Friday, November 30, 2012

ECRI concedes it was wrong

- by New Deal democrat

Yesterday Lakshman Achuthan made the rounds of business television shows to once again announce their 14+ month old recession call. This time he came armed with a graph of 4 coincident series, arguing that the expansion peaked in July (see video link below to view graph).

Indeed as of this morning, 3 of the 4 coincident indicators normally used to mark the onsets of recessions and recoveries are off their peaks (industrial production, real retail sales, and real income ex transfer receipts). Employment of course is still positive. As an aside, ECRI uses real manufacturing and trade sales, for which we have data through September, and at that time those sales were only -0.1% off their April 2012 peak).

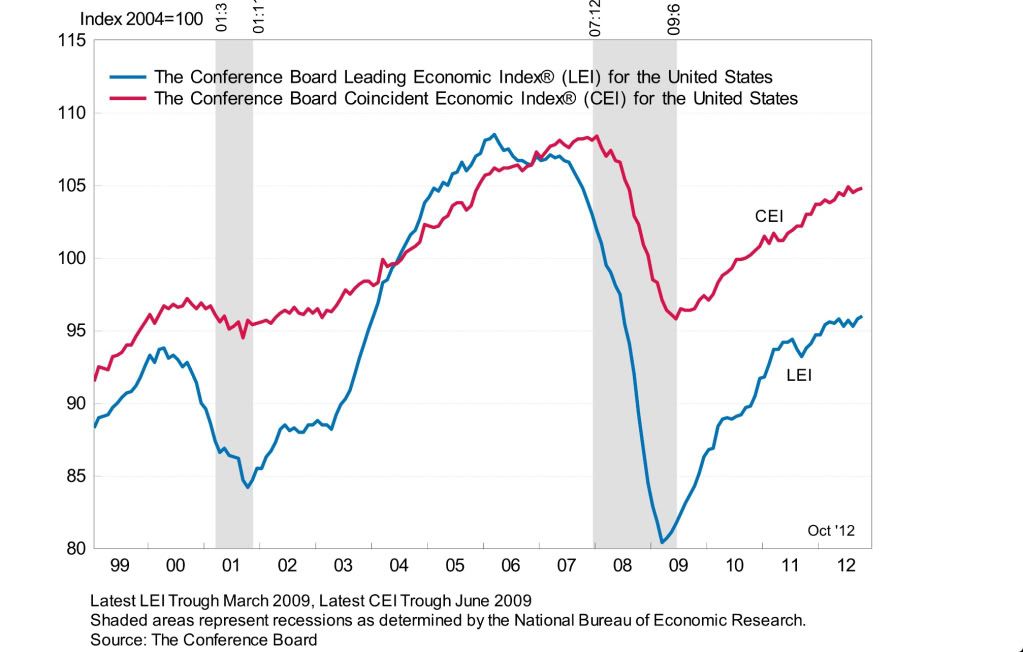

It is possible that if the slide in the data continues, the NBER could ultimately decide that presently we are in a recession, probably with a start date of August 2012. Such a slide, however, has a lot to do with things that aren't (and really couldn't be) in Leading Indicators - tension in the Gulf of Hormuz sending gas prices soaring in late summer, the fiscal cliff, and most of all Hurricane Sandy. That might be enough to tip the "inching higher" Conference Board LEI into an "inching lower" economy.

But here's the problem:

1. ECRI's first announcement, in September 2011, was that we were already IN a recession, or one was imminent, with a start date in Q3 or A4 of 2011. Here's the video:

2. In December, they revised it to a recession "by midyear" 2012, but most likely begining in Q1 2012.

3. On July 10, Achuthan gave an interview to Bloomberg TV in which he said a recession had already started. Here's the link:

http://www.bloomberg.com/video/ecri-s-achuthan-says-u-s-economy-is-in-recession-8B7WivlWSb~6ufDTVKeOoQ.html

Between the 0:50 mark and the 1:12 mark, Achuthan specifically admits to the call in paragraph 2 above, and specifically states that as of the date of his interview, a recession has already begun.

So with the current "announcement" that the peak of activity was in July, presumably meaning a recession started in August, ECRI is factually conceding without saying so, that it's first three forecasts were wrong.

Not that they'll ever admit to that.

Are we in a recession now? The November data is probably going to be bad, mainly due to Sandy. We won't get the December data until January. Once we see if we get a rebound from Sandy, and if so how much, we'll be in a better position to tell. In the meantime, my best information is that the economy is "shambling along."

-----

P.S. I'll have the Weekly Indicators up at some point this weekend, but I won't swear as to which day and what time.

The economy shambles along: employment

- by New Deal democrat

On Monday I pointed out that there has been a ratcheting down of the economy since march, in a way that hadn't happened in the summers of 2010 or 2011. I described the economy as 'shambling along.'

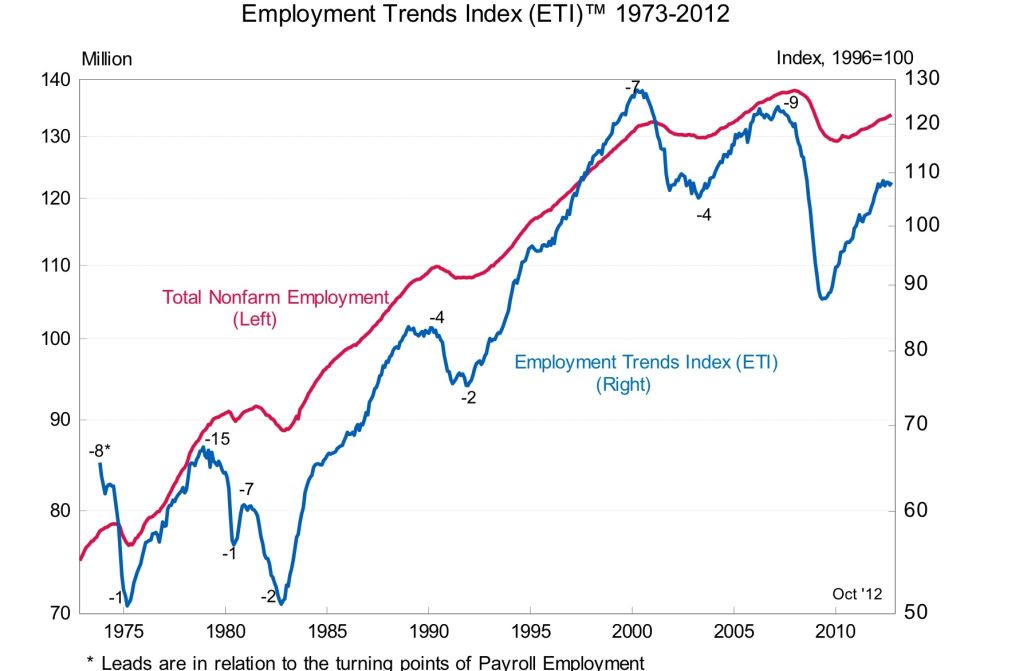

One area where this ratcheting down shows up is in employment. first off, let's look at the Conference Board's "Employment trends index," which is a totally transparent index designed to forecast job gains or losses about 6 months into the future:

Note that this has completely flattened out, presaging a flatlining of employment (but not a contraction).

