Saturday, June 11, 2016

Weekly Indicators for June 6 - 10 at XE.com

- by New Deal democrat

You know how temp hiring is a leading indicator for hiring overall? And temp jobs have been in decline since December in the monthly jobs report?

Well, the American Staffing Index turned negative in May of last year. Since the beginning of this year, it has been progressively "less bad" and this week it is the lead in my Weekly Indicators piece up at XE.com.

Friday, June 10, 2016

Dissectlng the Doomer porn du Jour

- by New Deal democrat

Let me preface this post by noting that unlike the past 6 years, those who believe we are in a recession this year have a reasonable (although I think incorrect) position. There simply is no doubt that there are a variety of production-related measures that have turned down to an extent that in the past has normally - but not always - indicated a recession. The reason I think they are mistaken is that there are even more consumption-related and financial measures which are at levels that have never been consistent with a recession.

I always try to fit my analysis into a leading/coincident/lagging indicator framework. Coincident indicators tell us where we are now. Lagging indicators can confirm where we have been. But leading indicators tell us where we are going.

With that out of the way, let me turn to the Doomer graph du jour, which compares Federal withholding taxes paid and state tax receipts:

You've probably seen this at a variety of sites in the last few days.

The problem with this graph is that includes two slightly to significantly lagging indicators. Your employer doesn't start paying withholding taxes until after you are hired. State tax receipts aren't paid until a month or a quarter after the spending or other taxable event has occurred. Worse, since both have seasonality, both have to be measured on a YoY basis, which means the turn in the data will come after the actual turn in the economy.

Let's take each of the two measures in turn. The first measure purports to be of state tax receipts through May. The source article does not appear to be online, but it is pretty clear that the data is being presented in Quarterly terms. In fact, it appears to match the Rockefeller Institute's quarterly measure of state tax receipts, below:

I include this because the Rockefeller graph makes clear that the YoY nadir in tax receipts for the last 2 recessions was in Q2 2002 and Q2 2009 -- in the latter case coincident with the end of the recession, and in the former 2 quarters *after* the recession had ended. In other words, it doesn't tell us anything about where we are headed, only where we have been. And there is nothing inconsistent with this graph with the shallow industrial recession having ended in the first quarter of this year! For example, note that the first quarter of 2014 was nearly as bad, and yet the series rebounded thereafter. And we already knew from Q1 GDP that the first quarter was on the threshold of recessionary, and could even be revised to a negative number.

Now let's turn to Federal income tax withholding. This isn't difficult to check, since tax withholding is published publicly daily by the Department of the Treasury (I report on in every Saturday). Here's the YoY% changes in tax withholding for January through March, March through May, and the 2nd quarter through Wednesday (the most recent date available):

Now let's turn to Federal income tax withholding. This isn't difficult to check, since tax withholding is published publicly daily by the Department of the Treasury (I report on in every Saturday). Here's the YoY% changes in tax withholding for January through March, March through May, and the 2nd quarter through Wednesday (the most recent date available):

3 months Jan - Mar: +3.6% YoY

3 months Feb - Apr +4.1% YoY

3 months Mar - May: +3.5% YoY

3 months Mar - May: +3.5% YoY

Q2 to date Apr 1 - Jun 8: +4.1% YoY

The graph is labeled as the 3 month average YoY%. I simply cannot duplicate the poor result shown in the graph, no matter what 3 month YoY period I use, even adjusting by several measures of wage inflation, since these only varied between 1.8% and 2.6% during this period:

Until Evercore puts its full article in the public dowmain, with links to the source data, it is impossible to check further. But the bottom line is that this graph, even if perfectly valid, is being abused as Doomer porn. It may tell us that the 1st Quarter was nearly if not outright recessionary (but we knew that). But it tells us nothing about where we are now or where we are going.

Until Evercore puts its full article in the public dowmain, with links to the source data, it is impossible to check further. But the bottom line is that this graph, even if perfectly valid, is being abused as Doomer porn. It may tell us that the 1st Quarter was nearly if not outright recessionary (but we knew that). But it tells us nothing about where we are now or where we are going.

