I live in Houston, Texas. We are expecting hurricane Ike to make landfall on Saturday. But, we're getting ready for the storm tonight and tomorrow.

I and Mr$. Bonddad are fine. Out house is built to withstand a category 4 hurricane and Ike will at most be a category 3. But, we're shutting everything down until Monday or Tuesday.

See you then.

Thursday, September 11, 2008

AIG -- Not Looking Good

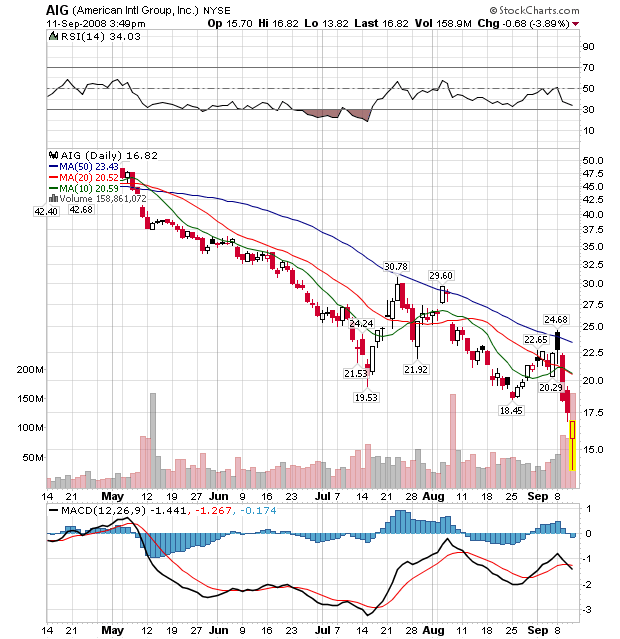

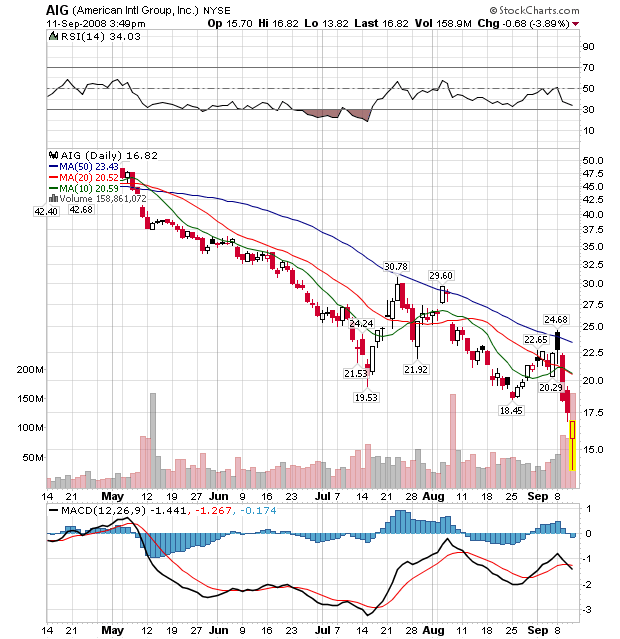

There has been considerable and understandable concern expressed about Lehman Brothers, Washington Mutual and Merrill Lynch over the last few days. One of these companies looks as though they are headed for corporate oblivion. However, AIG has not been mentioned. And they should be. They are a member of many important averages -- including the DJIA. Their stock chart is terrible:

And they are big holders of Fannie and Freddie preferred stock:

Remember that one part of the government bail-out of these companies is the government will get a super-preferred share that will supercede common and existing preferred shareholders. It has been speculated this arrangement would essentially made the existing common and preferred shareholders take the brunt of the damage. That includes AIG -- a company whose stock chart says "we're in trouble."

Hat tip Atrios.

And they are big holders of Fannie and Freddie preferred stock:

American International Group Inc (AIG.N: Quote, Profile, Research, Stock Buzz), the world's largest insurer, holds between $550 million and $600 million in Fannie Mae and Freddie Mac preferred shares, according to a source familiar with the investment.

Remember that one part of the government bail-out of these companies is the government will get a super-preferred share that will supercede common and existing preferred shareholders. It has been speculated this arrangement would essentially made the existing common and preferred shareholders take the brunt of the damage. That includes AIG -- a company whose stock chart says "we're in trouble."

Hat tip Atrios.

A Note On the Latest Tax Evasion Scheme

Full disclosure: I'm a tax lawyer. I have an LLM with a dual concentration in both domestic (US) and international taxation. Part of any LLM curriculum is anti-avoidance law. And anyone -- anyone -- with a modicum of anti-avoidance law under their belt will recognize the latest tax "planning" scheme as pure crap.

Let's start with the basic law. foreign corporations are taxed at a rate of 30% on income from dividends within the US. For those of you who are legally oriented, here's the relevant law:

Pretty straightforward, right? Here's the latest scheme to avoid this rule:

Here's the problem with this scheme: it violates one of the oldest anti-abuse rules in tax law which is substance over form. All that means is the IRS will look at what is actually happening rather than what the parties to the transaction say is happening. Here, the situation is pretty clear. The foreign owners of the stock are still receiving a dividend. They're just calling it something different. And any tax adviser worth his salt knows this is what is happening.

Here's what really ticks me off. In several news reports, advisers from several Wall Street firms said they believe the transactions to be legal. BULLSHIT. These guys are lying their asses off. At that level of the game, the people involved should be getting much better legal advice.

On top of that, there are plenty of legal ways to lower taxes. And these guys also know that. Instead, they are going for the bullshit scheme rather than really earning their money.

