Saturday, October 31, 2015

Weekly Indicators for October 26 - 30 at XE.com

- by New Deal democrat

My Weekly Indicators post is up at XE.com .

Nothing scary this Halloween. Just weakness, but steady as she goes.

Friday, October 30, 2015

Ed Morrissey Shows His Amateurish Economic Abilities ... Again

I haven't picked on ol' Ed in awhile. Frankly, it seemed that he passed on the economic writing to the far more competent Steve Eggleston. But after yesterday's GDP print of 1.5%, I had a feeling Ed would chime in with his, "the economy really sucks" line of thought. Thankfully, he didn't disappoint. So, let's explain why his analysis is incredibly amateurish.

He starts by correctly noting that PCEs were very strong, coming in over 3%. It would have been a bit better if he'd actually looked at the report's detail, however. Had he done so, he would have found that durable good spending was up a very strong 6.7% while non-durable spending increased 3.5% (see table 1 from the accompanying Excel information; it's on the right hand side of the BEA release). Why is this important? Because durable goods require financing, meaning consumers don't make these purchases unless they think they'll be able to make payments for a few years. This is why the strong level of new car sales (that's a durable good, Ed) is so important; recessions don't happen when the consumer is buying bigger goods. And this is the second quarter in a row this reading has been strong; 2Q DGs M/Ms were up 4.3%. In short, this data alone tells us that the release probably isn't the harbinger of doom.

But then Ed shows is analytical failings. And I mean his amazingly amateurish "abilities." He notes that Reuters mentioned the large inventory drag. But then Ed drops the ball when he notes, "That might be the case, but the big decline in business investment was in structures rather than inventory."

Actually, Ed, if you had looked at the accompanying Excel sheet, ESPECIALLY TABLE 2, you would have seen that an inventory correction subtracted 1.44% from GDP growth. See especially cell T48 of Table 2, Ed. In fact, Ed, according to the same table, total fixed investment added .47% to total growth.

In contrast to Ed's perma-bear routine, people who know how to read tables and data and who also watch more than the one data point, yesterday's report wasn't nearly as fatal as Ed makes out. As my co-blogger noted:

The big issue this year has been the effect of the 20% increase in the broad trade weighted dollar. Yesterday's report indicates that

(1) the consumer has not been harmed, and continues to power the US economy forward;

(2) the bleeding in the import/export sector has been staunched; and

(3) affected industries are making progress working through their accumulated inventories.

This isn't to say there aren't reasons for concern. As I've noted in my weekly equity columns for a number of months, corporate earnings may have peaked for this cycle. And the shallow industrial recession caused by a combination of the strong dollar, oil sector contraction and weak international environment continues. But ol' Ed doesn't mention any of these. Instead, he continues in the same pattern he has since 2008: he waits for news he can spin negatively and then does so.

In short, Ed is a partisan hack, who's analysis is poor and whose understanding of the topic is weak.

He really needs to stop writing about econ; he's that bad.

He starts by correctly noting that PCEs were very strong, coming in over 3%. It would have been a bit better if he'd actually looked at the report's detail, however. Had he done so, he would have found that durable good spending was up a very strong 6.7% while non-durable spending increased 3.5% (see table 1 from the accompanying Excel information; it's on the right hand side of the BEA release). Why is this important? Because durable goods require financing, meaning consumers don't make these purchases unless they think they'll be able to make payments for a few years. This is why the strong level of new car sales (that's a durable good, Ed) is so important; recessions don't happen when the consumer is buying bigger goods. And this is the second quarter in a row this reading has been strong; 2Q DGs M/Ms were up 4.3%. In short, this data alone tells us that the release probably isn't the harbinger of doom.

But then Ed shows is analytical failings. And I mean his amazingly amateurish "abilities." He notes that Reuters mentioned the large inventory drag. But then Ed drops the ball when he notes, "That might be the case, but the big decline in business investment was in structures rather than inventory."

Actually, Ed, if you had looked at the accompanying Excel sheet, ESPECIALLY TABLE 2, you would have seen that an inventory correction subtracted 1.44% from GDP growth. See especially cell T48 of Table 2, Ed. In fact, Ed, according to the same table, total fixed investment added .47% to total growth.