April JOLTS report: mature cycle deceleration, again

- by New Deal demorat

Wednesday's JOLTs report (note: for April) gives us a more granular look at the jobs market. For most of the last 12 months I have noted that the pattern was similar to that in late in the last expansion, and the April report was more of the same.

First, here is a comparison of job openings (blue) and hires (red). Because there is only one compete past business cycle for comparison, lots of caution is required. But in that cycle, hires peaked first and then openings continued to rise before turning down in the months just prior to the onset of the Great Recession:

The same pattern shows up in the YoY comparisons, where actual hires turned flat well before YoY openings declined to zero:

After making a new post-reession record three months ago, quits have since fallen back at their late 2015 level. For comparison, in the last cycle, quits made a high in November 2006 as indicated below:

On the one hand, the increasing trend over the last several years of Quits appears intact. On the other hand, the pullback of the last few months is consistent with the 2006 or early 2007 flatness in the last cycle.

Quits (blue) also appear very consistent with, and to slightly lead, the unemployment rate (red):

If the uptrend in Quits continues, then we should expect a continuing decline in the unemployment rate. If on the other hand the recent pullback is establishing a new flat (or worse!) trend, then the unemployment rate has probably made its cycle low. Unfortunately, I suspect that the latter, rather than the former, is more likely the case.

In summary, the JOLTS reports have been adding to the accumulating evidence that we are getting late in the

expansion, but on the positive side, if we follow the 2001-07 template, there is stll another 6 - 24 months to go of jobs growth.

Bonddad Thursday Linkfest

Recession Watch (Econbrowser)

It's Not Just Millenials Who Aren't Buying Homes (Macroblog)

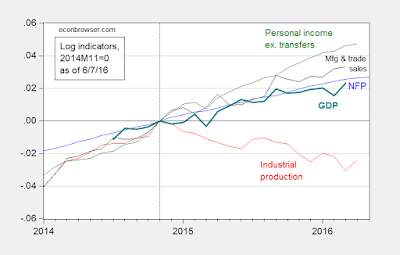

While most series are still rising, as of latest reported observations, the decline in industrial production is worrisome. (Employment is rising, but as Justin Fox points out, principal component measure of the labor market has been declining for a while).

It's Not Just Millenials Who Aren't Buying Homes (Macroblog)

In recent years, much attention has been focused on the growing tendency of millennials to rent. Theories for the decrease in homeownership among young adults abound. They include rising student debt levels that crowd out additional borrowing, a tendency to live in more urban areas where the cost to buy is relatively high, a generally tougher credit environment, and even shifts in the perception of homeownership in the wake of the housing bust. The ideas have been widely debated, and yet no single factor seems to neatly explain the declining share of the millennial population opting to buy a house. (See this webcast by the Atlanta Fed's Center for Real Estate Analytics for a discussion of these issues.)

To the extent that these factors are true, they may be affecting the decisions of other generations as well. Chart 1 below shows the overall average homeownership rate and homeownership rates by age group from 1982 to 2015. It's clear that homeownership rates have declined for everyone during the past 10 years, not just for millennials.

Chart From the Report

New and Existing Home Sales At Base 100 For the Last Three Years

Daily Chart of the Homebuilders ETF

Job Openings

Job openings were little changed at 5.8 million in April. The job openings rate was 3.9 percent. The number of job openings was little changed in April for total private and for government. Job openings increased in a number of industries, with the largest changes occurring in wholesale trade (+65,000), transportation, warehousing, and utilities (+58,000), durable goods manufacturing (+46,000), and real estate and rental and leasing (+41,000). Job openings decreased in professional and business services (-274,000). The number of job openings was little changed in all four regions. (See table 1.)

