Last week, the biggest news was the continued lack of global inflationary pressures. The US’ core PPI was 1.4% Y/Y while the core CPI printed at 1.7% for the same period. Germany’s WPI was .4% M/M, Italy’s was .2% M/M and .7% Y/Y while Spain’s was .3% Y/Y. UK inflation dropped a bit, with core CPI coming in at 1.7% Y/Y and core PPI coming in at 1% Y/Y. The sum total of all this news is central banks in the US, EU and UK have nothing to worry about from inflationary pressures. Should each bank want to continue their policy of low interest rates, they certainly can.

More over at XE.com

Saturday, January 18, 2014

Weekly Indicators for January 13 - 17 at XE.com

- by New Deal democrat

Weekly Indicators are up over at XE.com.

Remember the polar vortex from last week? It seems to have kept consumers indoors and freight from moving.

Friday, January 17, 2014

December housing permits and starts: least improvement in almost 3 years

- by New Deal democrat

I discuss this morning's report on housing permits and starts over at XE.com.

Both of these series continue their deceleration and are on the verge of turning negative YoY.

Thursday, January 16, 2014

Housing: the last time low interest rates got 'less low,' it wasn't 'different this time'

- by New Deal democrat

Two signifiant arguments contra my contention that housing demand will actually decrease at least for awhile YoY this year are that (1) there is a lot of pent-up demand, and (2) interest rates at 3% are still low so there shouldn't be that much of a reaction.

Fair points. But this isn't the first time that there has been pent-up demand for housing in an era of low interest rates. While the statistical series aren't identical, they clearly show that there was a huge housing bust during the Great Depresssion, that lasted through World War 2. Then all the GI's came home in 1945 and got busy making babies. Boom!

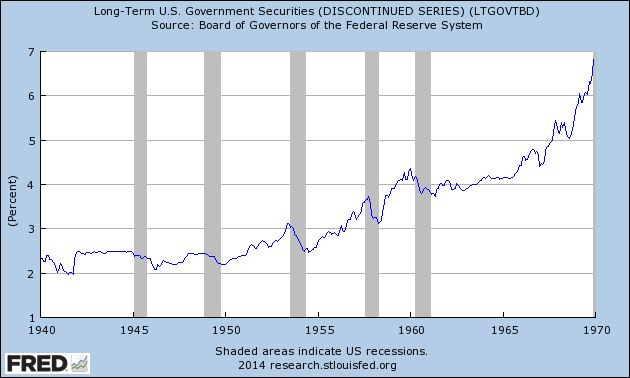

And interest rates were low throughout the 1940's and 1950's, rising to no more than 3% until about 1957. While the 10 year or 30 year treasury bond series doesn't go back that far, the archival series "long term US government securities" does:

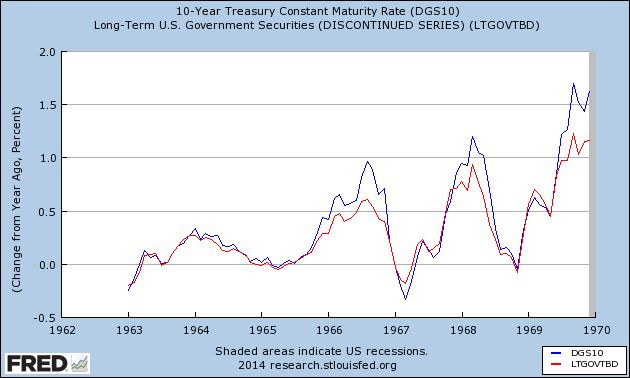

Note the series LTGOVTBD overlaps with the 10 year treasury series during the 1960's. Here's the comparison of YoY% changes in each, to show how closely they correspond:

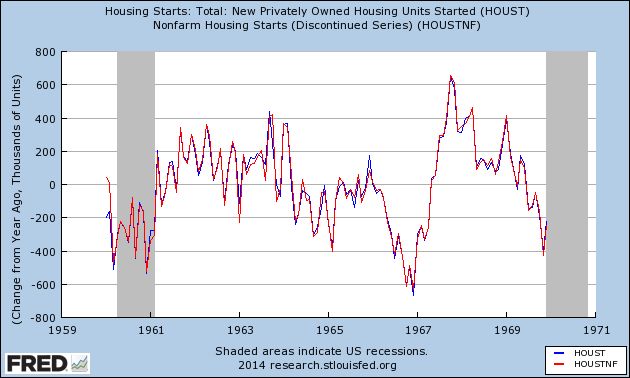

Similarly, the series "nonfarm housing starts" began in 1946 and ended in 1969. Here is the YoY% change in each during their period of overlap in the 1960's:

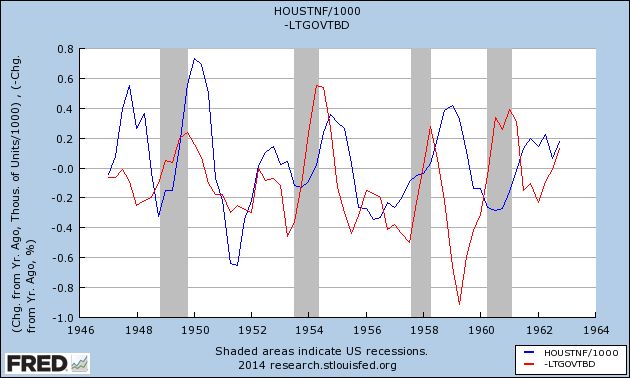

Now that we've established that the late 1940's and 1950's, like the present, were an era of pent-up demand with low interest rates, and we have two data series that will show us the correlation between changes in interest rates and housing starts, let's plot their YoY% change on a quarterly basis from 1946 through 1962 (I've already covered 1963 to the present):

The argument against my bearishness is that minor changes in interest rates won't result in major changes in housing demand. But in the post-WW2 suburban Baby Boom era, far from being muted, the changes were magnified. A change of as little as 0.2% in interest rates was associated with changes of 200,000 or more in housing starts. On 5 of the 6 occasions from 1946 through 1962 that interest rates increased YoY, housing starts fell YoY, in each case by at least 100,000 units annualized (even in 1962, several months were negative YoY, although no quarter was).

Previously I've shown that on 12 of 15 occasions since 1962 when interest rates have gone up by 1% YoY, housing permits have fallen by -100,000 or more. This data makes the total 17 of 21 times over almost 70 years, and even with interest rates rising by less than 1%.

So, could it be different this time? Certainly.

But what we can say is that the last time, like this time, that it was "different this time" because of pent-up demand and low interest rates, it turned out that it actually wasn't "different this time."

Wednesday, January 15, 2014

Population adjusted initial jobless claims and the unemployment rate: an update

- by New Deal democrat

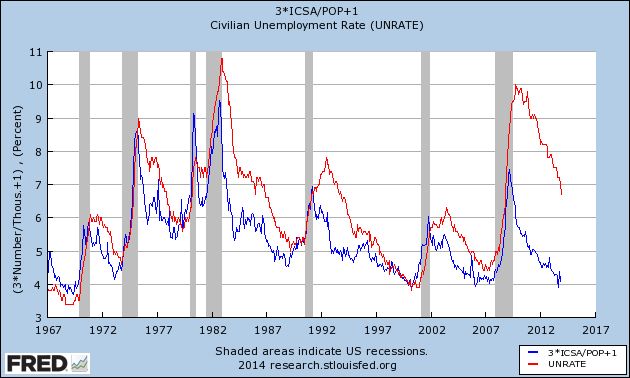

Occasionally over the last few years I have remarked upon the usually tight relationship between population-adjusted initial jobless claims and the unemployment rate. Overall the unemployment rate tends to follow the trend in the population-adjusted initial jobless claims with about a 6 to 12 month lag:

Thus, while we can quarrel about the reasons, the fact that the unemployment rate has continued to drop sharply over the last year, following the trend in initial claims, was not unexpected.