Let's start with the basic law. foreign corporations are taxed at a rate of 30% on income from dividends within the US. For those of you who are legally oriented, here's the relevant law:

(a) Imposition of tax

Except as provided in subsection (c), there is hereby imposed for

each taxable year a tax of 30 percent of the amount received from

sources within the United States by a foreign corporation as -

(1) interest (other than original issue discount as defined in

section 1273), dividends, rents, salaries, wages, premiums,

annuities, compensations, remunerations, emoluments, and other

fixed or determinable annual or periodical gains, profits, and

income,

Pretty straightforward, right? Here's the latest scheme to avoid this rule:

In one kind of dividend-enhancement product, offshore hedge funds would sell stocks to Wall Street firms near the time for a dividend payment. At the same time, the securities firms entered into swap contracts in which, for a fee, they agreed to pay investors the equivalent of the dividend plus any stock gains.

The swaps changed the definition of the income under IRS rules, letting offshore funds claim they didn't earn dividends subject to the 30 percent withholding tax. The Wall Street firms, in turn, might owe taxes on the dividends -- at the lower, 15 percent rate for U.S. taxpayers -- while claiming even larger deductions for the swap payments to investors.

Here's the problem with this scheme: it violates one of the oldest anti-abuse rules in tax law which is substance over form. All that means is the IRS will look at what is actually happening rather than what the parties to the transaction say is happening. Here, the situation is pretty clear. The foreign owners of the stock are still receiving a dividend. They're just calling it something different. And any tax adviser worth his salt knows this is what is happening.

Here's what really ticks me off. In several news reports, advisers from several Wall Street firms said they believe the transactions to be legal. BULLSHIT. These guys are lying their asses off. At that level of the game, the people involved should be getting much better legal advice.

On top of that, there are plenty of legal ways to lower taxes. And these guys also know that. Instead, they are going for the bullshit scheme rather than really earning their money.

Thursday Oil Market Round-Up

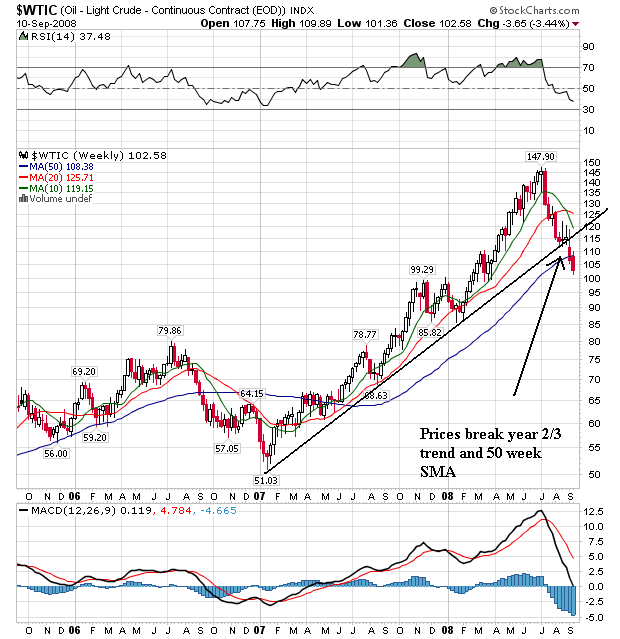

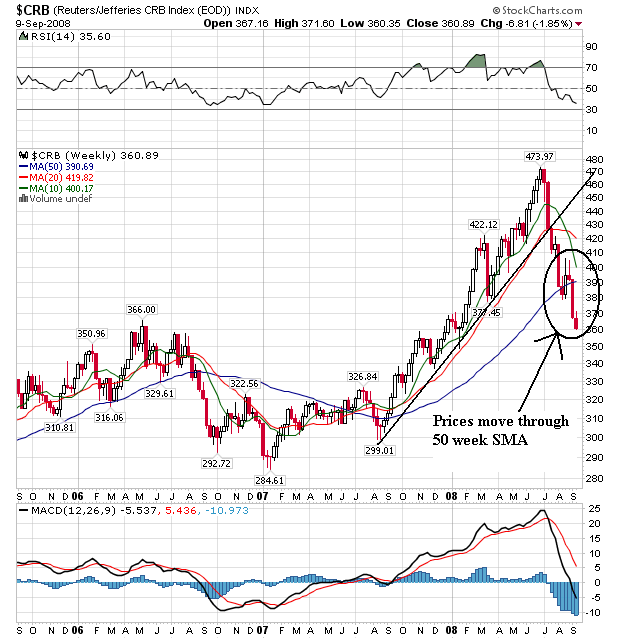

Prices continue moving lower. Note the following:

-- Prices broke the trend line that started a year and a half ago.

-- Prices moved through the 50 week SMA

-- The 10 week SMA moved below the 20 week SMA

-- The 20 week SMA is turning negative

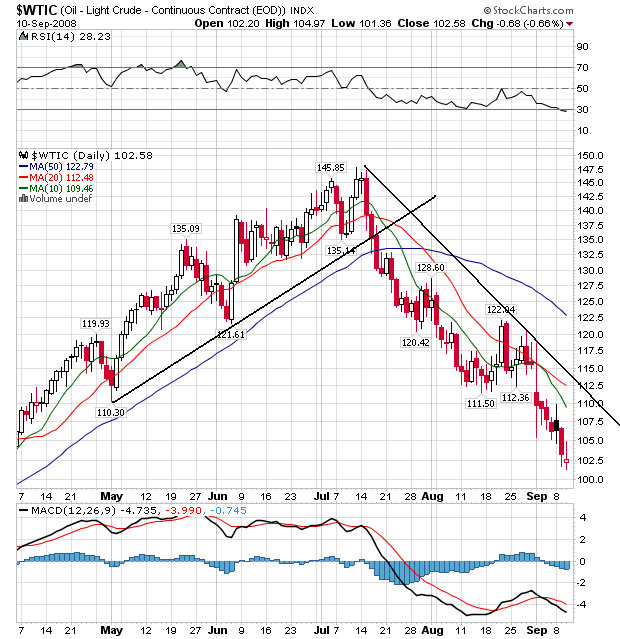

On the daily chart, note the following:

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

-- Prices have been moving lower for about two months

This is a bearish chart, and the weekly chart is bearish as well. The oil market is currently in the middle of a large sell-off.