Hires

The number of hires edged down to 5.1 million in April. The hires rate was 3.5 percent. The number of hires was little changed in April for total private and edged down for government (-31,000). Hires were little changed in all industries in April and decreased in the Midwest region. (See table 2.)

Longer Term Chart of Total Hires and Openings

Thursday, June 9, 2016

Valero's Earnings Miss Creates a Buying Opportunity

This investment has risk. It's certainly not for everyone. Please talk to a professional before doing anything. And, perhaps most importantly, I could be wrong.

According to the Finviz.com website, there are 29 companies in the oil and gas refining industry. Valero is the second largest. They are the third cheapest by current PE and fourth cheapest by future PE. Not only is the company cheap from a value perspective, they are trading near the bottom of their 1-year range:

Everything Looked Good in their 2015 Annual Report

The balance indicates the company is conservatively managed. Over the last 5 years, they increased their current ratio from 1.54 to 2.03 and quick ratio .78 to 1.2. Accounts receivable has decreased from $8.7 billion in 2011 to $4 billion in 2015, which decreased AR from 20% of assets to 10%. This indicates the company is not extending credit to bolster sales – a very prudent development in the current low oil price market. Inventory as a percentage of assets fluctuated between 13-14%, indicating the company is handling the slowdown well. And total cash increased from $1 billion to $4 billion over the last 5 years.

Their cash flow statement is also impressive. Since 2011, cash from operations has fluctuated between $4 and $5.6 billion. This is more than adequate to cover their net investments in property, which have varied between $1.4 billion and $2.9 billion over the same period. The difference between the two has left adequate capital for a stock buyback and dividend payment program (see below).

While revenue dropped 33% in 2015, COGS dropped 37%, leading to an increase in net income. This was reflected on their cash flow statement.

1Q2016 10-Q: An Earnings Miss Creates a Buying Catalyst

Unlike the favorable revenue/cost effects in fiscal 2015, VLO had a bad first quarter. From the 10-Q:

In the first quarter of 2016, we reported net income attributable to Valero stockholders of $495 million, or $1.05 per share (assuming dilution), compared to $964 million, or $1.87 per share (assuming dilution), in the first quarter of 2015.

.....

The $946 million decrease in refining segment operating income in the first quarter of 2016 compared to the first quarter of 2015 was due primarily to lower margins on refined products and lower discounts on light sweet and sour crude oils relative to Brent crude oil, partially offset by higher margins on other refined products (e.g., petroleum coke, propane, and sulfur). Our ethanol segment operating income decreased $3 million in the first quarter of 2016 compared to the first quarter of 2015 due primarily to lower ethanol margins that resulted from lower ethanol prices.

These poor results create a buying opportunity. And the future looks brighter than implied by the latest quarterly results. Crack spreads are increasing, meaning the company should see an uptick in revenue and profit. Increasing oil prices should increase VLOs sales amount. Finally, the summer driving season should mean an increase in overall demand.

Best of all, the company has a buyback plan and high dividend. Over the last year, the company authorized a $2.5 billion buyback plan, on which $1.3 billion is outstanding. They are paying a healthy 4.31% dividend that has a very small payout ratio of 26%. Both the buyback plan and high dividend should put a floor underneath the stock.

Financial Data is From Morningstar.com

Wednesday, June 8, 2016

Maybe It's Time to Be Concerned About the Jobs Market

Employment statistics are a very noisy data series. So it's best to look at their longer term performance to get an idea of their overall direction.

The chart about tracks the rolling 3, 6, and 12-month average employment gains since 1994. The 3-month rolling average (gray line) is near its lows for this cycle. So is the 6-month moving average.

Consider the above information in relation to corporate profits:

Corporate profits peaked in late 2011 and have moved sideways since. They declined in 4 of the last 6 quarters. And the 2-month increases in that time were weak.

This is not an environment where we can expect big increases in job growth.