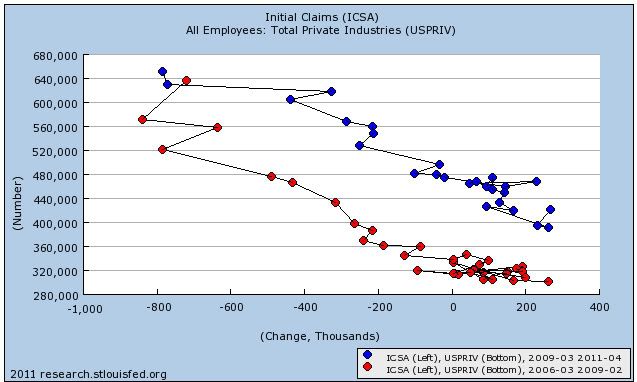

Next, let's return to a scattergraph I began running about 18 months ago, showing the relationship between initial jobless claims and employment. In the graph below, red indicates the months leading up to and in the "great recession" until the peak of initial jobless claims in March 2009. Blue represents the same relationship for the two years thereafter:

The point here is that, relatively speaking, a decline in new hiring precedes an increase in firing going into a recession. Similarly, a relative increase in hiring precedes a decrease in firing coming out of a recession.

Now, here's an update of the data from March 2009 to the present:

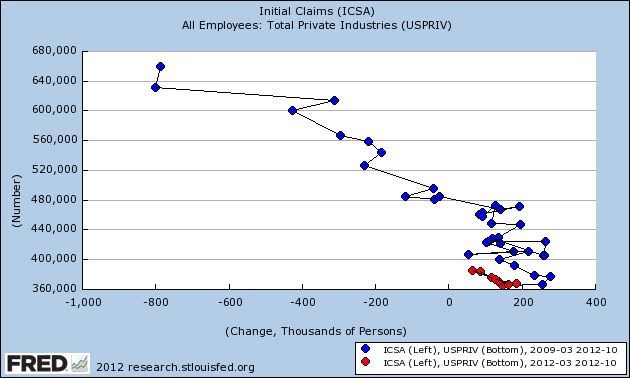

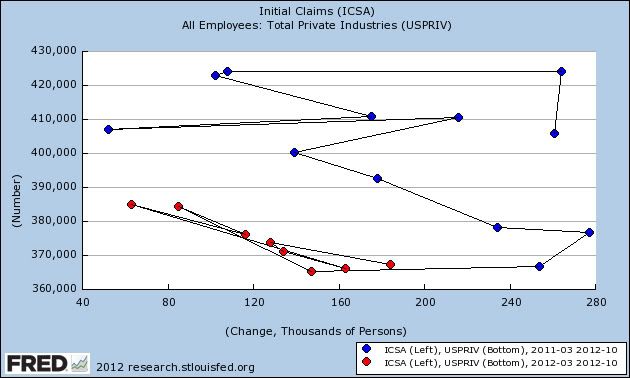

Notice the orange points, from March of this year through October. For the same general level in jobless claims, there has been a decrease in jobs created. There has been, relatively speaking, a decline in hiring.

Finally, here is a close-up of the same data since March 2011. The relative decline in hiring stands out even more:

There is a theory that an unintended seasonality has been introduced into the data, due to the great recession. What this final graph shows is that we have weaker hiring vs. firing even comparing with the same period one year ago, I.e., the seasonality argument does not explain the poor relative pace of hiring vs. firing. When it comes to jobs, there has been a real ratcheting down of the economy this year.

Thursday, November 29, 2012

Initial Jobless Claims: comparing Katrina and Sandy

- by New Deal democrat

Initial jobless claims fell 23,000 this past week but were well above the trend before Sandy hit at the end of October. Is this something we should be concerned about, or is this still the effect of the hurricane? A comparison with jobless claims after Hurricane Katrina suggests that while most of the effect has worn off, the entire effect won't abate for a few more weeks.

Here are initial jobless claims beginning with the first week of August 2005:

2005-08-06 311000

2005-08-13 319000

2005-08-20 315000

2005-08-27 318000 * Katrina hits 8/29

2005-09-03 326000

2005-09-10 422000

2005-09-17 424000

2005-09-24 359000

2005-10-01 384000

2005-10-08 383000

2005-10-15 348000

2005-10-22 324000

As you can see, the effects of Katrina on jobless claims weren't felt until 2 weeks later, when claims shot up by about 100,000. After two weeks, most of the effect wore off, but claims were still at least 30,000 (and as much as 65,000) above the pre-Katrina baseline for 4 more weeks.

Now here is the current data beginning with the first week of October:

2012-10-06 342000

2012-10-13 392000

2012-10-20 372000

2012-10-27 363000 * Sandy hits 10/29

2012-11-03 361000

2012-11-10 451000

2012-11-17 416000

2012-11-24 393000

Just as with Katrina, claims didn't spike up for 2 weeks. Just as with Katrina, most of the spike has disappeared 2 weeks later, but we are still significantly (about 30,000) above the pre-Sandy trend. If the pattern holds true, we will have 3 more weeks of elevated data due to Sandy before the underlying trend is discovered.

The Amazingly Scary Depth of the EU's Recession

The above graph is from the latest Eurostat GDP release for the EU area. Let's consider the following information to illustrate the depth of the EU problem.

1.) The EU 17 and 27 have both contracted YOY for the last two quarters. With the exception of the .1% Q/Q growth for the EU 27 last quarter, we'd be making the same observation for the overall EU 17 and EU 27 Q/Q results. This is what a region wide recession looks like.

2.) Only one of the big countries is doing well -- Germany.

3.) Five countries have been contracting YOY for four straight quarters; Greece, Italy, Cyprus, Netherlands and Portugal. Greece's contraction is especially severe.

4.) Four countries have been contracting YOY for three quarters: Spain, Czech Republic and Hungary.

5.) Four of the give largest economies are either barely growing or shrinking: UK, Spain, Italy and France.

6.) Only three countries are growing at strong rates: Lithuania, Latvia and Estonia.

The Impressive Longterm GLD Chart.