With initial claims near historical lows as a share of population, the issue becomes whetherr the unemployment rate can fall much below 6%, or whether the gap that opened up in 2009 will ultimately be closed.

I anticipate that the unemployment rate will continue to fall, perhaps at a somewhat slower rate, to about 6%, but have a very difficult time declining meaningfully below that level.

Tuesday, January 14, 2014

There is no "falling rate of personal consumption growth"

- by New Deal democrat

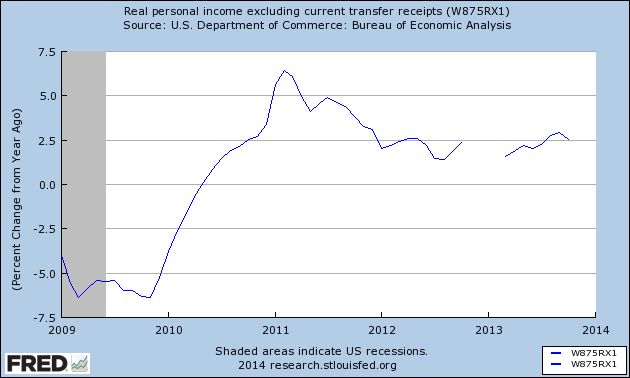

Yesterday the blog "Capital Spectator" featured a post entitled Is the falling rate of personal consumption growth a new risk factor? featuring this graph of the YoY% change in real personal income:

The blog is a good and respectable source of information, but in this case, I think they made a mistake. The entire "decline" for 2013 is contained in last month's data, and there's a very good reason why that happened.

Here's a bar graph of the monthly percentage change for the very same data:

Notice the huge spike upward in November and December 2012, and similar spike downward in January 2013. That's because of moving taxable income forward from 2012 to 2013 due to the higher tax rates that were anticipated due to the "fiscal cliff" expiration of the Bush tax cuts at the end of 2012.

So the November 2013 - January 2014 YoY comparisons now will be between "regular" monthly changes now vs. the very volatile changes of one year ago.

When we back out the months of tax law timing, here is the YoY% comparisons we get:

Flat. There is no "falling rate of personal consumption growth." Not that Zero Hedge won't have an article trumpeting the alleged downturn when the December comparisons come out at the end of this month. Or that they won't be completely silent about YoY January comparisons too.

The relationship between interest rates and stock prices has changed

- by New Deal democrat

The correlation between stock prices and interest rates has completely changed for the last 15 years, compared with the previous 40 years. I have a new post up at XE.com explaining how and why.

Monday, January 13, 2014

The state of the consumer: "I'm not dead yet!"

- by New Deal democrat

Like the character in the "Bring out your dead!" Monty Python skit, the American consumer keeps protesting that s/he isn't dead yet.

So why, given wages that are several percent below their 2010 peak, do consumers keep spending?

Let's go back to the paradigm for the American consumer that I first set forth 6 years ago. In order to increase spending, the American consumer must either:

- have a wage increase

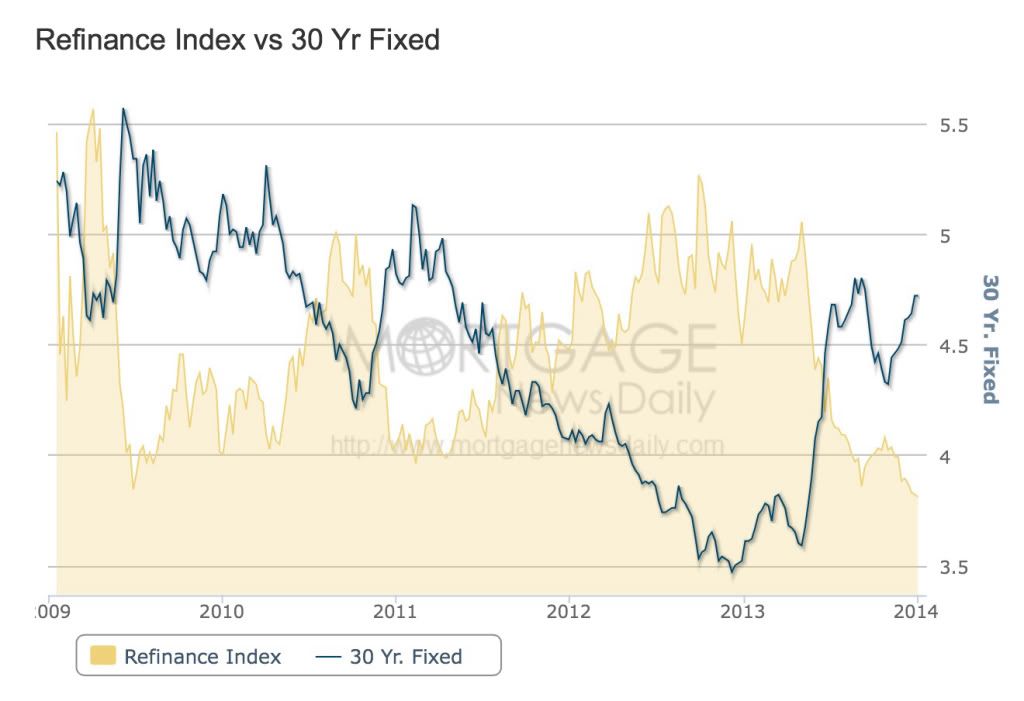

- be able to refinance debt at lower rates, thus freeing up cash

- be able to cash in an appreciating asset

On the other hand, as shown in this graph from Mortgage News Daily, the increase in interest rates has well and truly killed refinancing:

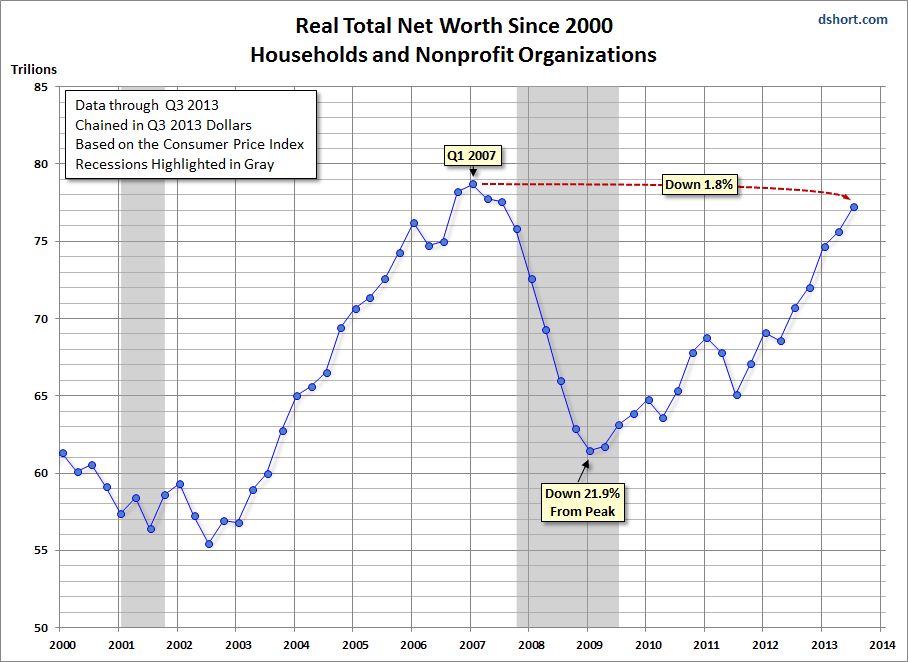

Finally, here is a graph of Americans' total net household worth, via Doug Short:

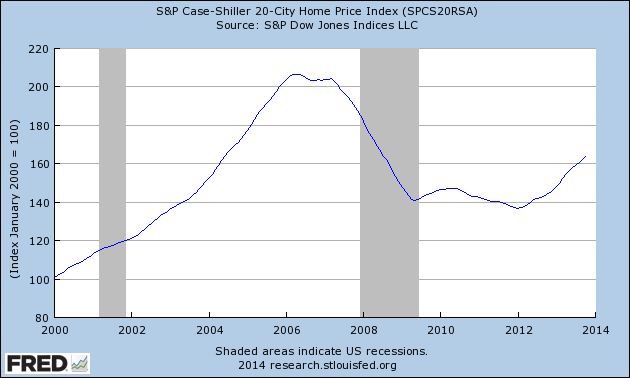

Why has household net worth almost completely rebounded? Mainly because of increasing house values, as shown in this graph of the Case Shiller index:

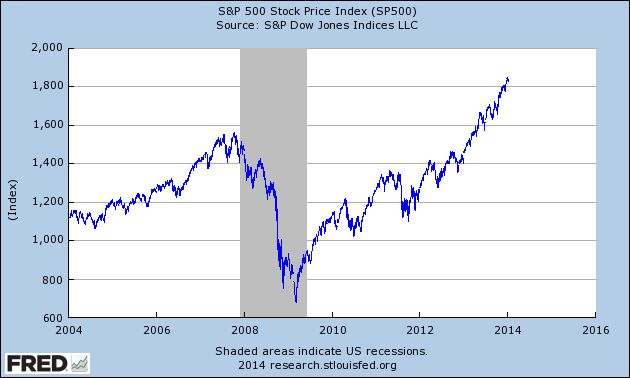

Secondly, more affluent households who rode out the downturn in the markets during the Great Recession are seeing their 401k balances completely recover along with stock prices, as shown in this graph of the S&P 500:

We know that there is a wealth effect, and for now the wealth effect is picking up where debt refinancing left off.

As an aside, here is the graph of those "Not in the Labor Force, Want a Job Now" I ran on Friday:

Notice the spike downward in the last 6 months. I do not think it is coincidental that it mirrors the graph of household worth above. The Altnata Fed has reported that in the last couple of years the percentage of those leaving the workforce due to retirements has increased, and I suspect that the recent spike in net worth has caused a stampede of Boomers for the exits.

Sunday, January 12, 2014

A thought for Sunday: when it comes to inequality of opportunity, yes there IS something wrong with the Pareto principle

- by New Deal democrat

Prof. Brad DeLong reposts an essay on inequality of opportunity from Angus Deaton:

Even if we believe that equality of opportunity is what we want, and don't care about inequality of outcomes, the two tend to go together, which suggests that inequality itself is a barrier to equal opportunity.What about envy of the rich? Economists have a strong attachment to something called the Pareto principle ...: If some people are made better off and no one is made worse off, the world is a better place. Envy should not be counted....

....

I beg to differ. The Pareto principle is an extremely conservative restriction that entrenches existing inequalities of power and wealth in place, virtually in perpetuity.To worry about these consequences of extreme inequality has nothing to do with being envious of the rich and everything to do with the fear that rapidly growing top incomes are a threat to the wellbeing of everyone else.There is nothing wrong with the Pareto principle, and we should not be concerned over other' good fortune if it brings no harm to us....

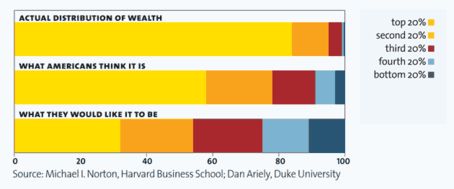

Let me explain. Below is a graph taken from a recent Harvard and Duke study, in which they asked Americans what they thought the existing distribution of wealth is, and what they think it should be, comparing those with the actual distribution of wealth:

Americans think the top 20% owns about 55% of the wealth. They think a fair distribution would be for the top 20% to own 33% of the wealth. In fact, the top 20% owns about 82% of all the wealth in the US, and the bottom 60% own only 4% of the wealth (and the breakdown only gets more lopsided when we consider the top 5%, top 0.5%, and top 0.05%).

