That the cure for high prices, is high prices, was once again shown this week. Among the monthly data, there was a nice positive surprise in the rise of 0.8 in the Leading Economic Indicators, as a big increase in housing permits largely cancelled out declines in manufacturing data. This appears to take outright recession off the table for the immediate future.

In other news, retail sales declined -0.2 mainly due to auto purchases. Ex auto they were up +0.3. The CPI came in a +0.2 with a slightly hot core reading of +0.3. Manufacturing continued to cliff dive, as both the Empire and Philly indexes were surprisingly negative. Industrial production was up +0.1, and capacity utilization was unchanged, but only because April was revised down -0.2. Consumer confidence declined slightly. As indicated above, housing starts increased +19,000 and permits were up +49,000 to one of highest levels since Jan 2009.

Turning to the high-frequency weekly indicators:

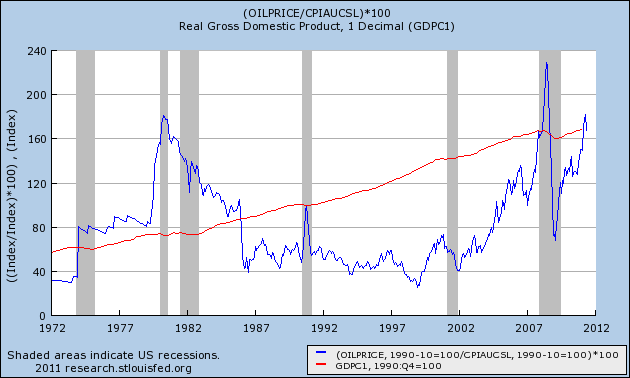

All of the scary, double-dippish bad news resulted in Oil finishing at $93 a barrel on Friday, which is slightly below the level of 4% of GDP for the first time in about five months. This level, according to Oil analyst Steve Kopits is the point at which a recession has been triggered in the past. Gas at the pump fell for the fourth week in a row, declining $.07 more to $3.71 a gallon. Gasoline usage at 9370 M gallons was slightly higher than last year's 9338. This is the second time in three weeks that gasoline usage has exceeded last year, after a two month period of negative YoY comparisons. In other words, the Oil choke-collar is relaxing.

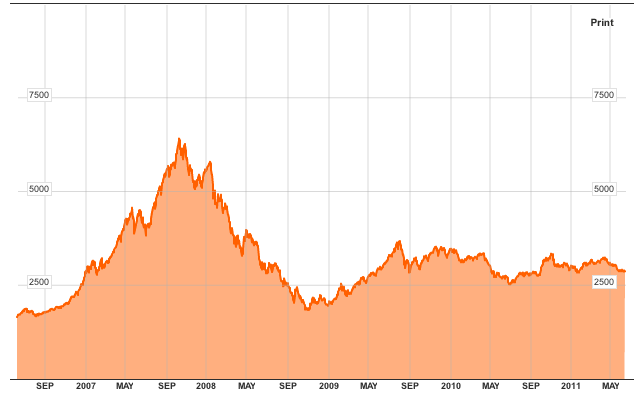

The Mortgage Bankers' Association reported that seasonally adjusted mortgage applications increased 4.5% last week. It was 6.1% higher than this week last year. This is the fourth week in a row that YoY comparisons in purchase mortgages were positive. Except for the rush at the two deadlines for the $8000 mortgage credit, these are the first YoY increases since 2007. Refinancing increased 16.5% w/w with the continued decline in mortgage rates.

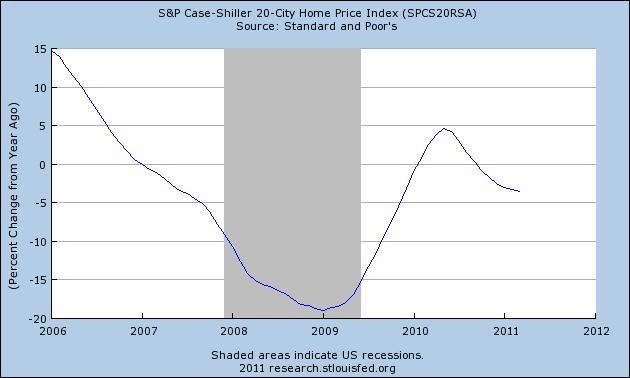

YoY weekly median asking house prices from 54 metropolitan areas at Housing Tracker showed that the decline abated to -4.5% (Note: Housing Tracker just made the total US weekly number available, so I am using that weighted average instead of the unweighted median). The areas with double-digit YoY% declines decreased by two to 9. The areas with YoY% increases in price increased by two to 5.

The BLS reported that Initial jobless claims last week were 414,000. The four week average remained the same at 424,750. We have at least stabilized under 430,000, but this is still considerably higher from earlier this year.

Railfax was up 2.9% YoY for the week, or 24,200 carloads. Baseline traffic is up only 1.53% from a year ago. Cyclical traffic is up 3.12% YoY. Intermodal traffic (a proxy for imports and exports) is up 3.95% compared with a year ago.

