivity and unit labor costs, and the employment cost index all rose. March factory orders and construcition spending declined. Pending home sales rose slightly, as did the Case-Shiller home price index. Personal income and spending both rose as the personal savings rate remained flat at a very low level.

Let's start this week's look at the high frequency weekly indicators by looking at transports and consumer spending, which were the two areas with significant changes last week:

Transport

Railroad transport from the AAR

- -7200 or -2.6% carloads YoY

- -6200 or -3.5% carloads ex-coal

- +5100 or +2.1% intermodal units

- -2100 or -0.4% YoY total loads

- Harpex up 5 to 396

- Baltic Dry Index up 7 to 878

Consumer spending

- ICSC +0.4% w/w +2.6% YoY

- Johnson Redbook +2.8% YoY

- Gallup daily consumer spending 14 day average at $89 up $20 YoY

Employment metrics

Initial jobless claims

- 324,000 down 15,000

- 4 week average 342,250 down 15,250

- 92 unchanged w/w, down -0.04% YoY

Daily Treasury Statement tax withholding

- $128.4 B (adjusted for 2013 payroll tax withholding changes) vs. $134.7 B, or -4.7% YoY for the last 20 days. The unadjusted result was $149.5 B for a 11.0% increase.

- $163.6 B was collected during April vs. $148.6 B unadjusted in 2012, a $15.0 B or a +10.1% increase YoY.

Housing metrics

Housing prices

- YoY this week +5.8%

Real estate loans, from the FRB H8 report:

- down 2 or -0.1% w/w

- up 12 or +0.3% YoY

- +2.1% from its bottom

Mortgage applications from the Mortgage Bankers Association:

- -1.4% w/w purchase applications

- +13% YoY purchase applications

- +3% w/w refinance applications

Interest rates and credit spreads

- 4.53% BAA corporate bonds down -0.01%

- 1.73% 10 year treasury bonds unchanged

- 2.80% credit spread between corporates and treasuries down -0.01%

Money supply

M1

- +1.2% w/w

- +3.7% m/m

- +10.9% YoY Real M1

M2

- -0.2% w/w

- +0.7% m/m

- +5.7% YoY Real M2

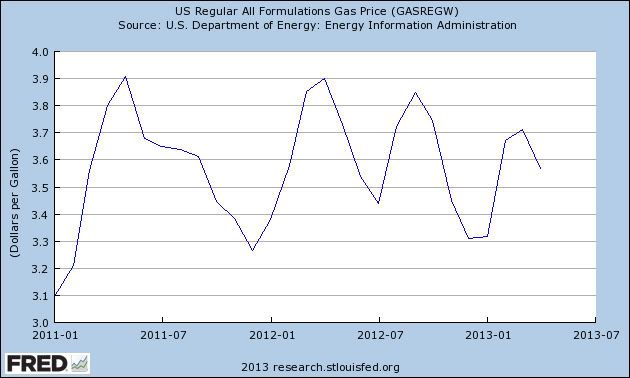

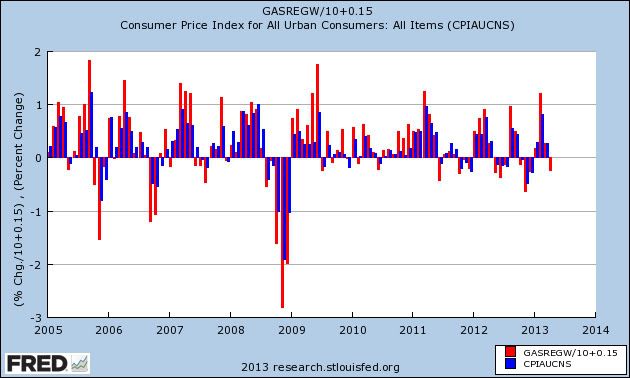

Oil prices and usage

- Oil $95.61 up +$2.61 w/w

- Gas $3.52 down -$0.02 w/w

- Usage 4 week average YoY -1.8%

Bank lending rates

- 0.23 TED spread unchanged w/w

- 0.2000 LIBOR unchanged w/w

JoC ECRI Commodity prices

- down 1.69 to 125.43 w/w

- +0.35 YoY

The high frequency indicators were more mixed this week. All money indiators, including money supply, corporate bond rates and interest rate spreads, and bank lending rates, were positive. Housing prices and mortgage applications were positive. Jobless claims were extremely positive. Consumer spending, which had been weakening, turned more positive again. Shipping rates were positive. Gas prices hit new multi-month lows.

Negatives again included rail shipments, joined this week by temporary staffing, which continues to deteriorate. Oil prices increased. Commodities tumbled.

Tax withholding remains a question mark. It is negative after my best estimated adjustment, which is obviously off, but relative to the last few months, this past week was very good.

This was a positive week, marked by low gas prices and low initial claims, but temporary staffing and rail weakness are a real concern. So long as the consumer keeps spending, we are keeping our heads above water.

Have a nice weekend.