Bonddad Wednesday Linkgfest

Daily Chart of IEV ETF

Candleglance Charts of Largest EU Area ETFs

"Overall we now have a fiscal stimulus in the global economy," writes Global Chief Economist Janet Henry. "It is not large, but it is getting bigger and, for the first time since 2010, we estimate that global government spending will grow more quickly than global GDP."

This news is music to the ears of international organizations such as the International Monetary Fund as well as financial heavyweights like former Fed Chair Ben Bernanke and BlackRock's Larry Fink, who have long argued that governments should play a larger role in driving growth.

The reasons for the pick-up in spending are manifold: Chinese authorities are pulling fiscal levers to buoy activity, state-level spending has increased in the U.S., Germany has been forced to expand spending in light of the refugee crisis, France's leaders have cut corporate taxes in a pre-election year, and in Canada, a new government is increasing investments in infrastructure.

In fact, standard models may already have broken down. Zero interest rates have failed to incentivize the kind of consumption and investment booms that we might have expected. Companies are hoarding their cash. Savings rates have actually risen, not fallen. It’s possible that this is due simply to a very long, persistent negative shock to demand, but it’s also possible that we’re just not in a New Keynesian world right now. Maybe some other theory, like Roger Farmer’s regime-switching model, or a Neo-Fisherian model, or a financial macro model, is in effect.

If the world isn’t in the comfortable, well-known New Keynesian territory, then policies designed to fit a New Keynesian model run the risk of backfiring. If Neo-Fisherism is right, very negative rates would cause damaging deflation. If financial frictions are now the driving force of the business cycle, negative rates could damage banks as Stiglitz and others have intimated.

Tuesday, June 7, 2016

The Labor Market Conditions Index: no, we're still not DOOMED

- by New Deal democrat

I have a new post up at XE.com, taking an extended look at the Labor Market Conditions Index and comparing it with several other similar series. The trend is certainly negative, but it still doesn't mean that we are inevitably falling into the Abyss.

Bonddad Tuesday Linkfest

In the US, the median monthly price of branded cancer drugs, which are still protected by patents, was almost $8,700, compared with about $2,600 in the UK, $2,700 in Australia and $3,200 in China, according to the study, one of the largest of its kind.

Daily Chart of PPH

Daily Chart of IBB

Investors taking refuge in defensive utilities stocks have pushed the sector to rich levels, according to Goldman Sachs Group Inc.

Analysts led by Michael Lapides note that regulated utilities now trade at a forward price-to-earnings ratio in excess of the S&P 500 based on estimated 2017 and 2018 earnings. That ratio is also elevated relative to the sector's five-year average.

"On an absolute basis, utilities still screen expensive," writes Lapides.

The outperformance of utility stocks last week stood in stark contrast to the previous three months, in which more cyclically sensitive segments of the market led the way, Bloomberg's Lu Wang highlights.

Daily Chart of the Utilities ETF

FINVIZ Table of Sector Valuations

5-Year Chart of the XLU/SPY Ratio

Monday, June 6, 2016

The 2016 Election Economy: the indicators so far

- by New Deal democrat

Beginning last summer, I wrote a series of articles on "Forecasting the 2016 election economy." Now that we are about half the way through the most important data period (January through September), this is a good time to revisit some of the indicators.

As with my series last year, let's start with the top 10 economic data series identified by Nate Silver in 2011 as the most correlated with the Presidential election results. Here's the list:

Let's take a look at all 10 of them in order.

1. ISM Manufacturing Index (average beginning January):

The average through 5 months is 50.3, just slightly into positive territory. Note that the trend has been positive so far this year.

2. Change in nonfarm payrolls:

Although there has been deceleration, this has been consistently positive.

3. Change in the unemployment rate since January:

At the moment this is positive, although it has been a negative for several months.

4. Real personal income less transfer receipts:

This has consistently been positive.

5. Employment to population ratio (measured since January):

This remains positive, although it has reversed course in the last several months.

6. Real GDP (blue):

7. Real GDP per capita (red):

These were positive in the first quarter, and so far look like they will be positive again in the second quarter.