In contrast to Ed's perma-bear routine, people who know how to read tables and data and who also watch more than the one data point, yesterday's report wasn't nearly as fatal as Ed makes out. As my co-blogger noted:

The big issue this year has been the effect of the 20% increase in the broad trade weighted dollar. Yesterday's report indicates that

(1) the consumer has not been harmed, and continues to power the US economy forward;

(2) the bleeding in the import/export sector has been staunched; and

(3) affected industries are making progress working through their accumulated inventories.

This isn't to say there aren't reasons for concern. As I've noted in my weekly equity columns for a number of months, corporate earnings may have peaked for this cycle. And the shallow industrial recession caused by a combination of the strong dollar, oil sector contraction and weak international environment continues. But ol' Ed doesn't mention any of these. Instead, he continues in the same pattern he has since 2008: he waits for news he can spin negatively and then does so.

In short, Ed is a partisan hack, who's analysis is poor and whose understanding of the topic is weak.

He really needs to stop writing about econ; he's that bad.

Q3 2015 GDP report: pretty d*#$!d good for +1.6%

- by New Deal democrat

I have a new post up at XE.com , explaining why yesterday's GDP report is probably the best +1.6% you could ever see.

Thursday, October 29, 2015

The decline in prime age labor force participation: the smoking gun (part 2 of 2); comparing June Cleaver and Roseanne Conner

- by New Deal democrat

I recently wrote about the compelling evidence that the biggest reason for the decline in the prime working age labor participation rate was the "child care cost crunch," i.e., the increase in the number of second-earner spouses who decided to stay at home and raise their children, occasioned by the particularly significant decline in wages among lower quintile jobs, together with the soaring costs of outside day care.

In my post yesterday, I showed that the biggest reason why the percentage of both mothers and fathers of minor children who have dropped out of the labor force has increased, is in order to care for their children -- not discouragement, not disability, not education, and not any other reason.

But that is not the end of the story, even though over 80% of men and women eventually become parents of minor children. In particular, there are other studies which put the spotlight on an increase in disability claims. In particular, the Atlanta Fed went to the trouble of decomposing the monthly data as to why people aren't in the labor force over the last 16 years. The graphs are interactive, and illuminating.

What can explain this shift from homemakers to disabled former workers over age 50? Was there a group,who formerly, say before the 1970s, were largely homemakers, who entered the labor force as young people, say in the 1970s and 1980s, and who are older now and, because they were working, can go on SS disability?

Of course! The aging of women who entered the labor force is the answer. First of all, here's the familiar graph showing the big secular increase of women in the workforce between 1965 and 1995:

In my post yesterday, I showed that the biggest reason why the percentage of both mothers and fathers of minor children who have dropped out of the labor force has increased, is in order to care for their children -- not discouragement, not disability, not education, and not any other reason.

But that is not the end of the story, even though over 80% of men and women eventually become parents of minor children. In particular, there are other studies which put the spotlight on an increase in disability claims. In particular, the Atlanta Fed went to the trouble of decomposing the monthly data as to why people aren't in the labor force over the last 16 years. The graphs are interactive, and illuminating.

To cut to the chase, the Atlanta Fed found that the single biggest reason for the increase in labor force non-participation was disability claims:

A similar graph was compiled in a separate report:

So that's it, the real reason for the increase isn't the "child care cost crunch" but disability, right? Well, yes and no. To see why, let's go into the Atlanta Fed's interactive database a little more closely.

At age 50 and above, there has been an outsized increase in the percentage of labor force participants who say they are disabled. That is the lion's hsare of the increase in disability claims:

Part of this is simply the overall aging of the labor force during that time. Older people are more likely to be disabled.

But the big news is the mirror image big decline in people aged 50 and over saying they are homemakers between 1998 and 2014:

Aside from this huge anomaly that begins at age 50, what we are left with is a sustained increase in people in their 30s and 40s who are staying home to take care of thier children.

What can explain this shift from homemakers to disabled former workers over age 50? Was there a group,who formerly, say before the 1970s, were largely homemakers, who entered the labor force as young people, say in the 1970s and 1980s, and who are older now and, because they were working, can go on SS disability?