Since 2005, the gold ETF has rallied. It dropped in late 2008 in reaction to the global financial crisis and has moved sideways for the last year and half. However, we've only seen one major retreat in prices.

Wednesday, November 28, 2012

Bonddad's Surgically Induced Vacation

On November 29th, I get to have my left hip resurfaced -- which I call hip replacement light. Put briefly, I was born with bad hips, so this is the only viable option on the table. The good news is that I had my right hip resurfaced 7 weeks ago and it feels great -- better than its felt in about a year. The other piece of good news is that I'm in very good physical shape, so rehab and recovery is easier.

The bad news is that I won't be blogging at least through next Wednesday, December 5. NDD will still be here, and a few other guest posters will be around as well.

I'll probably see you guys sometime late next week.

Bonddad Linkfest

- The new electoral math (Public Opinion Strategies)

- Revenge of the reality based community (Bruce Bartlett)\

- US housing in midst of recovery (Marketwatch)

- Consumer confidence at highest level in four years (Marketwatch)

- US heads to warmest year on record (BB)

- Bank of Thailand maintains rates at 2.75% (BOT)

- Bank of Canada Governor appointed to Bank of England (BOC)

- What's holding back the economy in 10 charts (Wonkblog)

- Sluggish service sector spending (FRBNY)

- Household debt report (FRBNY)

An Overview of the International Economic Situation With OECD Comments on Their Recently Lowered Growth Projections

What follows are the first five paragraphs from the latest Reserve Bank of Australia's minutes (italicized) with some additional commentary from me.

International economic news over the past month was, on balance, more positive than in recent months, though earlier weak data had led forecasters to expect further delay in a pick-up in global activity.

For most of this year, the overall story line for the world economy has been remarkably stable: The EU was mired in its debt issues with little chance of a quick recovery, the US was growing slowing and China was trying to re-balance its economy from an export based model to a consumption based model. It's almost as though the world economy is stuck in very deep mud and can't seem to pull free.

The pace of growth in China appeared to have stabilised in response to the earlier fiscal and monetary stimulus, with a pick-up in infrastructure construction. Timely measures of production and spending were mixed, but had generally been stronger in recent months.

A story that has gotten remarkably little play over the last year is the change of power in China, which has occurred recently. I think this has kept the Chinese government from making sure the economy did not crash nor allowing it to grow at strong rates, thereby allowing the change of power to occur at at time or relative calm. The economy has slowed down from a 10%+ annual pace to a 7%+ pace, with more emphasis on internal consumption. However, it's still too early to tell if this is a permanent situation or an anomaly lasting a few quarters. I tend to think its the former, as most Australian raw materials companies are now slowing down their capital investment, indicating they think their biggest trading partner is permanently changing course.

Members observed that the US economy continued to expand at a moderate pace. Growth in GDP and consumption picked up a little in the September quarter, although business investment had weakened. Employment growth had improved in the past four months relative to earlier in the year, and housing prices and commencements continued to rise, albeit from low levels. While significant uncertainty remained over the extent and effect of fiscal consolidation from early 2013, members noted that a positive resolution of this matter could result in better growth prospects.

The US economy is about where it's been for the last few years -- growing between 0% and 2%. While PCEs have been fair, we have seen a decrease in investment over the last few quarters with the primary downside pressure coming from state and local government austerity. On the good side, employment is still plodding forward and the housing market appears to to recovering. NDD sees the same thing.

Economic activity in Europe remained weak. The PMIs and household and business sentiment remained at low levels across the region, including in France and Germany, which until recently had been more resilient.

The overall economic situation in the EU is one of a recession which is now continent wide and growing. These is literally no hope for a quick and thoroughly conceived resolution to their issues. At this point, they are slowing moving into the "basket case" category.

The Japanese economy had weakened in the September quarter, with falls in consumption and exports. Growth in the rest of east Asia was also relatively subdued in the quarter, partly reflecting weakness in consumption, especially for the higher-income economies. Exports and industrial production were soft, though more recent data generally showed a slight improvement. In response to weaker growth, monetary and fiscal policies had been eased a little over recent months in some countries in the region.

Japan's problems continue. They printed another quarter of negative GDP growth recently and have moved to parliamentary elections. The government and the BOJ are feuding over who should do more to help the economy. In short, it's an overall mess. The rest of the region is acting in lock-step with the Chinese slowdown. Growth is slowing, but not to recessionary levels. Various central banks have lowered rates somewhat, but still have sufficient downside room in the event they need to add further stimulus.

The OECD has release their lowered economic projections for 2013 and beyond, which can be read here. Here are some salient points from the press release:

The global economy is expected to make a hesitant and uneven recovery over the coming two years. Decisive policy action is needed to ensure that stalemate over fiscal policy in the United States and continuing euroarea instability do not plunge the world back into recession, according to the OECD’s latest Economic Outlook.

“The world economy is far from being out of the woods,” OECD Secretary-General Angel Gurría said during the Economic Outlook launch in Paris. “The US ‘fiscal cliff’, if it materialises, could tip an already weak economy into recession, while failure to solve the euro area crisis could lead to a major financial shock and global downturn. Governments must act decisively, using all the tools at their disposal to turn confidence around and boost growth and jobs, in the United States, in Europe, and elsewhere,” Mr Gurría said.

GDP growth across the OECD is projected to match this year’s 1.4% in 2013, before gathering momentum to 2.3% for 2014, according to the Outlook.

In the United States, provided the “fiscal cliff” is avoided, GDP growth is projected at 2% in 2013 before rising to 2.8% in 2014. In Japan, GDP is expected to expand by 0.7% in 2013 and 0.8% in 2014. The euro area will remain in recession until early 2013, leading to a mild contraction in GDP of 0.1% next year, before growth picks up to 1.3% in 2014.

After softer-than-expected activity during 2012, growth has begun picking up in the emerging-market economies, with increasingly supportive monetary and fiscal policies offsetting the drag exerted by weak external demand. China is expected to grow at 8.5% in 2013 and 8.9% in 2014, while GDP is also expected to gather steam in the coming years in Brazil, India, Indonesia, Russia and South Africa.

International economic news over the past month was, on balance, more positive than in recent months, though earlier weak data had led forecasters to expect further delay in a pick-up in global activity.

For most of this year, the overall story line for the world economy has been remarkably stable: The EU was mired in its debt issues with little chance of a quick recovery, the US was growing slowing and China was trying to re-balance its economy from an export based model to a consumption based model. It's almost as though the world economy is stuck in very deep mud and can't seem to pull free.

The pace of growth in China appeared to have stabilised in response to the earlier fiscal and monetary stimulus, with a pick-up in infrastructure construction. Timely measures of production and spending were mixed, but had generally been stronger in recent months.