Wednesday, September 10, 2008

Today's Markets

Little has changed from yesterday --- which, as you'll recall, wiped out the Fannie/Freddie bail-out rally. Notice the following:

-- Prices are below all the SMAs

-- All the SMAs are bunched together and

-- All the SMAs are heading lower

The bunched position of the SMAs makes this chart difficult to interpret -- it could go either way. There are still a ton of variables in play that the market has to figure out. It's definitely a wait and see situation.

What Else Can Be Done To Prevent A Recession?

From CNBC:

Let's back up a bit and rundown everything that has been done to keep the economy going.

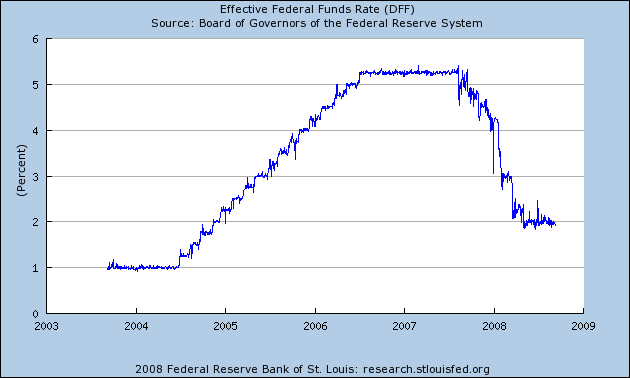

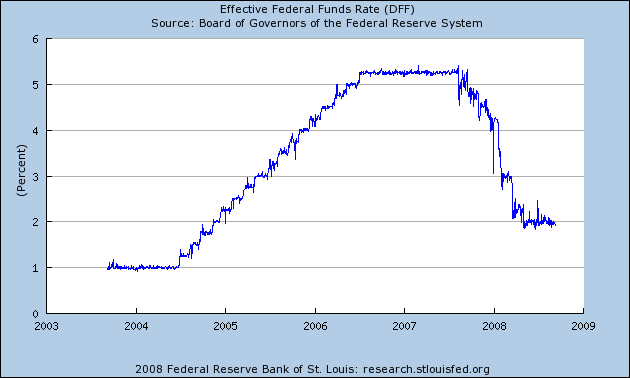

1.) We have a Federal Reserve that has cut interest rates to 0% after adjusting for inflation. Here's a chart from the St. Louis Federal Reserve of the effective federal funds rate:

So -- money is cheap. That means we should be seeing lots of lending, right?

Well, no. According to Bloomberg 1-month Libor is still 50 basis points above the effective Fed Funds rate. That means there isn't as much intra-bank lending going on as we would like. That means we are still seeing institutions horde cash.

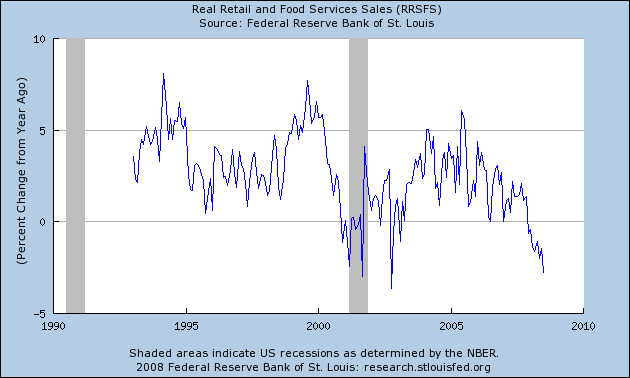

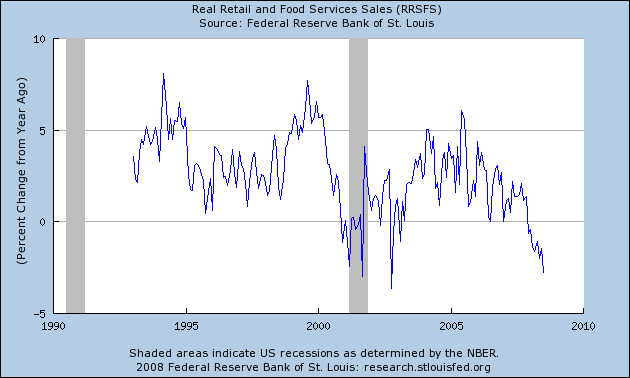

2.) We've seen the federal government give away money to increase spending. Did that work?

Year-over-year real (inflation-adjusted) retail sales are now negative, and

Year-over-year personal consumption expenditures are still positive but have been dropping for a year.

So people are tightening their belts -- and have been for awhile.

All that has really happened is the US is increasing its budget deficit:

The bottom line is we've done pretty much everything we possibly can at this point and we're nowhere near out of the woods. And that is what should scare people the most.

After a bailout of Fannie Mae and Freddie Mac, $168-billion of fiscal stimulus measures, a housing-rescue package and three-and-a-quarter percentage points worth of Federal Reserve interest rate cuts, the economy is still struggling and in some ways looks worse than ever.

And while the recent one-two punch of rising joblessness and shrinking payrolls restarted the recession debate, it begs an even bigger question: What will it take to bring the economy back to health, especially in a presidential election year?

Let's back up a bit and rundown everything that has been done to keep the economy going.

1.) We have a Federal Reserve that has cut interest rates to 0% after adjusting for inflation. Here's a chart from the St. Louis Federal Reserve of the effective federal funds rate:

So -- money is cheap. That means we should be seeing lots of lending, right?

Well, no. According to Bloomberg 1-month Libor is still 50 basis points above the effective Fed Funds rate. That means there isn't as much intra-bank lending going on as we would like. That means we are still seeing institutions horde cash.

2.) We've seen the federal government give away money to increase spending. Did that work?