Of course! The aging of women who entered the labor force is the answer. First of all, here's the familiar graph showing the big secular increase of women in the workforce between 1965 and 1995:

Consider the two cases of June Cleaver, 1950s homemaker, and Roseanne Conner, 1980s blue collar mother. When June Cleaver got older and more infirm, presumably she have told the Census Bureau that she was still a homemaker. Contrarily, when Roseanne Conner became older and more infirm, she would probably tell the Census Bureau that she was disabled, not that she had chosen to be a homemaker.

In short, homemakers don't go on disability. The big surge in those identifying as disabled in their 50s after 1999 probably reflects the fact that they are the group of women who when they were 18-25, entered the workforce between 1965 and 1995.

-----

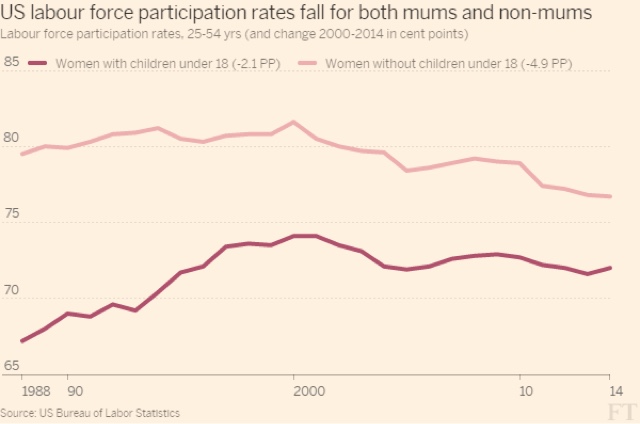

Another source of pushback against the idea that the decline of wages for second earners compared with the price of daycare for children came from the Financial Times.

As an initial matter, the FT's article clearly shows that the most striking feature of the change in the US labor force since 2000 in comparison with every single other country, has been the big decline in women in the labor force:

There is no such equivalent defference for men.

But the FT then pointed out that among the prime working age demographic, the percentage of women who were not in the labor force actually declined *more* for women who were not mothers of minor children. ere's their graph:

Here the problem is at the other end of the age spectrum. Look at the below graphic of the age at which women have typically have their first child over the last 30 years:

For most of the last decade, an absolute majority of 25 year old women had not yet had their first child -- and that age is still increasing!

And now let's go back to the Altnata Fed's interactive graphs, and show what has happened among younger adults who say they are not working because they are pursuing an education:

This shows a big increase in people in their 20s who are not in the labor force because they are continuing their educational studies. That's the explanation for the statistic cited by the Financial Times. The relatively big increase in childless women age 25 -54 who are not in the labor force (note: only about 18% of women ultimately fall into this category) is because of the big increase in this population at the youngest end of the range, and we know why that group is not in the labor force.

-------

In conclusion, put together this information with that published by the Pew Foundation, and we have a pretty complete picture of why there has been a decline in the prime age labor force since 1999:

1. There has been a spike in the relative number of disability claims among older workers, with a concomitant downward spike in the relative number of homemakers among older workers, as the demographics of women in the workforce has aged.

2. Parents of both sexes of minor children have been leaving the labor force in order to care for their minor children, driven by declining real wages for those jobs held by the second earner, and exacerbated by the surging costs of child day care.

3. A smaller part of the increase is explained by young adults seeking a competitive advantage in the workplace by staying in college longer to obtain deboth undergraduate and graduate degrees.

The mystery has been solved.

Wednesday, October 28, 2015

The decline in prime age labor participation: the smoking gun (Part 1of 2)

- by New Deal democrat

I recently wrote about the compelling evidence that the biggest reason for the decline in the prime working age labor participation rate was the increase in the number of second-earner spouses who decided to stay at home and raise their children, occasioned by the particularly significant decline in wages among lower quintile jobs, together with the soaring costs of outside day care.

Since that time (and I'd like to think in part because of my argument), the issue of the "child care cost crunch" has become much more visible, with the candidates in the recent Democratic Presidential debate weighing in, in support of more assistance for working mothers.

For example, Fortune magazine repored that:

Since that time (and I'd like to think in part because of my argument), the issue of the "child care cost crunch" has become much more visible, with the candidates in the recent Democratic Presidential debate weighing in, in support of more assistance for working mothers.