A story that has gotten remarkably little play over the last year is the change of power in China, which has occurred recently. I think this has kept the Chinese government from making sure the economy did not crash nor allowing it to grow at strong rates, thereby allowing the change of power to occur at at time or relative calm. The economy has slowed down from a 10%+ annual pace to a 7%+ pace, with more emphasis on internal consumption. However, it's still too early to tell if this is a permanent situation or an anomaly lasting a few quarters. I tend to think its the former, as most Australian raw materials companies are now slowing down their capital investment, indicating they think their biggest trading partner is permanently changing course.

Members observed that the US economy continued to expand at a moderate pace. Growth in GDP and consumption picked up a little in the September quarter, although business investment had weakened. Employment growth had improved in the past four months relative to earlier in the year, and housing prices and commencements continued to rise, albeit from low levels. While significant uncertainty remained over the extent and effect of fiscal consolidation from early 2013, members noted that a positive resolution of this matter could result in better growth prospects.

The US economy is about where it's been for the last few years -- growing between 0% and 2%. While PCEs have been fair, we have seen a decrease in investment over the last few quarters with the primary downside pressure coming from state and local government austerity. On the good side, employment is still plodding forward and the housing market appears to to recovering. NDD sees the same thing.

Economic activity in Europe remained weak. The PMIs and household and business sentiment remained at low levels across the region, including in France and Germany, which until recently had been more resilient.

The overall economic situation in the EU is one of a recession which is now continent wide and growing. These is literally no hope for a quick and thoroughly conceived resolution to their issues. At this point, they are slowing moving into the "basket case" category.

The Japanese economy had weakened in the September quarter, with falls in consumption and exports. Growth in the rest of east Asia was also relatively subdued in the quarter, partly reflecting weakness in consumption, especially for the higher-income economies. Exports and industrial production were soft, though more recent data generally showed a slight improvement. In response to weaker growth, monetary and fiscal policies had been eased a little over recent months in some countries in the region.

Japan's problems continue. They printed another quarter of negative GDP growth recently and have moved to parliamentary elections. The government and the BOJ are feuding over who should do more to help the economy. In short, it's an overall mess. The rest of the region is acting in lock-step with the Chinese slowdown. Growth is slowing, but not to recessionary levels. Various central banks have lowered rates somewhat, but still have sufficient downside room in the event they need to add further stimulus.

The OECD has release their lowered economic projections for 2013 and beyond, which can be read here. Here are some salient points from the press release:

The global economy is expected to make a hesitant and uneven recovery over the coming two years. Decisive policy action is needed to ensure that stalemate over fiscal policy in the United States and continuing euroarea instability do not plunge the world back into recession, according to the OECD’s latest Economic Outlook.

“The world economy is far from being out of the woods,” OECD Secretary-General Angel Gurría said during the Economic Outlook launch in Paris. “The US ‘fiscal cliff’, if it materialises, could tip an already weak economy into recession, while failure to solve the euro area crisis could lead to a major financial shock and global downturn. Governments must act decisively, using all the tools at their disposal to turn confidence around and boost growth and jobs, in the United States, in Europe, and elsewhere,” Mr Gurría said.

GDP growth across the OECD is projected to match this year’s 1.4% in 2013, before gathering momentum to 2.3% for 2014, according to the Outlook.

In the United States, provided the “fiscal cliff” is avoided, GDP growth is projected at 2% in 2013 before rising to 2.8% in 2014. In Japan, GDP is expected to expand by 0.7% in 2013 and 0.8% in 2014. The euro area will remain in recession until early 2013, leading to a mild contraction in GDP of 0.1% next year, before growth picks up to 1.3% in 2014.

After softer-than-expected activity during 2012, growth has begun picking up in the emerging-market economies, with increasingly supportive monetary and fiscal policies offsetting the drag exerted by weak external demand. China is expected to grow at 8.5% in 2013 and 8.9% in 2014, while GDP is also expected to gather steam in the coming years in Brazil, India, Indonesia, Russia and South Africa.

Morning Market Analysis

The grains complex has rallied from the 200 day EMA into resistance. Prices spiked in the early summer, but have been drifting lower since. The underlying technicals aren't pointing to a big move higher; the CMF is negative, and while the MACD has given a technical buy signal, it's still negative and moving sideways.

The daily Hong Kong market (top chart) shows a very strong rally that has lasted for the entire six month period. The weekly chart (bottom chart) shows that prices have broken through upside resistance and have rallied to near a two year high.

The daily yen chart (top chart) shows the yen broke through support at the 122 level a little over a week ago and has been dropping sharply since. The underlying technicals are all negative -- the MACD is dropping and below 0, the CMF is negative and all the EMAs are moving lower. The weekly chart (bottom chart) shows prices are dropping sharply with a negative MACD. Prices can ride the lower Bollinger Band down to the 200 day EMA.

The Russian market -- which broke trend in late October -- was in a counter-trend rally for the last week or so. However, after hitting the 50 day EMA, prices broke the trend line yesterday and are now below all the EMAs again.

Tuesday, November 27, 2012

Bonddad Linkfest

- What is Simpson Bowles (WaPo)

- Will the fiscal cliff break Grover Norquist? (WaPo)

- Democrats unwilling to trim entitlement spending (NYT)

- Texas manufacturing barely improving (Dallas Fed)

- US durable goods orders up barely (Census)

- CFNAI indicates continued below trend growth (Chicago Fed)

- The Greek debt deal (FT)

- OECD projects weak economy going forward (OECD)

- A short bio on China's new leader (FT)

- The multiplier is at least 2 (Economist's View)

Will Brazil Cut Rates Tomorrow?

Tomorrow, the central bank of Brazil meets to discuss interest rate policy, which the bank has been aggressively lowering over the last year, moving rates from 11% to their current 7.25% level. Brazil is facing the exact same situation as the other BRiC countries: as China changes its respective growth model from one that is based on exports to one driven by internal demand, those countries that supplied the raw materials to China's export engine are also slowing. Hence, the need to change their growth engine as well.

Let's take a look at the overall economic situation in Brazil, with information provided by the bank's monthly chart book and meeting minutes from their latest interest rate policy meeting.

The Brazilian Institute of Geography and Statistics (IBGE) released information on Gross Domestic Product (GDP) for the second quarter of 2012. The expansion of activity was 0.5% year-over-year and 0.4% over the first quarter of 2012, according to seasonally adjusted data. Thus, the cumulative growth rate in four quarters fell from 1.9% to 1.2%, confirming the view that the economy has grown below its potential. From the aggregate supply side, the service sector and agriculture grew 0.7% and 4.9%, respectively, compared to the previous quarter, and industrial production fell by 2.5%, according to the same comparison basis. From the aggregate demand side, household expanded by 0.6% and government consumption increased by 1.1%, while Gross Fixed Capital formation (GFCF) contracted by 0.7%, quarter-over-quarter. On its turn, the contribution of the external sector was negative, with a decrease of 3.9% in exports and expansion of 1.9% in imports. In particular, foreign sales to Argentina and to the European Union were negatively impacted. In short, domestic demand, driven by moderate expansion of credit and by employment and income growth, has been the main factor sustaining activity.