8. Real final sales of domestic product:

This was positive in the first quarter.

9. Real disposable income (red):

10. Real disposable income per capita (blue):

These have been positive through April.

There is no guarantee that any of these continue trending in the same direction as they have so far this year, but what we can say is that if they continue trending in the same direction through September, the historical likelihood based on these indicators is that the nominee of the incumbent Democratic Party will win the election.

Bonddad Monday Linkfest

Daily Chart of the UNG ETF

Note, however, that yesterday’s ADP national estimate of private payrolls looks dramatically brighter. The firm reported that US companies added 173,000 jobs last month. The chasm between this estimate and the government’s official data is surprisingly wide. Clearly, one number is wrong—big time. Deciding which data set is misleading us will take a month or two.

Note, however, that initial jobless claims continue to print at levels that are close to a multi-decade low, which implies that job growth will roll on at a healthy pace. But as I discussed yesterday, there are cracks in this seemingly upbeat picture via the raw year-over-year trend in claims. New filings for unemployment benefits increased 6.6% last week vs. the year-earlier level. The annual rise is the fourth time in the past five weeks that claims headed higher vs. year-ago figures. If claims continue to rise on a year-over-year basis, this leading indicator will signal trouble for the business cycle in a more convincing degree.

ADP v. Establishment Data

Econbrowser on the Jobs Report

The Strong Dollar and Manufacturing Jobs

Scott Grannis on the Jobs Report

The Strong Dollar and Manufacturing Jobs

Scott Grannis on the Jobs Report

The June employment report was much weaker than expected (+38K vs. +160K), but it's not necessarily the case that the engine of economic growth has virtually shut down. We've seen a half dozen very weak numbers like this over the past 5-6 years—it's the nature of this beast to be very volatile on a month-to-month basis. The monthly payroll numbers are simply not reliable enough to make confident judgments about the health of the economy, and, moreover, they can be revised significantly in the future.

What the report does tell us is that there is no sign of any fundamental improvement in the economy or the jobs market. There had been hints of improvement in past reports (e.g., a rise in the labor force participation rate and a quickening in the growth of the labor force), but they've been largely reversed now. As a result, it's likely that the economy is still plodding along at a miserably slow pace and will continue to do so unless and until there is a meaningful change to fiscal policy.

The way to bet is that two-thirds of the surprising component of this month's employment report will be reversed over the next quarter or so.

Nevertheless: does anybody want to say that the Federal Reserve's increase in interest rates last December and its subsequent champing-at-the-bit chatter about raising interest rates was prudent in retrospect? Anyone? Anyone? Bueller?

And does anybody want to say--given that the downside risks we are now seeing were in the fan of possibilities as of last December, and given that the Federal Reserve could have quickly reacted to neutralize any inflationary pressures generated by the upside possibilities in the fan last December--that the Federal Reserve's increase in interest rates last December and its subsequent champing-at-the-bit chatter about raising interest rates was sensible as any form of an optimal-control exercise?

And we haven't even gotten to the impact of the withdrawal of risk-bearing capacity from the rest of the world that happens in a Federal Reserve tightening cycle...

Visa and MasterCard agree that there hasn’t been any dramatic change in the consumer during the month of May.

“What we are seeing . . . it’s very much more of the same. . . . We don’t see that weakening environment, but in the same respect we also don’t see a strengthening of commerce, and obviously that’s something that we’d like to see. But I would say in every developed market around the world, volumes continue to perform at levels like we saw last quarter.” — Visa director and CEO Charles Scharf (Payments)

“I don’t think we see anything different really than what we said back when we had our last earnings call . . . in April . . . So from a US perspective . . . We don’t see that the consumer had a step-down in spend.” — MasterCard CFO Martina Hund-Mejean (Payments)

Daily Chart of the XLYs

Daily Chart of the XLPs

Daily Retail Sector ETF

Daily Consumer Services ETF

Sunday, June 5, 2016

Subscribe to:

Comments (Atom)