Year-over-year real (inflation-adjusted) retail sales are now negative, and

Year-over-year personal consumption expenditures are still positive but have been dropping for a year.

So people are tightening their belts -- and have been for awhile.

All that has really happened is the US is increasing its budget deficit:

The Congressional Budget Office said the U.S. budget deficit for fiscal 2008 -- $407 billion -- will be more than double the deficit for 2007, hit by the wars and a weak economy, and predicted it is likely to rise further in fiscal 2009.

"The figures make it challenging to avoid playing the dismal economist," said CBO director Peter Orszag in a statement.

The agency foresees an increase to $438 billion by fiscal 2009, which begins Oct. 1, with the government takeover of Fannie Mae and Freddie Mac further complicating budget projections.

The bottom line is we've done pretty much everything we possibly can at this point and we're nowhere near out of the woods. And that is what should scare people the most.

De-Coupling Bites the Dust

Over the last few years we've seen some great rationalizations and spin regarding the economy. Some of the more classic are the following:

-- "If you take out the financial sector everything is fine"

-- Housing has hit bottom

-- Because 95% of people are paying their mortgages on time, everything is OK

-- The world will decouple; meaning the US can slow down and not effect anybody else.

All of these lines of thought (using a very liberal definition of the word "thought") have fallen by the wayside. Today there is further evidence that "de-coupling" is, well, dead:

Considering exports have been one of the few bright spots in the US GDP reports, this is not good news.

-- "If you take out the financial sector everything is fine"

-- Housing has hit bottom

-- Because 95% of people are paying their mortgages on time, everything is OK

-- The world will decouple; meaning the US can slow down and not effect anybody else.

All of these lines of thought (using a very liberal definition of the word "thought") have fallen by the wayside. Today there is further evidence that "de-coupling" is, well, dead:

The European Union Wednesday slashed its economic growth forecast for 2008 and said several major European economies will slip into recession.

The European Commission, the EU's executive arm, said in its quarterly forecast that the sustained rise in commodities prices, financial market turmoil and a weaker global economy are taking a toll on the bloc's economy.

It predicted Germany will enter a recession in the second and third quarters of the year, and that the U.K. and Spain will suffer a similar fate in the third and fourth quarters.

Overall, the commission expects the European economy to grow 1.4% in 2008, down from the 2% growth it predicted in April. For the fifteen countries that use the euro, the commission cut its 2008 economic growth forecast to 1.3% from 1.7%. The commission said it will probably cut its 2009 forecasts in November due to weakness throughout the global economy.

Considering exports have been one of the few bright spots in the US GDP reports, this is not good news.

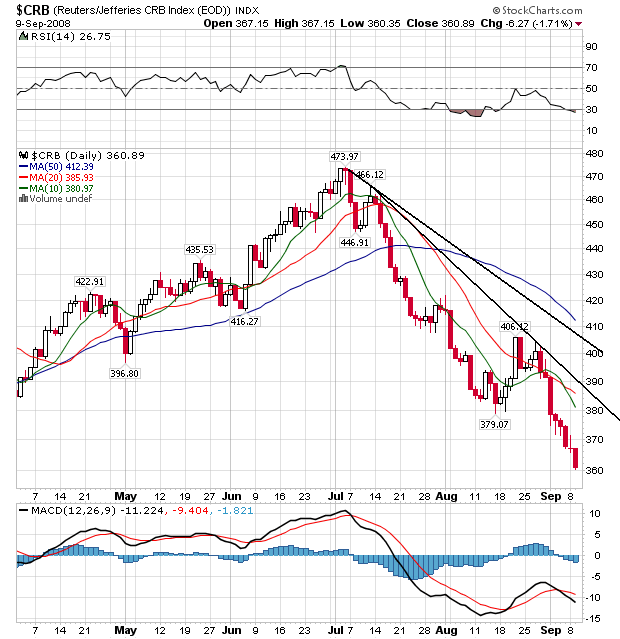

Wednesday Commodities Roundup

On the weekly chart, notice the following:

-- Price clearly broke the year long uptrend a few weeks ago

-- Prices have moved through the 50 week SMA and are heading lower. This is a very important technical development indicating downward moves are continuing.

-- Prices are below all the SMAs

-- The 10 week SMA has moved through the 20 week SMA

-- The 20 week SMA has turned negative

This chart is turning more and more bearish

On the daily chart, notice the following:

-- Prices have been dropping for two months

-- All the SMAs are moving lower

-- The shorter SMAs are below the longer SMAs

-- Prices are below all the SMAs

This is about as bearish as you can get on a daily chart.

Tuesday, September 9, 2008

Today's Markets

All of yesterday's gains are now gone. So much for the Fannie/Freddie bail-out rally.

Note the following:

-- Prices are below the 200 day SMA

-- All the SMAs are moving lower

-- Prices are below all the SMAs

-- Prices are below all relevant trend lines

BUT

-- The SMAs are bunched up indicating a lack of direction

However, given how quickly the rally died I would not be optimistic about the future.

Financial Sector Still In Trouble

Above is the yearly chart of the XLF -- the ETF that tracks the big financial companies. Notice yesterday the market rallied to the long term trend line but backed off. Also note that today the the downward trend is continuing. In other words, so far the Fannie/Freddie nationalization isn't breaking the trend.

On a closer look, notice the following:

-- The shorter term SMAs are bunched together.

-- The 20 and 50 day SMA are horizontal

-- The 10 day SMA is meandering

-- Before the Fannie/Freddie bump, prices and the SMAs were wound pretty tightly together for about a month.

Technically, you could argue the market was at least stabilizing. But with the financials still in the middle of the giant write-down (see Lehman and WAMU today), I'm just not comfortable making that call. There is still way too much possible turmoil out there.

Foreign Investors a Key Driver Of Freddie and Fannie Deal

From the WSJ:

A few points here:

1.) Paulson -- for all that I have criticized and even lampooned him -- is the right man for this job. He has extensive experience in dealing with big deals and big name players. He probably knows most of these people in a more than passing way in one capacity or another.