The above chart and discussion represents the primary problem faced by the Central Bank: declining growth. This slowdown was caused in large part by the Chinese slowdown, but has also been impacted by the EU's recession.

China accounts for 17% of Brazil's exports -- a percentage that has increased over the last few years -- as has the percentage of exports going to other Asian countries. In addition to exports bound for China, the EU accounts for 20% and other Asian countries account for 13% of Brazil's exports, meaning 50% of Brazil's exports are to regions that are experiencing a slowdown or recession. Hence, we get a drop in exports:

Exports and imports have been dropping for about the last 9-12 months according to the chart above.

Overall industrial production has also been dropping:

Industrial activity registered the third positive monthly growth in August, according to the series seasonally adjusted by the IBGE. Therefore, industrial production rose 1.5% in August, after an increase of 0.5% in July. Production grew in 20 of the 27 branches of activity. Year-over-year, industrial production fell 1.9% in August and 2.9% on a twelve-month accumulated basis. Under the quarterly moving average criteria, industrial production increased 0.8% from June to August. Regarding revenues in the manufacturing industry, there was

real growth of 7.0% in August, year-over-year, despite a 2.1% decline in the number of hours worked, according to the National Confederation of Industry (CNI).

Among the industry use categories, according to data seasonally adjusted by the IBGE, the production of durable consumer goods grew 2.6% in August, the third consecutive monthly increase. The production of semi-durable and nondurable consumer goods, capital goods and intermediate goods expanded in August 1.2%, 0.3% and 2.0%, respectively. Regarding the twelve-month accumulated growth through August, there were decreases in the production of durable consumer goods (-8.0%), semi-durable and non-durable consumer goods (-0.7%), capital goods (- 8.5%) and intermediate goods (-1.6%).

The installed capacity utilization rate (Nuci) in the manufacturing industry, calculated by the FGV, without seasonal adjustment, rose in September (84.9%), standing 0.5 p.p. above the level observed in September 2011. According to the seasonally adjusted series calculated by the FGV, the Nuci stood at 84.1% in

September – the highest value since July 2011 - 0.5 p.p. above the level recorded in September 2011 and 2.6 p.p. below the record high of the series recorded in June 2008. Capacity utilization intensified in the consumer goods sector, which reached 86.7%, and retreated in the capital goods sector, which recorded 82.0%. In the sectors of intermediate goods and construction inputs, the levels stood at 85.1% and 88.0%, respectively. Still according to the FGV, the Industry Confidence Index continues a gradual recovery trajectory, reaching the

highest level since July 2011 according to the seasonally adjusted series, mainly due to improvements in the expectations component. The share of companies that reported inventories at normal levels increased since the last Copom meeting.

The above data tells us that industrial production is down year over year, but has turned around over the last few months. Capacity utilization has been inching higher. In addition, the confidence level is now on a "recovery trajectory" indicating it was reading contraction or slowdown for some time.

The above numbers -- exports and industrial production -- highlight the rate cutting argument. However, there is also plenty of ammunition for the hawk's argument, starting with inflation:

While the inflation rate has dropped over the 2011-2012 period, it is starting to increase and currently stands at 5.45%. Other measures of inflation were higher:

Monthly inflation measured by the Extended Consumer Price Index (IPCA) rose to 0.57% in September (0.41% in August). As a consequence, twelve-month trailing inflation reached 5.28%, compared to 7.31% in September 2011. Market prices changed 5.93% in the twelve months through September (7.79% in September 2011), and regulated prices, 3.44% (6.17% in September 2011). Among market prices, the prices of tradable goods increased 3.37% in the twelve months through September (6.52% in September 2011), and the prices of non-tradable goods, 8.28% (8.88% in September 2011). The prices of food and beverages group, still impacted by domestic and external weather-related factors, increased by 1.26% in September (0.64% in September 2011) and reached 9.53% in twelve months. The prices of services rose 0.51% in September (0.49% in August) and 7.89% in twelve months (9.03% in September 2011). In short, services inflation still remains at high levels and there are localized pressures in the food and beverages segment.

.....

3. Broadest inflation, measured by the General Price Index (IGP-DI), decreased from 1.29% in August to 0.88% in September, resulting, on a twelve-month trailing basis, in 8.17% inflation (7.45% in September 2011). The main component of this indicator, the Wholesale Price Index (IPA), changed 9.18% in the twelve months through September, influenced by strong increase in the agricultural sector (18.06%), impacted by supply shocks. According to the breakdown by stage of production, there were increases in the prices of raw

materials (11.84%), intermediate goods (9.76%) and final goods (6.13%), according to the same comparison basis. Inflation measured by the Consumer Price Index (IPC), the second most important component of the IGP-DI, stood at 5.73% in the twelve months through September (7.13% in September 2011). The Civil Construction National Index (INCC), component with the lowest weight in the IGP-DI, changed 7.49%, according to the same comparison basis, driven by the increase in labor cost. On its turn, the Producer/Manufacturing Industry Price Index (IPP/IT), calculated by the Brazilian Institute of Geography and

Statistics (IBGE), increased 0.53% in August (0.50% in July), and 7.53% in twelve months. The Copom considers that the effects of the behavior of wholesale prices on consumer inflation will depend on the current and prospective demand conditions and on the price setters' expectations regarding the future inflation path.

And while overall job creation is lower (top chart) the unemployment rate is low. In the US, full employment is considered to be 5% --, so using that bench mark, Brazil is already near that level. This has led to strong wage growth, which leads to strong demand at the retain level:

Here's how the central bank described it:

The unemployment rate for the six metropolitan areas covered by the Monthly Employment Survey (PME), without seasonal adjustment, retreated to 5.3% in August, 0.7 percentage points (p.p.). below the rate recorded in August 2011. According to BCB seasonally adjusted data, the unemployment rate changed from 5.3% in July to 5.2% in August, a record low since the beginning of the series in March 2002. Compared to August 2011, there were expansions of 1.5% of the working population and 0.7% of the Active Economic Population (PEA). The lower growth rate of the PEA in the recent past has contributed to stability, at low levels, of the unemployment rates, despite the moderation in the pace of job creation. Also according to the PME, the average real income rose 2.3% in August, year-over-year. As a result, real payroll, considering the average income of the employed population in the six metropolitan areas, increased 3.8%, compared to August 2011. Data released by the Ministry of Labor and Employment (MTE) show that, in August, 100.9 thousand formal jobs were created (190.4 thousand in August 2011). The sectors that contributed the most to this increase in the number of formal jobs in the month, in absolute terms, were the services and trade sectors. In short, the set of available data indicates that, although the labor market remains robust, there are signs of moderation at the margin.