So, let us say that we democratically as a society decide that equality of opportunity should result in our fair wealth distribution as described above, and so we enact frictionless and fair policies, consistent with the Pareto principle, to move to the wealth distribution that Americans say would be fair now. How long would it take to get there? When would we arrive?

The answer is: never.

Under the Pareto principle, we cannot redistribute existing wealth, since doing so would make those from whom it is redistributed worse off.

We can try to get around this two ways: the first is, we only pass policies to ensure that future economic growth winds up being allocated, after taxes, in the distribution we have chosen as fair, or some facsimile thereof.

So we arrange our tax and other public policies to assure that not a cent of existing wealth is redistributed, but future growth winds up adding 33% of the total to the top 20%. Yes, I know we are talking unicorns and rainbows, but here's the point: even if we could do that, even if we did it for 10, or 20, or 50, or 100 years, or forever, we would never arrive at the wealth distribution we believe is fair. The top 20% would always have 33% of the wealth accumulated since now, and more than 33% of the pre-existing wealth. Thus, out into infinity, they would always have more than 33% of the total wealth. (Yes, I know what I've just written is a vast oversimplification blah blah blah. Note to economists: just consider it a "model," and then it's all good.)

The only way to get to 33% via future policies is to ensure that, for some period of time, the top 20% accumulate less than 33% of the new wealth, which we already have agreed is unfair, since we have agreed that they should have 33% of the wealth.

Needless to say, if our policies are far more incremental, which is of course far more likely, then we never even get close.

But wait, you say, people die. We simply change our estate tax laws to approximate what they were back in the 1930s, and prevent the transfer of $Billions to succeeding generations of heirs. There are several problems with this. The first is that, depending on how the tax laws are written, it will take decades to lifetimes to come to fruition. The second is the objection that existing plutocrats derive pleasure from the fact that they can dispose of their wealth, upon their death, as they see fit, and if that means ensuring that their heirs out unto the generations remain among the plutocrats, that is their right. If we interfere with that, we are making them very sad. The Pareto principle is violated.

The bottom line is, any choice by society to enact policies to move away from an existing distribution of wealth - even, let me emphasize, unearned, inherited wealth - violates the Pareto principle.

If Prof. Garcia's and DeLong's critique of inequality is correct, then surely it should not take a lifetime of resolute effort to approach a fairer result, and in fact the Pareto principle does not even permit that. The Pareto principle entrenches plutocracy.

So, I am sorry, Professors, but when it comes to entrenched inequality, there IS a problem

with the Pareto principle.

UPDATE; Just to be clear that this is not just about envying wealth, let's consider in our land of unicorns and rainbows that we have had a Rawlsian conference in which we have agreed to relentlessly enforce equality of opportunity. We then have a 10,000 year test run in which we reord the resulting distribution of wealth, which I'll call summation X.

We now go back into real history where we already have not had equality of opportunity, and we have any existing, different distribution of wealth. The Pareto priniple forbids us from ever arriving at summation X. A certain amount of wealth and assets can never be owned by those who should otherwise own them by dint of their efforts under conditions of equality of opporltunity. Why should we give our allegiance to such a principle?

======

P.S.: My primary solution to the above is to ignore the claimed utility as to heirs not yet in existence. I have no problem with Bill Gates or Henry Ford passing on their wealth, minus a reasonable tax rate, to their children or grandchildren. But by the time we get to great great grandchildren, inherited wealth should be taxed at confiscatory rates, e.g.,90%. I would only apply this to that portion of wealth that is inherited. If granddad leaves me $100 million, and by dint of acumen and industry I turn that into $1 Billion (after inflation) by the time of my death, only the inherited portion, i.e., the first $100 million, should be subject to the confiscatory rates.

Subscribe to:

Comments (Atom)