2.) The next Congress has to put aside partisan differences and hold extensive hearings on the entire financial system. We need to look at all the pieces, big and small, and figure out what needs to be done to provide competitive financing and prevent the last 7 years from happening again. The chance of that happening is, well, 0%.

3.) Perhaps the biggest crime with this situation is the reason for it -- the fact the US' trade deficit and lack of domestic savings leads to the need for foreign financing -- is so incredibly ephemeral that explaining it to most people is at best incredibly difficult. If there was a straight-forward reason for this happening it would be so much easier to deal with and solve. But trade deficits and foreign financing just seem so beyond the experience or exotic to most people that solving the underlying problem is next to impossible.

4.) Yesterday I wrote the following:

Think about this for a minute. One of the largest financial decisions of the last 100 years -- the decision to essentially nationalize elements of the mortgage market -- was driven by outside (non-US) investors. That does not mean we should stop selling our assets to non-US investors -- they are, after all, a vital source of funding for a variety of projects etc.... However, it is important to note that things are not going well in the US. That means that foreign investors who want to protect their investments will speak up and talk too the appropriate people in the US.

Throughout my writing career I have written extensively about debt. Right now the US is in debt up to its eyeballs. The federal government has issued over $500 billion dollars of net new debt per year since 2003. That means there is a fundamental problem in the US budgeting process that no one is addressing. The US consumer is just as bad. According to the federal reserve's flow of funds report, there is almost as much household debt as there is US GDP.

All of this debt has to go somewhere. That means that when we borrow money someone inherently has to lend it. And a fundamental rule of lenders is this: they want to be repaid. We've now seen the first round of lenders saying, "we want too make sure we will get repaid." Right now we have no idea how much this is going to cost, although I have a terrible feeling it's going to be far more than anyone is estimating.

But the real issue is our method of doing business as a country has finally gotten us in trouble. That means all of the people we have borrowed money from got nervous for the first time and said, "you better do something or we won't lend you money any more." And to keep the spigots pouring, we nationalized Freddie and Fannie.

Think about this basic fact: we -- the US as expressed through the Congress -- were not the people who decided what to do. Foreign investors forced out hand and made us allocate up to $200 billion to this endeavor.

Out way of doing business is broken.

Foreign central banks had been among those voicing concerns in the weeks ahead of the government's seizure of Freddie and Fannie. The banks had steadily reduced their holdings of debt in the two firms in recent weeks as the turmoil around the firms worsened.

China's four biggest commercial banks, too, pared back their holdings in agency debt, with Bank of China Ltd., the largest holder of Fannie and Freddie securities among these banks, saying it sold or allowed to mature $4.6 billion of the $17.3 billion it held as of June 30, down from more than $20 billion at the end of last year.

Treasury tried to head off such concerns by having David McCormick, an assistant secretary for international affairs, call foreign central banks and other overseas buyers of the companies' securities or debt to reassure them of the instruments' creditworthiness. Over the weekend, Treasury officials called sovereign-wealth funds in Abu Dhabi and elsewhere in the Middle East, assuring them that they were working on financial issues involving Fannie and Freddie, says an individual apprised of the conversations.

Like many investors, foreign governments, particularly central banks and sovereign-wealth funds, believed the U.S. government implicitly stood behind Fannie and Freddie and would prop them up to prevent a failure.

But when the Treasury won approval from Congress in July to backstop the pair through an equity investment or a loan, it sparked questions among some investors about the relationship between the government and the mortgage giants.

Amid worries about the debts' backing by the U.S. government, some central banks decided to buy Treasury securities instead. That increased the spread between the rates for Treasuries and mortgages, exacerbating the crisis that officials had been trying to resolve.

In his public comments Sunday, Mr. Paulson said the "ambiguities" in the firms' congressional charters led foreign central banks and investors in the U.S. and around the world to believe the firms' debt was "virtually risk-free."

"Because the U.S. government created these ambiguities, we have a responsibility to both avert and ultimately address the systemic risk now posed by the scale and breadth of the holdings," Mr. Paulson said.

On Monday, Mr. Paulson sought to assuage the concerns of foreign officials, explaining the government's takeover in a brief call with his financial counterparts in the Group of Seven.

A few points here:

1.) Paulson -- for all that I have criticized and even lampooned him -- is the right man for this job. He has extensive experience in dealing with big deals and big name players. He probably knows most of these people in a more than passing way in one capacity or another.

2.) The next Congress has to put aside partisan differences and hold extensive hearings on the entire financial system. We need to look at all the pieces, big and small, and figure out what needs to be done to provide competitive financing and prevent the last 7 years from happening again. The chance of that happening is, well, 0%.

3.) Perhaps the biggest crime with this situation is the reason for it -- the fact the US' trade deficit and lack of domestic savings leads to the need for foreign financing -- is so incredibly ephemeral that explaining it to most people is at best incredibly difficult. If there was a straight-forward reason for this happening it would be so much easier to deal with and solve. But trade deficits and foreign financing just seem so beyond the experience or exotic to most people that solving the underlying problem is next to impossible.

4.) Yesterday I wrote the following:

The point is all of the press indicates it's these conversations with foreign bankers that got Paulson's attention. That means there are some nervous people all over the globe. And that's what is driving this -- at least partially. And that should scare everyone to death. We are no longer in complete control of our sovereignty.

Think about this for a minute. One of the largest financial decisions of the last 100 years -- the decision to essentially nationalize elements of the mortgage market -- was driven by outside (non-US) investors. That does not mean we should stop selling our assets to non-US investors -- they are, after all, a vital source of funding for a variety of projects etc.... However, it is important to note that things are not going well in the US. That means that foreign investors who want to protect their investments will speak up and talk too the appropriate people in the US.