10. According to the retail monthly survey (PMC) from IBGE, broad retail sales increased 10.2% in July, year over- year, supported, in part, by fiscal stimuli. According to the seasonally adjusted series, broad retail sales decreased 1.5% in July, month-on-month, after expansion of 6.2% in June. Therefore, the accumulated growth rate in twelve months stood at 5.9% in July, with expansion in all ten sectors surveyed, with highlights for office, computer and communication material and equipment (19.9%) and furniture and appliances (14.2%). Since October 2011, the FGV, in partnership with the BCB, has released the Trade Confidence Index (ICOM). This indicator provides the current outlook and signals the evolution of commercial activity in a more timely manner. In September, the index expanded for the second consecutive month. For the upcoming months, the retail sales trajectory will continue to be influenced by governmental transfers, by the pace of real payroll growth, by the reduction in borrowing costs and by moderate credit expansion.

But in less formal terms, the economy is already running hot. Job creation is strong enough to lead to wage gains, which has led to strong retail sales. This is a classic case of demand pull inflation.

The Brazilian central bank is faced with a difficult policy dilemma: slowing growth is occurring while the economy is at full employment with fairly strong inflationary pressures. In addition, the slowing growth has occurred during a period when the bank has been cutting rates, indicating that lower rates aren't having the desired stimulative effect.

Let's take a look at the overall economic situation in Brazil, with information provided by the bank's monthly chart book and meeting minutes from their latest interest rate policy meeting.

The Brazilian Institute of Geography and Statistics (IBGE) released information on Gross Domestic Product (GDP) for the second quarter of 2012. The expansion of activity was 0.5% year-over-year and 0.4% over the first quarter of 2012, according to seasonally adjusted data. Thus, the cumulative growth rate in four quarters fell from 1.9% to 1.2%, confirming the view that the economy has grown below its potential. From the aggregate supply side, the service sector and agriculture grew 0.7% and 4.9%, respectively, compared to the previous quarter, and industrial production fell by 2.5%, according to the same comparison basis. From the aggregate demand side, household expanded by 0.6% and government consumption increased by 1.1%, while Gross Fixed Capital formation (GFCF) contracted by 0.7%, quarter-over-quarter. On its turn, the contribution of the external sector was negative, with a decrease of 3.9% in exports and expansion of 1.9% in imports. In particular, foreign sales to Argentina and to the European Union were negatively impacted. In short, domestic demand, driven by moderate expansion of credit and by employment and income growth, has been the main factor sustaining activity.

The above chart and discussion represents the primary problem faced by the Central Bank: declining growth. This slowdown was caused in large part by the Chinese slowdown, but has also been impacted by the EU's recession.

China accounts for 17% of Brazil's exports -- a percentage that has increased over the last few years -- as has the percentage of exports going to other Asian countries. In addition to exports bound for China, the EU accounts for 20% and other Asian countries account for 13% of Brazil's exports, meaning 50% of Brazil's exports are to regions that are experiencing a slowdown or recession. Hence, we get a drop in exports:

Exports and imports have been dropping for about the last 9-12 months according to the chart above.

Overall industrial production has also been dropping:

Industrial activity registered the third positive monthly growth in August, according to the series seasonally adjusted by the IBGE. Therefore, industrial production rose 1.5% in August, after an increase of 0.5% in July. Production grew in 20 of the 27 branches of activity. Year-over-year, industrial production fell 1.9% in August and 2.9% on a twelve-month accumulated basis. Under the quarterly moving average criteria, industrial production increased 0.8% from June to August. Regarding revenues in the manufacturing industry, there was

real growth of 7.0% in August, year-over-year, despite a 2.1% decline in the number of hours worked, according to the National Confederation of Industry (CNI).

Among the industry use categories, according to data seasonally adjusted by the IBGE, the production of durable consumer goods grew 2.6% in August, the third consecutive monthly increase. The production of semi-durable and nondurable consumer goods, capital goods and intermediate goods expanded in August 1.2%, 0.3% and 2.0%, respectively. Regarding the twelve-month accumulated growth through August, there were decreases in the production of durable consumer goods (-8.0%), semi-durable and non-durable consumer goods (-0.7%), capital goods (- 8.5%) and intermediate goods (-1.6%).

The installed capacity utilization rate (Nuci) in the manufacturing industry, calculated by the FGV, without seasonal adjustment, rose in September (84.9%), standing 0.5 p.p. above the level observed in September 2011. According to the seasonally adjusted series calculated by the FGV, the Nuci stood at 84.1% in

September – the highest value since July 2011 - 0.5 p.p. above the level recorded in September 2011 and 2.6 p.p. below the record high of the series recorded in June 2008. Capacity utilization intensified in the consumer goods sector, which reached 86.7%, and retreated in the capital goods sector, which recorded 82.0%. In the sectors of intermediate goods and construction inputs, the levels stood at 85.1% and 88.0%, respectively. Still according to the FGV, the Industry Confidence Index continues a gradual recovery trajectory, reaching the

highest level since July 2011 according to the seasonally adjusted series, mainly due to improvements in the expectations component. The share of companies that reported inventories at normal levels increased since the last Copom meeting.

The above data tells us that industrial production is down year over year, but has turned around over the last few months. Capacity utilization has been inching higher. In addition, the confidence level is now on a "recovery trajectory" indicating it was reading contraction or slowdown for some time.

The above numbers -- exports and industrial production -- highlight the rate cutting argument. However, there is also plenty of ammunition for the hawk's argument, starting with inflation:

While the inflation rate has dropped over the 2011-2012 period, it is starting to increase and currently stands at 5.45%. Other measures of inflation were higher:

Monthly inflation measured by the Extended Consumer Price Index (IPCA) rose to 0.57% in September (0.41% in August). As a consequence, twelve-month trailing inflation reached 5.28%, compared to 7.31% in September 2011. Market prices changed 5.93% in the twelve months through September (7.79% in September 2011), and regulated prices, 3.44% (6.17% in September 2011). Among market prices, the prices of tradable goods increased 3.37% in the twelve months through September (6.52% in September 2011), and the prices of non-tradable goods, 8.28% (8.88% in September 2011). The prices of food and beverages group, still impacted by domestic and external weather-related factors, increased by 1.26% in September (0.64% in September 2011) and reached 9.53% in twelve months. The prices of services rose 0.51% in September (0.49% in August) and 7.89% in twelve months (9.03% in September 2011). In short, services inflation still remains at high levels and there are localized pressures in the food and beverages segment.