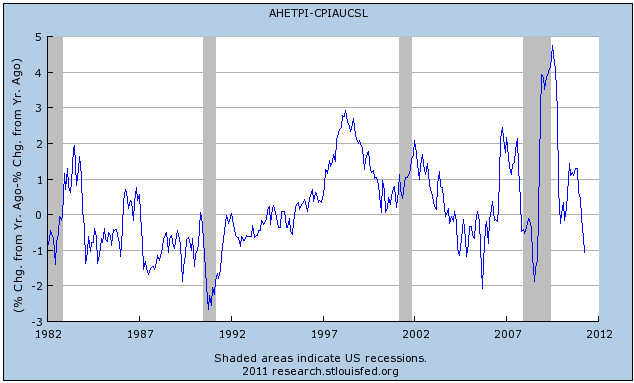

The American Staffing Association Index increased 1 point. The index has been rebenchmarked, so the new value is 87. This series is just barely trending positive. It is weaker than early 2007, but stronger than early 2008 or 2009. This is just barely above a stall, and is a significant danger sign.

The ICSC reported that same store sales for the week of June 11 increased 2.4% YoY, and decreased -0.8% week over week. The yearly comparison here, while still good, has been decreasing in the last few weeks. Shoppertrak reported a 3.3% YoY increase for the week ending June 11 and a WoW decrease of 4.6%. The w/w declines were anticipated due to Memorial Day seasonality. Weekly retail sales numbers are still a bright spot, generally showing the consumer not rolling over due to gas prices.

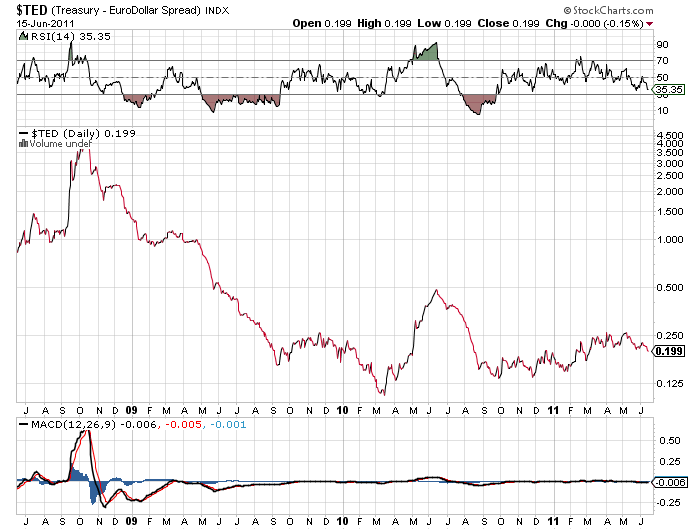

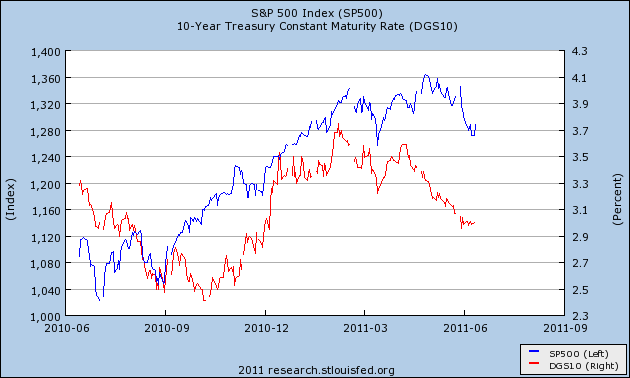

Weekly BAA commercial bond rates increased .03% to 5.73%. This compares with yields on 10 year treasury bonds decreasing .01% to 3.00%. The continuing decline in treasury rates shows fear of deflation, and the increase in corporate rates shows a slight increase in relative distress in the corporate market.

Adjusting +1.07% due to the 2011 tax compromise, the Daily Treasury Statement showed that for the first 11 days of June 2011, $75.5 B was collected vs. $77.5 B a year ago, for a decrease of $2.0 B YoY. For the last 20 days, $127.6 B was collected vs. $119.7 B a year ago, for an increase of $6.9 B, or 6.6%. Use this series with extra caution because the adjustment for the withholding tax compromise is only a best guess, and may be significantly incorrect.

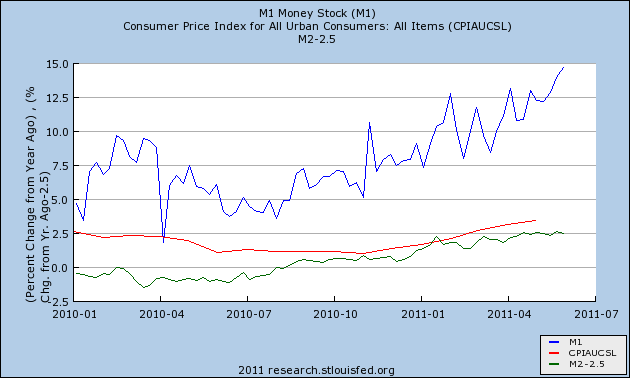

M1 was down -1.1% w/w, up 1.3% m/m, and up 13.5% YoY, so Real M1 was up 10.1%.

M2 was up 0.1% w/w, up 0.3% m/m, and up 5.2% YoY, so Real M2 was up 1.8%.

Real M1 remains very bullish, while Real M2 remains stuck in the caution zone under 2.5%