Throughout my writing career I have written extensively about debt. Right now the US is in debt up to its eyeballs. The federal government has issued over $500 billion dollars of net new debt per year since 2003. That means there is a fundamental problem in the US budgeting process that no one is addressing. The US consumer is just as bad. According to the federal reserve's flow of funds report, there is almost as much household debt as there is US GDP.

All of this debt has to go somewhere. That means that when we borrow money someone inherently has to lend it. And a fundamental rule of lenders is this: they want to be repaid. We've now seen the first round of lenders saying, "we want too make sure we will get repaid." Right now we have no idea how much this is going to cost, although I have a terrible feeling it's going to be far more than anyone is estimating.

But the real issue is our method of doing business as a country has finally gotten us in trouble. That means all of the people we have borrowed money from got nervous for the first time and said, "you better do something or we won't lend you money any more." And to keep the spigots pouring, we nationalized Freddie and Fannie.

Think about this basic fact: we -- the US as expressed through the Congress -- were not the people who decided what to do. Foreign investors forced out hand and made us allocate up to $200 billion to this endeavor.

Out way of doing business is broken.

Treasury Tuesday's

Again, remember that the federal plan regarding Freddie and Fannie have thrown a huge monkey wrench into any analysis of the markets. The standard way for this to play out is for the equity markets to rally and the bond markets to sell-off largely as a way to get money to put into the equity markets. That's not a guarantee, but simply the most logical way for investors to allocate resources during this time.

Bearing that in mind, note the following with the IEF (7-10 year) Treasury ETF:

-- All the SMAs are still heading higher

-- The shorter SMA are above the longer SMAs

-- Prices are above the 200 day SMA

-- Prices moved through the 10 day SMA yesterday, but bounced off the 20 day SMA back through the 10 day SMA.

The IEFs started a rally at the end of July. Since mid-August, the market has been bullishly aligned (SMAs moving higher, shorter SMAs above longer SMAs, Prices above all the SMAs and prices using the SMAs as technical support). However, the Fannie/Freddie deal has really thrown standard analysis for a loop. We'll have to wait and see how this whole thing plays out.

Monday, September 8, 2008

Today's Markets

Let's pull the lens back and put today's action in perspective

Prices jumped but closed below the open. Prices also formed a hammer -- not exactly the most promising candle we could see.

Also note the following:

-- Prices jumped into the 10 day SMA and fell to the 20 day SMA

-- The SMA picture is very confusing. While they are all going lower, they are also bunched together very tightly along with prices. In other words -- we don't have a solid direction either way right now.

Short version: when all is said an done, we're still pretty directionless right now.

Fannie and Freddie Part I

Obviously, the big news is the government bail-out of Freddie and Fannie. Over the weekend I wrote two articles on this. Here's a link to the first article which provides a history of how we got here and here's a link to the second article which outlines the plan and explains why it's happening now.

There's one point that I think is incredibly important right now. I touch on it in the second article, but I'm not the one who presented a detailed analysis of how it happened. That distinction goes to Angry Bear:

This has everything to do with foreign central banks and investors (along with some incredibly large US investors like PIMCO) essentially detailing US policy. Note the following statement from today's WSJ:

Paulson has repeatedly cited foreign ownership as a reason for the intervention. But let's back up a bit to see how the current economy is really structured:

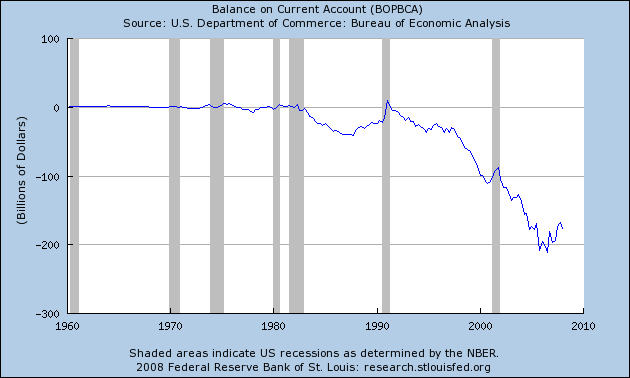

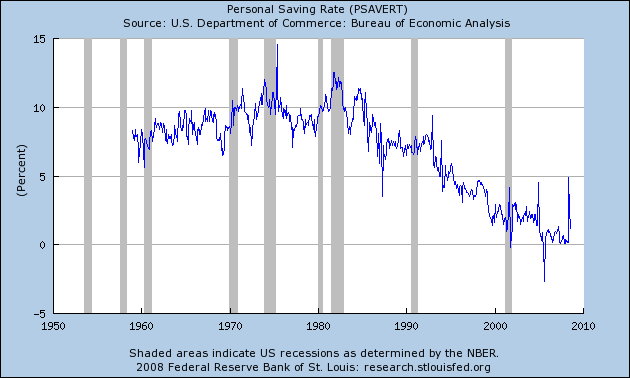

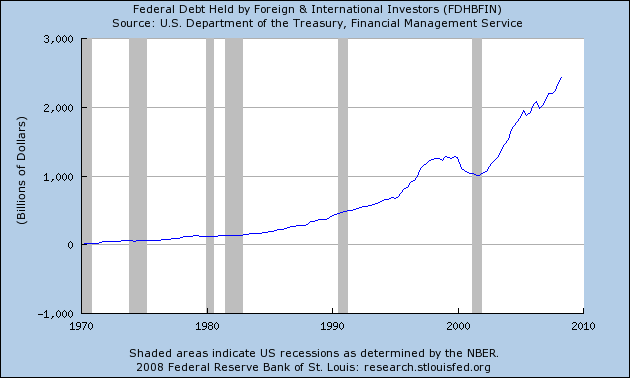

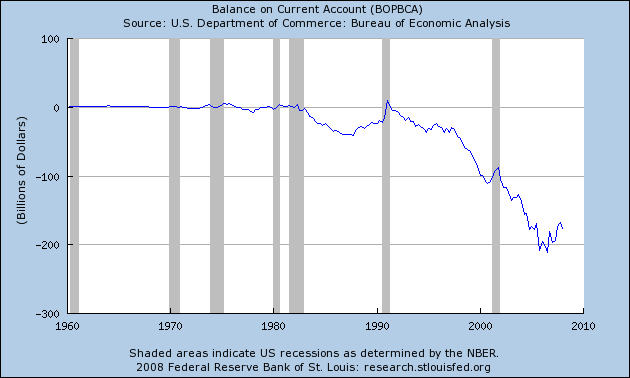

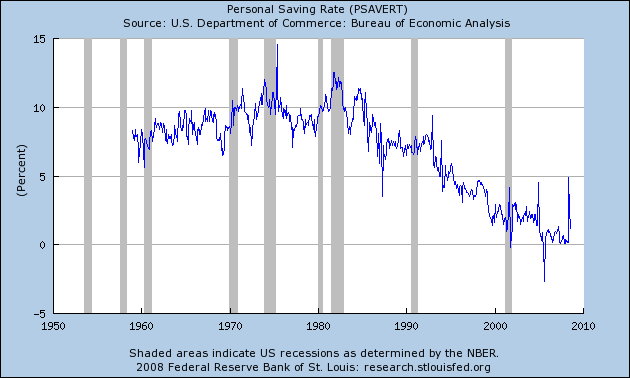

Above is a chart of the current account. All this means is the following: the US buys more stuff from abroad then we sell abroad. The problem is we don't have the money to pay for all of this. Why? Because the US savings rate is terrible:

Notice how the US is saving less and less. That means we have to borrow money to buy all of this great stuff.

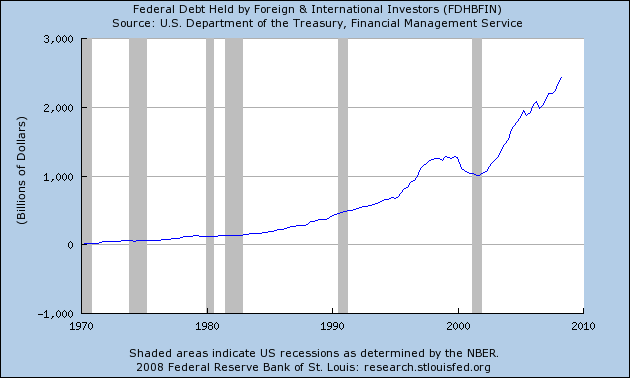

Above is a chart of foreign ownership of US government debt. Notice how it has doubled over the last 8 years. In other words -- we're in debt to foreign central banks up to our eyeballs.

Treasury Secretary Paulson has continually stated that US paper is owned all over the globe. Remember -- Paulson was a big guy at Goldman Sachs. He has contacts all over the world. He knows, well, everybody. Frankly, he's one of the few appointments of the Bush administration that is qualified for his job. When he says "so and so talked to me about this" you can bet it was a conversation between people who have known each other for some time.

The point is all of the press indicates it's these conversations with foreign bankers that got Paulson's attention. That means there are some nervous people all over the globe. And that's what is driving this -- at least partially. And that should scare everyone to death. We are no longer in complete control of our sovereignty.

A long time ago (actually about three years ago) Paul Volcker wrote an editorial in the Washington Post called An Economy on Thin Ice. Consider the following as food for thought:

This editorial seems more and more accurate as time passes.

There's one point that I think is incredibly important right now. I touch on it in the second article, but I'm not the one who presented a detailed analysis of how it happened. That distinction goes to Angry Bear:

Update: Market Watch

Consider the description of the bailout from the: New York Times:

Investors who own the companies’ common and preferred stock will suffer. Holders of debt, including many foreign central banks, are expected to receive government backing. Top executives of both companies will be pushed out, according to those briefed on the plan. [italics mine]

Now consider the following from MarketWatch,

The top five foreign holders of Freddie and Fannie long-term debt are China, Japan, the Cayman Islands, Luxembourg, and Belgium. In total foreign investors hold over $1.3 trillion in these agency bonds, according to the U.S. Treasury's most recent "Report on Foreign Portfolio Holdings of U.S. Securities."

China alone holds $376 billion in bond holdings.

Unless I am misreading something, foreign central banks will be protected, including China's...and the America taxpayer will foot that bill.

Secretary Paulson has been busy of late reassuring foreign central banks that they will be protected.

In recent weeks, Treasury officials have been reaching out to foreign central banks and other overseas buyers of securities or debt sold by the two companies, to reassure them of the creditworthiness of these instruments.

In one such conversation, at the end of August, the Treasury sought to reassure the Bank of Mexico, according to a person familiar with the matter, of the soundness of agency securities held by the bank. Treasury officials have also had similar conversations with Japanese investors who are buyers and holders of agency debt.

.....

The meaning and ramifications of this collapse cannot be unravelled in a single post--or a hundred posts. Mismanagement, corporate greed and excess need examining.

Once again, the U.S. taxpayer will be asked to shoulder another mountain of debt. Once again, the taxpayer has become the prop of last resort as poorly managed entities become too big to fail. How long this can continue is the question.

Everything seems broken. No one seems to be safely in charge. Instead, I imagine public officials--Bernanke and Paulson-- racing frantically from meeting to meeting, making assurances, looking for the next band-aid.

John McCain wants Fannie Mae and Freddie Mac to shrink so that their size no longer is a threat. Would he say the same thing about Bear Stearns, albeit it is far smaller? Should Bear Stearns not have been allowed to grow so large? How do we shrink such a massive entities? Remember, they hold over $5 trillion in mortgages. Do we hold a fire sale? And would he apply the lobbying rule to other large companies? After all, they now have a heavy hand in writing the regulations that govern them. (The Medicare Part D fiasco is evidence of just how influential the pharmaceuticals were in deciding just what regulations were best for them.) Is it big government that is the problem--or big corporations that run the government?