.....

3. Broadest inflation, measured by the General Price Index (IGP-DI), decreased from 1.29% in August to 0.88% in September, resulting, on a twelve-month trailing basis, in 8.17% inflation (7.45% in September 2011). The main component of this indicator, the Wholesale Price Index (IPA), changed 9.18% in the twelve months through September, influenced by strong increase in the agricultural sector (18.06%), impacted by supply shocks. According to the breakdown by stage of production, there were increases in the prices of raw

materials (11.84%), intermediate goods (9.76%) and final goods (6.13%), according to the same comparison basis. Inflation measured by the Consumer Price Index (IPC), the second most important component of the IGP-DI, stood at 5.73% in the twelve months through September (7.13% in September 2011). The Civil Construction National Index (INCC), component with the lowest weight in the IGP-DI, changed 7.49%, according to the same comparison basis, driven by the increase in labor cost. On its turn, the Producer/Manufacturing Industry Price Index (IPP/IT), calculated by the Brazilian Institute of Geography and

Statistics (IBGE), increased 0.53% in August (0.50% in July), and 7.53% in twelve months. The Copom considers that the effects of the behavior of wholesale prices on consumer inflation will depend on the current and prospective demand conditions and on the price setters' expectations regarding the future inflation path.

And while overall job creation is lower (top chart) the unemployment rate is low. In the US, full employment is considered to be 5% --, so using that bench mark, Brazil is already near that level. This has led to strong wage growth, which leads to strong demand at the retain level:

Here's how the central bank described it:

The unemployment rate for the six metropolitan areas covered by the Monthly Employment Survey (PME), without seasonal adjustment, retreated to 5.3% in August, 0.7 percentage points (p.p.). below the rate recorded in August 2011. According to BCB seasonally adjusted data, the unemployment rate changed from 5.3% in July to 5.2% in August, a record low since the beginning of the series in March 2002. Compared to August 2011, there were expansions of 1.5% of the working population and 0.7% of the Active Economic Population (PEA). The lower growth rate of the PEA in the recent past has contributed to stability, at low levels, of the unemployment rates, despite the moderation in the pace of job creation. Also according to the PME, the average real income rose 2.3% in August, year-over-year. As a result, real payroll, considering the average income of the employed population in the six metropolitan areas, increased 3.8%, compared to August 2011. Data released by the Ministry of Labor and Employment (MTE) show that, in August, 100.9 thousand formal jobs were created (190.4 thousand in August 2011). The sectors that contributed the most to this increase in the number of formal jobs in the month, in absolute terms, were the services and trade sectors. In short, the set of available data indicates that, although the labor market remains robust, there are signs of moderation at the margin.

10. According to the retail monthly survey (PMC) from IBGE, broad retail sales increased 10.2% in July, year over- year, supported, in part, by fiscal stimuli. According to the seasonally adjusted series, broad retail sales decreased 1.5% in July, month-on-month, after expansion of 6.2% in June. Therefore, the accumulated growth rate in twelve months stood at 5.9% in July, with expansion in all ten sectors surveyed, with highlights for office, computer and communication material and equipment (19.9%) and furniture and appliances (14.2%). Since October 2011, the FGV, in partnership with the BCB, has released the Trade Confidence Index (ICOM). This indicator provides the current outlook and signals the evolution of commercial activity in a more timely manner. In September, the index expanded for the second consecutive month. For the upcoming months, the retail sales trajectory will continue to be influenced by governmental transfers, by the pace of real payroll growth, by the reduction in borrowing costs and by moderate credit expansion.

But in less formal terms, the economy is already running hot. Job creation is strong enough to lead to wage gains, which has led to strong retail sales. This is a classic case of demand pull inflation.

The Brazilian central bank is faced with a difficult policy dilemma: slowing growth is occurring while the economy is at full employment with fairly strong inflationary pressures. In addition, the slowing growth has occurred during a period when the bank has been cutting rates, indicating that lower rates aren't having the desired stimulative effect.

Morning Market Analysis

Let's start by looking at one of the better performing equity markets (Germany) and one of the worst (Brazil).

The German market is the second best performing over the 1 and 3 month periods and was the best performing market last week (of the international markets I watch).

The German market is the second best performing over the 1 and 3 month periods and was the best performing market last week (of the international markets I watch).

On the daily

chart (top chart), notice that most of the gains occurred over the end of the summer and early fall, when prices moved from the 18 price level to 23.5. Since then, prices have moved sideways, trading between 21.5 and 23.5. The weekly chart shows that prices are now stuck just below a key Fib level. While there is conflicting information from the MACD, both charts now have a positive CMF. Additionally, both charts have bars above their respective EMAs.

The daily Brazilian chart (top chart) broke key support at the end of October as prices were taking a second run at the 200 day EMA. Now prices are in the middle of a counter-trend rally that's occurring on weak volume. The weekly chart (bottom chart) shows that prices are near multi-year lows with weak momentum (it's negative and has given a sell signal) and weak CMF.

The dollar rallied to the 200 day EMA, but has since fallen back to the top of the trading range where it spent the last few months. The MACD has given a sell signal and the CMF is weak.

Monday, November 26, 2012

Bonddad Linkfest

- The GOPs read my lips moment (WaPo)

- 7 GOPers who have disavowed Norquist pledge (TPM)

- Fiscal cliff talks update (WaPo)

- A history of Senate gridlock (NYT)

- BOJ Meeting Minutes (BOJ)

- German GDP up .2% Q/Q

- German business sentiment ticks up (IFO)

- Italian retail sales up marginally (Istat)

- US online sales jump 20% (FT)\

- Funds buying gold (FT)

The economy shambles along

- by New Deal democrat

For three years beginning in late spring 2009, the data justified optimism about the economy. That all changed with the very weak March 2012 employment report. Unlike the double dip scares of 2010 and 2011, this year first the leading indicators have moved generally sideways rather than improving, and now the coincident indicators are following suit. Note that I'm not saying that the economy is contracting, but rather that it is shambling along like a fighter who is out on his feet, or a drunk standing on the sidewalk.

My reason for caution now is the same as my reason for optimism in late spring 2009. While pundits charge hundreds of millions of dollars for attempting to look into the crystal ball, the K.I.S.S. method is simply to track the index of Leading Economic Indicators kept formerly by the BEA and for the last 15+ years by the Conference Board. You may not always be right, but you'll be right a lot more than some very well paid well known pundits.