For example, Fortune magazine repored that:

the Economic Policy Institute (EPI), a worker advocacy group, finds that caretaking costs have become so exorbitant that in most parts of the U.S., families spend more on childcare than they do on rent (included in that number: babysitting, nannies, and out-of-home day care centers.

I think [the cost of childcare] plays a role in a woman’s decision to go to work,” says Gould. “It is taking a toll on labor force participation and therefore on the economy.”

Measuring child care costs against a variety of benchmarks—including the cost of college tuition, the HHS’s 10 percent affordability threshold, and median family incomes—demonstrates that high quality child care is out of reach for working families.

And the Pew Research Foundations updated its study of the impact of child care on the careers of mothers in the labor force:

[W]hile 42% of mothers with some work experience reported in 2013 that they had reduced their work hours in order to care for a child or other family member at some point in their career, only 28% of fathers said the same. Similarly, 39% of mothers said they had taken a significant amount of time off from work in order to care for a family member (compared with 24% of men). And mothers were about three times as likely as men to report that at some point they quit a job so that they could care for a family member (27% of women vs. 10% of men).

It’s important to note that when we asked people whether they regretted taking these steps, the resounding answer was “No.”

To briefly recapitulate my posts from August, against a backdrop of surging costs for child care, and declining real wages for the lower quintile jobs occupied by second earners, the number of stay-at home dads has increased from 1.1 million to 2.0 million between 2000 and 2012, and the increase in the percentage of stay-at-home dads who are caring for their children is the primary reason:

Further, the percentage of mothers who are staying at home has also increased, going from 23% in 1999 to 29% of all mothers of minor children in 2012, as shown in the graph below:

In 1999, approximately 10% of stay at home mothers said they were home due to disability, and approximately 82% said they were home to take care of their home and family.

The Pew study found that as of 2012 the vast majority -- 85% -- of stay at home married mothers say the reason for not working is to take care of their children. Including both married and single mothers, the number of stay-at-home moms is about 10 times the number of stay at home dads.

What we didn't have was the *reason* those mothers have dropped out of the labor force since 1999. That was the missing " smoking gun." Until now.

What we didn't have was the *reason* those mothers have dropped out of the labor force since 1999. That was the missing " smoking gun." Until now.

Thanks to Gretchen Livingston of the Pew Foundation, who provided me with additional information, I was able to generate the following chart detailing the relative increases in mothers who dropped out of the labor force due to discouragement, child care, disability, and other reasons including education and retirement:

1999

|

2012

|

Change

| |

|---|---|---|---|

Can't find

job |

0.2

|

1.7

|

+1.5%

|

Child care

|

18.9

|

21.4

|

+2.5%

|

Disability

|

2.3

|

3.2

|

+0.9%

|

All Other*

|

1.6

|

2.5

|

+0.9%

|

TOTAL

|

23

|

28.9 (29)

| +5.9 |

*includes education, retirement, and other

This is the smoking gun. As you can see, the number of mothers who dropped out of the labor force in order to raise their minor children outstripped all other reasons including those who wanted a job, consituting nearly half of the total. Note by the way that the number of those who are out of the labor force but want a job now has declined by about 1 million since 2012, so the likelihood is that as of 2015, the effect of rising day care costs and declining real lower quintile wages is even stronger.

Since According to the Census Bureau, by age 40, 81% of all women have borne at least 1 child, the number of mothers utterly dwarfs the number of prime age women who are not mothers (and, ahem, by necessity of reproductive biology, it is similarly true of men). Together, the numbers of women and men who are staying at home to raise their children, solve the mystery of the decline in the labor force participation rate among the prime working age population.

In Part 2, I will address issues raised by an Atlanta Fed study of the microdata, and in prticular, disability. I will also address some pushback against the "child care cost crunch" meme by the Financial Times.

Tuesday, October 27, 2015

The Underpants Gnomes Theory of how the US imports a global recession

- by New Deal democrat

It used to be said that "When America sneezes, the world catches a cold." Sometime later this century, maybe even 20 years from now that will probably be updated to "When China sneezes, the world catches a cold." But I don't see how we are there yet.

The domestic consumer economy is still 70% of US GDP. International trade only accounts for about 15% of GDP. So it should take a really, really major dislocation of that international trade to overcome domestic strength.