Obama wants Fannie and Freddie out of the profit-making business. Is America ready for nationalizing such institutions? Is Obama? And could we have afforded a total collapse of Bear Stearns? Can the government simply allow such things to happen if the consequence for the nation is dire?

And how does the next president reassure our foreign creditors that the U.S. will pay its bills?

While we may be dismayed that foreign central banks will receive "government backing," we do not have much choice.

Yu Yongding, former advisor to China's central bank, put the matter bluntly:

``If the U.S. government allows Fannie and Freddie to fail and international investors are not compensated adequately, the consequences will be catastrophic,'' Yu said in e-mailed answers to questions yesterday. ``If it is not the end of the world, it is the end of the current international financial system.''

Foreign central banks have been propping up the U.S. economy:

Foreign central banks have financed the United States to keep their export sectors -- heavily dependent on U.S. consumer spending -- humming. But they now must weigh the benefits of providing the United States with such "vendor financing" against the rising costs of keeping the current system going.

Yu Yongding is not making a threat; he is stating a fact.

If foreign central banks stop financing U.S. debt (there are no free rides), then the U.S. is in a world of hurt. As Brad Setser notes:

...in fact, the economic and financial risks that arise from the U.S. current account deficit (and the resulting dependence on foreign financing) have not been exaggerated. If anything, they have received too little attention -- and are set to grow in the coming years.

Well, "the coming years" may be sooner, not later. For the U.S., the consequences may be immediate inflation as Treasury attempts to makes its offerings more palatable. The dollar will plunge. And these are just for starters.

The party is over. Sorry that most of you working stiffs missed it. Oh, by the way, here's the bill.

As Paul Krugman said:

I used to think that the major issues facing the next president would be how to get out of Iraq and what to do about health care. At this point, however, I suspect that the biggest problem for the next administration will be figuring out which parts of the financial system to bail out, how to pay the cleanup bills and how to explain what it’s doing to an angry public.

Although the American public is not exactly happy with the economy, it has no idea of the depth of the problems. Most people think the government's check writing ability is infinite.

Well, the government is broke and broken.

This has everything to do with foreign central banks and investors (along with some incredibly large US investors like PIMCO) essentially detailing US policy. Note the following statement from today's WSJ:

Mr. Paulson noted that more than $5 trillion of debt and mortgage-backed securities issued by Fannie and Freddie is owned by central banks and other investors world-wide. "Failure of either of them would cause great turmoil in our financial markets here at home and around the globe," Mr. Paulson said.

Paulson has repeatedly cited foreign ownership as a reason for the intervention. But let's back up a bit to see how the current economy is really structured:

Above is a chart of the current account. All this means is the following: the US buys more stuff from abroad then we sell abroad. The problem is we don't have the money to pay for all of this. Why? Because the US savings rate is terrible:

Notice how the US is saving less and less. That means we have to borrow money to buy all of this great stuff.

Above is a chart of foreign ownership of US government debt. Notice how it has doubled over the last 8 years. In other words -- we're in debt to foreign central banks up to our eyeballs.

Treasury Secretary Paulson has continually stated that US paper is owned all over the globe. Remember -- Paulson was a big guy at Goldman Sachs. He has contacts all over the world. He knows, well, everybody. Frankly, he's one of the few appointments of the Bush administration that is qualified for his job. When he says "so and so talked to me about this" you can bet it was a conversation between people who have known each other for some time.

The point is all of the press indicates it's these conversations with foreign bankers that got Paulson's attention. That means there are some nervous people all over the globe. And that's what is driving this -- at least partially. And that should scare everyone to death. We are no longer in complete control of our sovereignty.

A long time ago (actually about three years ago) Paul Volcker wrote an editorial in the Washington Post called An Economy on Thin Ice. Consider the following as food for thought:

More recently, we've become more dependent on foreign central banks, particularly in China and Japan and elsewhere in East Asia.

It's all quite comfortable for us. We fill our shops and our garages with goods from abroad, and the competition has been a powerful restraint on our internal prices. It's surely helped keep interest rates exceptionally low despite our vanishing savings and rapid growth.

And it's comfortable for our trading partners and for those supplying the capital. Some, such as China, depend heavily on our expanding domestic markets. And for the most part, the central banks of the emerging world have been willing to hold more and more dollars, which are, after all, the closest thing the world has to a truly international currency.

The difficulty is that this seemingly comfortable pattern can't go on indefinitely. I don't know of any country that has managed to consume and invest 6 percent more than it produces for long. The United States is absorbing about 80 percent of the net flow of international capital. And at some point, both central banks and private institutions will have their fill of dollars.

I don't know whether change will come with a bang or a whimper, whether sooner or later. But as things stand, it is more likely than not that it will be financial crises rather than policy foresight that will force the change.

This editorial seems more and more accurate as time passes.

Market Mondays

This weekend was clearly a game changing in more ways than anyone can count. Right now the only salient point I can think of is the following:

The Fed intervened in the markets in March when they backstopped the Bear Stearns buy-out. The market rallied for three months.

The market is in a lower low/lower high pattern right now, and is clearly in a downward trajectory. My best guess right now is we're going to see the start of a rally similar to the Bear Stearns rally with the 200 day SMA providing the stopping point/major resistance level. However, I will caution, this is an incredibly fluid situation. So get ready for a bumpy ride because that's what we're going to get

The Fed intervened in the markets in March when they backstopped the Bear Stearns buy-out. The market rallied for three months.

The market is in a lower low/lower high pattern right now, and is clearly in a downward trajectory. My best guess right now is we're going to see the start of a rally similar to the Bear Stearns rally with the 200 day SMA providing the stopping point/major resistance level. However, I will caution, this is an incredibly fluid situation. So get ready for a bumpy ride because that's what we're going to get

Subscribe to:

Comments (Atom)