A little background: the index is the fruit of a lifetime of work by Prof. Geoffrey Moore. In the 1980s, funded by the federal government, revisions were proposed which were implemented in the 1990s. At the same time, Prof. Moore founded ECRI. The BEA also sold the rights to the public LEI to the Conference Board. Since then, both ECRI and the Conference Board have made further refinements. The difference is that ECRI's information is almost all hidden in a black box (except for the WLI, which interestingly has been contradicting their public statements), whereas the LEI is public and transparent.

So, without further ado, here is a graph of the LEI through October 2012:

]

]

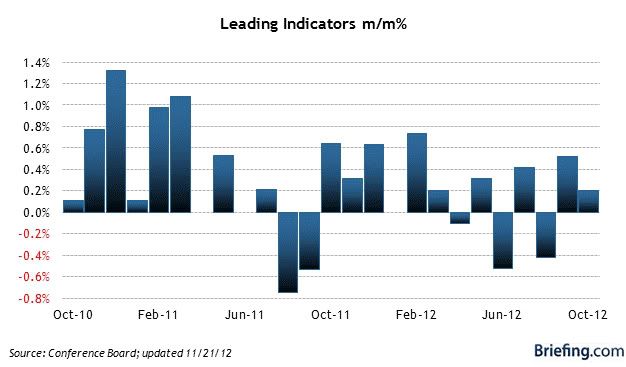

Note that the LEI, after advancing pretty much relentlessly since a few months before the end of the last recession, hiccuped in summer of 2011 and has pretty much stalled this year. Here is a close-up of the last 24 months' values:

The index is still generally advancing, but just barely.

There are several heuristics for determining for much of a decline in the LEI is significant enough to signal recession. The first is declines for three months in a row. As the close-up above shows, we've avoided that so far this year although twice on a three month rolling basis the average has been negative.

A second heuristic is that a recession begins when at least 8 of the 10 indicators are lower than where they were 6 months ago.

To that end, here is a screen shot of the values of the 10 indicators since April 2012 from the Conference Board's website:

As of October, the 6 circled series out of the 10 total were lower than their values 6 months ago. Only initial jobless claims, the stock market, building permits, and the expectations component of consumer confidence readings are at better readings than they were back in April.

So the bottom line is, the simplest reliable method of looking at the economy tells us that we aren't in a recession now, and may not be in one for the next few months at least, but on the other hand it couild lurch forward, come to a complete standstill, or enter a real contraction more or less randomly, and fairly quickly to boot. I intend to flesh this out in my next few posts.

Will The Second Time Be the Charm for the Chinese ETF?

The long-term trend of the Chinese ETF is consolidation in a symmetrical triangle pattern. Several weeks ago, prices broke out, but fell back to the 200 week EMA. Last week, however, prices printed a strong bar. While volume was weak, that can partially be explained by the market being closed on Thursday and weak overall participation on Friday. Bolstering the bull argument is the rising MACD and positive CMF reading.

But also consider the Chinese copper market is now flashing a warning signal, as imports dropped 22% in October.

High

quality global journalism requires investment. Please share this

article with others using the link below, do not cut & paste the

article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/e871ca92-37a0-11e2-8edf-00144feabdc0.html#ixzz2DKwZZDynPut

those two facts together, and the Chinese copper market appears to be

flashing a warning signal. Indeed, back-of-the-envelope calculations

suggest a month-on-month drop of almost 20 per cent in Chinese apparent

copper demand in October.

High

quality global journalism requires investment. Please share this

article with others using the link below, do not cut & paste the

article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/e871ca92-37a0-11e2-8edf-00144feabdc0.html#ixzz2DKwXPHICChinese copper data have just taken a worrying turn for the worse.

The country’s imports of the red metal tumbled 22 per cent in October to their lowest in more than a year. At the same time, stocks of the metal have risen to a record high: in October alone, inventories at Shanghai exchange and bonded warehouses collectively rose by about 135,000 tonnes, and are now not far off 1m tonnes, most traders believe.

The country’s imports of the red metal tumbled 22 per cent in October to their lowest in more than a year. At the same time, stocks of the metal have risen to a record high: in October alone, inventories at Shanghai exchange and bonded warehouses collectively rose by about 135,000 tonnes, and are now not far off 1m tonnes, most traders believe.

High

quality global journalism requires investment. Please share this

article with others using the link below, do not cut & paste the

article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/e871ca92-37a0-11e2-8edf-00144feabdc0.html#ixzz2DKwZZDynPut

those two facts together, and the Chinese copper market appears to be

flashing a warning signal. Indeed, back-of-the-envelope calculations

suggest a month-on-month drop of almost 20 per cent in Chinese apparent

copper demand in October.

High

quality global journalism requires investment. Please share this

article with others using the link below, do not cut & paste the

article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/e871ca92-37a0-11e2-8edf-00144feabdc0.html#ixzz2DKwepnPF

Chinese copper data have just taken a worrying turn for the worse.

The country’s imports of the red metal tumbled 22 per cent in October to their lowest in more than a year. At

The country’s imports of the red metal tumbled 22 per cent in October to their lowest in more than a year. At

High

quality global journalism requires investment. Please share this

article with others using the link below, do not cut & paste the

article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/e871ca92-37a0-11e2-8edf-00144feabdc0.html#ixzz2DKwZZDyn

Morning Market Analysis

Last week was a holiday shortened week, which means that any move has to be viewed skeptically. However, we did see stocks as the strongest performing sector with bonds selling off, indicating am overall risk on move, primarily premised on the good news coming out of Washington. Underlying the movement, we see consumer discretionary technology and energy sectors making positive moves. However, the lack of meaningful drop in the treasury market -- in conjunction with a holiday shortened week -- highlights that the risk off trade is still on everybody's mind right now.

Of the three major averages, two (the QQQs and SPYs) have broken through resistance, while the IWMs remain contained. In addition, all three averages have printed buy signals from their respective MACDs and all three have advanced above their respective 200 day EMAs. The issue with the moves higher is that they occurred on declining volume. Ideally, we'd like to see the opposite happen to

The entire treasury curve remains elevated and above important levels, indicating that the risk off trade has not removed the concern among traders about certain elements of the market overall.

Of the three major averages, two (the QQQs and SPYs) have broken through resistance, while the IWMs remain contained. In addition, all three averages have printed buy signals from their respective MACDs and all three have advanced above their respective 200 day EMAs. The issue with the moves higher is that they occurred on declining volume. Ideally, we'd like to see the opposite happen to

The entire treasury curve remains elevated and above important levels, indicating that the risk off trade has not removed the concern among traders about certain elements of the market overall.

Subscribe to:

Comments (Atom)

.JPG)