This morning's negative durable goods report is yet another reminder that the shallow industrial recession is real. Rail shipments are down YoY, truck shipments are down YoY, the regional Fed indexes are negative, industrial production and capacity utilization are down. That seems to have become widely accepted. I hasten to add that it showed up in February in the Weekly Indicators and has been there relentlessly since -- another reason not to wait for the lagging monthly reports.

At the same time, housing, cars, real retail spending and real personal consumption expenditures have continued to power ahead. And that is the problem for scenarios whereby the US imports a global recession.

I have read a number of articles over the last several months, including one this past week, all of which can be summarized as follows:

1. China is undergoing a downturn.

2. This has spread to China's suppliers, who are undergoing worse downturns.

3. ?????

4. This will bring about a US recession.

This is the "underpants gnomes" theory of how the US will import a global recession (if you don't know what this meme is, Google is your friend). None of the articles had any detailed or credible explanation of what step 3 is. It is all vagueness and hand-waving.

The weakness in the Oil patch, and generally in the industrial exporting sector will continue and will send ripples out into the wider pond, including layoffs and cutbacks in manufacturing, leading to I suspect one or more monthly employment reports that will be under 100,000 by the end of this winter.

But there is no reason to think that those ripples will be enough to overcome the positive ripples out from housing construction and vehicle production. And there is reason to believe that, contrary to expectations that the gas price dividend will peter out this fall, the US consumer is in the process of getting yet another boost, as gas prices are still over $.80 less than they were ago, and look like they will break below $2.02 (last January's bottom) before they seasonally bottom out this year:

The below is a graphic I cribbed from ECRI. They used it to explain how a consumer slowdown to propagate into a supplier recession, but the converse is just as valid:

Until someone comes up with a credible scenario for Step 3, all we have is the Doomer version of the Underpants Gnomes.

The domestic consumer economy is still 70% of US GDP. International trade only accounts for about 15% of GDP. So it should take a really, really major dislocation of that international trade to overcome domestic strength.

This morning's negative durable goods report is yet another reminder that the shallow industrial recession is real. Rail shipments are down YoY, truck shipments are down YoY, the regional Fed indexes are negative, industrial production and capacity utilization are down. That seems to have become widely accepted. I hasten to add that it showed up in February in the Weekly Indicators and has been there relentlessly since -- another reason not to wait for the lagging monthly reports.

At the same time, housing, cars, real retail spending and real personal consumption expenditures have continued to power ahead. And that is the problem for scenarios whereby the US imports a global recession.

I have read a number of articles over the last several months, including one this past week, all of which can be summarized as follows:

1. China is undergoing a downturn.

2. This has spread to China's suppliers, who are undergoing worse downturns.

3. ?????

4. This will bring about a US recession.

This is the "underpants gnomes" theory of how the US will import a global recession (if you don't know what this meme is, Google is your friend). None of the articles had any detailed or credible explanation of what step 3 is. It is all vagueness and hand-waving.

The weakness in the Oil patch, and generally in the industrial exporting sector will continue and will send ripples out into the wider pond, including layoffs and cutbacks in manufacturing, leading to I suspect one or more monthly employment reports that will be under 100,000 by the end of this winter.

But there is no reason to think that those ripples will be enough to overcome the positive ripples out from housing construction and vehicle production. And there is reason to believe that, contrary to expectations that the gas price dividend will peter out this fall, the US consumer is in the process of getting yet another boost, as gas prices are still over $.80 less than they were ago, and look like they will break below $2.02 (last January's bottom) before they seasonally bottom out this year:

The below is a graphic I cribbed from ECRI. They used it to explain how a consumer slowdown to propagate into a supplier recession, but the converse is just as valid:

Until someone comes up with a credible scenario for Step 3, all we have is the Doomer version of the Underpants Gnomes.

Monday, October 26, 2015

Price appreciatioin of new homes has completely stopped. Here's why

- by New Deal democrat

I have a new post up at XE.com .

Price appreciation in new homes has completely stopped over the last 11 months. That is partly due to the feeding through of the 2014 stall in construction, and partly due to the disappearance of the Chinese cash purchaser.

BTW, tomomrrow we will get the Q3 report on median rents, and that will complete the overall picture of the housing market.

Sunday, October 25, 2015

Subscribe to:

Comments (Atom)